Pharmaceutical Cold Chain Logistics Market Size

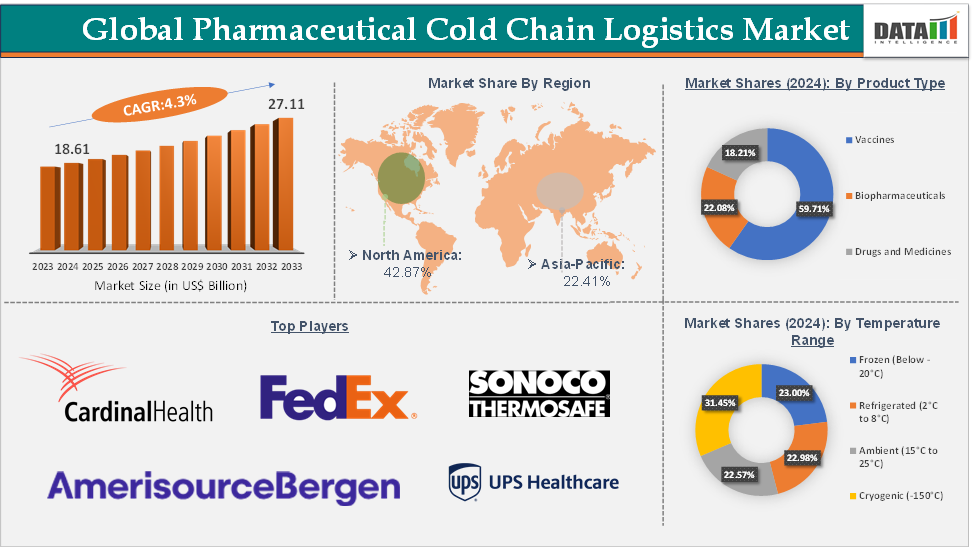

Pharmaceutical Cold Chain Logistics Market Size reached US$18.61 Billion in 2024 and is expected to reach US$27.11 Billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025-2033, according to DataM Intelligence report.

Pharmaceutical Cold Chain Logistics Market Overview

Pharmaceutical cold chain logistics refers to the specialized process of managing, storing, and transporting temperature-sensitive pharmaceutical products such as vaccines, biologics, and other medicinal products that require strict temperature controls to maintain their efficacy and safety throughout the supply chain. Pharmaceutical cold chain logistics involves the management of the entire lifecycle of temperature-sensitive pharmaceutical products from manufacturing through to the final delivery to the end-user. This logistics system includes temperature-controlled storage, transportation, packaging, real-time monitoring, and tracking.

In the past decade, pharmaceutical cold chain logistics has experienced rapid innovation and growth. The increasing demand for biologics and other temperature-sensitive medicines has heightened the need for reliable, temperature-controlled distribution systems. For instance, according to the National Institute of Health, in recent years, biologics accounted for 30% of all drugs. A specialized focus on cold chain logistics emerged, driven by a collaborative effort among industry experts to promote awareness and standardize best practices.

Executive Summary

For more details on this report – Request for Sample

Pharmaceutical Cold Chain Logistics Market Dynamics: Drivers & Restraints

Rising advancements in cold chain technology are significantly driving the pharmaceutical cold chain logistics market growth

IoT-enabled solutions have revolutionized cold chain logistics by providing real-time monitoring of environmental conditions during transport and storage. These systems use sensors to continuously track temperature, humidity, and other conditions, alerting logistics providers to any deviations. This ensures the integrity of pharmaceutical products, especially vaccines and biologics, which are sensitive to temperature changes. Major market players are focusing on the IoT-enabled solutions, which are driving the market growth.

For instance, in February 2024, Sensitech introduced TempTale GEO X, an innovative IoT temperature monitoring solution tailored specifically for the life sciences industry and logistics organizations. This cutting-edge solution is designed to deliver real-time monitoring and analytics for temperature-sensitive medicines and vaccines transported globally across various modes of transportation, including air, ocean, road, and rail. TempTale GEO X represents a significant step forward in enhancing cold chain compliance, supply chain efficiency, and sustainability outcomes in the pharmaceutical supply chain.

Automated systems are being integrated into cold chain logistics for sorting, handling, and storing temperature-sensitive pharmaceuticals. These technologies reduce the risk of human error, enhance efficiency, and improve compliance with GDP regulations. For instance, in June 2024, Overhaul, a global leader in active supply chain risk management and intelligence, launched its cutting-edge Cold Chain Quality Solution. This innovative software solution delivers unparalleled risk and quality management for time and temperature-sensitive cargo, ensuring optimal conditions throughout the supply chain for the pharmaceutical, healthcare, and high-value food and beverage sectors.

Regulatory challenges are hampering the pharmaceutical cold chain logistics market's growth

Stringent regulations such as Good Distribution Practice (GDP) and Good Manufacturing Practice (GMP) require high levels of compliance, which includes maintaining proper temperature controls during storage and transportation. These standards are expensive to implement and maintain due to the need for specialized equipment, facilities, and personnel. For instance, the FDA’s GDP guidelines mandate strict documentation and monitoring of temperature-controlled shipments for pharmaceuticals. Compliance with these guidelines requires significant investments in technology and infrastructure, which can be a barrier for smaller logistics providers.

Different regions have different regulatory requirements. In the United States, the FDA provides comprehensive guidelines for cold chain management, primarily through the Good Distribution Practices (GDP) and current Good Manufacturing Practices (cGMP). These regulations ensure that pharmaceutical products are stored, handled, and transported under appropriate conditions to maintain their safety, efficacy, and quality. The European Medicines Agency (EMA) sets out strict cold chain requirements for pharmaceutical distribution within the European Union. This inconsistency complicates logistics management, especially for global operations.

Regulatory bodies impose heavy fines and sanctions on companies for non-compliance, such as temperature excursions that damage pharmaceutical products. These penalties can be severe, leading to financial losses and reputational damage. For instance, a product recall due to temperature mishandling could cost a company millions in lost sales, legal fees, and damage to its brand reputation.

Pharmaceutical Cold Chain Logistics Market, Segment Analysis

The global pharmaceutical cold chain logistics market is segmented based on product type, service type, temperature range, mode of delivery, end-user, and region.

The cryogenic segment from the temperature range is expected to hold 31.45% of the market share in 2024 in the pharmaceutical cold chain logistics market

The demand for cryogenic conditions (temperatures typically below -150°C) is usually high as these are essential for transporting and storing advanced biopharmaceutical products such as mRNA vaccines, gene therapies, and CAR-T cell therapies. These products are highly sensitive to temperature variations, necessitating ultra-low temperature logistics to maintain their stability and efficacy.

For instance, in April 2024, CSafe launched three new technologies, building on its portfolio of solutions, integrating real-time data tracking to ensure maximum visibility throughout the shipping journey. CSafe's Multi-Use Dewars, the first in the CGT Cryo Series, are designed to serve the growing cell and gene therapy market. These cryogenic, reusable dewars maintain the coldest temperature range of -150°C or colder. This technology uses liquid nitrogen dry vapor units and includes a built-in TracSafe RLT real-time data tracking device.

Technological advancements have made cryogenic logistics more efficient and reliable. The development of advanced cryogenic packaging solutions, including passive cooling technologies like phase change materials and insulated containers, has improved the ability to maintain ultra-low temperatures for longer periods, especially during transit.

Pharmaceutical Cold Chain Logistics Market Geographical Analysis

North America is expected to dominate the global pharmaceutical cold chain logistics market with a 42.87% share in 2024

North America, particularly the United States and Canada, boasts a highly developed healthcare system with a significant demand for biologics, vaccines, and temperature-sensitive pharmaceuticals. The region's advanced cold chain infrastructure, including a vast network of refrigerated warehouses and transportation facilities, ensures that products remain stable from manufacturer to patient.

For instance, in six years, NewCold has gone from zero to three of the most advanced temperature-controlled warehouses in the United States, with a fourth set to become operational in mid-2024. January 18, 2024 marks six years since the first pallet was received in 2018. At the time of its founding, NewCold Tacoma was considered one of the most energy-efficient and technologically advanced North American automated warehouses in the United States.

North America leads globally in the demand for biopharmaceuticals such as vaccines, biologics, and advanced therapies. This demand drives the growth of the cold chain logistics market as these products require ultra-low temperatures during transit and storage. For instance, according to the National Institute of Health (NIH), U.S. vaccine sales are estimated to be about $1.5 billion per year.

North America is a hub for cold chain technology innovation. The region is at the forefront of developing advanced logistics technologies such as IoT-enabled real-time temperature monitoring, automated warehouses, and cryogenic packaging solutions. These advancements enhance the efficiency and reliability of cold chain logistics.

For instance, in April 2025, Cold Chain Technologies (CCT) launched a reusable universal temperature-controlled pallet shipper, the company’s first innovation for the life sciences sector since its acquisition of reusable pallet specialist, Tower Cold Chain, in 2024. Offering a capacity of 1600L and a design that accommodates both Euro and US pallets, the CCT Tower Elite provides a singular solution for pharmaceutical companies, airlines, and 3PLs looking to ship large consignments globally. Notably, the new product stands out as the lightest solution in the market for this type of temperature-controlled packaging, ensuring cost efficiency and ease of handling without compromising performance.

Pharmaceutical Cold Chain Logistics Market Top Companies

Top companies in the pharmaceutical cold chain logistics market include Cardinal Health, AmerisourceBergen Corporation, Envirotainer AB, FedEx, United Parcel Service of America, Inc., Thermo King, Sonoco ThermoSafe, B Medical Systems India Private Limited, DoKaSch TEMPERATURE SOLUTIONS GmbH, and Nordic Cold Chain Solutions, among others.

Market Scope

Metrics | Details | |

CAGR | 4.3% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Vaccines, Biopharmaceuticals, Drugs, and Medicines |

Service Type | Storage, Transportation, Packaging, and Others | |

Temperature Range | Frozen (Below -20°C), Refrigerated (2°C to 8°C), Ambient (15°C to 25°C), and Cryogenic (-150°C) | |

Mode of Delivery | Last-Mile Delivery and Hubs-to-Distributor | |

End-User | Pharmaceutical and Biopharmaceutical Companies, Biotechnology Companies, Hospitals and Healthcare Facilities, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global Pharmaceutical Cold Chain Logistics market report delivers a detailed analysis with 78 key tables, more than 74 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.