Pharmaceutical Sealing Machines Market Size

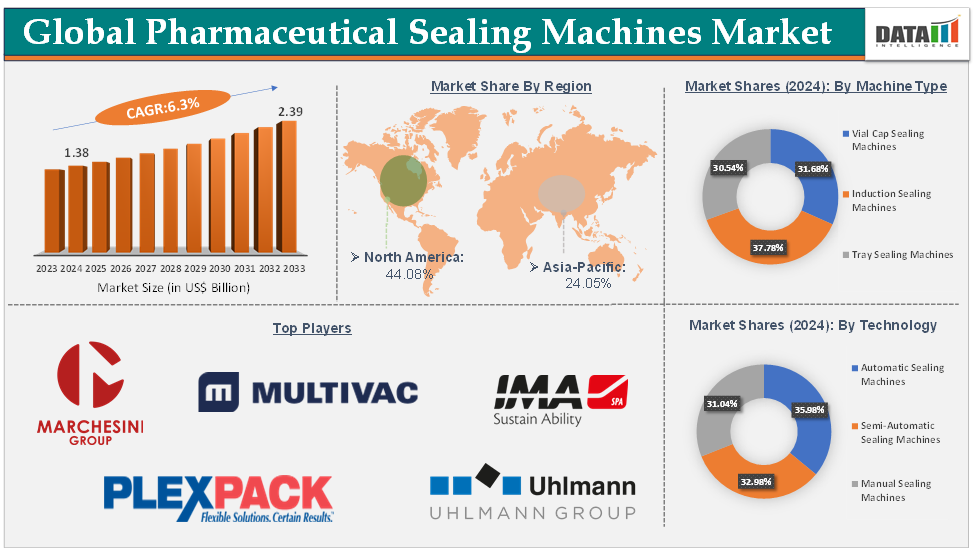

Pharmaceutical Sealing Machines Market Size reached US$ 1.38 Billion in 2024 and is expected to reach US$ 2.39 Billion by 2033, growing at a CAGR of 6.3% during the forecast period 2025-2033.

The demand for pharmaceutical sealing machines is steadily growing due to the increasing need for product safety, compliance with stringent regulations, and the expansion of the pharmaceutical industry in terms of high production. For instance, the cap-sealing machine can produce up to 36,000 to 12,000 vials in an hour. The growth in biologics and biosimilars has increased the demand for sealing machines capable of handling sensitive packaging materials and ensuring airtight seals.

Executive Summary

For more details on this report – Request for Sample

Pharmaceutical Sealing Machines Market Dynamics: Drivers & Restraints

Growth in pharmaceutical manufacturing is significantly driving the pharmaceutical sealing machines market growth

The growth in pharmaceutical manufacturing is primarily driven by several factors, including increased demand for pharmaceutical products, expansion of manufacturing facilities, and the need for stringent regulatory compliance. The global rise in chronic diseases such as diabetes, cardiovascular conditions, and cancer is boosting the production of pharmaceutical products, which in turn drives the need for effective sealing machines.

The growth of biologics and biosimilars, which often require specialized packaging and sealing technologies to maintain efficacy and prevent contamination, has led to increased demand for sealing machines capable of handling complex packaging requirements. For instance, by the end of 2024, the FDA approved a total of 71 biosimilars. The adoption of next-generation sealing machines allows advantages, especially by enhancing sterility and user-friendliness. This reduces downtime and ensures consistent quality across manufacturing lines.

Material compatibility issues are hampering the growth of the pharmaceutical sealing machines market

Material compatibility issues are a significant challenge for the pharmaceutical sealing machines market, as they directly affect the efficiency, reliability and adoption of these machines. As pharmaceutical companies adopt eco-friendly and biodegradable packaging materials, traditional sealing machines often struggle to handle these materials effectively.

For instance, conventional sealing machines optimized for plastic and aluminum may not provide the required seal strength or consistency when used with biodegradable plastics or paper-based materials, leading to production inefficiencies and increased waste. This transition increases the need for retrofitting or replacing machines, which adds to operational costs and delays adoption.

Advanced materials, such as multi-layer films used for sensitive drugs, can cause challenges in achieving uniform heat distribution and sealing strength. For instance, sealing machines designed for single-layer materials may cause overheating or under-sealing when used with multi-layer films, resulting in defective packaging and product recalls. This hampers productivity and increases waste, driving up costs for manufacturers.

Pharmaceutical Sealing Machines Market Segment Analysis

The global pharmaceutical sealing machines market is segmented based on machine type, technology, end-user, and region.

