Orthopaedic Implants Market Size & Industry Outlook

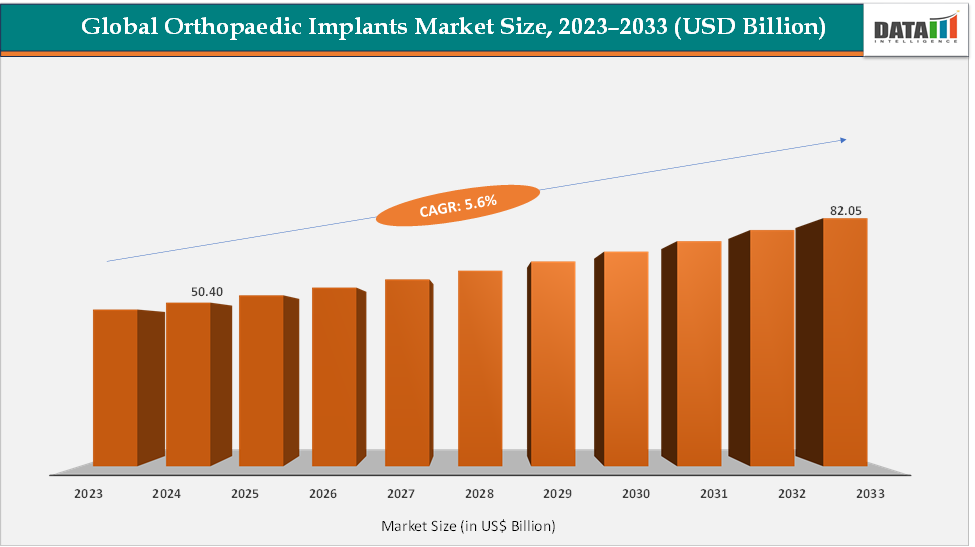

The global orthopaedic implants market size reached US$ 50.40 Billion in 2024 from US$ 47.9 Billion in 2023 and is expected to reach US$ 82.05 Billion by 2033, growing at a CAGR of 5.6% during the forecast period 2025-2033. The orthopaedic implants market is undergoing a steady transformation driven by demographic, clinical, and technological forces that make it one of the most essential segments of modern healthcare. Demand is primarily fueled by the rising prevalence of musculoskeletal disorders such as osteoarthritis, osteoporosis, and spinal deformities, alongside a growing incidence of sports-related injuries and trauma cases, particularly road traffic accidents in developing nations.

Technological advancements are reshaping the landscape, with robotic-assisted systems improving surgical precision, navigation software aiding intraoperative decisions, and 3D-printed personalized implants enabling anatomical customization in revision and oncology cases. The market is also witnessing early adoption of smart implants embedded with sensors that can transmit real-time biomechanical data, a development that aligns with the broader trend toward connected healthcare and remote monitoring.

Key Market Highlights

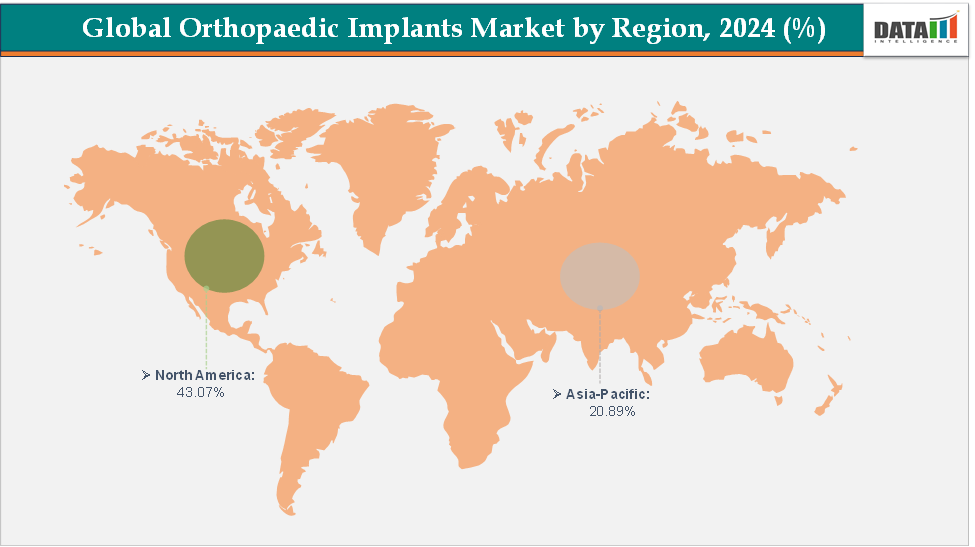

- North America dominates the orthopaedic implants market with the largest revenue share of 43.07% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 5.9% over the forecast period.

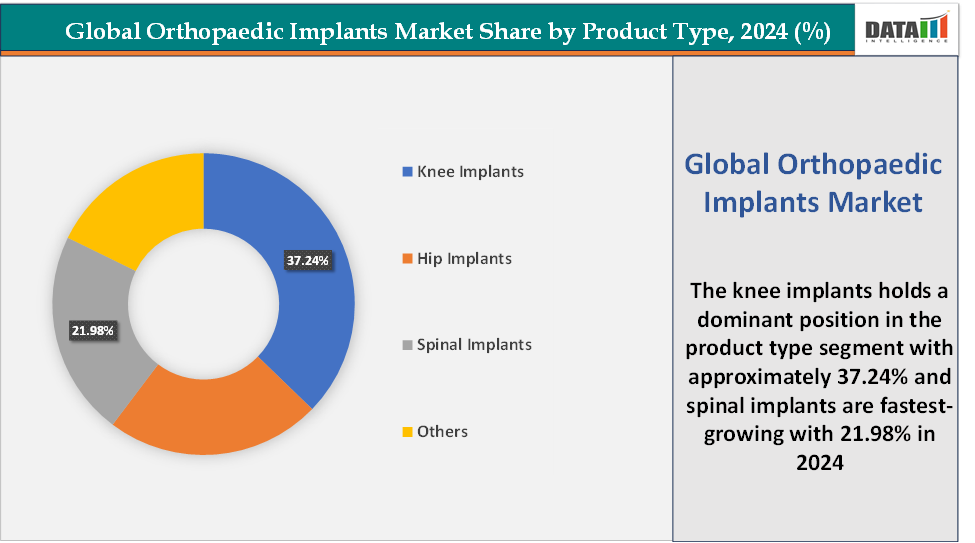

- Based on product type, the knee implants segment led the market with the largest revenue share of 37.24% in 2024.

- The major market players in the orthopaedic implants market are Stryker, Johnson & Johnson (DePuy Synthes), Zimmer Biomet, Smith+Nephew, CONMED Corporation, B. Braun SE, Globus Medical, and Enovis Corporation, among others

Market Dynamics

Drivers: The rising prevalence of musculoskeletal disorders is significantly driving the orthopaedic implants market growth

The surge in musculoskeletal disorders, particularly osteoarthritis, osteoporosis, and sports-related injuries, has become a foundational growth engine for the orthopaedic implants market, as aging populations and sedentary lifestyles accelerate the incidence of joint degeneration and fractures. For instance, according to the Centers for Disease Control and Prevention (CDC), osteoarthritis (OA) is the most common form of arthritis, affecting 33 million US adults. Additionally, according to the International Osteoporosis Foundation, osteoporosis is a major non-communicable disease and the most common bone disease, affecting one in three women and one in five men over the age of 50 worldwide. It is estimated that 75 million people in Europe, the USA, and Japan are affected by osteoporosis.

To address these needs, major manufacturers are rapidly innovating. The strategic product launches directly respond to growing clinical needs, offering solutions that are more stable, better integrated, and personalized, thus firmly linking the prevalence of musculoskeletal disorders to expanding orthopaedic implant adoption. For instance, in July 2025, Overture Orthopaedics announced the full U.S. commercial launch of its OvertureTi Knee Resurfacing System. The system is composed of femoral and tibial implants intended to be used in the partial replacement of the articular surfaces of the knee. These implants were designed with sizing options that allow the surgeon to replace only the diseased or damaged region of the joint while preserving healthy surrounding cartilage and meniscus.

According to the World Health Organization, by 2030, one in six people globally will be aged 60 or above, with the population in this age group rising from 1 billion in 2020 to 1.4 billion. By 2050, the number of people aged 60 and older will double to 2.1 billion, and those aged 80 and above are expected to triple to 426 million. This rising aging population is prone to more musculoskeletal disorders, which in turn accelerates the growth of the market.

Restraints: The risk of implant failure and revision surgeries is hampering the growth of the market

The risk of implant failure and the growing incidence of revision surgeries pose significant challenges to the growth of the orthopaedic implants market. Implant failure can occur due to factors such as loosening, wear and tear, infection, improper alignment, or material degradation, leading to pain, reduced mobility, and the need for corrective surgery. Revision procedures are typically more complex, costly, and associated with higher complication rates compared to primary surgeries, discouraging patients and straining healthcare systems. For instance, early-generation metal-on-metal hip implants from several manufacturers, including those recalled by DePuy Orthopaedics (ASR system), resulted in widespread failures and lawsuits, prompting stricter regulatory oversight.

Similarly, spinal implant breakages and infections have raised safety concerns, leading surgeons to adopt a more cautious approach. Frequent revisions not only increase healthcare costs but also impact patient confidence and slow elective procedure uptake. Moreover, implant recalls and post-market surveillance issues can damage brand reputation and delay product approvals. These challenges compel manufacturers to invest heavily in R&D for advanced materials, such as highly cross-linked polyethylene, titanium alloys, and bioactive coatings, to enhance implant longevity and reduce complications. Despite these efforts, the persistent risk of implant failure remains a major restraint, limiting market expansion, especially in cost-sensitive and risk-averse patient populations.

For more details on this report – Request for Sample

Segmentation Analysis

The global orthopaedic implants market is segmented based on product type, application, material, end-user, and region.

Product Type: The knee implants segment is dominating the orthopaedic implants market with a 37.24% share in 2024

According to the National Institute of Health, the number of primary total knee replacements in the U.S. alone is projected to exceed 3.48 million procedures annually by 2030, highlighting the massive clinical demand. Knee replacements are often considered more frequent than hip replacements, as knee joints bear greater stress from obesity, lifestyle changes, and aging. Manufacturers are also driving adoption through continuous innovations such as Zimmer Biomet’s Persona IQ “smart knee,” which integrates sensors to track patient recovery, while Stryker’s MAKO robotic-assisted platform is increasingly used in hospitals for precision placement and reduced revision rates. The combination of high patient volume, growing adoption of minimally invasive and robotic procedures, and ongoing product launches cements knee implants as the dominant and fastest-evolving segment in orthopaedic implants globally.

In emerging markets such as India, MicroPort Orthopedics introduced the Evolution Medial-Pivot Knee in April 2025, catering to rising osteoarthritis prevalence in rapidly aging populations. With patients seeking minimally invasive procedures and faster recovery, ambulatory surgical centers are increasingly performing knee replacements, broadening access beyond traditional hospital settings. The knee implants segment also benefits from a younger demographic of patients, including those with sports injuries, who require partial or unicompartmental replacements, fueling further demand. This combination of rising procedure volumes, constant innovation, smart technologies, and expanded geographic reach underscores why knee implants remain the dominant and most rapidly evolving segment within the orthopaedic implants market.

The spinal implants segment is the fastest-growing in the orthopaedic implants market, with a 21.98% share in 2024

The spinal implants segment has become the fastest-growing area within the orthopedic implants market, driven by the increasing prevalence of degenerative spinal disorders, such as herniated discs, scoliosis, spinal stenosis, and spondylolisthesis, which are rising rapidly due to aging populations and sedentary lifestyles. Unlike hip and knee procedures that address localized joint degeneration, spinal disorders often cause chronic pain and neurological deficits, prompting surgical interventions that demand specialized implants and devices.

The segment’s growth is strongly supported by technological innovations, especially in minimally invasive spinal fusion, motion-preserving implants, and 3D-printed interbody cages, which enhance surgical precision, reduce recovery time, and improve patient outcomes. For instance, Medtronic’s Adaptix Interbody System, equipped with Titan nanoLOCK surface technology, offers improved osseointegration and mechanical stability, while Zimmer Biomet’s Zyston Strut became its first FDA-cleared 3D-printed spinal implant, reinforcing the trend toward personalized, additive-manufactured solutions, highlighting material innovation as a key driver.

The introduction of 4WEB Medical’s stand-alone anterior spinal implant and Accelus’s FlareHawk expandable interbody device further exemplifies the demand for flexible, minimally invasive, and MRI-compatible implant options. As the market embraces robotic-assisted spine surgery and AI-based navigation systems, procedure precision and patient safety continue to improve, leading to wider adoption across hospitals and specialized spine centers. Overall, spinal implants are outpacing other orthopaedic categories, propelled by a powerful combination of demographic demand, surgical innovation, regulatory approvals, and the ongoing evolution toward less invasive and motion-preserving technologies.

Geographical Analysis

North America is expected to dominate the global orthopaedic implants market with a 43.07% in 2024

North America stands out as the most dominant region in the orthopaedic implants market, driven by advanced healthcare infrastructure, high awareness, and early adoption of cutting-edge technologies. The region accounts for the largest share of global implant procedures.

US Orthopaedic Implants Market Trends

The rising prevalence of osteoarthritis, osteoporosis, and spinal disorders has made orthopedic procedures routine, with knee and hip replacements among the most common elective surgeries. With the US performing over one million hip and knee replacements annually (about 790,000 total knee replacements and 544,000 hip replacements are done every year in the US, according to the American College of Rheumatology), a figure projected to grow significantly as the population ages.

The presence of major market players such as Zimmer Biomet, Stryker, and DePuy Synthes, headquartered in the US, ensures faster product launches and clinical adoption. For instance, Zimmer Biomet’s Persona IQ “smart knee” was first introduced in the US before global rollout, underscoring the region’s role as a testing ground for innovation. Similarly, Stryker’s MAKO robotic-assisted surgery platform has become widely integrated into US hospitals, setting benchmarks for precision and patient outcomes.

Regulatory approvals in the US are further accelerating the market growth in the region. For instance, in July 2025, Health Canada approved US medical device startup Nanochon’s launch of a first-in-human study for its 3D printed Chondrograft knee implant. This approval represents a significant step forward in validating Nanochon’s minimally invasive joint repair technology.

The Asia Pacific region is the fastest-growing region in the global orthopaedic implants market, with a CAGR of 5.9% in 2024

The Asia-Pacific region has emerged as the fastest-growing market for orthopaedic implants, driven by a rapidly aging population, rising prevalence of osteoarthritis and osteoporosis, and increasing access to advanced healthcare infrastructure. Countries such as China, India, Japan, and South Korea are witnessing a surge in joint replacement and spinal surgeries due to higher life expectancy, urbanization, and lifestyle changes leading to obesity and joint stress.

Global manufacturers are localizing their presence, for instance, in April 2025, MicroPort Orthopedics Inc., a U.S. headquartered global medical devices company, announced the introduction of its flagship second generation solution, the Evolution Medial-Pivot Knee, in India. This innovative solution is designed to deliver superior flexion stability, anatomic motion, and wear-limiting design, replicating the natural stability and motion of the knee to allow superior patient outcomes after total knee replacement surgery.

Europe Orthopaedic Implants Market Trends

The orthopaedic implants market in Europe is experiencing steady growth, driven by an aging population, a high prevalence of musculoskeletal disorders, and a strong emphasis on technological innovation and clinical quality. Europe has one of the world’s oldest populations, with nearly 21% aged 65 or above, leading to a surge in demand for hip, knee, and spinal implants to treat osteoarthritis, osteoporosis, and degenerative spine diseases. European manufacturers and subsidiaries of global leaders are continuously launching innovative products.

For instance, in January 2025, Bioretec Ltd., a pioneer in absorbable orthopedic implants, successfully completed its CE mark approval process and can start commercialization of its RemeOs Trauma Screw product portfolio within the European Union and non-European countries that recognize the CE mark market authorization. This comprehensive approval covers all cannulated and non-cannulated product designs, with sizes ranging from diameters of 2.0mm to 4.0mm and lengths from 8mm to 50mm. Indications approved include the use of these screws for fracture and malalignment fixations in both upper and lower extremities of adult and pediatric patients, excluding the hand and forefoot.

Moreover, European healthcare systems’ growing focus on minimally invasive and day-care orthopaedic surgeries is boosting demand for compact, high-performance implants. With increasing R&D collaborations between universities, hospitals, and medtech companies, Europe remains a leader in innovation, quality standards, and robotic integration, all of which continue to propel the growth of the orthopaedic implants market across the continent.

Competitive Landscape

Top companies in the orthopaedic implants market include Stryker, Johnson & Johnson (DePuy Synthes), Zimmer Biomet, Smith+Nephew, CONMED Corporation, B. Braun SE, Globus Medical, and Enovis Corporation, among others.

Market Scope

| Metrics | Details | |

| CAGR | 5.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Knee Implants, Hip Implants, Spinal Implants, and Others |

| Application | Primary Joint Replacement, Revision Procedures, Spinal Fusion & Deformity Correction, Arthroscopic Procedures, and Others | |

| Material | Metals & Metal Alloys, Ceramics, and Polymers | |

| End-User | Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Orthopedic Centers | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global orthopaedic implants market report delivers a detailed analysis with 64 key tables, more than 64 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here