Primary Aluminum Market Overview

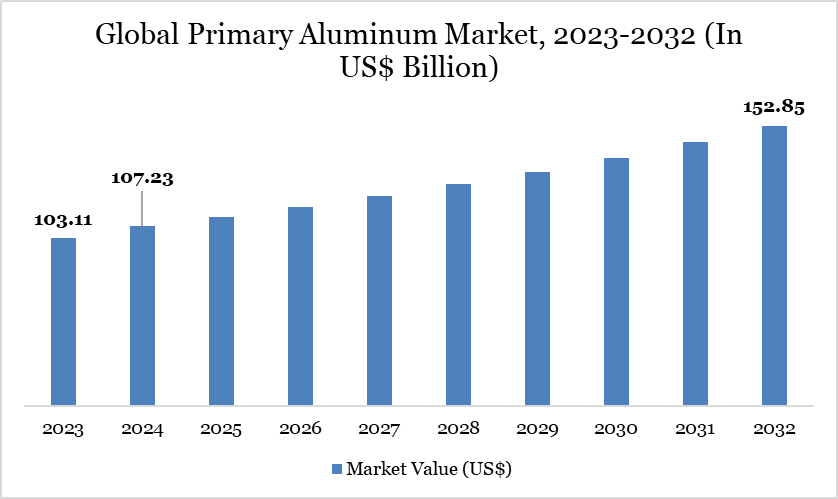

The global primary aluminum market reached US$107.23 billion in 2024 and is expected to reach US$152.85 billion by 2032, growing at a CAGR of 4.59% during the forecast period 2025-2032.

The global Primary Aluminum market is expanding steadily, driven by rising demand from the automotive. The Global Primary Aluminum Market is witnessing steady growth, driven by rising demand from the automotive, construction, packaging, and electrical & electronics sectors. Rapid urbanization and infrastructure development, particularly in the Asia-Pacific, are creating strong consumption patterns for lightweight and durable aluminum products. A

ccording to the WBMS report, global primary aluminum production in February 2025 was 5.6846 million tons, slightly exceeding consumption of 5.6613 million tons, resulting in a surplus of 23,300 tons. In the first two months of 2025, production totaled 11.7991 million tons, while consumption was 11.6124 million tons, leading to a cumulative surplus of 186,700 tons. This indicates a modest oversupply in the market during the early part of the year.

The market growth is supported by the shift toward electric vehicles, where aluminum’s lightweight properties improve efficiency. Technological advancements in production processes, coupled with sustainability initiatives like low-carbon aluminum adoption, are enhancing efficiency and reducing environmental impact. Strong demand in renewable energy infrastructure, packaging, and consumer goods further reinforces the positive growth trajectory of the global primary aluminum market.

Primary Aluminum Market Trend

The Global Primary Aluminum Market is witnessing a shift toward sustainable production, driven by rising demand for low-carbon aluminum solutions. Technological advancements in smelting and recycling processes are improving efficiency and reducing energy consumption. Growing applications in automotive, construction, and packaging sectors are fueling steady market expansion. Additionally, fluctuations in raw material costs and trade policies are influencing global supply-demand dynamics.

For more details on this report - Request for Sample

Market Scope

| Metrics | Details |

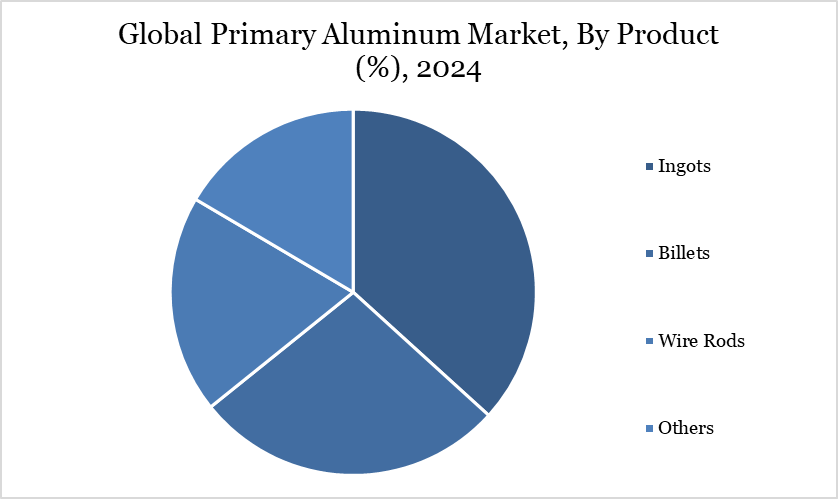

| By Product | Ingots, Billets, Wire Rods, Others |

| By Production Process | Hall-Heroult Process, Bayer Process, Others |

| By End-User | Automotive & Transportation, Construction & Infrastructure, Consumer Goods, Packaging, Electrical & Electronics, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Primary Aluminum Market Dynamics

Construction and Infrastructure Growth

The growth of the construction and infrastructure sector is a key driver of the global primary aluminum market, as aluminum’s lightweight, corrosion-resistant, and durable properties make it ideal for modern building applications. Rapid urbanization and increasing population, particularly in emerging economies, are driving higher demand for residential and commercial structures. According to the Indian government, India, the world’s fifth-largest economy, has witnessed rapid infrastructure growth over the past decade, with budget allocations reaching US$110 billion (₹10 lakh crore) in 2023-24, highlighting the scale of construction investments.

Aluminum is extensively used in windows, doors, roofing, curtain walls, and cladding, directly linking construction growth to increased aluminum consumption. Governments worldwide are prioritizing infrastructure development, including bridges, airports, and railways, further boosting demand. The trend towards sustainable and energy-efficient buildings also encourages the adoption of aluminum due to its recyclability and low carbon footprint. Consequently, expansion in construction and infrastructure globally is strengthening the primary aluminum market and reinforcing its strategic importance.

Environmental Regulations and Emissions

Environmental regulations and emissions restrictions are major restraints for the global primary aluminum market. Aluminum production is highly energy-intensive and generates significant CO₂ emissions, contributing to climate change concerns. Stricter environmental policies force producers to adopt cleaner but costlier technologies, increasing operational expenses. Compliance with emissions standards can also limit production capacity in regions with stringent regulations. As a result, these factors collectively slow down market expansion and affect profitability.

Primary Aluminum Market Segment Analysis

The global primary aluminum market is segmented based on product, production process, end-user and region.

Ingots Dominate Global Primary Aluminum Market Due to Their Versatility and Essential Role in Downstream Manufacturing

Ingots hold a significant share in the global primary aluminum market due to their foundational role as the main raw material for downstream aluminum products. They are essential for producing billets, sheets, plates, and extrusions, which are widely used across industries such as automotive, construction, packaging, and electronics. The demand for high-quality aluminum ingots continues to rise, driven by industrial expansion and the need for materials with consistent chemical composition and mechanical properties.

The automotive sector, in particular, has boosted the importance of ingots, as manufacturers increasingly require specialized alloys for lightweight and high-performance components. For instance, on 25 June 2025, National Aluminium Company Limited (NALCO), a Navratna CPSE under the Ministry of Mines, launched its IA90 Grade Aluminium Alloy Ingot to meet the evolving needs of the automotive industry. This strategic move not only expands NALCO’s product portfolio but also highlights the growing demand for tailored ingots that cater to sector-specific requirements. Consequently, ingots remain a dominant product segment, driving production trends and shaping the global primary aluminum market.

Primary Aluminum Market Geographical Share

Asia-Pacific Holds Major Share in Global Primary Aluminum Market Driven by China’s High Production and Regional Industrial Growth

Asia-Pacific holds a significant share in the global primary aluminum market due to its robust industrial base and high manufacturing demand. According to the International Aluminium Institute, between 2024 and 2025, global primary aluminum production across 11 selected regions is estimated at 109.468 million metric tonnes, with China alone contributing 65.222 million tonnes. This dominant output underscores the region’s central role in meeting global aluminum demand. Rapid industrialization, especially in China, has driven strong demand for aluminum in the automotive, construction, and packaging sectors. Consequently, Asia-Pacific continues to influence global supply dynamics, reinforcing its strategic importance in the primary aluminum market.

Sustainability Analysis

The global primary aluminum market faces significant sustainability challenges due to its energy-intensive production process and high CO₂ emissions, which have led to increasing regulatory pressure and a shift toward greener practices. Companies are now focusing on reducing their carbon footprint through the adoption of renewable energy, low-carbon smelting technologies, and innovative production methods.

A notable example is Vedanta Aluminium, which on 24 February 2022 launched its low-carbon brand ‘Restora’ with two product lines, Restora and Restora Ultra. Restora is India’s first primary aluminium produced using renewable energy, while Restora Ultra features an ultra-low carbon footprint developed in collaboration with Runaya Refining. Both products are independently verified as low-carbon, demonstrating the industry’s commitment to sustainable growth and supporting the broader goal of achieving Net Zero Carbon by 2050.

Primary Aluminum Market Major Players

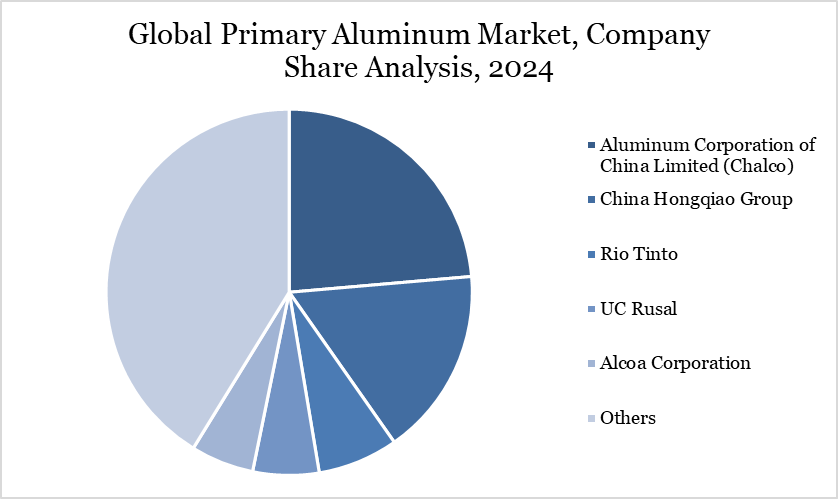

The major global players in the market include Aluminum Corporation of China Limited (Chalco), China Hongqiao Group, Rio Tinto, UC Rusal, Alcoa Corporation, Hydro Aluminium, Hindalco Industries Limited, Emirates Global Aluminium (EGA), China Minmetals Corporation, Kaiser Aluminum Corporation.

Key Developments

In May 2025, Emirates Global Aluminium (EGA), a premium aluminium producer, announced plans to develop the first new primary aluminium plant in the US. The plant is expected to produce 600,000 tonnes annually, nearly doubling US production and reducing reliance on imports for industries such as automotive, aviation, and construction. EGA plans to invest around US$4 billion, with construction beginning after a feasibility study and first hot metal expected by the end of the decade

In May 2025, Aluminium Dunkerque, a leading European primary aluminium producer, launched its state-of-the-art Furnace 8 for aluminium recycling, enabling the plant to process 7,000 tonnes of scrap annually and produce an additional 20,000 tonnes of low-carbon aluminium each year. The furnace is expected to reduce CO₂ emissions by 25,000 tonnes annually, supporting France’s reindustrialisation and reducing reliance on high-carbon imports.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies