Pharmaceutical Drying Equipment Market Size and Trends

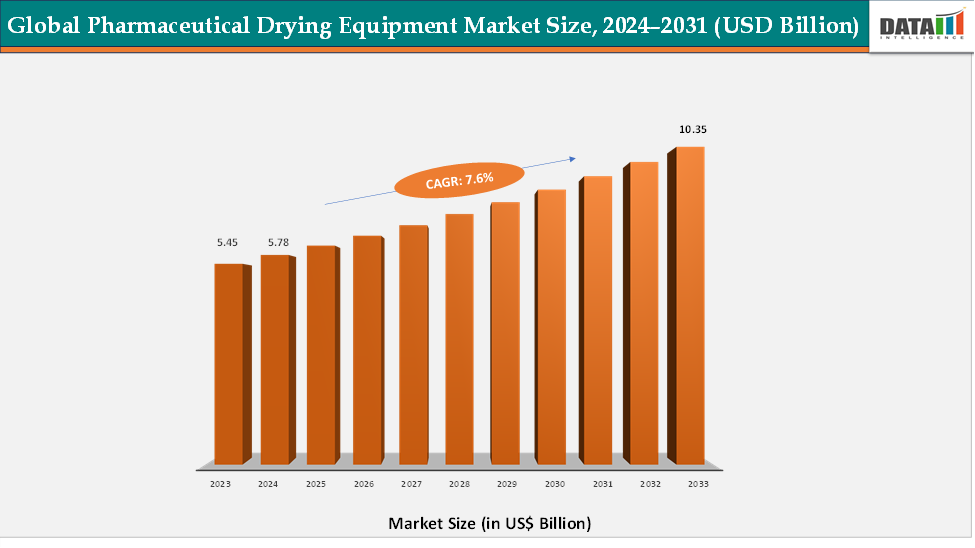

The global pharmaceutical drying equipment market reached US$ 5.45 billion in 2023, with a rise to US$ 5.78 billion in 2024, and is expected to reach US$ 10.35 billion by 2033, growing at a CAGR of 6.7% during the forecast period 2025–2033. The market growth is driven by the increasing demand for precise and efficient drying solutions in pharmaceutical manufacturing, rising production of biologics and sterile drugs, and technological advancements in drying systems such as fluid bed dryers, spray dryers, and tray dryers. Innovations, including multifunctional drying equipment with integrated monitoring, energy-efficient designs, and automation-compatible platforms, are expanding their utility across oral solids, injectables, and advanced therapies. Continuous R&D and regulatory compliance initiatives are further enhancing the adoption of pharmaceutical drying equipment globally.

Key Market highlights

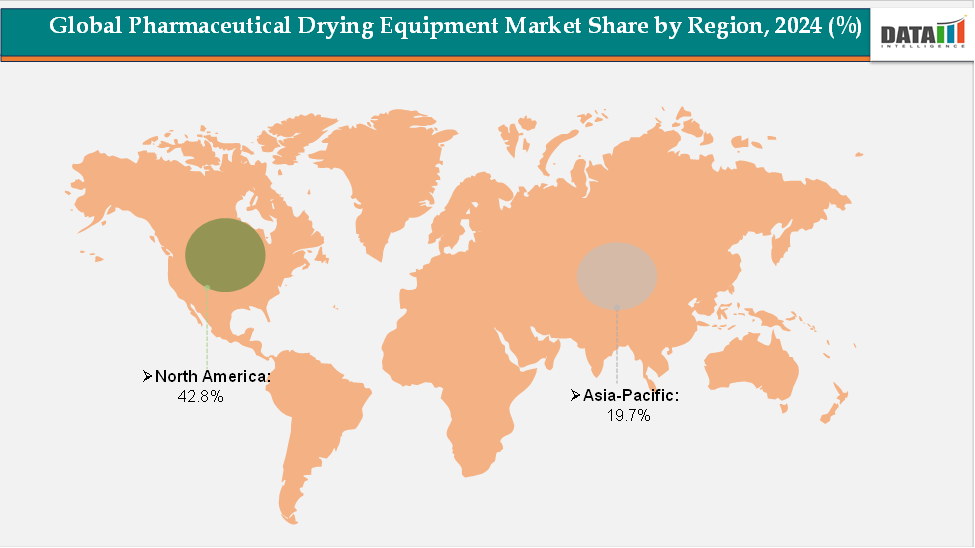

North America holds 42.8% of the Pharmaceutical Drying Equipment market, driven by advanced pharmaceutical manufacturing infrastructure, stringent quality regulations, and the presence of leading equipment manufacturers.

Asia-Pacific accounts for 19.7% and is the fastest-growing region, supported by increasing pharmaceutical production, growing biotech manufacturing, and rising healthcare access in China, India, and Japan.

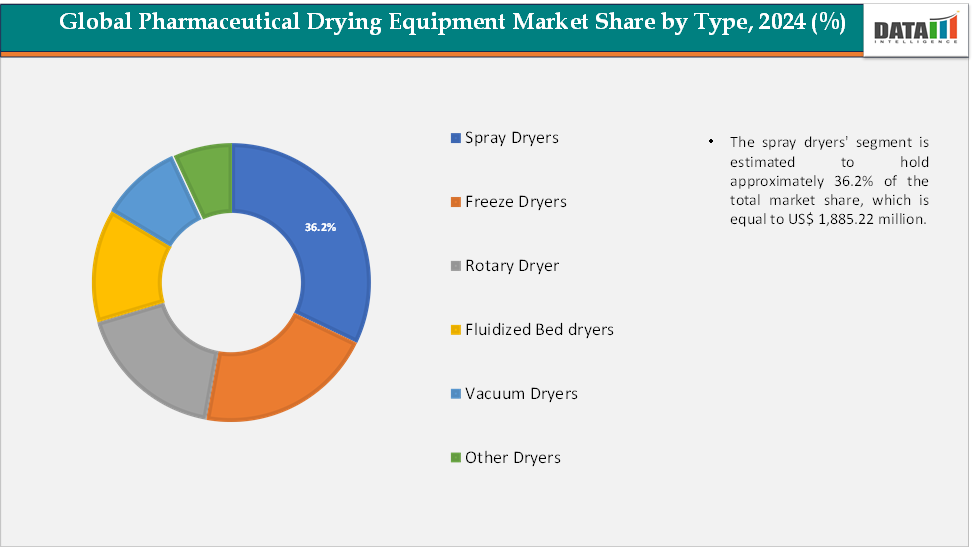

Spray dryers segment dominates with 36.2% share, preferred for flexibility, cost-effectiveness, and applicability across different drug formulations.

Market Size & Forecast

2024 Market Size: US$ 5.78 Billion

2033 Projected Market Size: US$ 10.35 Billion

CAGR (2025–2033): 7.6%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Market Dynamics

Driver: Increasing global pharmaceutical production

The increasing global production of pharmaceutical drugs, particularly biologics, sterile injectables, and oral solid formulations, is emerging as one of the most influential factors fueling the demand for pharmaceutical drying equipment worldwide. For instance, according to the EFPIA, in 2022, the pharmaceutical industry invested more than € 47,000 million in R&D in Europe. Drying plays a vital role in pharmaceutical manufacturing, as it directly impacts the stability, efficacy, and shelf life of drugs, making it an indispensable step in the production chain. With the growing complexity of modern drug formulations, including biopharmaceuticals and targeted therapies, the demand for advanced drying technologies such as fluidized bed dryers, spray dryers, and freeze dryers has intensified, as these systems ensure uniformity, precision, and compliance with regulatory standards.

Moreover, stringent Good Manufacturing Practices (GMP) mandates and heightened scrutiny from regulatory authorities such as the FDA and EMA are pushing pharmaceutical companies to adopt technologically advanced, validated drying systems that deliver both product quality and process efficiency.

At the same time, the rapid expansion of contract manufacturing organizations (CMOs) and pharmaceutical facilities in emerging markets such as Asia-Pacific and Latin America is driving the need for high-capacity, cost-efficient, and energy-optimized drying equipment to support large-scale production while meeting global regulatory requirements.

Furthermore, the ongoing push toward continuous manufacturing, personalized medicine, and biologics production is accelerating the replacement of conventional drying techniques with modern, automated systems capable of delivering consistent output with reduced downtime. Collectively, these trends are creating a strong growth environment for the pharmaceutical drying equipment Market, positioning it as a cornerstone of the evolving global pharmaceutical manufacturing industries.

Restraint: Availability of alternative surgical tools

The high capital cost of advanced pharmaceutical drying equipment and the availability of alternative drying methods, such as conventional tray drying and oven-based systems, limit market adoption in cost-sensitive facilities. Smaller manufacturers may prefer low-cost solutions that require less technical expertise and infrastructure, restraining the growth of high-end equipment in certain regions.

For more details on this report, Request for Sample

Global Pharmaceutical Drying Equipment Market Segment Analysis

The global pharmaceutical drying equipment market is segmented by type, scale of operation, end-user, and region.

Type:The spray dryers segment is estimated to have 36.2% of the pharmaceutical drying equipment market share.

Spray dryers are the dominant segment in the global pharmaceutical drying equipment market. Their widespread adoption stems from their ability to convert liquid formulations into uniform, fine, and stable powders, which is critical for maintaining drug quality, efficacy, and shelf life. Spray dryers are highly versatile, catering to a wide range of pharmaceutical products including antibiotics, vaccines, enzymes, and biologics. Their precision, reproducibility, and compliance with good manufacturing practices (GMP) standards make them the preferred choice for large-scale pharmaceutical production.

Additionally, spray dryers can be seamlessly integrated into continuous manufacturing processes, which enhances efficiency, reduces processing times, and supports high-volume production. This combination of scalability, versatility, and regulatory compliance firmly establishes spray dryers as the backbone of the pharmaceutical drying equipment market, maintaining the largest market share across both developed and emerging pharmaceutical manufacturing regions.

The freeze dryers segment is estimated to have 15.4% of the pharmaceutical drying equipment market share.

Freeze dryers are the fastest-growing segment due to the rising demand for temperature-sensitive formulations such as biologics, vaccines, and sterile drugs that require lyophilization to preserve stability and efficacy. The growth of biotechnology, increasing production of advanced therapies, and expansion of sterile drug manufacturing facilities have significantly accelerated the adoption of freeze dryers, particularly in regions such as North America, Europe, and Asia-Pacific.

Freeze drying ensures the long-term stability of sensitive compounds, reduces degradation, and supports the production of high-value pharmaceutical products, making it indispensable for modern drug development. This high-growth trajectory reflects the evolving needs of pharmaceutical manufacturers who are increasingly focusing on biologics, personalized medicines, and complex therapies, thereby positioning freeze dryers as a critical investment area within the Pharmaceutical Drying Equipment market.

Geographical Analysis

The North America pharmaceutical drying equipment market was valued at 42.8% market share in 2024

North America holds the dominant position in the global pharmaceutical drying equipment market, driven by advanced pharmaceutical manufacturing infrastructure, high R&D investment, and strong regulatory frameworks. The region benefits from a well-established ecosystem of pharmaceutical and biotechnology companies, contract manufacturing organizations (CMOs), and academic research centers, which accelerates the adoption of high-precision drying equipment.

The United States, in particular, leads the market due to its large-scale pharmaceutical production, high volumes of biologics and sterile drugs, and robust compliance with good manufacturing practices (GMP). According to the National Library of Medicine, the United States accounts for nearly 40% of the world’s pharmaceutical market. The presence of key equipment manufacturers and early adoption of automated, multifunctional, and energy-efficient drying systems further strengthen North America’s dominance. Additionally, favorable government policies, stringent quality standards, and consistent product innovation ensure that the region remains the largest and most technologically advanced market for Pharmaceutical Drying Equipment globally.

The Europe pharmaceutical drying equipment market was valued at 23.4% market share in 2024

Europe represents a significant and stable market for pharmaceutical drying equipment, supported by well-established pharmaceutical manufacturing hubs, advanced infrastructure, and strict regulatory compliance. Germany, the UK, and France are the key contributors, with Germany being the largest market due to its specialized manufacturing capabilities and early adoption of high-precision drying systems. Companies are developing solutions to cater to pharmaceutical companies in drug manufacturing. For instance, in July 2025, Aenova announced the expansion of its Killorglin site with the addition of a state-of-the-art spray drying platform designed for amorphous solid dispersions (ASD) and inhalation powders. The newly installed laboratory and pilot-scale systems are intended to support the development of innovative drug formulations, particularly those addressing bioavailability challenges, which remain one of the most significant obstacles in modern pharmaceutical development.

European pharmaceutical companies prioritize quality, precision, and automation in production, which drives steady demand for spray dryers, freeze dryers, and fluidized bed dryers. While the market growth in Europe is relatively moderate compared to Asia-Pacific, the region remains critical due to its advanced technological adoption, strong pharmaceutical output, and regulatory leadership in GMP compliance.

The Asia-Pacific Pharmaceutical Drying Equipment market was valued at 19.7% market share in 2024

Asia-Pacific is the fastest-growing region in the pharmaceutical drying equipment market, propelled by increasing pharmaceutical manufacturing, growing biotech production, and rising healthcare access across emerging economies. Countries such as China, India, and Japan are driving this growth through significant investments in modern manufacturing facilities, expansion of sterile drug and biologics production, and adoption of advanced drying technologies. For instance, in April 2025, Yowa Kirin completed its HB7 drug substance (DS) manufacturing facility at the Takasaki plant in Japan, with an investment of ¥16.8 billion ($117 million). The new facility will support biopharmaceutical DS manufacturing, research, and staff training, while utilizing the company’s expertise in protein engineering and antibody technology.

The rising prevalence of chronic diseases, increasing demand for vaccines and innovative therapies, and government initiatives to modernize pharmaceutical infrastructure are further fueling market penetration. Asia-Pacific’s combination of high-volume production and rapid adoption of advanced manufacturing technologies makes it a dynamic growth engine for the pharmaceutical drying equipment market, with tremendous opportunities for both local and international equipment manufacturers.

Competitive Landscape

The major players in the pharmaceutical drying equipment market include Hosokawa Micron B.V., FREUND CORPORATION, I.M.A. Industria Macchine Automatiche S.p.A., Syntegon Telstar, BUCHI Labortechnik AG, OPTIMA, MechaTech Systems Ltd, among others.

Syntegon Telstar:

Syntegon’s acquisition of Telstar brings over 60 years of freeze-dryer manufacturing expertise into its pharmaceutical portfolio, marking a significant milestone in offering comprehensive solutions for drug production. Telstar’s flagship product lines, LyoMega and LyoZeta freeze dryers, offer large-scale capacities, with shelf surfaces reaching up to 60 m². These grinders are celebrated for their robust integration capabilities, including loading and unloading (Lyogistic) systems that support manual, semi-automatic, and fully automatic operations tailored for vials and bulk materials

Market Scope

Metrics | Details | |

CAGR | 6.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Spray Dryers, Freeze Dryers, Rotary Dryers, Fluidized Bed Dryers, Vacuum Dryers, Other Dryers |

Scale of Operation | Industrial-Scale Equipment, Pilot-Scale Equipment, Laboratory-Scale Equipment | |

End-User | Pharmaceutical and Biotechnology Companies, Contract Development and Manufacturing Organizations, Research Academies and Universities, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global pharmaceutical drying equipment market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here