Neurodegenerative Disease Therapeutics Market Size and Overview

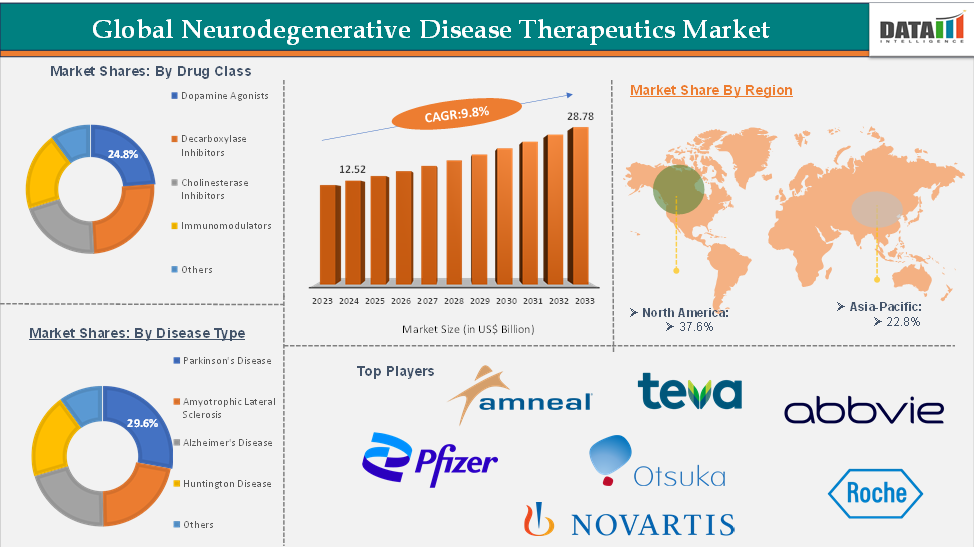

Neurodegenerative Disease Therapeutics Market size reached US$ 12.52 Billion in 2024 and is expected to reach US$ 28.78 Billion by 2033, growing at a CAGR of 9.8% during the forecast period 2025-2033.

The neurodegenerative disease therapeutics market is experiencing robust growth, fueled by the increasing prevalence of disorders such as Alzheimer’s, Parkinson’s, and Huntington’s disease, particularly among the aging population. With an estimated 6.9 million Americans aged 65 and older living with Alzheimer’s in 2024, the demand for effective treatment options is escalating rapidly.

Pharmaceutical companies are intensifying their focus on this space by pursuing strategic collaborations and licensing agreements to accelerate drug development and expand global reach. For instance, in December 2024, Novartis entered into a global licensing and partnership agreement with PTC Therapeutics to advance PTC518, an investigational oral therapy for Huntington’s disease. Such initiatives highlight the industry's commitment to addressing the urgent need for innovative therapeutics targeting neurodegenerative conditions.

Executive Summary

For more details on this report – Request for Sample

Neurodegenerative Disease Therapeutics Market Dynamics: Drivers & Restraints

Rising approvals for innovative drugs is expected to significantly drive the neurodegenerative disease therapeutics market

The neurodegenerative disease therapeutics market is being significantly propelled by an increasing number of regulatory approvals, which are expanding treatment options for patients with conditions such as Alzheimer’s disease, Parkinson’s disease, and multiple sclerosis. In recent years, regulatory bodies like the FDA and EMA have approved a variety of innovative therapies that not only target symptoms but also aim to modify disease progression. For instance, in May 2024, Biogen Inc. announced that the European Commission (EC) has granted marketing authorization under exceptional circumstances for QALSODY (tofersen), while also maintaining its orphan drug designation. QALSODY is approved for the treatment of adults with amyotrophic lateral sclerosis (ALS) linked to mutations in the superoxide dismutase 1 (SOD1) gene.

Additionally, in September 2024, Roche received FDA approval for OCREVUS ZUNOVO, a twice-yearly subcutaneous injection for relapsing and primary progressive multiple sclerosis, offering patients a more convenient and effective treatment option.

Similarly, in January 2024, AbbVie launched PRODUODOPA in the European Union to treat advanced Parkinson’s disease with severe motor fluctuations. These approvals reflect a growing commitment to advancing personalized and disease-modifying therapies, fostering greater competition and innovation within the market to address the complex needs of neurodegenerative disease patients.

Side effects and safety concerns are expected to hinder the neurodegenerative disease therapeutics market

Side effects and safety concerns pose significant challenges to the neurodegenerative disease therapeutics market. Many treatments, especially novel or disease-modifying therapies, can lead to adverse reactions ranging from mild symptoms to serious complications, which may limit their widespread adoption. Regulatory authorities enforce stringent safety standards, and drugs with unfavorable safety profiles often face delays or rejection, impacting the speed of market entry.

Additionally, concerns over long-term safety and tolerability can affect patient adherence and physician willingness to prescribe certain therapies. These factors collectively hinder market growth by reducing the pool of viable treatment options and increasing the costs and timelines associated with drug development.

Neurodegenerative Disease Therapeutics Market, Segment Analysis

The global neurodegenerative disease therapeutics market is segmented based on drug class, disease type, route of administration, and region.

Drug Class:

The dopamine agonists segment is expected to hold 24.8% of the market share in 2024 in the neurodegenerative disease therapeutics market

The dopamine agonists segment is expected to dominate the neurodegenerative disease therapeutics market due to its central role in managing Parkinson’s disease and other dopamine-related neurological disorders. As the global prevalence of Parkinson’s disease continues to rise, especially in aging populations, the demand for effective, long-term treatment options is increasing. Dopamine agonists offer significant advantages, particularly in the early stages of Parkinson’s, where they are often used to delay levodopa initiation and minimize long-term motor complications. Their favorable safety profile and efficacy in alleviating symptoms such as tremors and rigidity make them a preferred choice for both patients and clinicians.

Several compaies are conducting clinical trials to introduce advanced dopamine agonists solutions to make them available for the treatment of various neurodegenerative diseases. For instance, in September 2024, AbbVie announced positive topline results from its pivotal Phase 3 TEMPO-1 trial, evaluating tavapadon as a once-daily monotherapy for early Parkinson’s disease. Tavapadon is an investigational D1/D5 dopamine receptor partial agonist.

This development further underscores the growing dominance of dopamine agonists in the neurodegenerative disease therapeutics market. These agents play a central role in managing Parkinson’s disease by directly stimulating dopamine receptors, thereby alleviating motor symptoms like tremors, rigidity, and bradykinesia.

Additionally, these drugs are used in treating conditions like Restless Legs Syndrome, expanding their therapeutic reach. The market is further bolstered by innovations such as extended-release formulations and transdermal patches, which enhance patient compliance. The availability of generics and growing adoption in emerging markets, supported by strategic industry collaborations, are also contributing to the segment’s dominance in the neurodegenerative disease therapeutics market.

Neurodegenerative Disease Therapeutics Market Geographical Analysis

North America is expected to hold 37.6% of the market share in 2024 in the global neurodegenerative disease therapeutics market with the highest market share

North America holds a leading position in the global neurodegenerative disease therapeutics market and is projected to maintain a significant share throughout the forecast period. This dominance is driven by the rising prevalence of neurodegenerative disorders, robust research and development activities focused on innovative treatments, the presence of numerous multinational pharmaceutical companies, and strong regulatory support coupled with increasing funding for neurodegenerative disease research.

Government funding plays a vital role in fueling the market’s growth in North America by supporting ongoing research, development, and innovation in this critical healthcare segment. For example, in March 2024, an additional $100 million was allocated to the National Institutes of Health (NIH), bringing the annual federal funding for Alzheimer’s research to approximately $3.8 billion. Furthermore, in fiscal year 2022, the National Institute of Neurological Disorders and Stroke (NINDS) funded about $125 million of the $259 million total NIH-supported research for Parkinson’s disease.

The surge in drug approvals within the region is also a key growth driver, offering patients more treatment options. Pharmaceutical companies are actively developing new neurodegenerative disease therapies to meet this growing demand. Notably, in August 2024, Amneal Pharmaceuticals received FDA approval for CREXONT (carbidopa and levodopa) extended-release capsules for Parkinson’s disease. CREXONT combines immediate-release granules with extended-release pellets in a novel oral formulation. Similarly, in May 2024, Teva Pharmaceuticals obtained FDA approval for AUSTEDO XR, a once-daily, single-pill treatment available in four new tablet strengths, indicated for tardive dyskinesia (TD) and Huntington’s disease (HD) chorea in adults.

Together, these factors are expected to drive North America’s expanding market share in the neurodegenerative disease therapeutics sector.

Asia-Pacific is expected to hold 22.8% of the global neurodegenerative disease therapeutics market in 2024

The Asia-Pacific region is experiencing the fastest growth in the global neurodegenerative disease therapeutics market, driven by several key factors. A major contributor to this growth is the increasing prevalence of neurodegenerative disorders such as Alzheimer’s and Parkinson’s disease, which has led to a rising demand for healthcare services in countries like China and India. As these numbers continue to rise, the demand for effective drugs and treatments in the region is expected to grow substantially, thereby boosting the region’s market share.

Additionally, the strong pharmaceutical industry in Asia-Pacific, comprising both multinational corporations and local companies, plays a pivotal role in driving market expansion through active research and development efforts. This focus on innovation is improving the availability of advanced therapies that address the unique needs of patients in the region. For instance, in September 2024, Otsuka Pharmaceutical Co., Ltd. received regulatory approval in Japan for an expanded indication of Rexulti (brexpiprazole), targeting symptoms such as excessive motor activity and aggressive behavior linked to mood fluctuations and irritability in patients with Alzheimer’s disease dementia. Collectively, these factors are expected to propel the Asia-Pacific region to become the fastest-growing market for neurodegenerative disease therapeutics.

Neurodegenerative Disease Therapeutics Market Top Companies

Top companies in the neurodegenerative disease therapeutics market include AbbVie Inc., Amneal Pharmaceuticals LLC., Eisai Co., Ltd., F. Hoffmann-La Roche Ltd, Merck KGaA, Novartis AG, Pfizer Inc., Teva Pharmaceutical Industries Ltd., Otsuka Pharmaceutical Co., Ltd., Orion Corporation, among others.

Key Developments

In February 2025, Supernus Pharmaceuticals, Inc. received the U.S. Food and Drug Administration (FDA) has approval for ONAPGO (apomorphine hydrochloride) injection as the first and only subcutaneous apomorphine infusion device for managing motor fluctuations in adults with advanced Parkinson’s disease. The company plans to launch ONAPGO in the second quarter of 2025, supported by a dedicated team of experts, including a comprehensive nurse education program and access support services to assist patients and healthcare providers.

In January 2025, Eisai Co., Ltd. and Biogen Inc. received the U.S. Food and Drug Administration (FDA) approval for Supplemental Biologics License Application (sBLA) for LEQEMBI (lecanemab-irmb), allowing for a once-every-four-weeks intravenous (IV) maintenance dosing schedule. LEQEMBI is approved in the U.S. for the treatment of Alzheimer’s disease in patients at the mild cognitive impairment (MCI) or mild dementia stage.

Scope

Metrics | Details | |

CAGR | 9.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Drug Class | Dopamine Agonists, Decarboxylase Inhibitors, Cholinesterase Inhibitors, Immunomodulators, Others |

Disease Type | Parkinson's Disease, Amyotrophic Lateral Sclerosis, Alzheimer's Disease, Huntington Disease, Others | |

| Route of Administration | Oral, Injection, Transdermal |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global neurodegenerative disease therapeutics market report delivers a detailed analysis with 68 key tables, more than 61 visually impactful figures, and 198 pages of expert insights, providing a complete view of the market landscape.