Pulmonary Arterial Hypertension Market Size & Industry Outlook

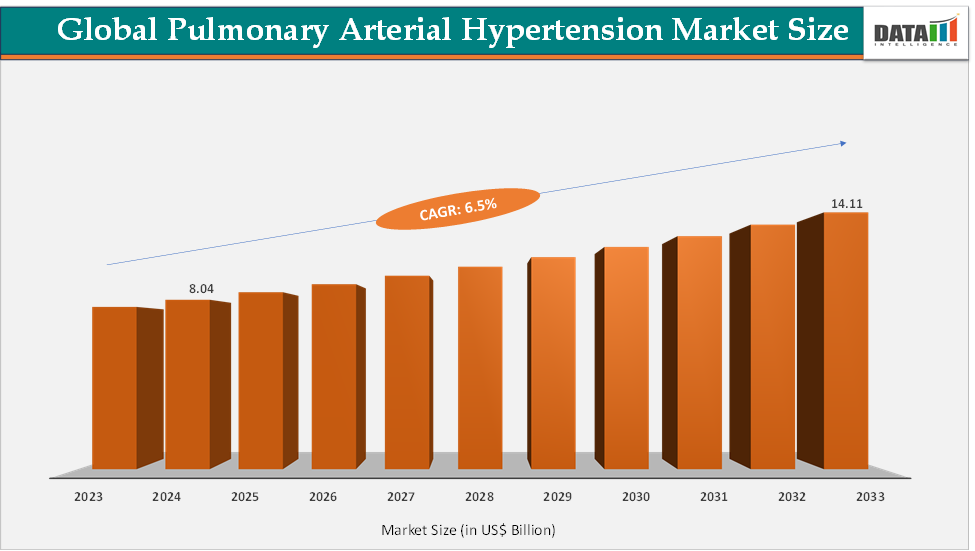

The global pulmonary arterial hypertension market size reached US$ 8.04 Billion in 2024 from US$ 7.59 Billion in 2023 and is expected to reach US$ 14.11 Billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025-2033. The market is evolving rapidly due to rising awareness on pulmonary arterial hypertension, improved diagnostic capabilities, and the availability of advanced therapies. Drug innovation, particularly in prostacyclin analogs, endothelin receptor antagonists, and newer entrants like sotatercept, is expanding treatment choices for patients. Increasing adoption of oral and combination therapies reflects a shift toward more convenient and effective management strategies. Additionally, supportive healthcare policies in Europe, strong infrastructure in North America, and accelerating demand in Asia-Pacific highlight the global momentum of this market.

Key Market Trends & Insights

Key trends shaping the pulmonary arterial hypertension (PAH) market include the growing use of combination therapies, where drugs like macitentan with tadalafil are prescribed together to improve survival rates and functional capacity. The rise of personalized medicine is also notable, with genetic and molecular profiling guiding treatment decisions.

Furthermore, emerging therapies such as sotatercept, recently FDA-approved, represent a breakthrough by targeting novel disease pathways. Alongside these, the adoption of inhalable and portable drug delivery systems is enhancing patient convenience and supporting the shift toward home healthcare solutions.

