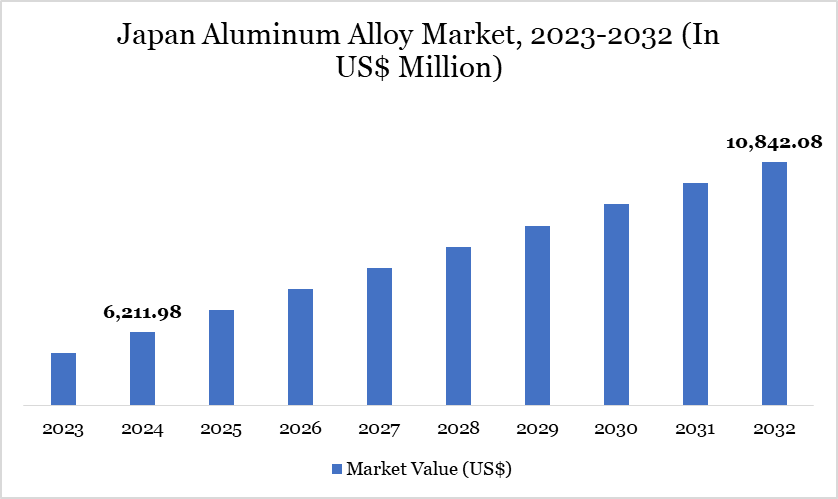

Market Size

Japan Aluminum Alloy Market reached US$ 6,211.98 million in 2024 and is expected to reach US$ 10,842.08 million by 2032, growing with a CAGR of 7.21% during the forecast period 2025-2032.

Japan aluminum alloy market is a mature yet dynamic sector, driven by a robust manufacturing base, technological advancement, and increasing applications across the automotive, aerospace, electronics, and construction industries. Japan is one of the world's leading producers and users of high-performance aluminum alloys, known for precision engineering and quality control.

The country's emphasis on lightweighting in the automotive and transportation sectors is a major growth driver, especially with automotive giants like Toyota, Honda, and Nissan increasingly incorporating aluminum alloys to meet fuel efficiency and carbon reduction targets. For instance, UACJ Corporation, one of the largest rolled aluminum manufacturers in Asia, has expanded its supply of aluminum sheets for electric vehicles (EVs), especially battery enclosures, aligning with the country’s push towards EV adoption.

Market Trend

One of the most prominent trends in the Japan aluminum alloy market is the rising integration of advanced manufacturing technologies, such as high-pressure die casting and additive manufacturing (3D printing). These techniques allow for more complex and lightweight alloy component designs, especially for automotive and aerospace applications.

For instance, Mazda has adopted high-pressure die casting to develop thinner yet stronger parts for its SKYACTIV engine series, improving fuel efficiency and performance. Similarly, JIS-compliant aluminum powders are being used for prototyping complex components in R&D-intensive sectors like robotics and medical devices.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Alloy Type | Wrought Alloys, Cast Alloys, Others | |

| By Strength | High-Strength Alloys, Medium-Strength Alloys, Low-Strength Alloys | |

| By Product Form | Extrusions, Forgings, Castings, Rolled Products, Bars & Rods, Wires, Others | |

| By Application | Transportation, Construction, Electrical, Packaging, Consumer Durables, Machinery, Others | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Demand from the Automotive Industry

A major driving factor for the Japan aluminum alloy market is the strong demand from the automotive industry due to the country’s aggressive push toward fuel-efficient and electric vehicles (EVs). Japan’s leading automakers Toyota, Nissan, and Honda are increasingly adopting aluminum alloys to reduce vehicle weight and improve fuel efficiency.

For instance, in 2023, zero-emission vehicles in Japan showed a strong performance across various categories. Hybrid Electric Vehicles (HEVs) dominated the market with 11.5 million units sold, reflecting strong demand as a transitional option. There were 207,865 Plug-in Hybrid Electric Vehicles (PHEVs) sold in 2023, appealing to those seeking both electric and traditional power.

Additionally, the ongoing transition to electric vehicles (EVs) is a major driver. Aluminum alloys are lightweight, which helps in reducing the overall weight of EVs, improving energy efficiency and range. Japan, home to auto giants like Toyota, Honda, and Nissan, has significantly ramped up investments in EV R&D and production.

High Production Cost Associated with Primary Aluminum and Specialized Alloys

One of the primary restraining factors in the Japan aluminum alloy market is the high production cost associated with primary aluminum and specialized alloys. Japan lacks significant domestic bauxite reserves, the key raw material for aluminum, and relies heavily on imports from countries like Australia, Indonesia, and China.

This dependence exposes the market to price volatility in global commodities and higher transportation and processing costs. As a result, manufacturing aluminum alloys locally becomes expensive, especially compared to countries with abundant natural resources and lower energy costs. For instance, the elevated electricity prices in Japan driven by limited domestic energy resources and post-Fukushima energy reforms, further increase the cost of smelting and alloy production.

Segment Analysis

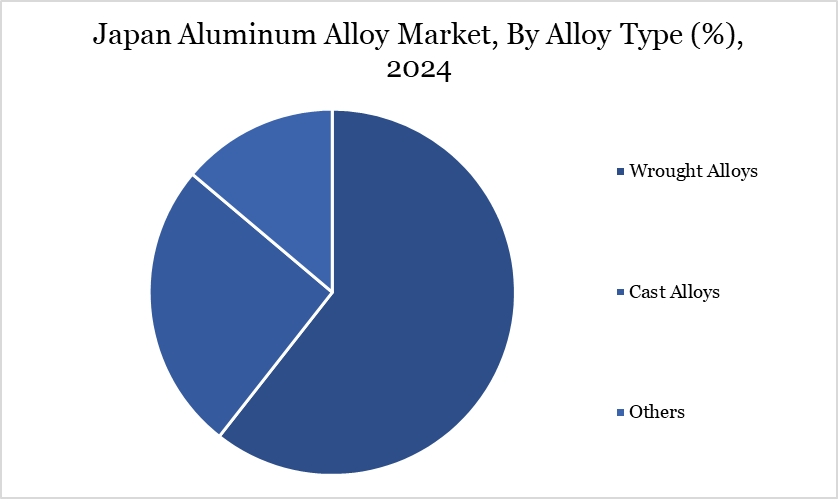

The Japan aluminum alloy market is segmented based on alloy type, strength, product form, and application.

Wrought Alloys Segment Leads Market Growth in Japan Through Versatile Applications

The Wrought Alloys segment dominates the Japan aluminum alloy market due to its extensive application across high-demand sectors like automotive, construction, electronics, and packaging. Wrought alloys are mechanically worked into shapes through processes such as rolling, extrusion, and forging, resulting in superior mechanical strength, surface finish, and formability compared to cast alloys.

This makes them ideal for producing structural components that require durability and precision. In the automotive industry, companies like Toyota and Nissan utilize wrought aluminum sheets and extrusions for body panels, chassis parts, and crash-resistant components, especially in hybrid and electric vehicles, where lightweight materials are critical for energy efficiency.

Impact of US Tariffs on the Aluminum Alloy

The imposition of US aluminum tariffs under Section 232 in 2018 had a notable impact on Japan’s aluminum alloy market. Japan, not being permanently exempted from the 10% tariff, saw reduced competitiveness for its aluminum exports, especially semi-finished products like sheets and extrusions used by major US companies such as Ford, Boeing, and Tesla. Leading suppliers like Kobe Steel and UACJ experienced declining export volumes and tighter profit margins.

In response, Japanese producers began targeting Southeast Asian and European markets and ramped up domestic demand utilization. Some larger firms pursued US joint ventures or local manufacturing to bypass tariffs, but smaller players struggled to adapt, leading to industry consolidation. The tariffs also caused global price fluctuations and procurement challenges, indirectly straining Japanese manufacturers’ supply chains.

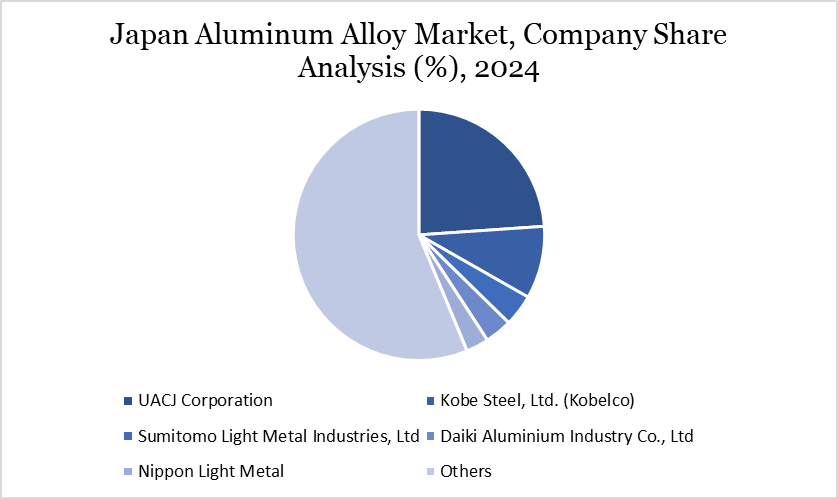

Major Japan Players

The major Japan players in the market include UACJ Corporation, Kobe Steel, Ltd. (Kobelco), Sumitomo Light Metal Industries, Ltd, Daiki Aluminium Industry Co., Ltd, Nippon Light Metal, Sankyo Tateyama, Inc, S.S. ALUMINUM CO., LTD, Tokyo Light Alloy Casting Co., Ltd, FujiLight Metal Co., Ltd., Lixil Corporation Ltd and among others.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies