Overview

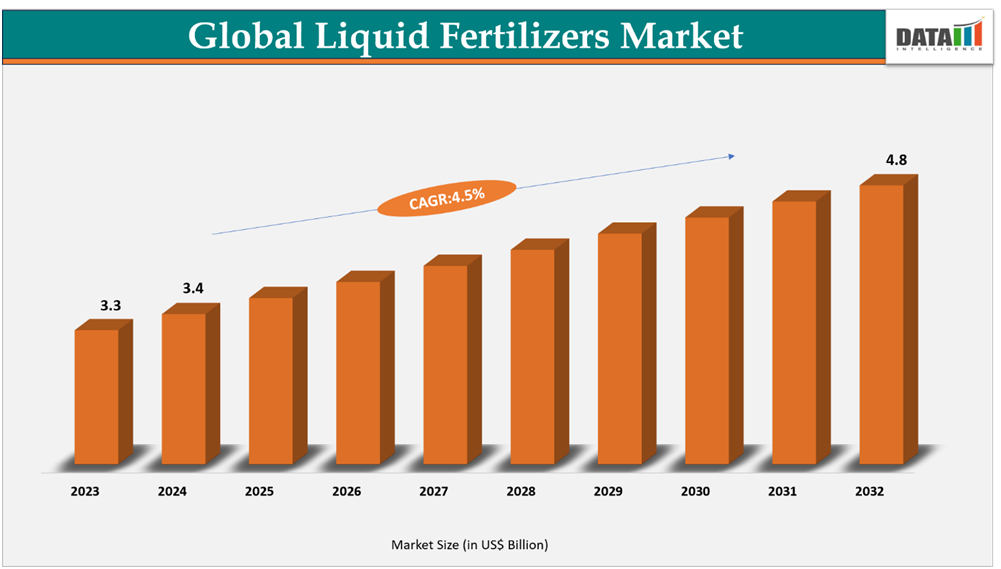

The global liquid fertilizers market reached US$3.3billion in 2023, rising to US$3.4billion in 2024 and is expected to reach US$4.8billion by 2032, growing at a CAGR of 4.5% from 2025 to 2032.

The global liquid fertilizers market is growing steadily, driven by the rising focus on sustainable farming and efficient nutrient management. Liquid fertilizers enable precise application, quick nutrient absorption, and compatibility with modern irrigation systems, enhancing crop yields while minimizing environmental impact.

Advancements in formulation technologies, expanding adoption of precision agriculture, and government support for balanced fertilization are further fueling demand. With increasing use across high-value crops such as fruits, vegetables, and oilseeds, the liquid fertilizers market is set to maintain strong growth in the years ahead.

Liquid Fertilizers Market Industry Trends and Strategic Insights

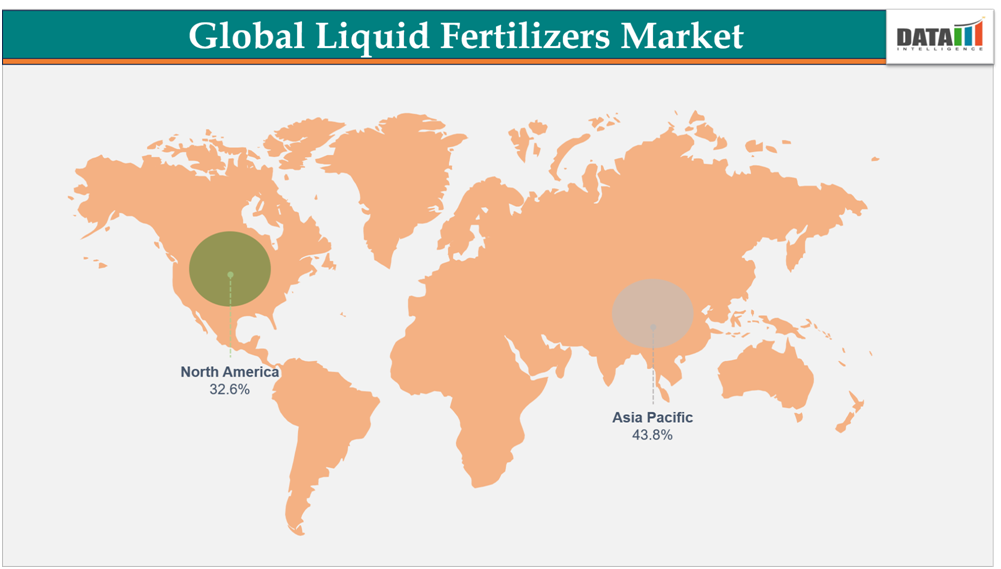

- Asia-Pacific leads the global liquid fertilizers market, capturing the largest revenue share of 43.8% in 2024.

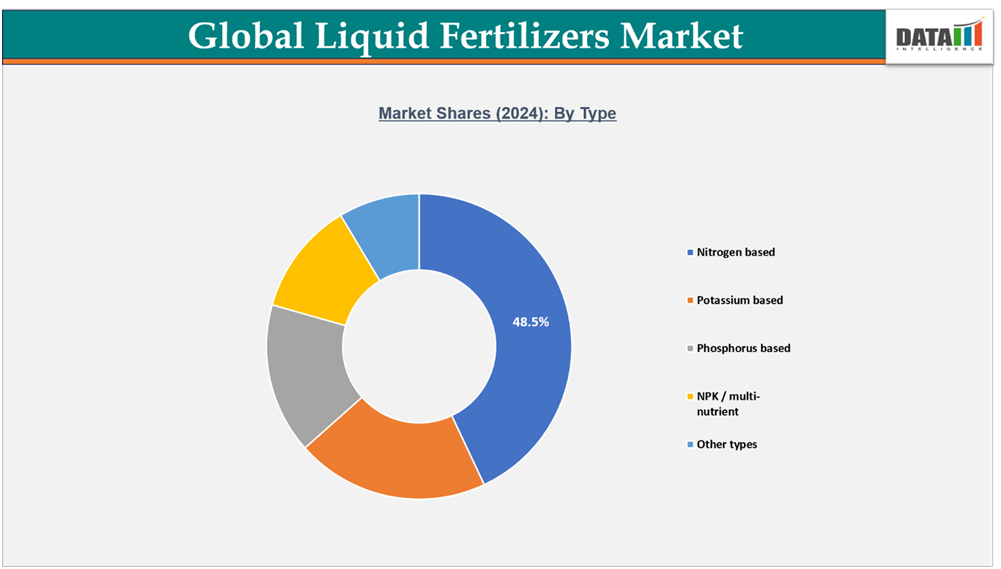

- By type form segment, nitrogen-based based lead the global liquid fertilizers market, capturing the largest revenue share of 48.5% in 2024.

Global Liquid Fertilizers Market Size and Future Outlook

- 2024 Market Size:US$3.4billion

- 2032 Projected Market Size:US$4.8billion

- CAGR (2025–2032):4.5%

- Dominating Market: Asia-Pacific

Fastest Growing Market: North America

source : Datam intelligence Email : [email protected]

Market Scope

| Metrics | Details |

| By Type | Nitrogen-based, Potassium-based, Phosphorus-based, NPK / multi-nutrient, Other types |

| By Application | Soil, Fertigation, Foliar |

| By Crop Type | Cereals & Grains, Fruits & Vegetables, Oilseeds& Pulses, Others crop type |

| By Distribution Channel | B2B, B2C |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising need for higher crop yields globally

The growing global population, changing dietary patterns, and rapid urbanization in 2024 are placing unprecedented pressure on agriculture to produce more food on limited arable land. This has heightened the need for efficient and precise nutrient management, making liquid fertilizers a critical component of modern farming.

Compared to traditional granular fertilizers, liquid fertilizers offer faster nutrient absorption, uniform distribution, and targeted application, helping to maximize crop productivity while minimizing nutrient losses. Challenges such as soil degradation, climate variability, and increasing occurrences of drought and heat stress are further driving farmers to adopt high-efficiency liquid nutrient solutions. These fertilizers enable improved crop growth, enhanced yield quality, and more sustainable agricultural practices.

In 2024, AgroLiquid, a leading provider of liquid fertilizer solutions, acquired Monty’s Plant Food Company, a Louisville-based specialist in soil health and plant nutrition. This strategic partnership combines AgroLiquid expertise in liquid fertilizers with Monty’s innovative soil health technologies, creating advanced, science-driven nutrient management solutions that help farmers achieve higher yields efficiently.

These developments underscore the broader trend of integrating technology, research, and innovation into nutrient management. The increasing global focus on enhancing crop productivity and efficiency is a significant driver for the growth of the liquid fertilizers market, particularly in regions such as Asia-Pacific, North America, and Latin America, where agricultural modernization and sustainable farming practices are expanding rapidly.

Segmentation Analysis

The global liquid fertilizers market is segmented based on type, application, crop type, distribution channel and region.

Nitrogen-Based Liquid Fertilizers Dominate the Market with Focus on Sustainability and Precision Farming

The nitrogen-based segment remains the largest contributor to the global liquid fertilizers market in 2025, driven by its essential role in promoting crop growth, enhancing yields, and supporting large-scale agriculture. Liquid nitrogen fertilizers, such as urea-ammonium nitrate (UAN) solutions and ammonium nitrate-based formulations, are widely applied to cereals, vegetables, and high-value horticultural crops for their fast nutrient availability and ease of application.

A key trend influencing this segment is the shift toward low-carbon and sustainable nitrogen production. In 2025, Genesis Fertilizers signed a commercial Letter of Intent (LOI) with Gunvor USA LLC to establish agreements for natural gas supply, diesel exhaust fluid (DEF) offtake, and carbon credits for its proposed nitrogen fertilizer facility in Belle Plaine, SK. This initiative highlights the industry’s growing focus on environmentally responsible production that adds value across the supply chain while minimizing emissions.

The segment’s growth is further supported by precision farming techniques, fertigation, and digital crop monitoring systems that enhance nitrogen use efficiency and minimize nutrient losses. Asia-Pacific leads consumption due to intensive farming practices and government programs promoting efficient nitrogen use, followed by North America and Europe, where advanced farming technologies and sustainability initiatives are driving adoption. Overall, technological innovation, eco-friendly production, and the rising need for effective crop nutrition are set to sustain the segment’s dominance in the coming years.

Potassium-Based Liquid Fertilizers Gain Momentum with Focus on Crop Quality and Stress Tolerance

The potassium-based liquid fertilizers segment is witnessing steady growth, supported by the increasing demand to enhance crop quality, water-use efficiency, and stress resistance. These fertilizers are vital in fruit, vegetable, and plantation crop cultivation, where they improve color, size, taste, and shelf life while boosting resistance to drought and disease.

Manufacturers are increasingly developing chloride-free and balanced formulations suitable for sensitive crops and hydroponic systems, aligning with the trend toward precision and controlled-environment agriculture. Adoption is particularly strong in Europe and Asia-Pacific, driven by the expansion of high-value horticulture and greenhouse farming.

Overall, while nitrogen-based fertilizers dominate in volume, potassium-based fertilizers are rapidly gaining traction in quality-focused crop production, reflecting the global shift toward sustainable and productivity-enhancing agricultural practices.

Geographical Penetration

DOMINATING MARKET:

Asia-Pacific Leads the Global Liquid Fertilizers Market Driven by Modern Agriculture and Sustainable Growth Initiatives

The global liquid fertilizers market is expanding rapidly, led by the Asia-Pacific region, driven by agricultural modernization, precision farming, and strong government support for sustainable practices. Rising food demand, limited arable land, and the need for nutrient-efficient solutions are fueling the adoption of nitrogen-, potassium-, and micronutrient-based liquid fertilizers.

In 2024, Asia-Pacific dominated the global market, with China, India, Australia, and Japan leading in adoption through initiatives promoting precision agriculture and sustainable farming. Strategic moves like Fertiglobe’s 2025 acquisition of Wengfu Australia’s distribution assets highlight efforts to enhance regional supply efficiency.

Advancements in fertigation, smart irrigation, and digital monitoring are improving productivity, while the shift toward eco-friendly and bio-based fertilizers supports sustainability goals. Overall, Asia-Pacific is expected to remain the largest and fastest-growing liquid fertilizers market through 2024.

India Liquid Fertilizers Market Insights

India is one of the fastest-growing markets in the Asia-Pacific region, supported by large-scale agricultural activities and policies promoting balanced nutrient use. Government schemes encouraging precision agriculture, drip irrigation, and fertigation are driving demand for liquid fertilizers. The market is also witnessing increased local production and technological adoption to improve distribution and nutrient efficiency. Rising awareness about sustainable crop nutrition and improved soil health management continues to strengthen India’s position in the regional market.

China Liquid Fertilizers Market Growth

China remains the largest producer and consumer of liquid fertilizers in the region, supported by robust agricultural infrastructure and innovation in fertilizer formulation. The country’s strong focus on crop productivity, along with ongoing research into efficient nutrient delivery systems, is accelerating adoption across high-value crops. Technological advancements, government-backed initiatives promoting green agriculture, and private sector investments are further propelling market growth, ensuring consistent demand despite trade and export challenges.

FASTEST GROWING MARKET:

North America Emerges as the Fastest-Growing Region Supported by Precision Agriculture and Advanced Fertilizer Technologies

The global liquid fertilizers market is experiencing robust expansion, with North America emerging as the fastest-growing region due to strong emphasis on sustainable agriculture, high crop productivity, and technological innovation. The region’s advanced farming practices, combined with growing awareness about efficient nutrient use, are accelerating the transition toward liquid fertilizers designed for environmental and economic efficiency.

US Liquid Fertilizers Market Outlook

The US leads regional growth, supported by large-scale adoption of precision farming technologies, increased investments in Agri-tech solutions, and government efforts to promote nutrient efficiency. Farmers are increasingly turning to customized liquid fertilizers for cereals, corn, and specialty crops to improve yield while adhering to sustainability standards. Partnerships between fertilizer producers and technology firms continue to drive innovation in formulation, application, and monitoring systems.

Canada Liquid Fertilizers Market Trends

Canada’s liquid fertilizers market is expanding steadily, supported by efforts to improve soil health, optimize nutrient efficiency, and promote environmentally conscious farming practices. Liquid fertilizers are increasingly being used across field crops and horticulture to ensure consistent nutrient delivery and minimize losses. Government programs incentivizing sustainable agriculture, coupled with collaborations between fertilizer producers and research institutions, are enhancing product innovation and adoption. The ongoing shift toward high-value and export-oriented crops further supports Canada’s market growth and positions it as a key player in North America’s evolving agricultural landscape

Sustainability and ESG Analysis

Sustainability and ESG (Environmental, Social, and Governance) considerations are increasingly shaping the global liquid fertilizers market, guiding production practices, investment strategies, and regulatory compliance. Companies are focusing on environmentally responsible operations, efficient resource management, and transparent governance to enhance long-term resilience and market credibility.

The market is seeing a shift toward low-emission, bio-based, and nutrient-efficient fertilizers that support soil health and reduce ecological impact. Manufacturers are adopting circular economy practices, optimizing nutrient delivery, reducing waste, and integrating renewable energy and water-efficient processes into production and supply chains.

Social initiatives are also gaining importance, with firms partnering with farmers, research institutions, and governments to promote precision and regenerative agriculture. These collaborations help improve crop productivity while maintaining environmental sustainability and community welfare.

Robust ESG frameworks are allowing companies to meet global sustainability standards, strengthen brand reputation, and drive responsible growth. By embedding sustainability across sourcing, production, and distribution, the global liquid fertilizers industry is advancing toward a more efficient, eco-friendly, and future-ready market.