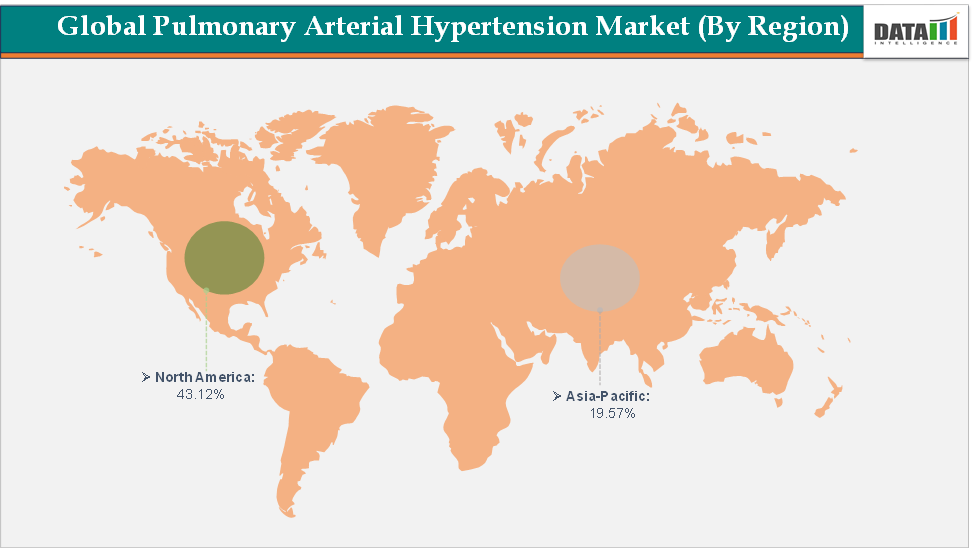

North America dominates the pulmonary arterial hypertension market with the largest revenue share of 43.12% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 6.6% over the forecast period.

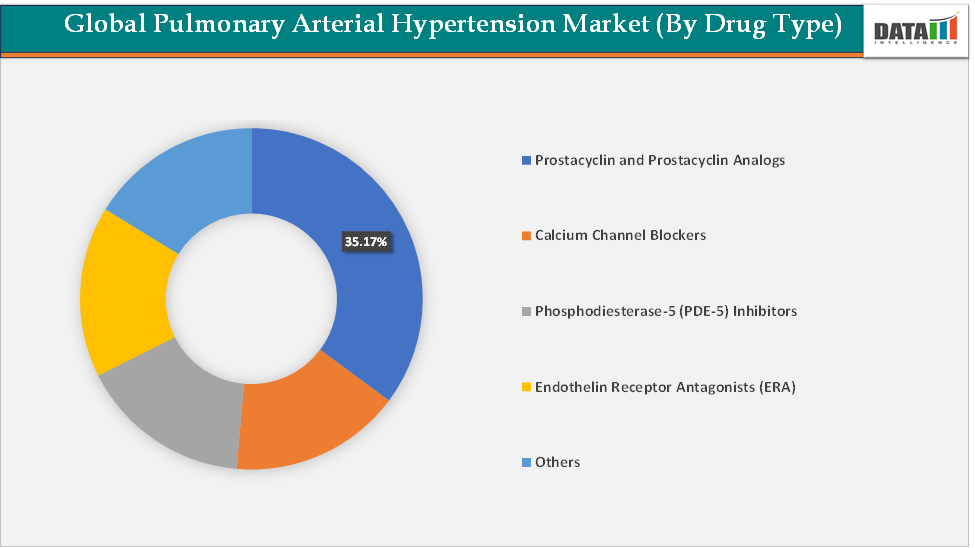

Based on drug class, the prostacyclin and prostacyclin analogs segment led the market with the largest revenue share of 35.17% in 2024.

The major market players in the pulmonary arterial hypertension market are Johnson & Johnson, United Therapeutics Corporation, Bayer AG, Gilead Sciences, Inc., Viatris Inc., Merck & Co., Inc., and Liquidia Corporation among others

Market Size & Forecast

2024 Market Size: US$ 8.04 Billion

2033 Projected Market Size: US$ 14.11 Billion

CAGR (2025–2033): 6.5%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Market Dynamics

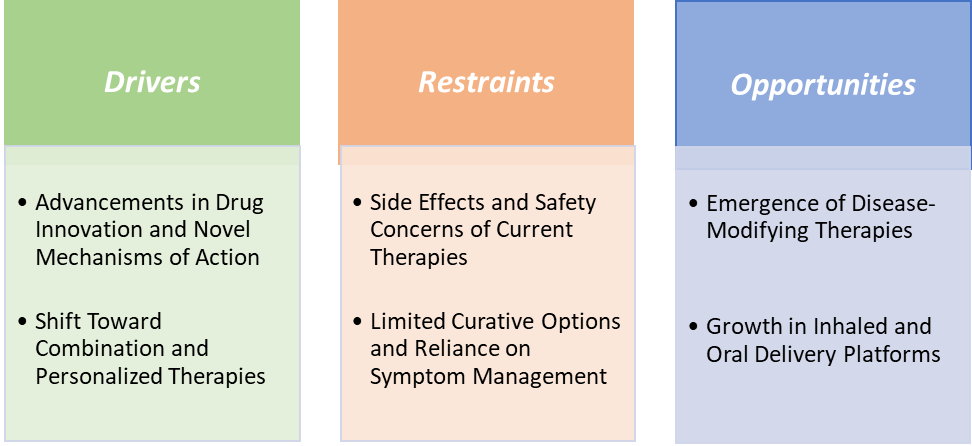

Drivers:Advancements in drug innovation and novel mechanisms of action are significantly driving the pulmonary arterial hypertension market growth

Advancements in drug innovation and the introduction of novel mechanisms of action are playing a transformative role in driving the growth of the Pulmonary Arterial Hypertension (PAH) market. Traditionally, PAH therapies focused on vasodilation pathways through drug classes such as endothelin receptor antagonists (ERAs) like bosentan (Tracleer) and macitentan (Opsumit), and phosphodiesterase-5 (PDE-5) inhibitors like sildenafil (Revatio) and tadalafil (Adcirca). While these agents improved symptoms and exercise tolerance, they largely provided palliative benefits rather than altering the underlying disease course. The emergence of prostacyclin analogs and receptor agonists such as epoprostenol (Flolan), treprostinil (Remodulin, Tyvaso, Tyvaso DPI), and selexipag (Uptravi) expanded treatment options by targeting prostacyclin pathways, thereby improving hemodynamics and patient survival, especially in advanced disease.

In March 2024, Merck announced that the U.S. Food and Drug Administration (FDA) approved sotatercept-csrk (U.S. Brand Name: WINREVAIR, for injection, 45mg, 60mg) for the treatment of adults with pulmonary arterial hypertension to increase exercise capacity, improve WHO functional class (FC), and reduce the risk of clinical worsening events. WINREVAIR is the first FDA-approved activin signaling inhibitor therapy for PAH, representing a new class of therapy that works by improving the balance between pro- and anti-proliferative signaling to regulate vascular cell proliferation underlying PAH.

This most groundbreaking advancement came in 2024 with the FDA approval introduced a novel activin signaling inhibition mechanism, addressing vascular remodeling and right heart strain, key drivers of PAH progression. This approval is considered a game-changer as it represents the first therapy to move beyond symptom relief toward disease modification.

In addition, the development of more convenient drug delivery systems, such as inhaled treprostinil DPI and oral selexipag, is reshaping patient adherence and accessibility. Ongoing research into gene therapies, stem cell approaches, and precision medicine guided by biomarkers further demonstrates the market’s evolution toward next-generation solutions. These innovations not only expand the treatment arsenal but also attract significant investment, increase patient access to advanced therapies, and improve long-term outcomes, thereby fueling sustained growth of the PAH market.

Restraints:Side effects and safety concerns of current therapies are hampering the growth of the pulmonary arterial hypertension market

Side effects and safety concerns of existing therapies remain a critical restraint on the growth of the market, as they often limit adoption, reduce patient adherence, and complicate long-term management. For instance, prostacyclin analogs such as epoprostenol (Flolan) and treprostinil (Remodulin, Tyvaso) are highly effective in improving survival but come with significant drawbacks, including severe headaches, jaw pain, nausea, flushing, and risks of catheter-related infections when administered intravenously.

Similarly, endothelin receptor antagonists (ERAs) like bosentan (Tracleer) and ambrisentan (Letairis) are associated with hepatotoxicity and teratogenic effects, requiring strict liver function monitoring and pregnancy prevention programs, which complicate patient management. Phosphodiesterase-5 inhibitors (PDE-5 inhibitors) such as sildenafil (Revatio) and tadalafil (Adcirca), though generally well tolerated, can cause systemic hypotension, dizziness, and vision disturbances, posing risks for patients with comorbid cardiovascular conditions. Soluble guanylate cyclase (sGC) stimulators like riociguat (Adempas) are effective in both PAH and chronic thromboembolic pulmonary hypertension (CTEPH), but they carry risks of symptomatic hypotension and bleeding events, especially when combined with PDE-5 inhibitors. These adverse effects often force physicians to adopt a conservative treatment approach, delaying escalation to more aggressive therapies despite worsening disease.

