Pharmaceutical Suppositories Market Size & Industry Outlook

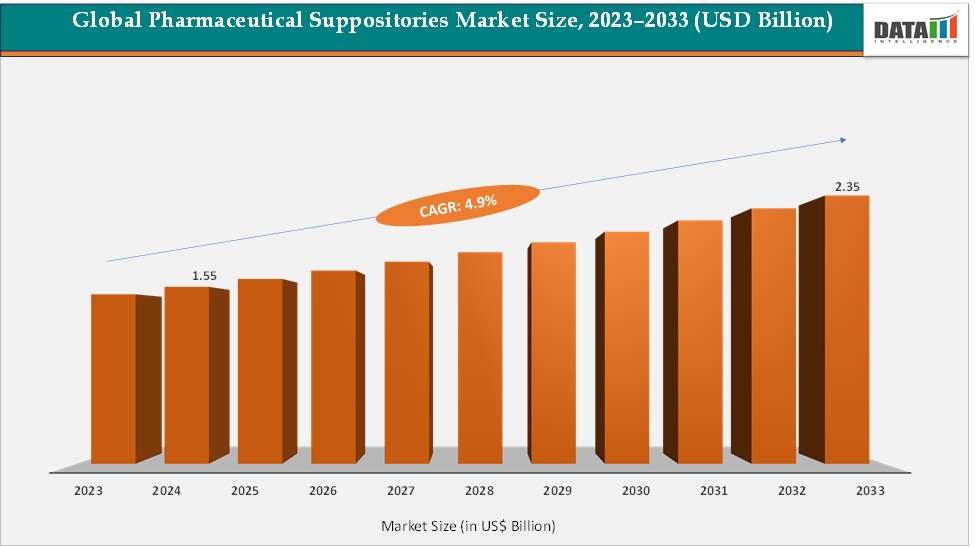

The global pharmaceutical suppositories market size reached US$ 1.55 Billion in 2024 from US$ 1.48 Billion in 2023 and is expected to reach US$ 2.35 Billion by 2033, growing at a CAGR of 4.9% during the forecast period 2025-2033. The market is being driven by a mix of clinical need, patient convenience, and expanding therapeutic applications. They offer a vital alternative for patients who cannot swallow oral medicines, such as pediatrics, geriatrics, or those with gastrointestinal disorders. Rising cases of hemorrhoids, constipation, and vaginal infections continue to boost OTC demand for products like Dulcolax and Preparation H. On the Rx side, mesalamine and progesterone suppositories are increasingly prescribed for inflammatory bowel disease and fertility treatments.

Key Market Trends & Insights

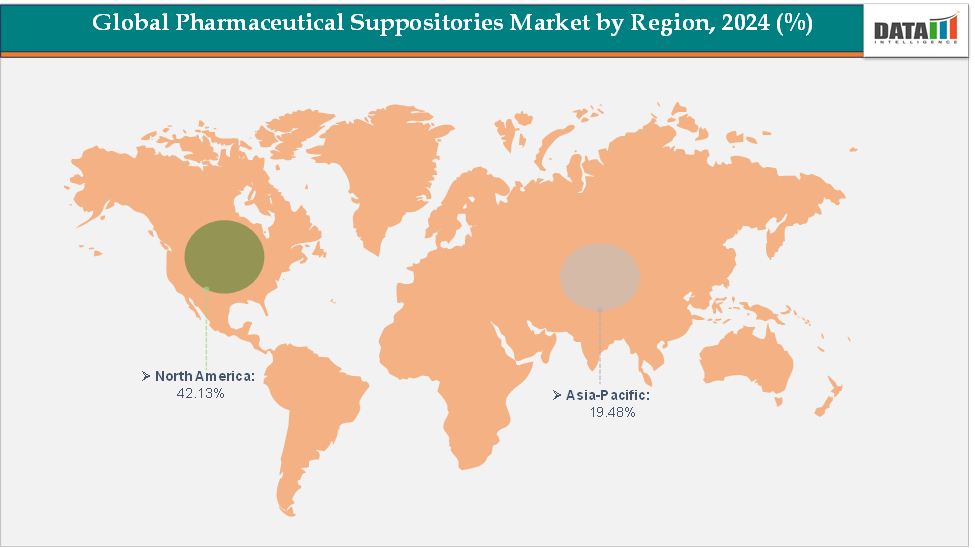

North America dominates the pharmaceutical suppositories market with the largest revenue share of 42.13% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 5.4% over the forecast period.

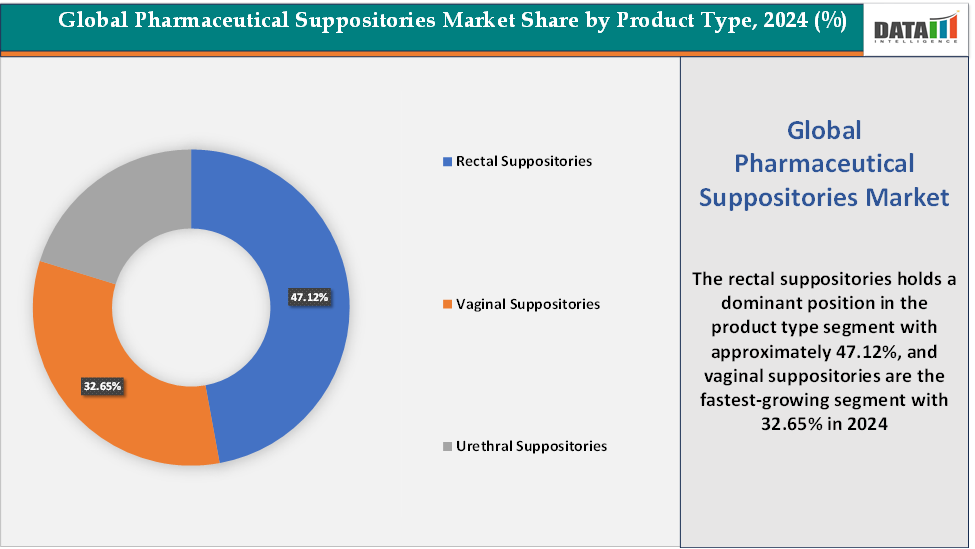

Based on product type, the rectal suppositories segment led the market with the largest revenue share of 47.12% in 2024.

The major market players in the pharmaceutical suppositories market are Sanofi, Haleon Group, Church & Dwight Co., Inc., Teva Pharmaceuticals USA, Inc., Zydus Cadila, Camber Pharmaceuticals, Inc., Prestige Consumer Healthcare Inc., and Typharm Group, among others

Market Dynamics

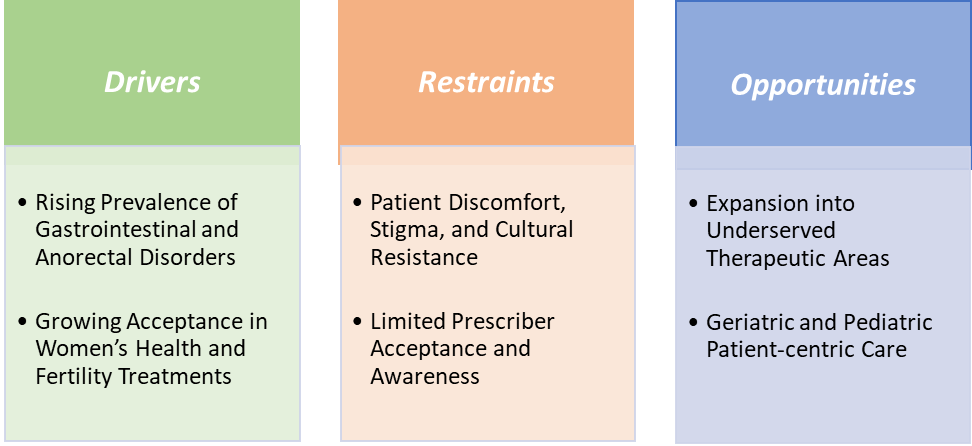

Drivers:The rising prevalence of gastrointestinal and anorectal disorders is significantly driving the pharmaceutical suppositories market growth

The growth of the pharmaceutical suppositories market is being significantly driven by the rising prevalence of gastrointestinal (GI) and anorectal disorders worldwide, which is creating sustained demand for local, non-invasive treatment options. According to the Rome Foundation, more than 40% of the global population suffers from one of the 22 recognized functional GI disorders, such as irritable bowel syndrome (IBS) and chronic constipation, highlighting a vast patient pool requiring effective therapies.

Inflammatory bowel disease (IBD) incidence is also climbing, with pediatric-onset IBD increasing by 1.23% annually between 2023 and 2035, reinforcing the need for targeted local formulations like mesalamine suppositories to manage ulcerative proctitis when oral therapies are less effective. Hemorrhoids, another major anorectal condition, affect about 4.4% of the global population, and in the U.S. alone, up to 50% of adults over 50 suffer from the condition, generating nearly 4 million medical visits each year, a clinical and economic burden that drives demand for rectal suppositories such as Preparation H and Anusol.

These epidemiological pressures are directly reflected in market performance, with gastrointestinal disorders cited as one of the strongest growth drivers. Moreover, the aging population, which is particularly prone to constipation and swallowing difficulties, and the pediatric population, where suppositories are often preferred due to ease of administration, are further accelerating uptake. Coupled with increasing consumer preference for self-care solutions and OTC access to laxative and hemorrhoid products, as well as a surge in online pharmacy sales that reduce stigma around intimate health purchases, the rising burden of GI and anorectal disorders is creating a powerful tailwind for the pharmaceutical suppositories industry, ensuring consistent market expansion in the coming decade.

Restraints:Patient discomfort, stigma, and cultural resistance are hampering the growth of the market

Patient discomfort, stigma, and cultural resistance remain some of the strongest barriers restraining the pharmaceutical suppositories market, despite their clinical effectiveness in many conditions. Patients may often prefer injections or oral medications over suppositories due to embarrassment or unease with rectal and vaginal routes. Cultural norms also shape acceptance, highlighting stigma-driven regional disparities. Even in common conditions like hemorrhoids, 15% of patients avoided medical care due to shame, and almost 30% felt uncomfortable discussing symptoms with physicians, delaying treatment. Altogether, these instances illustrate how embarrassment, reluctance to discuss anorectal or vaginal health, and lack of cultural acceptance limit patient adherence, discourage physician prescriptions, and ultimately slow the overall growth of the suppositories market despite evident therapeutic benefits.

For more details on this report – Request for Sample

Pharmaceutical Suppositories Market, Segment Analysis

The global pharmaceutical suppositories market is segmented based on product type, application, end-user, and region.

Product Type:The rectal suppositories segment is dominating the pharmaceutical suppositories market with a 47.12% share in 2024

Rectal suppositories dominate the pharmaceutical suppositories market because they combine the widest therapeutic reach, highest patient utility in vulnerable groups, and the strongest retail and hospital presence of the three route types. Rectal forms address a broad set of indications, rapid-acting laxatives for constipation (Dulcolax bisacodyl and Fleet glycerin suppositories), internal hemorrhoid treatments (Preparation H, Anusol suppositories), and prescription anti-inflammatories for distal ulcerative colitis such as CANASA (mesalamine), which together create a continuous, high-volume demand stream across OTC and Rx channels.

Clinically, rectal delivery offers both local high-concentration therapy for anorectal disease and a reliable alternative when oral dosing is impractical (vomiting, dysphagia, pediatric/geriatric care), so hospitals and primary-care physicians keep rectal options on formularies and in bedside kits. Prescription rectal products like mesalamine suppositories have long demonstrated superior local efficacy for proctitis versus systemic therapy, which secures a durable Rx niche and steady institutional purchasing.

The vaginal suppositories are the fastest-growing segment in the pharmaceutical suppositories market, with a 32.65% share in 2024

The vaginal suppositories segment is emerging as the fastest-growing area of the pharmaceutical suppositories market, fueled by rising demand in women’s health, expanding therapeutic uses, and increasing social acceptance compared to rectal or urethral routes. Vaginal suppositories are widely used for treating vaginal infections such as bacterial vaginosis and candidiasis, with well-established antifungal products like Monistat (miconazole), Clotrimazole suppositories, and Metronidazole vaginal formulations being top-sellers in both prescription and OTC markets.

Beyond anti-infectives, the segment is accelerating due to the rapid expansion of the fertility and hormone replacement therapy (HRT) markets. Approved products such as Endometrin (progesterone vaginal insert), Crinone (progesterone vaginal gel/suppository), and Cyclogest are integral to assisted reproductive technology (ART), particularly in supporting luteal phase deficiency during in vitro fertilization (IVF). With infertility affecting an estimated 1 in 6 people worldwide, according to the WHO, the use of vaginal progesterone is scaling quickly in fertility clinics globally.

Additionally, the development of novel vaginal drug delivery systems, including nanoparticle-loaded suppositories and controlled-release hormone inserts, is attracting investment from biotech and pharmaceutical companies, further accelerating this segment. Compared to rectal and urethral forms, vaginal suppositories are less burdened by stigma in many markets and are seen as a more socially acceptable route, contributing to rising adoption. Altogether, a combination of expanding indications (infection, fertility, HRT, contraception), demographic trends (rising infertility, aging women), and innovation in formulation is making vaginal suppositories the fastest-growing segment in the global pharmaceutical suppositories market.

