Secondary Aluminum Market Overview

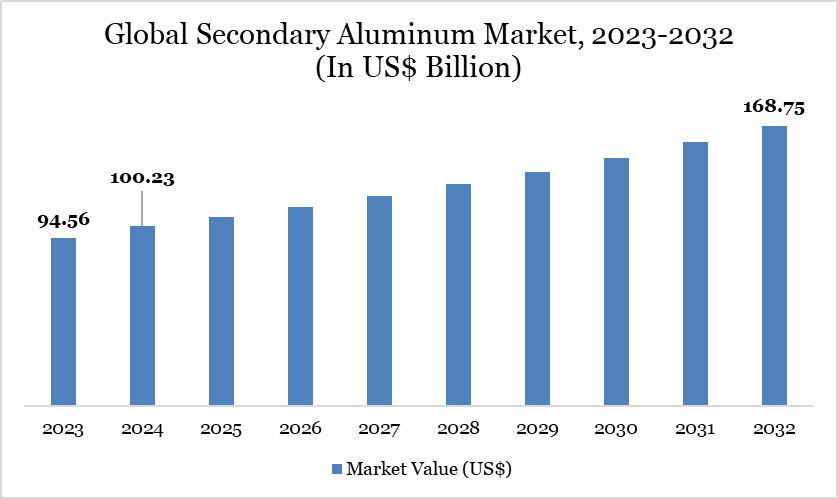

The Global Secondary Aluminum Market reached US$100.23 billion in 2024 and is expected to reach US$168.75 billion by 2032, growing at a CAGR of 6.81% during the forecast period 2025-2032.

The secondary aluminum market revolves around recycling and reprocessing scrap aluminum into usable products, which reduces production costs while supporting environmental sustainability, making it increasingly valuable for industries such as automotive, construction, packaging, and aerospace that require lightweight yet durable materials. This rising industrial demand is evident in the US, where in 2023, 3.3 million tonnes of secondary aluminum were produced, representing 81% of total aluminum output-well above the global average of 33%, showing the country’s strong reliance on recycling over primary production.

Growth in this market is driven by secondary aluminum’s significantly lower energy consumption and reduced carbon footprint compared to primary production, aligning closely with global ESG and decarbonization goals. Continuous advancements in recycling technologies are enhancing both the quality and efficiency of output, encouraging greater adoption worldwide. Furthermore, expanding urbanization and industrialization are increasing scrap availability, enabling stable supply and reinforcing secondary aluminum’s importance as a sustainable and competitive material choice across global manufacturing sectors.

Secondary Aluminum Market Trend

The secondary aluminum market is witnessing strong growth driven by increasing demand for sustainable and recycled materials across automotive, construction, and packaging sectors. Advanced recycling technologies and efficient scrap collection systems are improving yield and reducing production costs. Additionally, rising environmental regulations and corporate ESG initiatives are encouraging the use of secondary aluminum over primary aluminum. Emerging markets are also contributing to higher consumption, supporting a global expansion of the secondary aluminum supply chain.

For more details on this report - Request for Sample

Market Scope

| Metrics | Details |

| By Product Type | Ingots, Billets, Wire Rods, Others |

| By Source of Aluminum | Post-Consumer Scrap, Industrial Scrap |

| By Alloy Type | Cast Aluminum Alloys, Wrought Aluminum Alloys |

| By Purity Level | High Purity Aluminum, Standard Purity Aluminum |

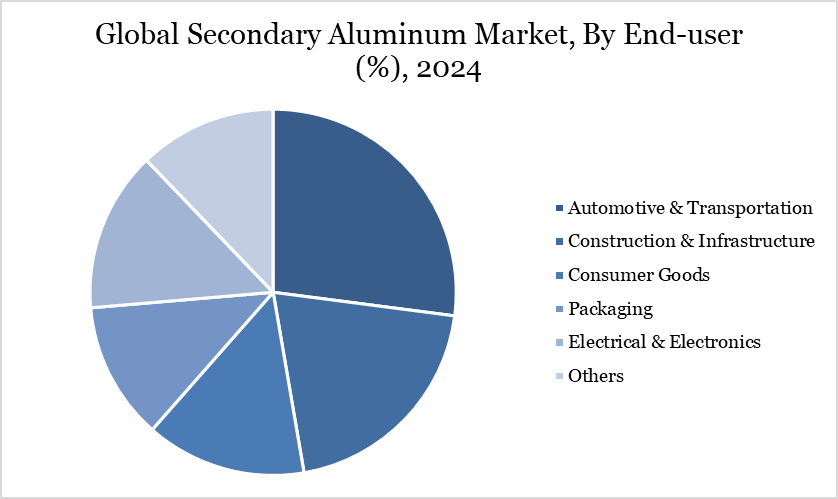

| By End-User | Automotive & Transportation, Construction & Infrastructure, Consumer Goods, Packaging, Electrical & Electronics, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Secondary Aluminum Market Dynamics

Sustainability & Environmental Regulations

Sustainability and environmental regulations are increasingly driving the secondary aluminum market, as industries shift towards eco-friendly materials with lower carbon footprints. India is advancing towards a carbon-neutral future with a focus on sustainable development and innovative solutions. Initiatives like the Long-Term Low Emission Development Strategy and the Miyawaki tree planting at Mahakumbh 2025 underscore the nation’s commitment to reducing greenhouse gas emissions.

Several major real estate developers have committed to cutting emissions by at least 50% by 2030 and achieving carbon neutrality by 2040, highlighting the demand for sustainable building materials. Aluminum, especially recycled secondary aluminum, is playing a key role in these innovative technological solutions, enabling industries to meet environmental targets while maintaining efficiency and cost-effectiveness.

Quality Variability of Scrap

Quality variability of scrap restrains the secondary aluminum market because recycled aluminum comes from diverse sources, including post-consumer and industrial scrap. The presence of impurities, mixed alloys, or contamination can reduce the material’s consistency and performance. This makes it less suitable for high-precision applications such as aerospace, automotive, and electronics. As a result, manufacturers may prefer primary aluminum for critical uses, limiting the overall growth and adoption of secondary aluminum.

Secondary Aluminum Market Segment Analysis

The global Secondary Aluminum market is segmented based on product type, source of aluminum, alloy type, purity level, end-user end-user and region.

Automotive and Transportation Gain Significant Share Due to Lightweighting and Fuel Efficiency

The automotive and transportation sector drives a significant share of the secondary aluminum market, as manufacturers increasingly rely on lightweight materials to improve fuel efficiency and reduce emissions. Recycled aluminum is ideal for vehicle bodies, engine components, and chassis parts, linking material choice directly to sustainability and cost-efficiency goals.

The rapid adoption of electric vehicles further strengthens this demand. According to IEA, 2024 saw an increase of 3 million EVs, bringing the global total to 17 million electric cars sold, exceeding 20% of new car sales, with an overall electric fleet reaching almost 58 million vehicles by year-end. This surge in EV production amplifies the need for secondary aluminum, allowing automakers to balance performance, weight reduction, and environmental impact, making the sector a key driver of market growth.

Secondary Aluminum Market Geographical Share

Asia-Pacific Holds Major Share in Global Secondary Aluminum Market Driven by Industrial Growth

Asia-Pacific holds a significant share in the secondary aluminum market due to the region’s rapid industrialization and growing demand for lightweight and sustainable materials. Countries like China, India, and Japan are major consumers of aluminum in automotive, construction, and electrical sectors, driving the adoption of recycled aluminum. The availability of abundant post-consumer and industrial scrap further supports secondary aluminum production, making it a cost-effective and eco-friendly alternative to primary aluminum.

In India, rapid infrastructure growth has intensified this trend. According to the Indian government, India, the world’s fifth-largest economy, has witnessed budget allocations of US$110 billion (₹10 lakh crore) in 2023-24, enhancing connectivity, boosting trade, and improving quality of life. This surge in infrastructure development has accelerated demand for rolled aluminum products, further strengthening the region’s leadership in the secondary aluminum market.

Sustainability Analysis

The secondary aluminum market significantly contributes to sustainability by reducing the need for primary aluminum production, which is highly energy-intensive. Recycling aluminum consumes up to 95% less energy than producing it from bauxite, lowering carbon emissions and conserving natural resources. Increasing adoption of advanced sorting and remelting technologies enhances material recovery rates, minimizing waste and environmental impact.

Highlighting industry developments, in May 2025, Pure Aluminum, a secondary aluminum producer in Saranac, Michigan, has partnered with Traxys and Consortium Metals to recycle aluminum and manufacture value-added products like secondary aluminum specification alloys, recycled secondary ingot (RSI), wrought alloys, and aluminum deoxidizers. This collaboration supplies critical materials to steel, die casting, and primary aluminum industries, reinforcing circular economy practices. Growing regulatory support and demand for eco-friendly materials further strengthens the market’s sustainability trajectory.

Secondary Aluminum Market Major Players

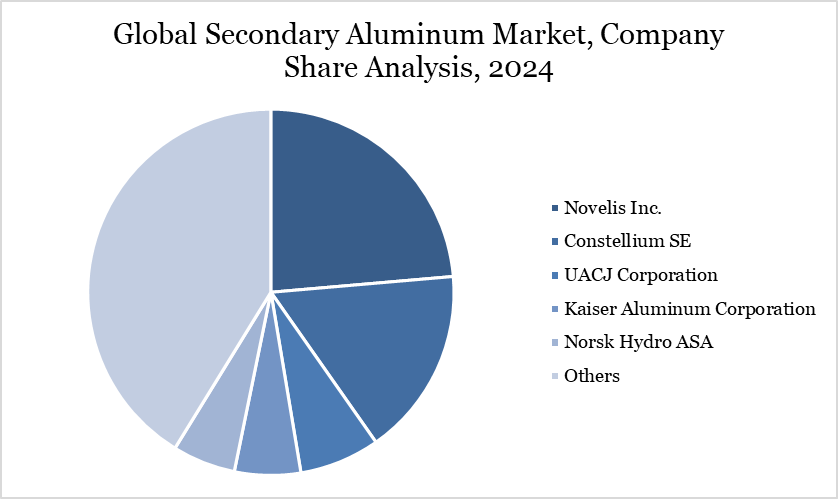

The major global players in the market include Novelis Inc., Constellium SE, UACJ Corporation, Kaiser Aluminum Corporation, Norsk Hydro ASA, AMAG Austria Metall AG, Alcoa Corporation, CMR Green Technologies Ltd., Daiki Aluminium Industry Co., Ltd., Metal Exchange.

Key Developments

In March 2024, Emirates Global Aluminium (EGA) has signed an agreement to acquire German secondary aluminum producer Leichtmetall Aluminium Giesserei Hannover GmbH from Munich-based Quantum Capital Partners. Leichtmetall, a specialty foundry producing up to 30,000 metric tons per year with 80% recycled aluminum, uses renewable energy in its Hanover plant and manufactures hard alloys and large-diameter billets. EGA calls the acquisition a landmark deal, supporting its global growth in low-carbon primary and recycled aluminum and advancing its goal to reach net-zero greenhouse gas emissions by 2050.

In June 2025, the Shanghai Futures Exchange (SHFE) officially launched China’s first cast aluminum alloy futures and options, marking a milestone for secondary metal trading. With brisk trading and significant turnover, the new contracts provide market participants with tools for risk management and transparent price signals. Produced from recycled aluminum scrap, cast aluminum alloy supports low-carbon development and the industry’s shift toward sustainable secondary aluminum.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies