Seed Coating Materials Market Size

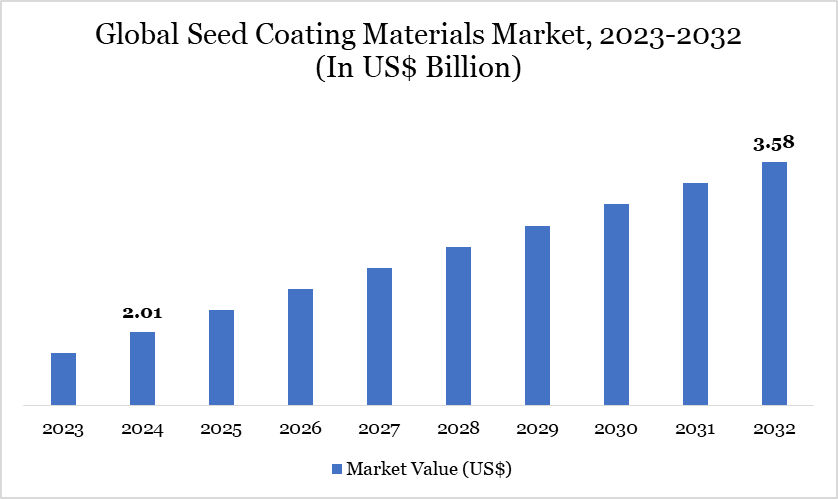

Seed Coating Materials Market reached US$ 2.01 billion in 2024 and is expected to reach US$ 3.58 billion by 2032, growing with a CAGR of 7.50% during the forecast period 2025-2032.

Seed coating materials are applied to seeds to enhance their performance and safeguard them during the initial growth phase. The coatings improve germination rates, increase resistance to diseases and deliver essential nutrients. The seed coating material market is expanding as it aims to improve seed performance and protection using specialized coatings.

The coatings, available in chemical, biological and polymer forms, perform diverse functions including pest control, nutrient delivery and environmental protection. The market is advancing due to technological innovations and the rising demand for greater agricultural productivity. Advancements in coating materials, emphasizing sustainability and efficiency, are shaping the industry's future.

Seed Coating Materials Market Trend

A key trend in the seed coating materials market is the shift towards biodegradable and bio-based formulations. Materials like chitosan, cellulose, and starches are increasingly used to replace synthetic polymers. This move supports eco-friendly farming by reducing soil pollution and enhancing sustainability. It reflects the agricultural sector’s growing commitment to environmental responsibility. Government initiatives are significantly propelling the growth of the seed coating materials market by promoting sustainable agriculture, enforcing environmental regulations, and providing financial support for innovation.

For instance, in February 2022, Xampla, in partnership with Croda International, launched a UK Government-backed trial for a plastic-free, biodegradable seed coating. Supported by a US$ 866.26 (£640) thousand investment, the project aims to replace traditional petroleum-based coatings that contribute to soil microplastic pollution. Developed with input from the National Institute of Agricultural Botany, the year-long trial seeks to match the performance of conventional seed coatings while safeguarding soil health.

For more details on this report – Request for Sample

Market Scope

Metrics | Details |

By Additive | Polymers, Polymer Gels, Superabsorbent, Colorants, Pellet Binders, Others |

By Coating Type | Bio-based Coating, Synthetic Coating |

By Crops | Grains & Cereals, Oil Crops & Pulses, Fruits & Vegetables, Turf & Ornamental, Others |

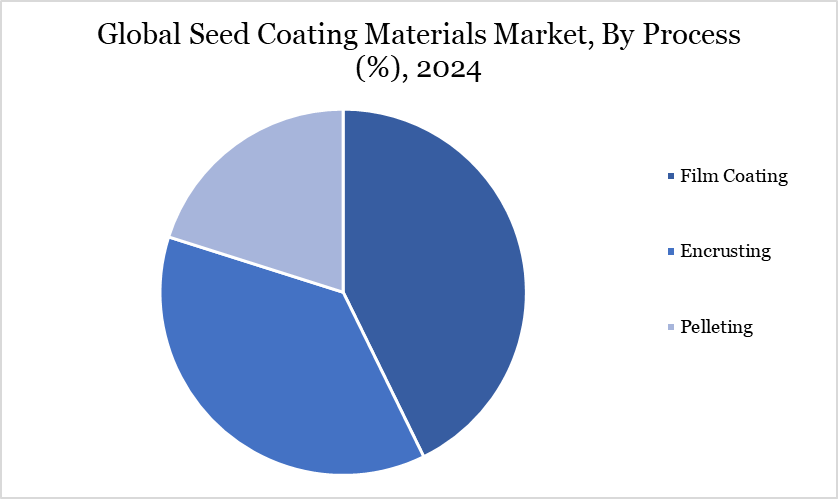

By Process | Film Coating, Encrusting, Pelleting |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Seed Coating Materials Market Dynamics

Rising Need For Enhanced Agricultural Productivity

According to the FAO, the global population is projected to increase by over 2.3 billion by 2050, especially in developing nations and urban areas. Hence, there is an urgent need for more efficient agricultural practices to meet the rising demand for food. The need for enhanced agricultural productivity became essential. Seed coatings are important in improving seed germination, promoting healthier seedling growth and protecting against pests and diseases.

Seed coatings ensure more robust plant development and higher yields by incorporating nutrients, growth regulators and protective agents. They also help seeds withstand environmental stresses, reduce the need for additional inputs and contribute to more sustainable farming practices. The choice and composition of seed materials in seed coatings are crucial for ensuring that coatings perform their intended functions effectively, driving market growth.

High Costs of Seed Coating Materials

The high costs associated with production and application restrain the market expansion. The expenses related to raw materials, advanced technology and the application process can add to a higher cost end of the process that is burdensome for smaller players in the market, potentially limiting their ability to compete and grow. Additionally, economic downturns and fluctuations impact agricultural investment, leading farmers and agricultural companies to reduce spending on seed coatings.

Seed Coating Materials Market Segment Analysis

The global seed coating materials market is segmented based on additives, coating type, crops, process and region.

Affordability and Ease of Application of Film Coating

The global seed coating materials market is segmented based on process into film coating, encrusting and pelleting. The film coating segment dominated the market. Film coating leads the global seed coating materials market due to its versatility, cost-effectiveness and performance-enhancing benefits. This method applies to a wide variety of seed types and conditions, offering a thin, even layer that can be customized with growth-promoting substances, nutrients or pesticides.

The film coating functions without significantly altering the size and shape of the seed. Its cost-efficiency makes it an attractive option for both large-scale and smaller agricultural operations. Additionally, film coating enhances seed handling, reduces damage during planting and provides protection against diseases and pests, improving overall seed germination and growth and enhancing segment growth.

Seed Coating Materials Market Geographical Share

High Agricultural Productivity and Technological Advancements in North America

North America, particularly the US, demonstrates dominance in the global seed coating market through its significant agricultural productivity and technological advancements. With family farms and ranches accounting for 90% of total agricultural production value and a notable increase in farm productivity, such as a more than 360% rise in corn yield since 1950, the region showcases its efficiency and scale in farming.

The emphasis on high output and efficiency translates into a strong demand for advanced agricultural technologies, including seed coatings, which enhance crop performance and protection. Additionally, the US exports US$ 174.9 billion worth of agricultural products annually, underscoring the importance of maintaining quality and consistency in areas where seed coatings play a critical role. Hence, there is a demand that directly fuels the growth of the seed coating materials market in the region. Seed coatings enhance germination, protect against pests, and ensure uniform crop establishment, which are essential for meeting export standards.

Sustainability Analysis

Sustainable seed coatings enhance seed performance while minimizing ecological impact, promoting efficient use of resources like water and fertilizers. Advances in precision agriculture and seed treatment technologies are driving demand for low-toxicity, non-GMO, and environmentally safe coatings. Companies are investing in bio-based polymers and natural additives to reduce reliance on synthetic chemicals that can harm soil and water ecosystems.

For instance, in January 2024, Lucent BioSciences introduced Nutreos, a groundbreaking biodegradable seed coating designed to meet the rising demand for sustainable agricultural solutions. Made from non-toxic, plant-based materials, Nutreos serves as an eco-friendly alternative to conventional microplastic-based seed treatments. This innovation comes in response to impending EU regulations that aim to ban microplastics in agricultural applications.

Seed Coating Materials Market Major Players

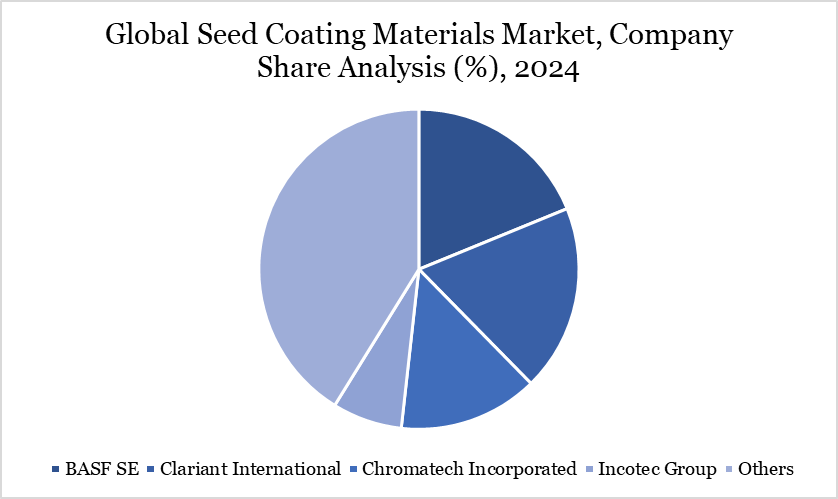

The major global players in the market include BASF SE, Clariant International, Chromatech Incorporated, Incotec Group, German Seeds Technology, BrettYoung, Azelis Holding S.A., Michelman, Inc., Imerys S.A. and Solvay.

Key Developments

In December 2024, the Indian Institute of Oilseeds Research (IIOR), under the Indian Council of Agricultural Research, launched a cutting-edge biopolymer seed coating technology aimed at enhancing crop productivity and sustainability.

In October 2024, Incotec announced the launch of Disco Blue L-1523, a new microplastic-free film coating specifically designed for sunflower seeds. Showcasing a vibrant blue color, the product meets both environmental and customer aesthetic standards.

In February 2024, Milliken do Brasil has launched Milli Solum and Milli Fusion seed coating polymers in Brazil, certified by Syngenta's Seedcare Institute, offering greater flexibility for seed treatment customization.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies