Foot and Ankle Devices Market Size and Trends

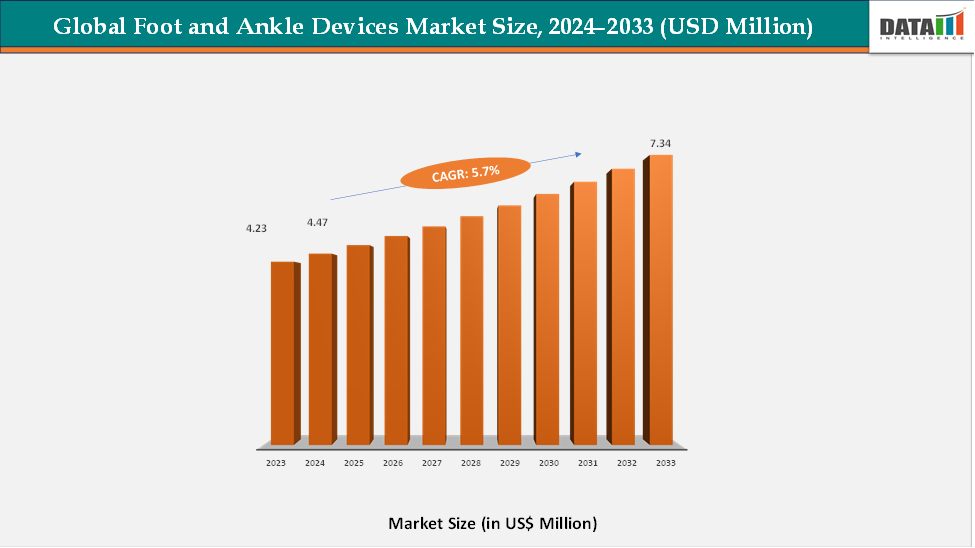

The global foot and ankle devices market reached US$ US$ 4.23 billion in 2023, with a rise to US$ 4.47 billion in 2024, and is expected to reach US$ 7.34 billion by 2033, growing at a CAGR of 5.7% during the forecast period 2025–2033. The global foot and ankle devices market is experiencing steady growth, driven by the increasing prevalence of orthopedic disorders, sports-related injuries, and the expanding aging population worldwide. The growing awareness of early intervention in musculoskeletal conditions and advancements in orthopedic surgical technologies are accelerating the adoption of these devices across hospitals, ambulatory surgical centers, and specialty orthopedic clinics. Rising participation in sports and recreational activities has also led to a surge in ankle sprains, fractures, and ligament injuries, further fueling the demand for innovative fixation systems, joint implants, and support devices.

A major factor propelling market growth is the technological evolution of implant design and materials, such as titanium alloys, bioresorbable polymers, and 3D-printed components, which enhance patient outcomes through improved biocompatibility, durability, and anatomical precision. Furthermore, the growing preference for minimally invasive and robot-assisted orthopedic surgeries is transforming conventional treatment approaches by reducing recovery times and post-operative complications. Digital tools and AI-assisted surgical planning are also improving procedural accuracy, making complex foot and ankle reconstructions more efficient and reliable.

In addition, rising healthcare expenditures, greater access to specialized orthopedic care, and a growing emphasis on mobility and quality of life are reinforcing market expansion globally. Leading medical technology companies such as Zimmer Biomet, Stryker, and Enovis are actively investing in advanced product development and commercialization to address unmet clinical needs. With continuous innovation, expanding healthcare infrastructure, and increasing patient awareness of early treatment, the global Foot and Ankle Devices Market is set to strengthen its position as a crucial segment within the orthopedic industry.

Key Market highlights

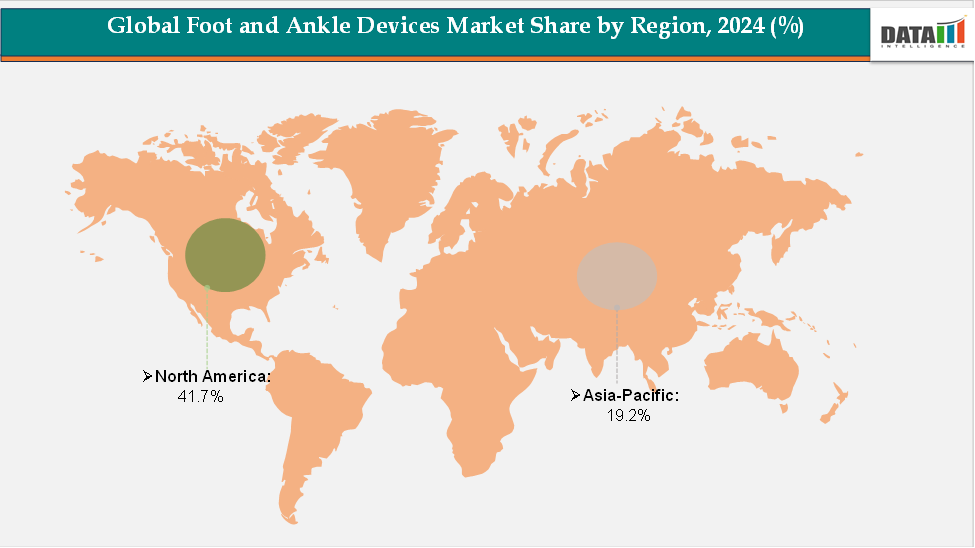

- North America accounted for approximately 41.7% of the global foot and ankle devices market in 2024 and is expected to maintain its leading position throughout the forecast period. The region’s dominance is supported by the strong presence of key medical technology companies, advanced healthcare infrastructure, and a growing number of orthopedic and sports-related procedures. Furthermore, rising awareness about early diagnosis and treatment of joint and ligament injuries, coupled with favorable reimbursement policies and continuous innovation in implant design, continues to drive market growth across the United States and Canada.

- The Asia-Pacific region held around 19.2% of the global market in 2024 and is projected to be the fastest-growing region over the forecast period. The rapid expansion is attributed to increasing healthcare expenditure, expanding access to specialized orthopedic care, and the growing burden of fractures, arthritis, and sports injuries.

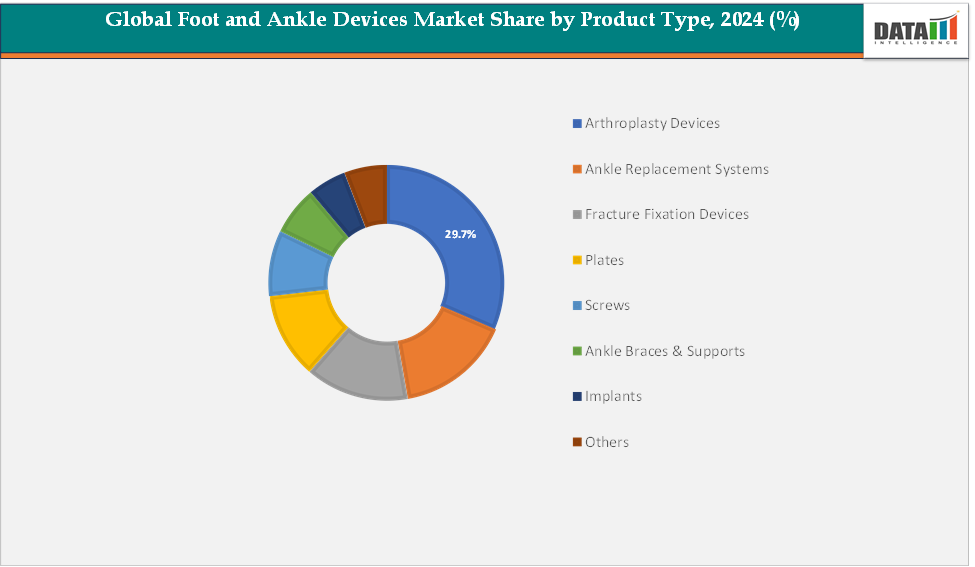

- By product type, arthroplasty devices dominated the global Foot and Ankle Devices Market, accounting for approximately 29.7% of total revenue in 2024. This dominance is driven by the growing adoption of total ankle replacement and joint reconstruction procedures, particularly among elderly and osteoarthritis patients.

Market Size & Forecast

- 2024 Market Size: US$4.47 Billion

- 2033 Projected Market Size: US$7.34 Billion

- CAGR (2025–2033): 5.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Market Dynamics:

Driver: Rising Prevalence of Foot and Ankle Disorders and Injuries

The rising prevalence of foot and ankle disorders and injuries is one of the key factors driving the growth of the global foot and ankle devices market. With increasing participation in sports, fitness, and outdoor activities, the number of ankle sprains, fractures, and ligament injuries has surged significantly across all age groups. According to recent orthopedic studies, ankle injuries account for nearly 15% of all sports-related emergency room visits, underscoring the growing demand for advanced fixation systems, prosthetics, and support devices.

Beyond sports trauma, lifestyle changes, obesity, and an aging global population have led to a rise in chronic musculoskeletal conditions such as osteoarthritis, plantar fasciitis, and hallux valgus. A 2024 study published in the Journal of Foot and Ankle Research revealed that the prevalence of hallux valgus increases from 11% in younger adults to over 22% among individuals above 60 years, reflecting the escalating need for corrective and reconstructive procedures.

Additionally, a 2024 clinical assessment among Umrah pilgrims reported 18.7% of foot and leg sprains and strains, further emphasizing the widespread occurrence of mobility-related injuries. These growing clinical cases have intensified the demand for technologically advanced implants, braces, and minimally invasive surgical solutions, ultimately propelling the expansion of the global foot and ankle devices market.

Restraint: High Cost of Advanced Digital Otoscopes

The high cost of foot and ankle implants and surgical procedures is expected to hinder market growth, particularly in developing regions. Advanced implants made from premium materials like titanium and bioresorbable polymers, along with the use of navigation-assisted or robotic surgical systems, significantly increase treatment expenses. Additionally, post-operative rehabilitation and follow-up care further add to patient costs, making these procedures less accessible to those without comprehensive insurance coverage. This cost barrier limits adoption rates and restrains the overall expansion of the foot and ankle devices market.

For more details on this report, Request for Sample

Global Foot and Ankle Devices Market Segment Analysis

The global foot and ankle devices market is segmented by Product Type, Application, end user and region.

Product Type: The arthroplasty devices segment is estimated to have 29.7% of the foot and ankle devices market share.

The arthroplasty devices segment is expected to dominate the foot and ankle devices market, driven by the growing preference for joint replacement procedures that restore natural motion and reduce post-operative complications. These devices play a crucial role in treating conditions such as severe arthritis, deformities, and traumatic injuries that compromise ankle and foot function. The shift from traditional fusion techniques to total joint replacement is gaining strong clinical acceptance due to improved implant durability, better pain management, and enhanced mobility outcomes.

Advancements such as 3D-printed implants, customized prosthetics, and designs that closely mimic the biomechanics of the ankle joint have further improved surgical precision and patient satisfaction. For instance, new implant designs with enhanced stability and motion preservation capabilities are being increasingly adopted in complex foot and ankle reconstruction surgeries, reinforcing the segment’s dominance.

The digital otoscopes segment is estimated to have 17.2% of the foot and ankle devices market share.

Ankle replacement systems represent the fastest-growing segment in the market as demand rises for motion-preserving alternatives to arthrodesis (fusion) procedures. Surgeons and patients alike are shifting toward total ankle arthroplasty due to its ability to maintain joint mobility, improve gait function, and provide better long-term quality of life. This growth is supported by continuous technological progress, such as the introduction of next-generation fixed-bearing implants, improved polyethylene materials, and precision-driven navigation tools that enhance surgical accuracy. For instance, the latest total ankle replacement systems are showing reduced revision rates and higher patient satisfaction compared to earlier models, driving their adoption across orthopedic centers globally. The combination of favorable clinical outcomes, growing awareness, and supportive technological innovation positions ankle replacement systems as the fastest-expanding area within the foot and ankle devices market.

Global Foot and Ankle Devices Market - Geographical Analysis

The North America foot and ankle devices market was valued at 41.7% market share in 2024

North America continues to dominate the global foot and ankle devices market, supported by an advanced healthcare infrastructure, rising incidence of orthopedic injuries, and a strong concentration of leading medical device manufacturers. The region benefits from early adoption of cutting-edge surgical technologies, high patient awareness, and strong insurance coverage for orthopedic procedures. For instance, in October 2025, U.S.-based Zimmer Biomet Holdings, Inc. and its subsidiary Paragon 28 launched two innovative solutions for complex foot and ankle trauma, providing surgeons with enhanced tools for treating pilon fractures and hindfoot injuries.

Similarly, Stryker Corporation, another U.S.-based medtech leader, introduced its Incompass Total Ankle System in September 2025, an FDA-cleared implant designed for patients with end-stage ankle arthritis. The region’s emphasis on advanced arthroplasty techniques, surgeon training programs, and ongoing R&D investment continues to reinforce its leadership in the global market.

The European foot and ankle devices market was valued at 21.2% market share in 2024

Europe holds a significant position in the foot and ankle devices market, driven by its well-established orthopedic care infrastructure, rising geriatric population, and increasing prevalence of degenerative joint diseases. European hospitals and clinics have been progressively adopting advanced implant designs and fixation systems that enhance post-operative recovery and improve biomechanical stability.

The region also plays an active role in global product innovation, with European participation in international orthopedic conferences and research collaborations. For instance, in September 2024, Enovis unveiled its Tarsoplasty Percutaneous Lapidus System at the AOFAS Annual Meeting in Vancouver, showcasing its focus on surgical efficiency and patient outcomes. Additionally, the region’s growing awareness of early joint disease management and expanding rehabilitation facilities continues to sustain steady market demand.

The Asia-Pacific foot and ankle devices market was valued at 19.2% market share in 2024

The Asia-Pacific region is witnessing the fastest growth in the foot and ankle devices market, fueled by improving healthcare infrastructure, a surge in road and sports-related injuries, and increasing adoption of advanced orthopedic implants. Rapid urbanization, lifestyle changes, and a higher incidence of conditions such as diabetes-related foot complications are also contributing to the demand for reconstructive and fixation devices. For instance, recent regional data indicate a notable rise in trauma and fracture cases across India and China, prompting both local manufacturers and global players to expand their presence through product launches and surgeon training initiatives. The growing affordability of implants, along with government-backed healthcare modernization programs, is driving broader access to surgical care. These factors collectively position Asia-Pacific as the most dynamic and rapidly advancing region in the global foot and ankle devices market.

Global Foot and Ankle Devices Market – Competitive Landscape

The major players in the foot and ankle devices market include Zimmer Biomet, Stryker, OSSIO Inc., Arthrex Inc., MedShape Inc., DePuy Synthes, Acumed LLC, Dieter Marquardt Medizintechnik GmbH, Invibio, among others.

Key Developments:

- In September 2024, Johnson & Johnson MedTech announced that its orthopaedics division, DePuy Synthes, had launched the TriLEAP Lower Extremity Anatomic Plating System. The TriLEAP system provides procedure-specific plates tailored to support a wide range of forefoot and midfoot reconstructive and trauma procedures, enabling precise fixation and fusion of bones and bone fragments in both adult and adolescent patients.

Market Scope

| Metrics | Details | |

| CAGR | 5.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$Bn) | |

| Segments Covered | Product Type | Arthroplasty Devices, Ankle Replacement Systems, Fracture Fixation Devices, Plates, Screws, Ankle Braces & Supports, Implants, Others |

| Application | Rheumatoid Arthritis, Osteoarthritis, Osteoporosis, Others | |

| End User | Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global foot and ankle devices market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape

Suggestions for Related Report

For more medical device-related reports, please click here