Pharma Blisters Packaging Market Size

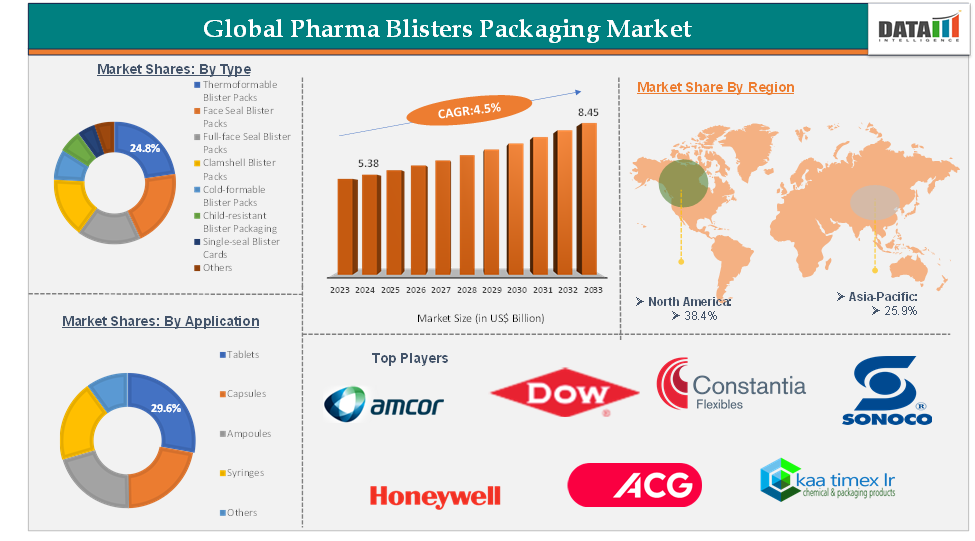

Pharma Blisters Packaging Market reached US$5.38 Billion in 2024 and is expected to reach US$8.45 Billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025-2033, according to DataM Intelligence report.

Pharma Blisters Packaging Market Overview

The global pharmaceutical blister packaging market is experiencing robust growth driven by increasing demand for unit-dose packaging, advancements in smart packaging technologies, and a shift towards sustainable materials. The market's expansion is further fueled by the rising prevalence of chronic diseases and an aging population, necessitating efficient and secure medication delivery systems. Key drivers include stringent regulatory standards, which compel manufacturers to adopt tamper-evident and child-resistant packaging solutions, and technological innovations such as automation and smart packaging features like RFID and QR codes, enhancing patient compliance and supply chain transparency.

Executive Summary

For more details on this report – Request for Sample

Pharma Blisters Packaging Market Dynamics: Drivers & Restraints

Innovations in packaging technology are significantly driving the pharma blister packaging market growth

Innovations in packaging technology are expected to significantly propel the pharma blister packaging market by enhancing safety, improving patient adherence, and promoting sustainability. Recent advancements have focused on integrating smart technologies, such as sensors and tracking devices, which can monitor medication usage and expiration dates.

Another significant innovation is the development of sustainable packaging solutions. Eco-friendly alternatives like Dry Molded Fiber (DMF) and paper-based blister packs are emerging as viable substitutes for traditional plastic packaging. These materials are both recyclable and biodegradable, addressing environmental concerns while still providing the necessary protective qualities for pharmaceutical products. For instance, in July 2024, Aluflexpack announced the development of a new product, the 4∞ Form. This blister pack, designed specifically for the pharmaceutical industry, is constructed entirely of lacquered aluminum, offering a sustainable and recyclable alternative to traditional multi-material packaging. The 4∞ Form solution addresses growing concerns about the environmental impact within the pharmaceutical packaging sector.

Advancements in design are also making blister packs more user-friendly, particularly for vulnerable populations such as the elderly. Features like child-resistant mechanisms and senior-friendly designs ensure that medications remain safe yet accessible. For instance, in November 2024, Schreiner MediPharm launched a New Child-Resistant Smart Blister Wallet. The product provides secure and smart packaging solutions for clinical trials. Schreiner MediPharm offers a wide variety of smart blister packs for clinical trials.

The introduction of customizable dosage tracking tools allows patients to easily monitor their medication schedules, thereby enhancing adherence and improving health outcomes. Overall, these innovations not only enhance the functionality and sustainability of blister packaging but also align with the growing demand for patient-centric solutions in the pharmaceutical industry. Thus, the above factors are contributing to the pharma blisters packaging market..

Growing rate of medical waste is expected to hamper pharma blisters packaging market growth

The increasing rate of medical waste is expected to be a significant restraining factor for the pharma blister packaging market. This is due to increasing environmental concerns and regulatory pressures. Blister packaging, while effective in protecting medications and extending shelf life, is primarily composed of plastic and aluminum, which complicates disposal and recycling efforts.

The complexity of materials used in blister packs makes them challenging to recycle, resulting in a considerable amount of waste that often ends up in landfills or incinerators. This not only contributes to environmental degradation but also raises concerns among consumers and regulatory bodies regarding the sustainability of pharmaceutical packaging practices. Companies will need to innovate and adapt their packaging strategies to address these issues while complying with evolving regulations aimed at reducing waste and promoting sustainability.

Pharma Blisters Packaging Market Segment Analysis

The global pharma blisters packaging market is segmented based on type, material, application, and region.

The thermoformable blister packs from the type segment are expected to hold 24.8% of the market share in 2024 in the pharma blisters packaging market

Induction sealing provides a hermetic (airtight) seal on containers, such as plastic and glass bottles, which prevents contamination from external elements like air, moisture, and light. This is critical for preserving the efficacy and shelf life of pharmaceutical products, especially sensitive ones like liquids, creams, and powders, by providing inspection and process analysis.

For instance, in November 2024, Yoran Imaging introduced a system that provides inspection and process analysis for induction-sealed bottles, jars, and vials. Capable of operating at full production speeds, the company’s i-PAM induction seal process analytical monitoring system performs non-intrusive through-the-cap thermal imaging inspection of all induction seals and provides process insights to reveal the root causes of current or foreseeable adverse issues.

Induction sealing is widely adopted because it provides tamper-evident seals that are difficult to counterfeit. This meets the regulatory requirements set by bodies such as the FDA and the EU for pharmaceutical packaging. For instance, in the U.S., the Drug Supply Chain Security Act (DSCSA) mandates tamper-evident packaging for prescription drugs, pushing manufacturers to use induction sealing machines to include tamper-evident seals on product containers.

Pharma Blisters Packaging Market Geographical Analysis

North America is expected to dominate the global pharma blisters packaging market with a 38.4% share in 2024

North America is expected to hold a significant position in the global pharma blisters packaging market. This is due to the rising innovation in packaging solutions, increasing pharmaceutical production, and consumption. The presence of a large number of packaging companies is expected to contribute to the region’s market growth.

The presence of major pharmaceutical companies, including giants like Pfizer and Moderna, further solidifies North America's position in the blister packaging market. These companies not only dominate the production of high-demand pharmaceuticals but also invest heavily in research and development, leading to a continuous influx of new drug formulations that require effective packaging solutions.

The increasing focus on patient safety and adherence to medication regimens further emphasizes the need for effective packaging that can protect pharmaceuticals from environmental factors. Moreover, advancements in packaging technology are enhancing the functionality of blister packs, making them more user-friendly and sustainable.

For instance, in April 2025, Jones Healthcare Group launched the FlexRx One, a sustainable blister pack solution designed for pharmacies seeking eco-friendly packaging that integrates smoothly with automated filling systems. This unit-dose adherence package is well-suited for retail, specialty, and long-term care pharmacies, whether they use centralized fulfillment or in-house automation. It also offers consistent sealing speed and quality, making it equally effective for pharmacies that prepare prescriptions manually.

Asia-Pacific is growing at the fastest pace in the pharma blisters packaging market, holding 25.9% of the market share

Asia-Pacific is currently experiencing the fastest growth in the pharma blister packaging market. This growth is driven by the rising consumption of pharmaceutical products due to the incidence of several chronic diseases, particularly in China, Japan and India, increasing pharmaceutical production by manufacturing companies, and the increasing innovations in packaging solutions.

Pharma Blisters Packaging Market Major Players

The major global players in the Pharma Blisters Packaging market include ACG, KAA Timex LR, Amcor plc, Caprihans India Limited, Constantia Flexibles, Honeywell International Inc., Sonoco Products Company, The Dow Chemical Company, Tekni-Plex, Inc., and Körber AG, among others.

Pharma Blisters Packaging Market Key Developments

In October 2024, Bayer introduced a groundbreaking innovation in the healthcare industry by launching polyethylene terephthalate (PET) blister packaging for its well-known brand, Aleve. Developed in collaboration with pharmaceutical packaging expert Liveo Research, this first-of-its-kind solution eliminates the use of polyvinyl chloride (PVC) and achieves a 38% reduction in carbon footprint, representing a significant step forward in sustainable packaging and environmental responsibility.

Market Scope

Metrics | Details | |

CAGR | 4.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Thermoformable Blister Packs, Face Seal Blister Packs, Full-face Seal Blister Packs, Clamshell Blister Packs, Cold-formable Blister Packs, Child-resistant Blister Packaging, Single-seal Blister Cards, Others |

Material | PVC (Polyvinyl Chloride), PVDC (Polyvinylidene Chloride), Polychlorotrifluoroethylene, Aluminum-Aluminum (Alu-Alu), Cold Form Foil (CFF), Paper & Cardboard, Others | |

Application | Tablets, Capsules, Ampoules, Syringes, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global pharma blisters packaging market report delivers a detailed analysis with 62 key tables, more than 52 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.