Geographical Analysis

North America is expected to dominate the global pharmaceutical suppositories market with a 42.13% in 2024

North America is the dominant region in the global pharmaceutical suppositories market, supported by its high prevalence of gastrointestinal and gynecological disorders, and the widespread availability of both prescription and OTC products. Together, the combination of a large patient base, diverse therapeutic indications, established product portfolios, and strong commercial infrastructure ensures that North America remains the largest and most influential region in shaping the global pharmaceutical suppositories market.

US Pharmaceutical Suppositories Market Trends

Constipation alone affects an estimated 16% of US adults and is even more common in the elderly, creating consistent demand for rectal laxatives such as Dulcolax (bisacodyl) and Fleet glycerin suppositories, which are staples in pharmacies and hospitals across the region. Hemorrhoids, another major driver, impact up to 50% of Americans over 50 years old, with well-known treatments like Preparation H suppositories and Anusol contributing to steady OTC sales.

In addition, the US market benefits from widespread use of rectal mesalamine suppositories (CANASA), approved for ulcerative proctitis, which are integral in managing inflammatory bowel disease, conditions that have a high and rising incidence in the US. On the women’s health side, the region also drives growth in the vaginal suppositories segment, particularly with fertility-supporting progesterone products like Endometrin, Crinone, and Cyclogest, which are routinely used in IVF procedures. With infertility affecting nearly 1 in 5 couples in the US, these products are heavily prescribed in reproductive medicine clinics.

The Asia Pacific region is the fastest-growing region in the global pharmaceutical suppositories market, with a CAGR of 5.4% in 2024

The Asia-Pacific region is the fastest-growing market for pharmaceutical suppositories, driven by a mix of demographic shifts, rising healthcare access, and increasing awareness of both gastrointestinal and women’s health conditions. The region has one of the largest geriatric populations, particularly in Japan and China, where constipation and anorectal disorders are highly prevalent, fueling demand for rectal products such as Dulcolax (bisacodyl suppositories) and glycerin-based laxatives that provide rapid relief.

Growing urbanization, changing diets, and sedentary lifestyles are also contributing to the rising incidence of hemorrhoids and chronic constipation, further boosting sales of OTC rectal suppositories. On the women’s health side, vaginal suppositories are gaining traction due to the increasing burden of vaginal infections and infertility across the region. Countries such as India, China, and South Korea are witnessing a sharp rise in assisted reproductive technology (ART) procedures, where progesterone vaginal products like Endometrin, Crinone, and Cyclogest are widely prescribed for luteal phase support, reinforcing market growth.

Europe Pharmaceutical Suppositories Market Trends

In Europe, the pharmaceutical suppositories market is being driven by high prevalence of gastrointestinal disorders, strong cultural acceptance of rectal and vaginal formulations, and well-established healthcare systems that support both prescription and OTC use. Constipation and hemorrhoids remain significant health burdens, particularly among the elderly, fueling consistent demand for rectal products like Dulcolax (bisacodyl) and Anusol. Additionally, Europe faces a rising incidence of inflammatory bowel disease (IBD), particularly in Northern and Western nations, where rectal mesalamine suppositories (CANASA/Salofalk) are commonly prescribed for distal ulcerative colitis, reinforcing prescription demand.

On the women’s health side, the growing adoption of progesterone vaginal suppositories such as Cyclogest and Crinone for fertility treatments is contributing significantly, as many European countries report increasing use of assisted reproductive technologies due to delayed pregnancies. Regulatory harmonization across the European Medicines Agency (EMA) also streamlines product approvals, encouraging companies to launch innovative suppository formulations. Altogether, the combination of cultural normalization, disease prevalence, fertility trends, and robust healthcare access makes Europe one of the strongest regional drivers of the pharmaceutical suppositories market.

Competitive Landscape

Top companies in the pharmaceutical suppositories market include Sanofi, Haleon Group, Church & Dwight Co., Inc., Teva Pharmaceuticals USA, Inc., Zydus Cadila, Camber Pharmaceuticals, Inc., Prestige Consumer Healthcare Inc., and ypharm Group, among others.

Market Scope

Metrics | Details | |

CAGR | 4.9% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Rectal Suppositories, Vaginal Suppositories, and Urethral Suppositories |

Application | Gastrointestinal, Hemorrhoids, Vaginal Candidiasis, Fever, and Others | |

End User | Hospitals & Clinics, Nursing Homes, Homecare Settings, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global pharmaceutical suppositories market report delivers a detailed analysis with 56 key tables, more than 53 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.