Parkinson’s Disease Therapeutics Market Size& Industry Outlook

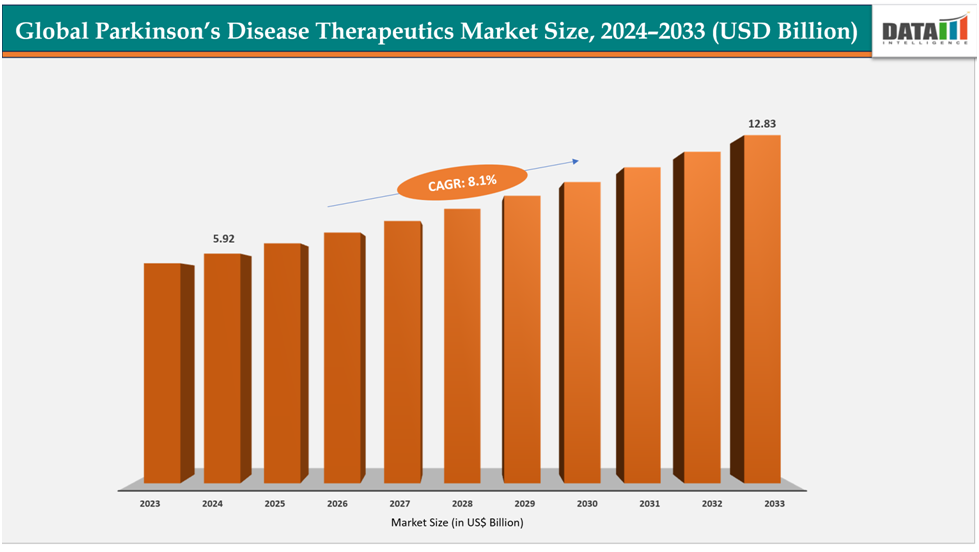

The global Parkinson’s disease therapeutics market size reached US$ 5.92 Billion in 2024 and is expected to reach US$ 12.83 Billion by 2033, growing at a CAGR of 8.1% during the forecast period 2025-2033.

The market for Parkinson's disease treatments is growing quickly as a result of the condition's rising incidence worldwide, which is mostly caused by an aging population. There is a great need for more creative and efficient solutions because current treatments mostly control symptoms rather than stopping the progression of the disease. There is a growing need for combination therapy, extended-release formulations, and supplementary treatments since patients frequently experience motor irregularities and the "wearing off" effect of levodopa. Moreover, increased public and private sector funding as well as growing healthcare awareness are speeding up research, FDA approvals and expanding access to cutting-edge treatments globally.