The induction sealing machines from the machine type segment are expected to hold 31.68% of the market share in 2024 in the pharmaceutical sealing machines market

Induction sealing provides a hermetic (airtight) seal on containers, such as plastic and glass bottles, which prevents contamination from external elements like air, moisture, and light. This is critical for preserving the efficacy and shelf life of pharmaceutical products, especially sensitive ones like liquids, creams, and powders, by providing inspection and process analysis.

For instance, in November 2024, Yoran Imaging introduced a system that provides inspection and process analysis for induction-sealed bottles, jars, and vials. Capable of operating at full production speeds, the company’s i-PAM induction seal process analytical monitoring system performs non-intrusive through-the-cap thermal imaging inspection of all induction seals and provides process insights to reveal the root causes of current or foreseeable adverse issues.

Induction sealing is widely adopted because it provides tamper-evident seals that are difficult to counterfeit. This meets the regulatory requirements set by bodies such as the FDA and the EU for pharmaceutical packaging. For instance, in the U.S., the Drug Supply Chain Security Act (DSCSA) mandates tamper-evident packaging for prescription drugs, pushing manufacturers to use induction sealing machines to include tamper-evident seals on product containers.

Pharmaceutical Sealing Machines Market Geographical Analysis

North America is expected to dominate the global pharmaceutical sealing machines market with a 44.08% share in 2024

North America hosts many of the world's leading pharmaceutical companies, including Pfizer, Merck, Johnson & Johnson, and Eli Lilly. These companies have substantial production facilities equipped with state-of-the-art sealing machines to maintain high standards of product quality and compliance. For instance, Pfizer’s manufacturing facilities in the United States use advanced sealing technologies to package drugs like biologics and vaccines, which require precise sealing for integrity and stability.

North America is known for having some of the world’s most stringent regulatory requirements for pharmaceutical manufacturing. The FDA mandates compliance with cGMP (Current Good Manufacturing Practices), which includes the use of specialized sealing machines to ensure product safety and quality. For instance, pharmaceutical companies in the US use induction sealing machines for tamper-evident seals on products like OTC medications to comply with the DSCSA and EU Falsified Medicines Directive.

Asia-Pacific is growing at the fastest pace in the pharmaceutical sealing machines market, holding 24.05% of the market share

The Asia-Pacific region is witnessing a significant expansion in pharmaceutical manufacturing facilities, driven by government initiatives and favorable economic conditions. Countries like Japan, India, China, and South Korea are major hubs for pharmaceutical production. For instance, India, often referred to as the "pharmacy of the world," is expanding its pharmaceutical manufacturing base to meet global demand for generic drugs.

The demand for biologics, vaccines, and specialized pharmaceutical products is growing rapidly in the APAC region. These products often require advanced sealing solutions to maintain product stability and prevent contamination. For instance, the production of COVID-19 vaccines, particularly in China and India, has highlighted the need for sealing machines that can handle complex packaging requirements and ensure product integrity during distribution.

As the pharmaceutical manufacturing sector expands rapidly in this region, the demand for advanced sealing technologies is set to rise, particularly with the increasing production of biopharmaceuticals and vaccines. The combination of technological advancements, favorable economic conditions, and strategic government initiatives is positioning the APAC region as the fastest-growing market in the pharmaceutical sealing machines landscape.

Pharmaceutical Sealing Machines Market Major Players

The major global players in the pharmaceutical sealing machines market include Marchesini Group S.p.A., Uhlmann Pac-Systeme GmbH & Co. KG, MULTIVAC Group, I.M.A. Industria Macchine Automatiche S.p.A., MG2 s.r.l., PlexPack, Bausch+Ströbel SE + Co. KG, Audion, Syntegon Technology GmbH, and MGA Technologies, among others.

Key Developments

In December 2024, ACG Engineering, a division of ACG, unveiled its new ADAPT X feeder at CpHI & PMEC 2024 in Delhi. Designed to handle complex and unusual tablet shapes, the ADAPT X feeder ensures flexibility for diverse packaging needs. Optimised for high-volume production, the feeder achieves speeds of 13.2 m/min on rotary sealing or 60 cycles per minute on intermittent machines.

In November 2024, Freudenberg participated in CPhI & PMEC India 2024. Freudenberg-NOK India presented hygienic sealing systems like Radiamatic HTS II Seals and ISO-compliant O-rings, ensuring reliability in pharmaceutical applications.

Market Scope

Metrics | Details | |

CAGR | 6.3% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Machine Type | Vial Cap Sealing Machines, Induction Sealing Machines, Tray Sealing Machines |

Technology | Automatic Sealing Machines, Semi-Automatic Sealing Machines, Manual Sealing Machines | |

End-User | Pharmaceutical Companies, Contract Packaging Organizations, Research Laboratories | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global pharmaceutical sealing machines market report delivers a detailed analysis with 62 key tables, more than 52 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.