Pharmaceutical Emulsions Market Size& Industry Outlook

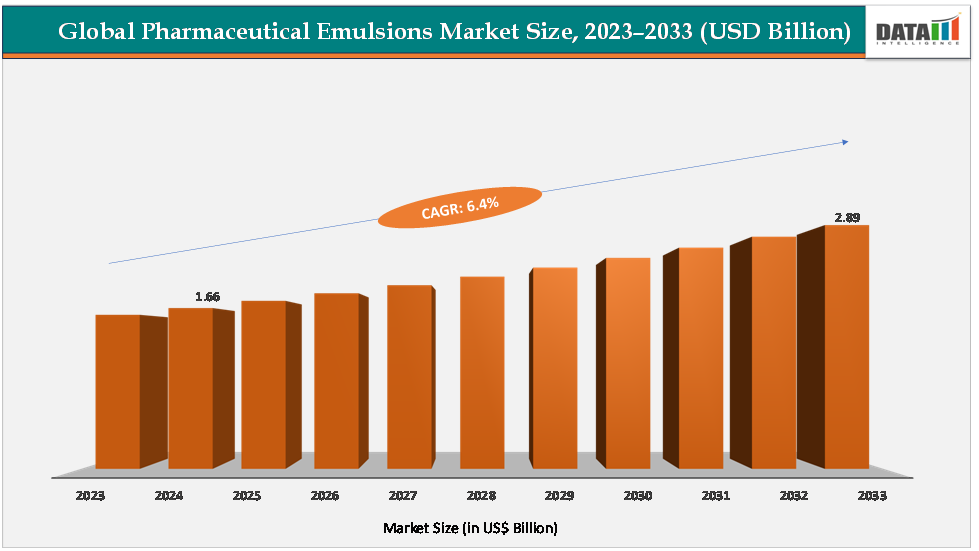

The global pharmaceutical emulsions market size reached US$1.66Billion in 2024 from US$1.57Billionin 2023 and is expected to reach US$ 2.89Billion by 2033, growing at a CAGR of 6.4%during the forecast period 2025-2033.

The growth of the market is being driven by the rising need for drug-delivery systems that enhance the solubility and bioavailability of poorly water-soluble drugs, alongside the expanding demand for parenteral nutrition in critical care. Widely approved products such as Intralipid and SMOFlipid (Fresenius Kabi) and ClinOleic (Baxter) highlight how intravenous lipid emulsions have become indispensable for hospital nutrition, especially in neonatal and ICU settings.

At the same time, regulatory approvals of innovative emulsions like Omegaven for pediatric parenteral nutrition reflect growing acceptance of fish-oil-based formulations tailored to specific clinical needs. Technological advances in nanoemulsions and self-emulsifying systems are also propelling oral formulations, enabling delivery of challenging APIs in oncology and neurology. Together, these clinical successes and product launches illustrate how emulsions are evolving from niche excipients to mainstream drug-delivery and nutritional solutions, fueling steady market expansion.

Key Market Highlights

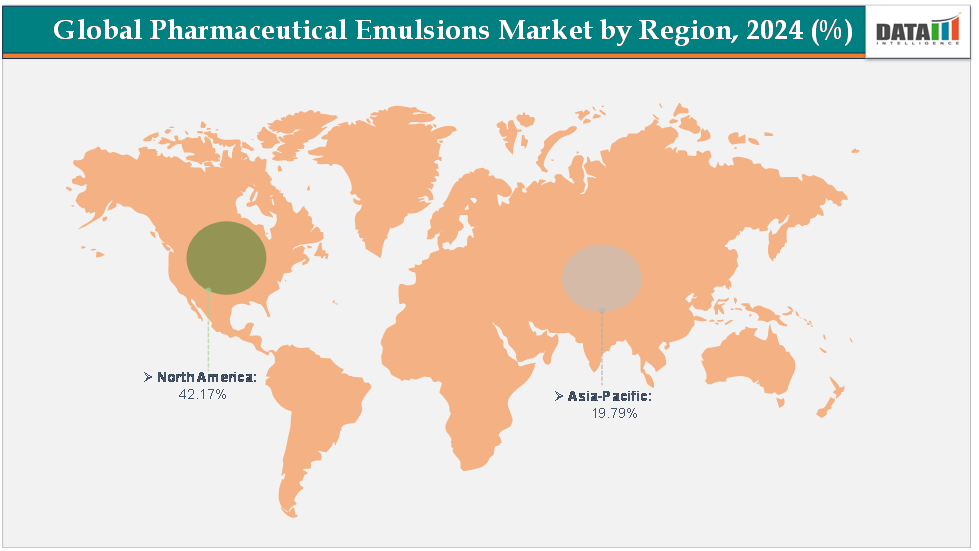

- North America dominates the pharmaceutical Emulsions Market with the largest revenue share of 42.17% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of6.7% over the forecast period.

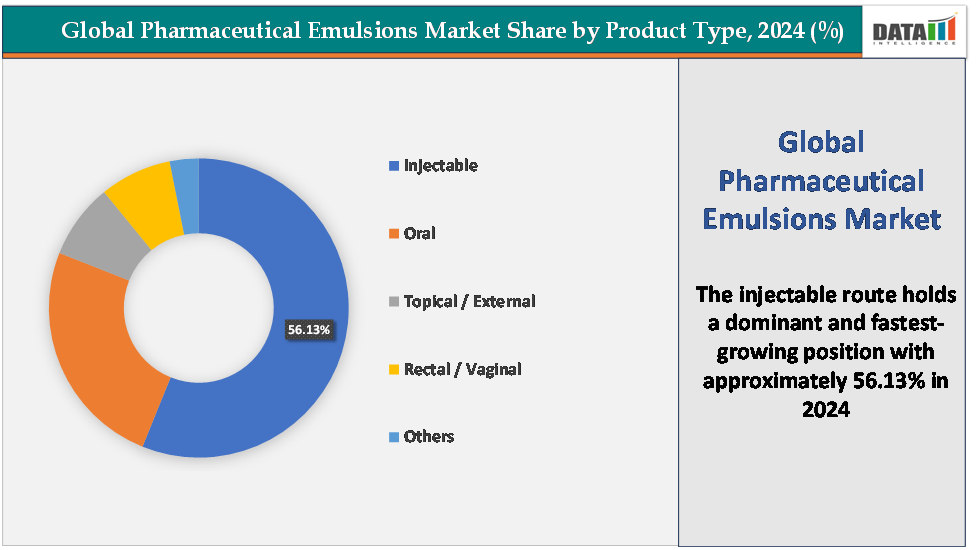

- Based on route of administration, the injectable segment led the market with the largest revenue share of 56.13% in 2024.

- The major market players in the pharmaceutical emulsions market are Fresenius Kabi, Baxter, B. Braun SE, Pfizer Inc., Glenmark Pharmaceuticals Ltd., Amneal Pharmaceuticals LLC, Grifols, S.A., Kelun, and Guangdong Otsuka Pharmaceutical Co., Ltd., among others

Market Dynamics

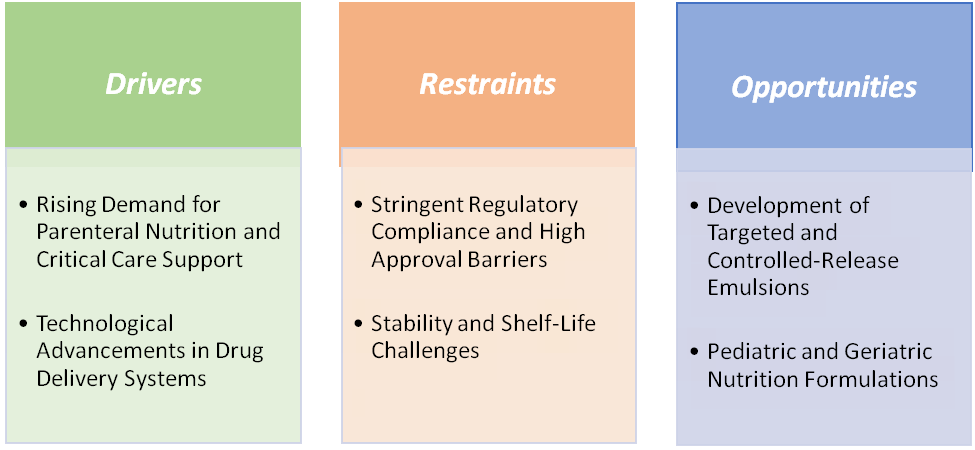

Drivers:

Rising demand for parenteral nutrition and critical care support is significantly driving the pharmaceutical emulsions market growth

The rising demand for parenteral nutrition and critical care support is one of the most significant growth drivers of the pharmaceutical emulsions market. Critically ill patients, premature infants, and post-surgical individuals often suffer from malabsorption, gastrointestinal disorders, or an inability to meet nutritional requirements orally, creating a high demand for intravenous lipid emulsions. Products such as Intralipid (soybean oil-based), SMOFlipid (multi-oil ILE), ClinOleic (olive oil-based), and Omegaven (fish-oil-based ILE approved for pediatric use) exemplify how emulsions are integral to modern parenteral nutrition therapy.