Key Market Trends &Insights

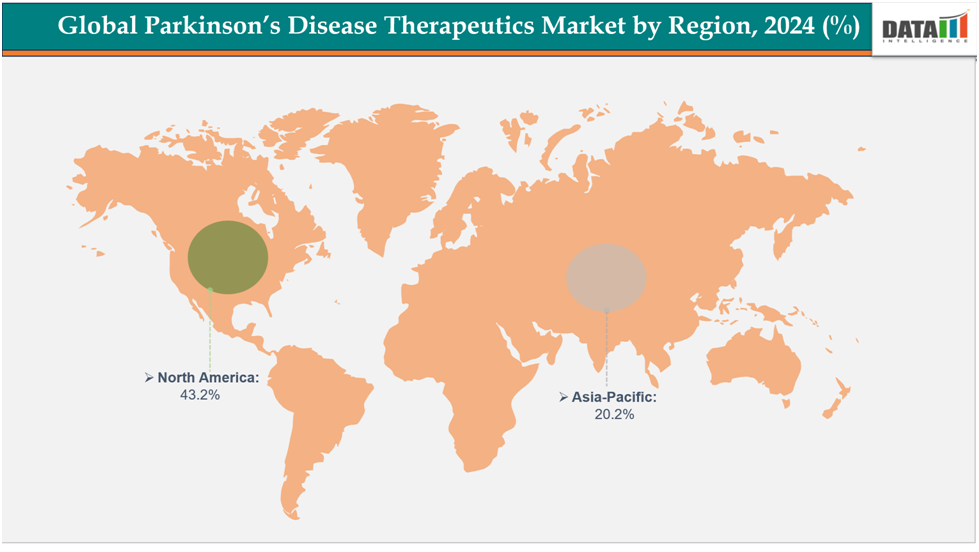

North America dominates the Parkinson’s disease therapeutics market with the largest revenue share of 43.2% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of7.6% over the forecast period.

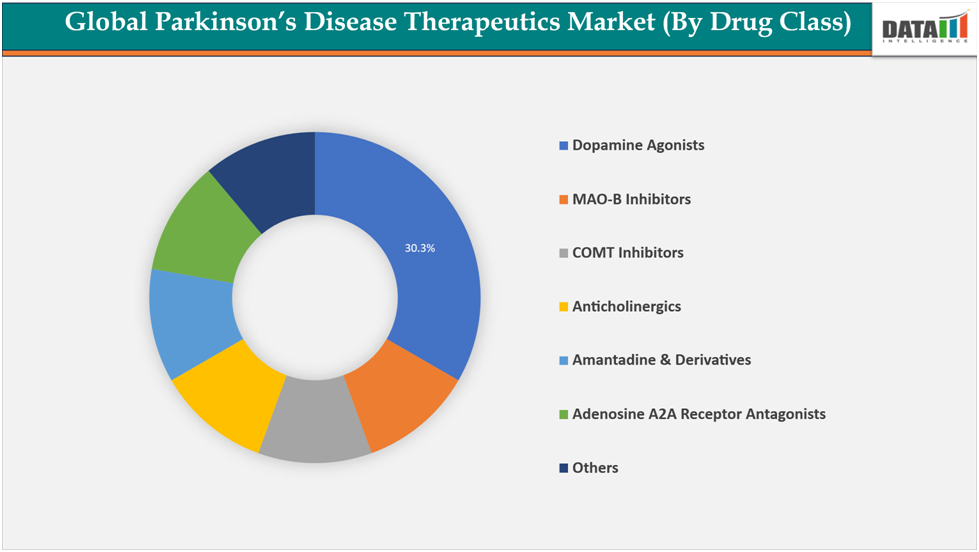

- The dopamine agonist from drug class dominates the Parkinson’s disease therapeutics market with a 30.3% share in 2024

The major market players in the Parkinson’s Disease Therapeutics market are F. Hoffmann-La Roche Ltd., AbbVie Inc., Supernus Pharmaceuticals, Inc., Amneal Pharmaceuticals LLC, Merck & Co., Inc., Boehringer Ingelheim International GmbH, GSK plc, Novartis AG, UCB S.A., Teva Pharmaceutical Industries Ltd., Acadia Pharmaceuticals Inc., Kyowa Kirin Co., Ltd., and Kyowa Kirin Co., Ltd.

Market Dynamics

Drivers: The rising prevalence of Parkinson’s disease is significantly driving the Parkinson’s disease therapeutics market growth

The growing number of patients with Parkinson's disease is directly driving the need for efficient treatment alternatives, which in turn is propelling the therapeutics industry. Because Parkinson's disease is closely linked to aging, its incidence is rapidly increasing as populations around the world age, particularly in developed and emerging nations. The need for both well-established treatments, such as levodopa-based therapy, and cutting-edge alternatives, such as gene therapies, sophisticated drug delivery systems, and disease-modifying medications, increases as a result of this rise. Furthermore, pressure for quicker approvals and R&D investments is increased by the toll that Parkinson's disease has on healthcare systems and quality of life.

Owing to factors like prevalence of disease, according to the Parkinson’s Foundation,over 10 million individuals worldwide and over 1.1 million Americans suffer from Parkinson's disease (PD), with that number expected to rise to 1.2 million by 2030. Nearly 90,000 Americans receive a new diagnosis every year. Although about 4% of cases occur before the age of 50, Parkinson's disease (PD) is the second most common neurological illness after Alzheimer's, and its risk increases with age. The disorder is almost 1.5 times more common in men than in women.

Restraints: The high cost of treatment costs hampering the growth of the Parkinson’s disease therapeutics market

The market for Parkinson's disease (PD) treatments is expanding slowly due to the high cost of therapy, which restricts patient access and puts a burden on healthcare systems. Advanced treatments that cost tens of thousands of dollars a year include deep brain stimulation, continuous drug infusion systems, and new gene or cell-based therapies. PD is a chronic, progressive condition that requires combination medication and lifetime management, making even basic drug regimens expensive over time. Limited insurance coverage and out-of-pocket costs impede the adoption of novel therapies in many areas, particularly in low- and middle-income nations.

For instance, In the United States, Parkinson's disease costs $52 billion a year. About $26.4 billion of this is due to non-medical difficulties including missed work, lost income, early retirement, and caregiver time, while the remaining $25.4 billion is due to direct medical costs like hospital stays and prescription drugs.

For more details on this report - Request for Sample

Segmentation Analysis

The global Parkinson’s disease therapeutics market is segmented based on disease type, drug class, route of administration, distribution channel, and region.

Drug Class:

The dopamine agonist from drug class dominates the Parkinson’s disease therapeutics market with a 30.3% share in 2024

The dopamine agonist class dominates the Parkinson’s disease therapeutics market because of its broad use across different stages of the disease and its ability to reduce long-term complications associated with levodopa therapy. These drugs mimic dopamine by directly stimulating dopamine receptors, providing effective symptom control. They are often prescribed as first-line therapy in younger patients to delay levodopa use and as adjunct therapy in advanced cases to smooth out “off” periods and extend levodopa’s effectiveness. Their multiple formulations (oral tablets, transdermal patches, and injectables) improve patient convenience and adherence. Additionally, strong R&D pipelines and new product launches have expanded their availability.

Owing to this, for dopamine agonists, in February 2025, the FDA-approved ONAPGO (apomorphine hydrochloride) is the first treatment for advanced Parkinson's disease in adults that uses subcutaneous infusion. It provides more reliable symptom management and lessens "OFF" time brought on by motor fluctuations by continually delivering apomorphine during the day.

By Disease Type—Idiopathic Parkinson’s disease dominates the Parkinson’s disease therapeutics market with a 45.16% share in 2024

Idiopathic Parkinson's disease (IPD) is the most common kind; it controls the market for Parkinson's disease treatments in 2024. The incidence of IPD is increasing due to the world's aging population, which greatly increases the number of patients. In order to maintain their dominance, the majority of licensed treatments—such as levodopa/carbidopa, dopamine agonists, MAO-B inhibitors, and COMT inhibitors—are created and evaluated largely for idiopathic cases. Furthermore, IPD is the primary focus of clinical research and pharmaceutical investment because of its larger commercial potential in comparison to less common familial or secondary variants because of its established gold-standard treatments, epidemiological prevalence, and commercial focus, IPD continues to be the primary driver of the market for Parkinson's disease therapies.

Owing to this prevalence, according to the Summit for Stem Cell Foundation, around 10 million people worldwide and 1 million in the U.S. have Parkinson’s disease. About 85% are idiopathic, and prevalence increases to 1.5–2% in those over 60.

Geographical Analysis

North America is dominating the global Parkinson’s disease Therapeutics market with 43.2% in 2024.

The global market for Parkinson's disease treatments is dominated by North America for a number of compelling reasons. Because of the region's huge aging population, Parkinson's disease is more common there and requires more treatment. Early detection and treatment adoption are supported by its sophisticated healthcare system, which includes extensive diagnostic facilities and specialized neurology institutes. Innovation in new medications, sophisticated formulations, and device-based therapies is fueled by the existence of top pharmaceutical and biotech firms as well as large investments in research and clinical trials.

Owing to these FDA approvals, the U.S. FDA approved Gocovri (amantadine)as the first medication designed especially to treat Parkinson's disease (PD) patients' levodopa-induced dyskinesia. This particular application received the first approval, and in 2021, a second indication for "off" time in PD was approved.

Europe is the second region to dominate the Parkinson’s disease therapeutic market with 33.4% in 2024

The market for Parkinson's disease (PD) therapies is expected to rise rapidly in Europe as a result of the continent's aging population and increasing rates of neurodegenerative diseases, which are pushing up demand for cutting-edge therapies. Widespread therapy access is guaranteed by a strong healthcare infrastructure, early diagnosis, and advantageous reimbursement schemes. Additionally, patient-cantered programs, clinical trials, and drug discovery are supported by European Union programs including EU4Health and the Innovative Medicines Initiative (IMI). Increasing patient advocacy through groups like Parkinson's Europe raises awareness, lessens stigma, and encourages the adoption of treatments earlier. Europe is positioned as a major growth area for the global market for PD therapies, in addition to advancements in digital health, gene therapy, and infusion technologies.

Owing to factors like the prevalence of PD, Globally, the prevalence of Parkinson's disease is expected to more than double by 2050, reaching over 25 million cases. Cases are predicted to increase by 28% in Central and Eastern Europe and 50% in Western Europe. It is anticipated that Germany will account for 574,000 instances, the UK for 307,000, and France and Spain for more than 350,000. These patterns highlight the pressing need for more effective healthcare plans and cutting-edge treatments.

The Asia Pacific region is the fastest-growing region in the Parkinson’s disease Therapeutics market, with a CAGR of 7.6% in 2025.

The increasingly aging population of the Asia Pacific area, especially in China, South Korea, and Japan, is expected to make it the market with the quickest rate of growth for Parkinson's disease treatments. Increased investment in neurology research, growing healthcare infrastructure, and rising prevalence are all contributing to the acceleration of therapy uptake. Improved diagnosis and patient care are being brought about by supportive government policies and awareness campaigns. Furthermore, because of its sizable patient base and room for expansion, pharmaceutical companies from throughout the world are concentrating on Asia Pacific for clinical trials and the introduction of new drugs.

Top companies in the Parkinson’s disease Therapeutics market include F. Hoffmann-La Roche Ltd, AbbVie Inc., Supernus Pharmaceuticals, Inc., Amneal Pharmaceuticals LLC, Merck & Co., Inc., Boehringer Ingelheim International GmbH, GSK plc, Novartis AG, UCB S.A., Kyowa Kirin Co., Ltd., Merz Pharmaceuticals, LLC, and Bausch Health US, LLC, among others.

F. Hoffmann-La Roche Ltd. :F. Hoffmann-La Roche Ltd is a leading Swiss multinational healthcare company headquartered in Basel, specializing in pharmaceuticals and diagnostics. It is among the top global players in neurology and oncology, with flagship PD products like Madopar and pipeline assets such as prasinezumab and selnoflast. Roche’s strong focus on innovation, biomarker-driven research, and partnerships positions it as a key driver in advancing disease-modifying therapies for Parkinson’s disease.

Market Scope

Metrics | Details | |

CAGR | 8.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Disease Type | Idiopathic Parkinson’s disease, Familial Parkinson's disease, Early-onset Parkinson’s disease |

Drug Class | Dopamine Agonists, MAO-B Inhibitors, COMT Inhibitors, Anticholinergics, Amantadine & Derivatives, Adenosine A2A Receptor Antagonists and others | |

Route of Administration | Oral, Injectable, Transdermal | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global Parkinson’s disease Therapeutics market report delivers a detailed analysis with 62 key tables, more than 61visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here