Global Balloon Kyphoplasty Devices Market Size & Industry Outlook

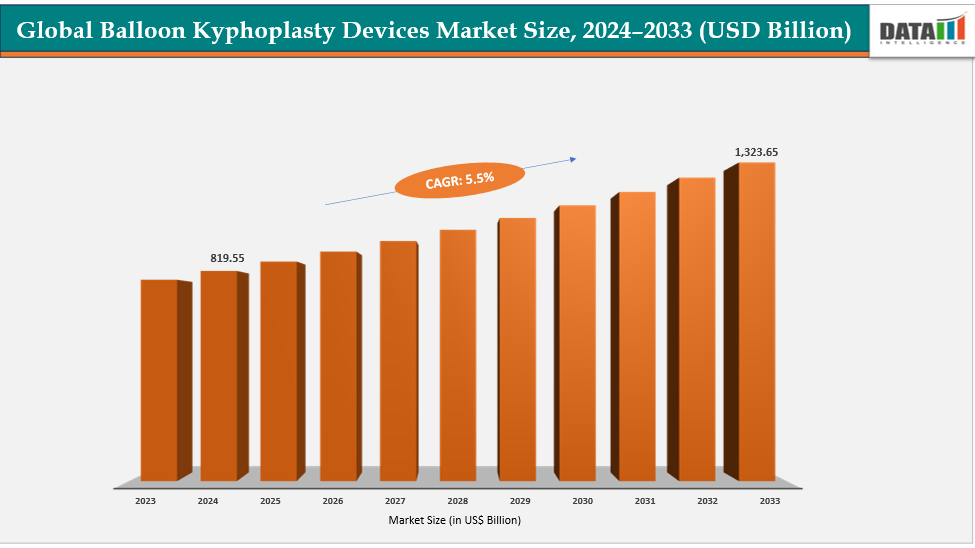

The global balloon kyphoplasty devices market size reached US$ 819.55 million in 2024 is expected to reach US$ 1,323.65 million by 2033, growing at a CAGR of 5.5% during the forecast period 2025-2033. Beyond age related osteoporosis, the increasing number of trauma-induced spinal injuries is contributing significantly to the demand for balloon kyphoplasty devices. Road traffic accidents, workplace injuries, and high-impact sports have led to a growing number of vertebral compression fractures among younger and middle-aged populations.

For instance, in many regions, motor vehicle accidents remain a leading cause of traumatic spinal fractures, creating a clinical need for procedures that provide faster pain relief, vertebral height restoration, and quicker return to daily activities. This trend is expanding the use of balloon kyphoplasty from primarily geriatric patients to a broader demographic base, further driving market growth.

Key Highlights

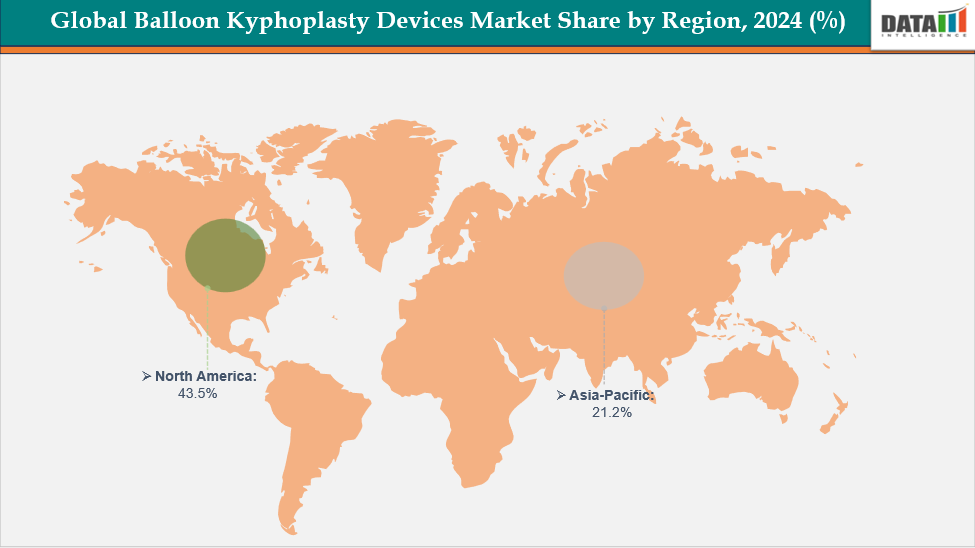

- North America dominates the balloon kyphoplasty devices market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.1% over the forecast period.

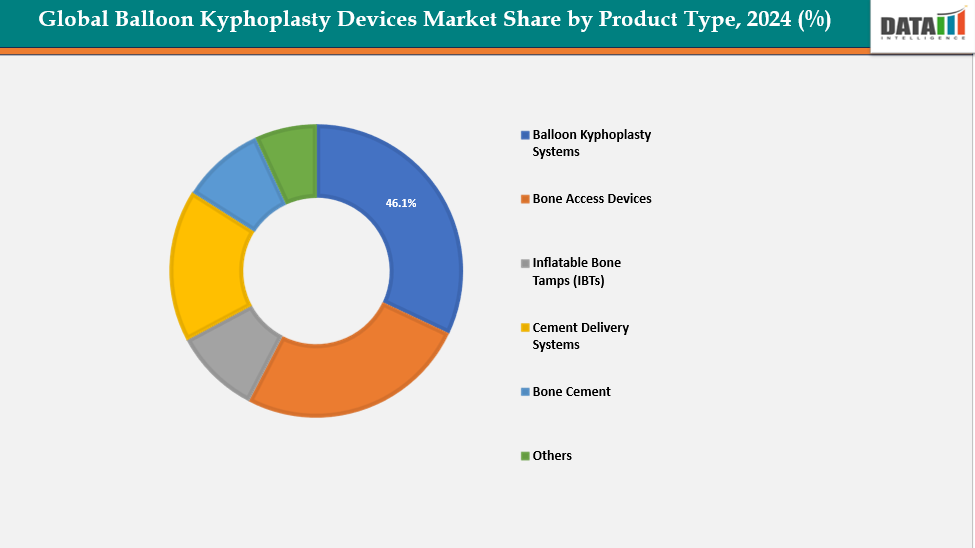

- Based on product type balloon kyphoplasty systems segment led the market with the largest revenue share of 46.1% in 2024.

- The major market players in the balloon kyphoplasty devices Medtronic, Stryker, Merit Medical Systems Inc, Johnson and Johnson, IZI Medical Products LLC and among others.

Market Dynamics

Drivers: Increasing Prevalence of Osteoporosis driving the global balloon kyphoplasty devices market growth

The rising prevalence of osteoporosis globally plays a critical role in driving the balloon kyphoplasty devices market, as osteoporosis is the leading cause of vertebral compression fractures (VCFs). With aging populations and longer life expectancy, the number of individuals experiencing weakened bone density continues to increase, especially among post-menopausal women and elderly patients. As these fractures often result in severe pain, reduced mobility, and diminished quality of life, balloon kyphoplasty has become an important treatment option due to its ability to stabilize the fracture, restore vertebral height, and provide rapid pain relief.

For instance, osteoporosis is a widespread and growing global health concern, affecting millions of people particularly older adults with one in three women and one in five men over age 50 experiencing the condition. As populations age and lifestyle factors shift, osteoporosis-related fragility fractures are increasing dramatically and often go underdiagnosed or untreated, especially in regions such as Asia and rural areas of large countries like China and India.

Currently, an estimated 200 million women worldwide are affected, and an initial fracture significantly increases the risk of subsequent fractures. Despite its prevalence and serious health impact, many patients remain unaware of their risk and lack access to timely diagnosis and treatment, contributing to rising fracture rates globally.

Restraints: High procedure and device cost limiting affordability and access are hampering the growth of the global balloon kyphoplasty devices market

The high cost associated with balloon kyphoplasty procedures and related medical devices remains a significant restraint to market growth, particularly in low- and middle-income regions. The expense includes not only the device and surgical tools but also imaging guidance, specialized cement systems, and hospital or surgical center fees, making the total treatment cost unaffordable for many patients without strong insurance or reimbursement support.

In regions with limited healthcare funding or inconsistent reimbursement frameworks, patients often opt for lower-cost alternatives such as conservative therapy or vertebroplasty, reducing the adoption of balloon kyphoplasty despite its clinical benefits. This cost barrier continues to restrict wider market penetration, especially in emerging economies.

For more details on this report – Request for Sample

Global Balloon Kyphoplasty Devices Market, Segmentation Analysis

The global balloon kyphoplasty devices market is segmented based on product type, indication, material, end user and region.

Product Type: The balloon kyphoplasty systems segment from product type segment to dominate the global balloon kyphoplasty devices market with a 46.1% share in 2024

The balloon kyphoplasty systems segment is primarily driven by the growing preference for minimally invasive treatment options that offer faster pain relief, reduced hospital stays, and improved vertebral height restoration compared to traditional conservative management or vertebroplasty. These systems allow controlled cavity creation within the vertebral body, enabling safer and more precise cement injection, which reduces the risk of cement leakage and postoperative complications. As patient and physician awareness increases and clinical outcomes continue to demonstrate strong benefits in mobility recovery and quality of life, adoption of balloon kyphoplasty systems continues to accelerate, especially in aging populations with vertebral compression fractures.

For instance, in June 2024, Medtronic, a leading global healthcare technology company, has announced a partnership with Merit Medical Systems, Inc. to introduce a unipedicular, steerable balloon catheter for the treatment of vertebral compression fractures (VCFs) in the United States. This collaboration builds on the existing relationship between the two companies, as Merit already supplies Medtronic with Kyphon Xpander Inflation Syringes used in balloon kyphoplasty procedures.

Indication: The osteoporotic vertebral compression fractures is estimated to have a 44.1% of the global balloon kyphoplasty devices market share in 2024

The rise in osteoporotic vertebral compression fractures (OVCF) is fueled by a growing elderly population and increased osteoporosis prevalence, which heightens spinal fracture risk. These fractures lead to severe pain and reduced mobility, driving demand for effective, minimally invasive treatments like balloon kyphoplasty. Enhanced clinical awareness and improved diagnostic methods are facilitating earlier fracture identification, boosting kyphoplasty adoption. Positive outcomes, including rapid pain relief and vertebral height restoration, further support market expansion.

Global Balloon Kyphoplasty Devices Market, Geographical Analysis

North America dominates the global balloon kyphoplasty devices market with a 43.5% in 2024

North America remains one of the leading markets due to the high prevalence of osteoporosis and vertebral compression fractures, a large aging population, and strong awareness of minimally invasive spine procedures such as balloon kyphoplasty. Well-established healthcare infrastructure, widespread access to advanced imaging, favorable reimbursement for kyphoplasty in many clinical settings, and the presence of major medical device companies further accelerate adoption

In the United States, the market is driven by high clinical acceptance of balloon kyphoplasty as a standard treatment for painful vertebral fractures and a well-developed insurance and reimbursement system that supports coverage in hospital and ambulatory surgical centers.

For instance, Osteoporosis is a disease characterized by significant bone loss and reduced bone strength, increasing fracture risk. It affects individuals regardless of race, ethnicity, or sex, with approximately 10 million people aged 50 and older in the U.S. diagnosed. While most affected are women, around 2 million are men. An additional 43 million individuals, including 16 million men, have low bone mass, elevating their risk for developing osteoporosis.

Europe is the second region after North America which is expected to dominate the global balloon kyphoplasty devices market with a 36.6% in 2024

Europe’s market growth is driven by rising awareness of osteoporosis management, improvements in diagnostic screening, and increasing preference for minimally invasive fracture stabilization procedures. Countries across Europe benefit from structured healthcare reimbursement frameworks and national fracture prevention programs, which are improving treatment rates for vertebral compression fractures.

In the United Kingdom, the market is supported by a growing aging population, government-backed initiatives for osteoporosis screening, and broader integration of minimally invasive spine procedures within the National Health Service (NHS). Increased clinical acceptance of kyphoplasty for improving mobility and reducing long-term disability among elderly patients is also contributing to demand.

For instance, osteoporosis impacts over 3 million individuals in the UK, with half of women over 50 and one-third of men over 60 likely to experience low trauma fractures. These fractures arise from minimal forces, such as falling onto a wrist, lifting a shopping bag, or falling from standing height. Annually, over 500,000 people require hospital treatment for fragility fractures resulting from osteoporosis, which occur from standing height or less.

The Asia Pacific region is the fastest-growing region in the global balloon kyphoplasty devices market, with a CAGR of 8.1% in 2024

In the Asia-Pacific region, increasing awareness of osteoporosis, improvements in healthcare access, and rising diagnosis rates of vertebral compression fractures are key growth drivers. Economic development, expanding insurance coverage, and growing investment in medical infrastructure are accelerating the availability of minimally invasive spine procedures in countries like China, India, and South Korea.

Japan’s balloon kyphoplasty market is largely driven by the country’s significant elderly population one of the highest globally which has resulted in a rising burden of osteoporotic fractures. Strong clinical emphasis on early mobility and quality of life for aging citizens encourages the use of minimally invasive treatments.

For instance, in Japan alone, there are an estimated 12.8 million individuals with osteoporosis, with around 193,400 hip fractures occurring annually.

Global Balloon Kyphoplasty Devices Market, Competitive Landscape

Top companies in the global balloon kyphoplasty devices market Medtronic, Stryker, Merit Medical Systems Inc, Johnson and Johnson, IZI Medical Products LLC and among others.

Medtronic:- Medtronic plays a leading role in the balloon kyphoplasty devices market, recognized as one of the earliest innovators and largest suppliers of vertebral augmentation solutions. Its Kyphon product portfolio including balloon catheters, cement systems, and complementary surgical tools has set industry benchmarks for safety, clinical outcomes, and procedural efficiency. The company continues to strengthen its position through ongoing product innovation, expanding partnerships, and surgeon training programs that support the wider adoption of minimally invasive fracture treatment. With a strong global distribution network and established clinical credibility, Medtronic remains a key driver of market growth and technological advancement in balloon kyphoplasty.

Market Scope

| Metrics | Details | |

| CAGR | 6.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Product Type | Balloon Kyphoplasty Systems, Bone Access Devices, Inflatable Bone Tamps (IBTs), Cement Delivery Systems Bone Cement, Others |

| Indication | Osteoporotic Vertebral Compression Fractures, Malignant (Cancer-related) Vertebral Compression Fractures, Traumatic Vertebral Fractures, Pathological Fractures | |

| Material | Metal-based Accessories, Polymer-based Devices, Radiopaque Materials (used in cement) | |

| End User | Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Orthopedic & Spine Clinics, Academic & Research Centers | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global balloon kyphoplasty devices market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggested Reports

For more medical devices-related reports, please click here