Sports Medicine Market Size & Industry Outlook

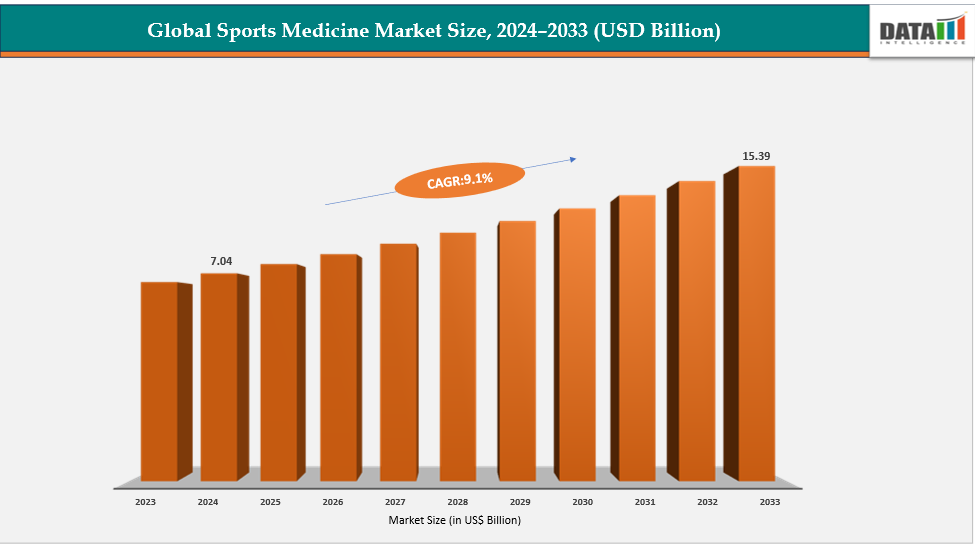

The global sports medicine market size reached US$ 7.04 billion in 2024 is expected to reach US$ 15.39 billion by 2033, growing at a CAGR of 9.1% during the forecast period 2025-2033. Expanding awareness about injury prevention and rehabilitation is a key driver in the global sports medicine market, as athletes and fitness enthusiasts increasingly focus on long-term physical health and performance sustainability. With the growing emphasis on preventive care, sports organizations, schools, and fitness centers are implementing training programs that reduce the risk of musculoskeletal injuries.

For instance, professional leagues and athletic associations have introduced mandatory injury-prevention protocols, such as neuromuscular training and strength-conditioning programs, which create demand for supportive products like braces, compression garments, and physiotherapy devices. Moreover, awareness campaigns by healthcare providers and manufacturers such as Arthrex’s educational initiatives and DJO Global’s rehabilitation awareness programs further encourage early diagnosis and recovery-based treatment, thereby boosting the adoption of sports medicine products globally.

Key Highlights

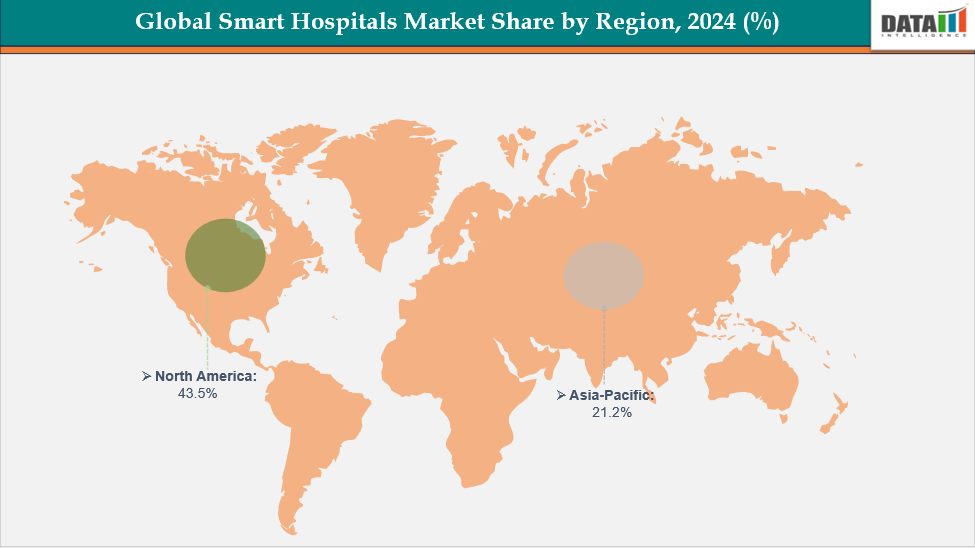

- North America dominates the sports medicine market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.1% over the forecast period.

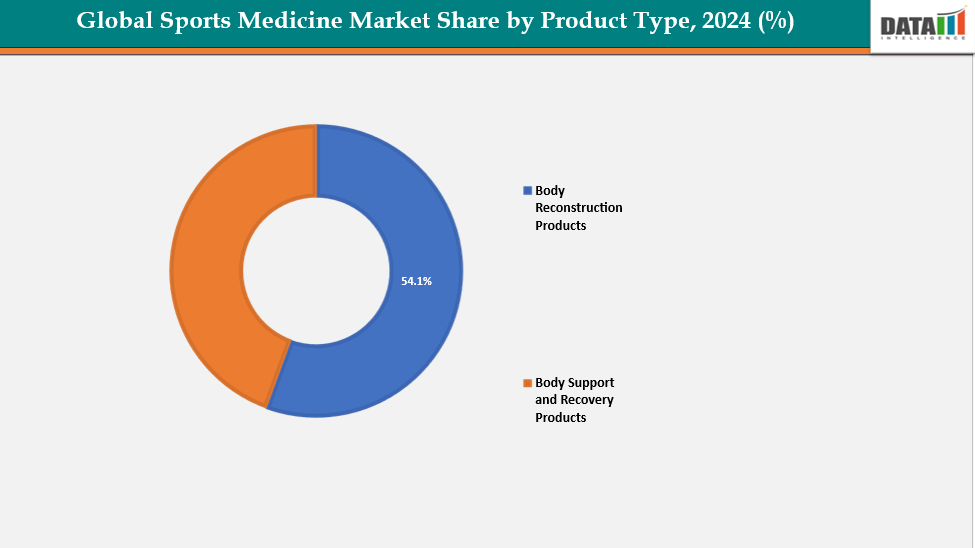

- Based on product type, body reconstruction products segment led the market with the largest revenue share of 54.1% in 2024.

- The major market players in the Sports Medicine market includes Arthrex, Inc, Smith & Nephew plc, Stryker Corporation, Zimmer Biomet Holdings, Inc, Johnson & Johnson (DePuy Synthes), CONMED Corporation, DJO Global, Inc, Breg, Inc., Össur hf and among others.

Market Dynamics

Drivers: Rising incidence of sports injuries driving the sports medicine market growth

The rising incidence of sports injuries is one of the primary drivers fueling the growth of the global sports medicine market. With increasing participation in organized sports, fitness programs, and recreational physical activities, there has been a significant rise in injuries such as ligament tears, fractures, sprains, and tendonitis. This trend is especially evident among younger populations and professional athletes, where high-intensity training and competitive pressure lead to greater injury risks.

For instance, in the U.S., nearly 30 million children and adolescents take part in organized sports, resulting in over 3.5 million sports-related injuries each year that led to missed participation time. Approximately one-third of all childhood injuries are linked to sports activities, with sprains and strains being the most frequently reported types.

Restraints: High cost of products are hampering the growth of the sports medicine market

The high cost of sports medicine products and procedures acts as a major restraint on market growth, particularly in developing regions. Advanced surgical devices, implants, and orthobiologic materials used in sports injury treatment often come with significant expenses. For instance, arthroscopic surgery for ligament repair can cost between USD 5,000 to 10,000 per procedure in the U.S., while specialized implants and anchors used in reconstruction surgeries may range from USD 500 to 2,000 each.

Similarly, physiotherapy and rehabilitation sessions can add USD 50 to 200 per visit, increasing the overall treatment burden. These high costs limit accessibility for amateur athletes and patients without comprehensive insurance coverage, thereby restraining the widespread adoption of sports medicine solutions.

For more details on this report – Request for Sample

Sports Medicine Market, Segmentation Analysis

The global sports medicine market is segmented based on product type, application, end user and region.

Product Type: The body reconstruction products segment from product type segment to dominate the sports medicine market with a 54.1% share in 2024

The body reconstruction products segment is a key growth driver in the global sports medicine market, primarily due to the rising demand for advanced surgical solutions to treat bone and soft-tissue injuries. Increasing incidences of ligament tears, fractures, and joint dislocations among athletes have accelerated the adoption of implants, arthroscopy devices, and fixation systems. Technological advancements, such as bioabsorbable implants and 3D-printed prosthetics, are improving surgical precision and patient recovery outcomes.

Moreover, companies like Arthrex, Smith & Nephew, and Stryker continue to expand their product portfolios with innovative devices designed for minimally invasive procedures. The growing preference for faster recovery and enhanced mobility post-surgery further strengthens the demand for body reconstruction products, making this segment one of the most dynamic areas within the sports medicine market.

For instance, in March 2025, Smith+Nephew a global leader in medical technology, announced that it will showcase its latest sports medicine innovations for joint repair at the American Academy of Orthopaedic Surgeons (AAOS) Annual Meeting in San Diego this week. The company aims to highlight advancements that enhance surgical precision, promote faster recovery, and improve outcomes for patients undergoing joint repair procedures.

Application: The knee injuries segment is estimated to have a 41.1% of the sports medicine market share in 2024

The knee injuries segment represents a major driving factor in the global sports medicine market, driven by the rising prevalence of anterior cruciate ligament (ACL), meniscus, and cartilage injuries among professional athletes and active individuals. High-impact sports such as football, basketball, and soccer contribute significantly to knee-related trauma due to repetitive strain and sudden movements. The growing demand for minimally invasive arthroscopic surgeries, combined with technological advancements in graft fixation devices, sutures, and biologic implants, is fueling segment growth. Moreover, increasing rehabilitation awareness and the availability of advanced braces and physiotherapy equipment from companies like DJO Global and Breg are further boosting recovery outcomes.

For instance, in July 2025, Overture Orthopaedics, a privately held U.S.-based medical device company specializing in innovative joint preservation solutions for sports medicine and orthopaedic surgery, has announced the full U.S. commercial launch of its OvertureTi Knee Resurfacing System.

This system includes femoral and tibial implants designed for partial replacement of the knee’s articular surfaces. With multiple sizing options, it enables surgeons to target only the damaged or diseased regions while preserving healthy cartilage and meniscus. The proprietary procedure is known as Focalplasty.

Geographical Analysis

North America dominates the global sports medicine market with a 43.5% in 2024

North America region dominates the global sports medicine market due to the high prevalence of osteoarthritis and sports-related knee injuries, combined with a large, well-funded healthcare system and rapid adoption of new implants and surgical techniques, drive market growth. Strong private-provider networks and reimbursement coverage for joint procedures encourage uptake of focal/partial solutions that preserve bone and soft tissue.

For instance, in September 2025, A generous gift from Nathan and Catherine Forbes established the Nathan and Catherine Forbes Sports Medicine Institute at the University of Michigan. This interdisciplinary institute aims to advance sports medicine, orthopaedic, and physical medicine and rehabilitative care, including research and education across the state.

Europe is the second region after North America which is expected to dominate the global sports medicine market with a 34.5% in 2024

Europe's growth in sports medicine is significantly influenced by increasing sports injuries, an ageing population and growing burden of degenerative joint disease are key structural drivers, while centralized hospital procurement and cost-effectiveness scrutiny push manufacturers to demonstrate clinical and health-economic value. Advances in implant materials and demand for procedures that enable faster recovery (shorter hospital stays) also support market expansion.

For instance, in the United Kingdom, sports injuries are prevalent, with around 2 million individuals visiting Accident & Emergency departments annually, as reported by the National Health Service (NHS). These injuries arise from various activities, including team sports like football and rugby, as well as individual exercises such as running and gym workouts.

The Asia Pacific region is the fastest-growing region in the global sports medicine market, with a CAGR of 8.1% in 2024

Rapidly improving healthcare infrastructure, greater surgical capacity, expanding private healthcare, and rising awareness of joint-preservation options are driving growth across APAC. Economic development and increasing elective surgery rates in China, India and Southeast Asia create a large addressable market for partial and minimally invasive knee solutions.

Japan’s very fast-aging population and high proportion of elderly patients create sustained demand for knee procedures; at the same time, strong local surgical expertise and willingness to adopt advanced biomaterials and regenerative adjuncts support uptake of resurfacing and cartilage-preserving approaches. Market growth is driven by demographic need plus a focus on quality-of-life improvements for older adults.

For instance, a study among Japanese collegiate lacrosse players found that 42% experienced sports-related injuries within one year, and 82.3% of these injuries resulted in time lost from training or competition.

Competitive Landscape

Top companies in the sports medicine market Arthrex, Inc, Smith & Nephew plc, Stryker Corporation, Zimmer Biomet Holdings, Inc., Johnson & Johnson (DePuy Synthes), CONMED Corporation, DJO Global, Inc, Breg, Inc., Össur hf and among others.

Arthrex Inc:- Arthrex Inc. plays a significant role in the knee joint preservation and sports medicine market through its extensive portfolio of minimally invasive orthopedic solutions. The company is recognized for its innovative implants, biologics, and arthroscopy instruments designed to support cartilage repair, ligament reconstruction, and partial joint resurfacing. Arthrex’s continuous focus on research-driven advancements, surgeon education, and product development in regenerative medicine such as bioabsorbable materials and allograft technologies has strengthened its position as a key player in joint preservation.

Market Scope

| Metrics | Details | |

| CAGR | 9.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Body Reconstruction Products, Body Support and Recovery Products |

| Application | Knee Injuries, Shoulder Injuries, Ankle and Foot Injuries Back and Spine Injuries, Elbow and Wrist Injuries, Hip and Groin Injuries, Others | |

| End User | Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, Rehabilitation Centers | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global sports medicine market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.