Moreover, the need for constant monitoring, dose adjustments, and management of drug-related complications increases the overall treatment burden, discouraging patient compliance. In real-world practice, many patients discontinue or switch therapies due to intolerable side effects, undermining the clinical benefits demonstrated in trials. Collectively, these safety challenges create hesitancy in both patients and healthcare providers, thereby hampering wider adoption and slowing down the overall growth of the PAH market, despite the availability of advanced therapeutic options.

For more details on this report – Request for Sample

Pulmonary Arterial Hypertension Market, Segment Analysis

The global pulmonary arterial hypertension market is segmented based on drug class, route of administration, distribution channel, and region.

Drug Class:The prostacyclin and prostacyclin analogs segment is dominating the pulmonary arterial hypertension market with a 35.17% share in 2024

The prostacyclin and prostacyclin analogs segment is dominating the market because these therapies remain the gold standard for patients with advanced or rapidly progressing disease, offering the most significant improvements in survival and quality of life. Prostacyclin is a potent vasodilator and inhibitor of platelet aggregation, directly countering the pathophysiology of PAH. The first approved therapy, epoprostenol (Flolan, Veletri), set the benchmark by demonstrating substantial survival benefits, even though it required continuous intravenous infusion with complex catheter systems.

Building on this, newer analogs such as treprostinil (Remodulin for IV/SC, Tyvaso for inhalation, and Tyvaso DPI for dry powder inhalation) have expanded administration options, making treatment more convenient and reducing infection risks associated with IV delivery. Similarly, iloprost (Ventavis) offers inhalation therapy for patients unable to tolerate systemic side effects, while selexipag (Uptravi), an oral prostacyclin receptor agonist, represents a breakthrough by providing prostacyclin pathway targeting in a patient-friendly tablet form. These advancements not only improve adherence but also expand use into earlier stages of the disease.

The clinical superiority of prostacyclin therapies in improving exercise capacity, hemodynamics, and long-term outcomes has ensured their central role in treatment guidelines worldwide. Moreover, the continued innovation in formulations, such as the approval of Tyvaso DPI in 2022, the first dry powder inhaler for PAH, has boosted adoption by improving ease of use. Because these drugs provide unmatched efficacy in reducing disease progression and mortality, especially in severe cases, the prostacyclin and prostacyclin analogs segment holds the largest share in the PAH market and continues to lead despite competition from ERAs, PDE-5 inhibitors, and newer therapies.

Geographical Analysis

North America is expected to dominate the global pulmonary arterial hypertension market with a 43.12% in 2024

North America dominates the global market due to its strong healthcare infrastructure, early adoption of advanced therapies, and favorable reimbursement policies. The US, in particular, accounts for the largest share, supported by a high prevalence of PAH-associated conditions such as connective tissue diseases, congenital heart disorders, and systemic sclerosis. The region has been at the forefront of introducing breakthrough therapies, with multiple FDA approvals shaping the treatment landscape.

For instance, sotatercept (Winrevair), the first disease-modifying therapy for PAH, received FDA approval in 2024, reinforcing the region’s leadership in innovation. Widely prescribed products like sildenafil (Revatio), tadalafil (Adcirca), bosentan (Tracleer), macitentan (Opsumit), treprostinil (Tyvaso DPI, Remodulin), and selexipag (Uptravi) are heavily marketed and accessible in North America, giving patients a broader range of options compared to other regions. Robust reimbursement frameworks provided by Medicare, Medicaid, and private insurers ensure that even high-cost therapies are supported, thereby supporting higher uptake.

Moreover, strong patient advocacy through organizations such as the Pulmonary Hypertension Association (PHA) has increased awareness, leading to earlier diagnosis and proactive treatment initiation. The concentration of key pharmaceutical players such as United Therapeutics, Johnson & Johnson, and Merck in the U.S. further strengthens the regional dominance through aggressive R&D investments and continuous product launches. With its advanced diagnostic facilities, strong regulatory support, and a large treated patient pool, North America continues to be the epicenter of PAH innovation and market growth.

The Asia Pacific region is the fastest-growing region in the global pulmonary arterial hypertension market, with a CAGR of 6.6% in 2024

The Asia-Pacific region is emerging as the fastest-growing market for pulmonary arterial hypertension (PAH), driven by rising prevalence, improving healthcare infrastructure, and expanding access to advanced therapies. Countries such as China, India, and Japan are witnessing an increase in PAH cases, often linked to connective tissue diseases, congenital heart disorders, and chronic respiratory illnesses. Historically, diagnosis rates were low due to limited awareness and inadequate screening facilities, but recent investments in specialty clinics, advanced diagnostic imaging, and pulmonary care programs have significantly improved early detection.

Governments across the region are also prioritizing rare disease management, with initiatives such as China’s National Rare Disease List supporting better access to high-cost treatments. Multinational pharmaceutical companies are actively expanding in this region, such as United Therapeutics’ Tyvaso DPI, Johnson & Johnson’s Opsumit (macitentan), and Merck’s recently approved sotatercept (Winrevair) are gradually entering Asian markets through partnerships and regulatory approvals.

Furthermore, the rapid rise of medical tourism in countries like India and Thailand, offering advanced PAH care at lower costs, is attracting patients from neighboring regions. As awareness grows and governments strengthen reimbursement frameworks, the Asia-Pacific is expected to outpace mature markets in growth rate, making it a key focus for global pharma players seeking long-term expansion in the PAH landscape.

Pulmonary Arterial Hypertension Market Competitive Landscape

Top companies in the pulmonary arterial hypertension market include Johnson & Johnson, United Therapeutics Corporation, Bayer AG, Gilead Sciences, Inc., Viatris Inc., Merck & Co., Inc., and Liquidia Corporation, among others.

Recent Developments

In August 2025, Natco Pharma launched oral suspension tablets used in the treatment of pulmonary arterial hypertension (PAH). In an exchange filing, the company said it has launched Bosentan tablets for oral suspension (TFOS), 32mg, a generic version of Tracleer by Actelion Pharmaceuticals US Inc. NATCO’s marketing partner for the product is Lupin Ltd. Bosentan tablets are used for the treatment of pulmonary arterial hypertension (PAH) (WHO Group 1) in paediatric patients aged three years and older with idiopathic or congenital PAH to improve pulmonary vascular resistance (PVR), which is expected to result in an improvement in exercise ability.

In June 2025, Merck announced positive topline results from the Phase 3 HYPERION study evaluating WINREVAIR (sotatercept-csrk) versus placebo (both in combination with background therapy) in recently diagnosed adults with pulmonary arterial hypertension (PAH, WHO Group 1) functional class (FC) II or III at intermediate or high risk of disease progression. HYPERION met its primary endpoint of time to clinical worsening (TTCW) as measured by a composite endpoint of all-cause death, the need for non-planned PAH-related hospitalization > 24 hours, atrial septostomy, lung transplantation, or PAH deterioration.

In May 2025, Liquidia Corporation announced that the U.S. Food and Drug Administration (FDA) approved YUTREPIA (treprostinil) inhalation powder, a prostacyclin analog for adults with pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD) to improve exercise ability. YUTREPIA is the first and only prostacyclin dry-powder formulation enabled by Liquidia’s proprietary PRINT technology, which yields uniform, free-flowing particles designed to enhance deep-lung delivery via an easy-to-use, low-effort device requiring less inspiratory effort.

In March 2025, Nippon Shinyaku Co., Ltd. launched Uptravi tablets for pediatric 0.05 mg for the treatment of pulmonary arterial hypertension (PAH) in Japan. Uptravi is an oral prostacyclin receptor (IP receptor) agonist with high selectivity for the IP receptor among prostacyclin pathway drugs. Uptravi is believed to reduce pulmonary arterial pressure by binding to the IP receptors on vascular smooth muscle cells and increasing cAMP production, thereby leading to vasodilation and inhibition of vascular smooth muscle proliferation.

Market Scope

Metrics | Details | |

CAGR | 6.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Drug Class | Prostacyclin and Prostacyclin Analogs, Calcium Channel Blockers, Phosphodiesterase-5 (PDE-5) Inhibitors, Endothelin Receptor Antagonists (ERA), and Others |

Route of Administration | Inhalation, Subcutaneous and Intravenous and Oral | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global pulmonary arterial hypertension market report delivers a detailed analysis with 53 key tables, more than 51 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here