Competitive Landscape

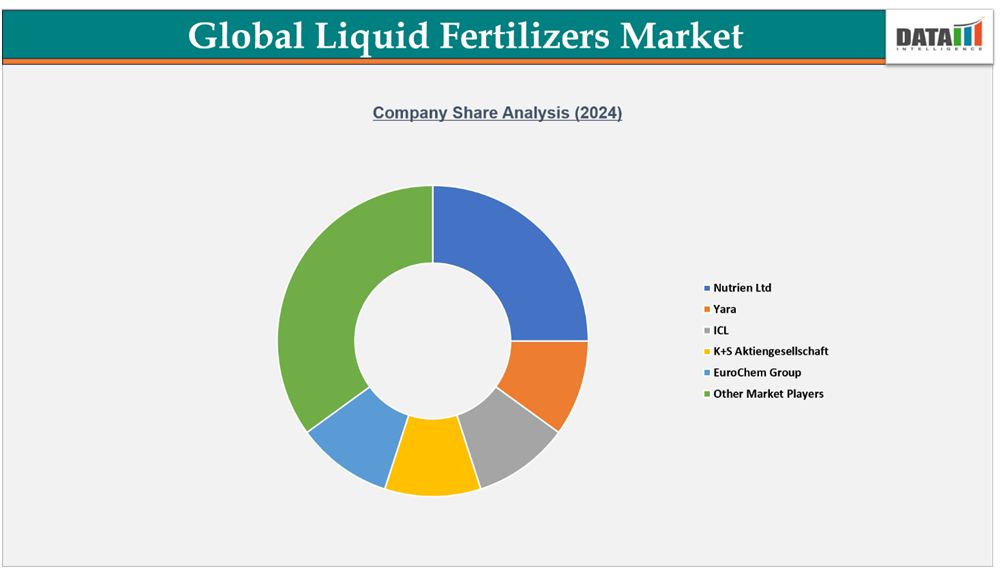

- The global liquid fertilizers market is highly competitive, comprising a mix of major multinational corporations and prominent regional players. Leading companies such as Nutrien Ltd., Yara International ASA, The Mosaic Company, ICL Group Ltd., OCP Group, and Haifa Chemicals maintain market dominance through large-scale production capabilities, diverse fertilizer portfolios, and ongoing investments in advanced nutrient technologies and R&D.

- Several manufacturers are expanding their footprint in emerging markets via strategic alliances, joint ventures, and enhanced distribution networks. Collaborations with agri-tech platforms and digital farming solutions are enabling companies to improve nutrient-use efficiency and better serve small- and medium-scale farmers worldwide.

- Market competition is driven by sustainability initiatives, innovation in nitrogen- and potassium-based fertilizers, and customized nutrient solutions for high-value crops. Compliance with regulatory standards, product differentiation, and integration with precision agriculture technologies continue to shape leadership and long-term growth in the global liquid fertilizers industry.

Key Developments

- In September 2025: Adufértil Fertilizantes, a subsidiary of Indorama Corporation and a prominent provider of crop nutrition solutions, has reached a key milestone by signing definitive agreements to acquire Fass Agro, a company renowned for its expertise in the liquid fertilizer sector.

Investment & Funding Landscape

The global liquid fertilizers market is witnessing significant investment activity and strategic partnerships, reflecting strong industry confidence in sustainable and high-performance agricultural solutions.

In September 2025, cleantech startup Nitricity raised $50 million in a Series B funding round to scale up its technology for producing organic, low-emission nitrogen fertilizers. This investment highlights the growing focus on eco-friendly and sustainable fertilizer production to meet global crop nutrition demands.

Meanwhile, in September 2024, IFFCO invested approximately Rs 2,000 crore since 2017 in the development of nano liquid urea and nano liquid DAP. These innovative fertilizers aim to enhance crop productivity and soil health, with IFFCO targeting 80% capacity utilization within the next 2–3 years through substantial annual promotion and adoption initiatives.

These developments underline a global shift toward technological innovation, sustainability, and strategic investments in the liquid fertilizers industry, as leading players focus on improving efficiency, crop yield, and long-term growth potential.

What Sets This Global Liquid FertilizersMarket Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by product type, stage, form, and distribution channel segments. Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect liquid fertilizers' commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.