These emulsions provide essential fatty acids, calories, and lipid-soluble nutrients, ensuring adequate energy and growth support, especially in neonates and critically ill adults. The sterility, stability, and standardized composition of these ready-to-use emulsions reduce risks associated with manual compounding and improve patient safety. Hospitals prefer pre-mixed parenteral nutrition bags containing emulsions, which streamline administration and minimize errors, further reinforcing adoption. The aging population, coupled with the rising prevalence of chronic diseases and ICU admissions, has amplified the need for parenteral nutrition solutions globally.

Additionally, regulatory approvals,such as FDA approvals accelerating the market growth. For instance, in May 2024, Baxter International Inc. announced US FDA approval of an expanded indication for Clinolipid (Lipid Injectable Emulsion) to be used in pediatric patients, including preterm and term neonates. Clinolipid is Baxter’s proprietary mixed oil lipid emulsion that is used to provide calories and essential fatty acids in parenteral (intravenous) nutrition (PN) when oral or enteral nutrition is not possible, insufficient, or contraindicated. Clinolipid has been available in the US for adults since 2019 and is now available for use in all ages.

Restraints:

Stability and shelf-life challenges are hampering the growth of the market

Stability and shelf-life challenges are major restraints that hamper the growth of the pharmaceutical emulsions market. Emulsions, by nature, are thermodynamically unstable systems, prone to phase separation, creaming, coalescence, and chemical degradation over time, which can compromise both efficacy and safety. Injectable emulsions, such as Intralipid, SMOFlipid, ClinOleic, and Omegaven, require strict control of droplet size, pH, temperature, and lipid composition to maintain stability. Even minor deviations in storage conditions or handling can lead to emulsion breakdown, aggregation, or oxidation of lipids, resulting in reduced shelf life and potential clinical complications. These stability issues necessitate refrigeration, cold chain logistics, and frequent monitoring, particularly in hospitals and during distribution to remote regions, increasing operational costs and limiting market accessibility.

Additionally, stability constraints restrict the formulation of advanced emulsions, such as W/O/W multiple emulsions or nanoemulsions, which often require more sophisticated stabilizers and production techniques. Moreover, shorter shelf lives can lead to product wastage, higher replacement costs, and logistical inefficiencies, which discourage hospitals and clinics from maintaining large inventories. Overall, the inherent stability and shelf-life challenges of pharmaceutical emulsions act as a significant growth barrier, impacting the distribution, adoption, and commercial scalability of both conventional and advanced emulsion products.

For more details on this report – Request for Sample

Segmentation Analysis

The global pharmaceutical emulsions market is segmented based on type, particle size, route of administration, application, distribution channel, and region.

Route of Administration:

The injectable segment is dominating and the fastest-growing in the pharmaceutical emulsions market, with a 56.13% share in 2024

The injectable segment is both the dominant and fastest-growing sector in the pharmaceutical emulsions market, primarily due to the increasing demand for parenteral nutrition and critical care therapies. Injectable lipid emulsions are essential for patients who cannot meet their nutritional requirements orally, including preterm and term neonates, critically ill adults, and post-surgical patients. Products such as SMOFlipid, a four-oil lipid injectable emulsion approved for pediatric parenteral nutrition, and Clinolipid, indicated for neonatal and pediatric use, exemplify the clinical reliance on injectable emulsions for maintaining energy balance and supplying essential fatty acids.

The market is also witnessing innovation with novel product launches, which are driving the segment growth. For instance, in January 2025, Glenmark Pharmaceuticals Inc., USA, announced the launch of Phytonadione Injectable Emulsion USP, 10 mg/mL Single Dose Ampules. Glenmark's Phytonadione Injectable Emulsion USP, 10 mg/mL Single Dose Ampules is bioequivalent and therapeutically equivalent to the reference listed drug, Vitamin K1 Injectable Emulsion USP, 10 mg/mL of Hospira, Inc.

Geographical Analysis

North America is expected to dominate the global pharmaceutical Emulsions Market with a 42.17% in 2024

The North American region is the dominant player in the global pharmaceutical emulsions market, largely due to its presence of major market players, innovations and novel product launches along with FDA approvals, high healthcare expenditure, and strong adoption of innovative medical therapies. These factors, such as regulatory support, clinical necessity, innovative product launches, and robust healthcare infrastructure, establish North America not only as the largest market for pharmaceutical emulsions but also as a trendsetter shaping global demand and technological development in this sector.

US Pharmaceutical Emulsions Market Trends

The United States, in particular, leads the region, supported by a dense network of hospitals, neonatal intensive care units (NICUs), and critical care centers that rely heavily on injectable lipid emulsions for parenteral nutrition in critically ill patients, preterm neonates, and surgical recovery cases. FDA-approved products such as SMO Flipid, a multi-oil lipid injectable emulsion for pediatric parenteral nutrition, and Clinolipid, indicated for preterm and term neonates, exemplify the widespread use and clinical acceptance of lipid emulsions in the US, along with FDA approvals. These regulatory supports for novel product launches are driving the market growth in the US.

For instance, in April 2025, Avenacy launched Propofol Injectable Emulsion, USP in the United States as a therapeutic generic equivalent for Diprivan, as approved by the U.S. Food and Drug Administration. Propofol Injectable Emulsion, USP is an intravenous general anesthetic and sedation drug indicated for the induction of general anesthesia for patients greater than or equal to 3 years of age, maintenance of general anesthesia for patients greater than or equal to 2 months of age, initiation and maintenance of monitored anesthesia care (MAC) sedation in adult patients, sedation for adult patients in combination with regional anesthesia, and intensive care unit (ICU) sedation of intubated, mechanically ventilated adult patients.

Additionally, in August 2024, Amneal Pharmaceuticals, Inc. received Abbreviated New Drug Application approval from the U.S. Food and Drug Administration (FDA) for Propofol Injectable Emulsion USP, 200 mg/20 mL (10 mg/mL), 500 mg/50 mL (10 mg/mL), and 1,000 mg/100 mL (10 mg/mL), Single-Dose Vials. Propofol is an intravenous drug commonly used in hospitals for the induction and maintenance of anesthesia and sedation.

The Asia Pacific region is the fastest-growing region in the global pharmaceutical Emulsions Market, with a CAGR of 6.7% in 2024

The Asia Pacific region is the fastest-growing market for pharmaceutical emulsions, driven by rapid urbanization, expanding healthcare infrastructure, rising disposable incomes, and increasing healthcare expenditure in key countries such as China, India, Japan, and South Korea. The region has witnessed significant growth in hospital networks, intensive care units, and neonatal care facilities, which has fueled the demand for injectable lipid emulsions used in parenteral nutrition and critical care therapies. The growth is driven by the rising prevalence of chronic diseases, an aging population, increasing ICU admissions, and a growing need for critical care nutrition.

Major players such as Fresenius Kabi, Baxter, and B. Braun are actively expanding their presence in APAC through product launches and strategic partnerships, including the introduction of SMOFlipid and Omegaven in select markets. Collectively, these factors position the APAC region as the fastest-growing and highly lucrative market for pharmaceutical emulsions globally, offering significant opportunities for both multinational and regional manufacturers.

Europe Pharmaceutical Emulsions Market Trends

The Europe pharmaceutical emulsions market is witnessing steady growth, primarily driven by the increasing demand for parenteral nutrition and critical care therapies, coupled with advancements in lipid-based drug delivery systems. The growth is largely fueled by the rising prevalence of hospital malnutrition, cancer, gastrointestinal disorders, and other chronic conditions, which necessitate the use of injectable lipid emulsions for both nutritional support and as carriers for drug delivery. The European Medicines Agency (EMA) has approved several key products, such as SMOFlipid, a four-oil lipid injectable emulsion for pediatric and adult parenteral nutrition, and Clinolipid, which is widely used in neonatal and critical care units, exemplifying the region’s commitment to high-quality, clinically effective emulsions.

Europe is also at the forefront of innovation in lipid-based drug delivery systems, including drug-loaded fat emulsions and lipid nanoparticle formulations, which improve the solubility, bioavailability, and targeted delivery of lipophilic drugs, extending applications into areas such as chemotherapy, antibiotic therapy, and anesthesia. Collectively, these factors, such as regulatory approvals, clinical necessity, technological innovation, and advanced healthcare systems, position Europe as a key growth driver in the global pharmaceutical emulsions market, enabling both the expansion of existing applications and the development of novel therapeutic uses.

Competitive Landscape

Top companies in the pharmaceutical emulsions market include Fresenius Kabi, Baxter, B. Braun SE, Pfizer Inc., Glenmark Pharmaceuticals Ltd., Amneal Pharmaceuticals LLC, Grifols, S.A., Kelun, and Guangdong Otsuka Pharmaceutical Co., Ltd., among others.

Market Scope

| Metrics | Details | |

| CAGR | 6.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Oil-in-Water (O/W), Water-in-Oil (W/O), and Mixed Emulsions |

| Particle Size | Macroemulsions (>1 µm), Miniemulsions (~200–500 nm), Microemulsions (~10–100 nm), and Nanoemulsions (<200 nm) | |

| Route of Administration | Oral, Injectable, Topical / External, Rectal / Vaginal, and Others | |

| Application | Oncology, Cardiovascular, Neurology, Anti-Infectives, Dermatology, and Others | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global pharmaceutical Emulsions Market report delivers a detailed analysis with 75 key tables, more than 77visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

For more pharmaceuticals-related reports, please click here