Orthopaedic Devices Market Size & Industry Outlook

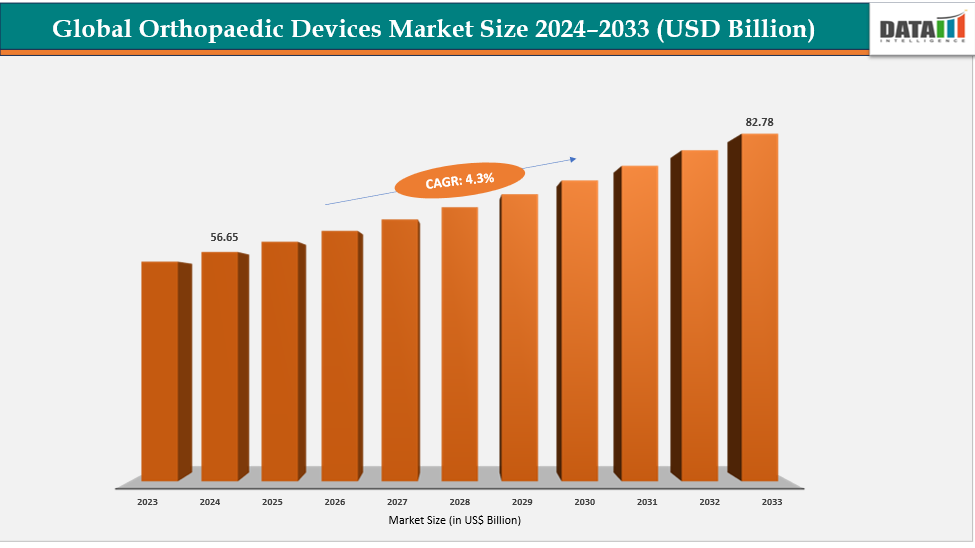

The global orthopaedic devices market size reached US$ 54.47 Billion in 2023 with a rise of US$ 56.65 Billion in 2024 and is expected to reach US$ 82.78 Billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025-2033.

The market for orthopaedic equipment is expanding due to the increased incidence of osteoarthritis, osteoporosis, trauma, and sports injuries. These disorders deteriorate muscles, joints, and bones, making surgical replacement and repair more necessary because osteoarthritis wears down cartilage, there is a greater need for knee and hip implants because osteoporosis weakens bones, fixing devices are necessary for fractures. Trauma and ligament injuries are exacerbated by an increase in traffic accidents and sports activity. This increases the need for arthroscopy equipment, screws, and plates. Timely interventions are encouraged by early diagnosis and growing awareness.

Key Highlights

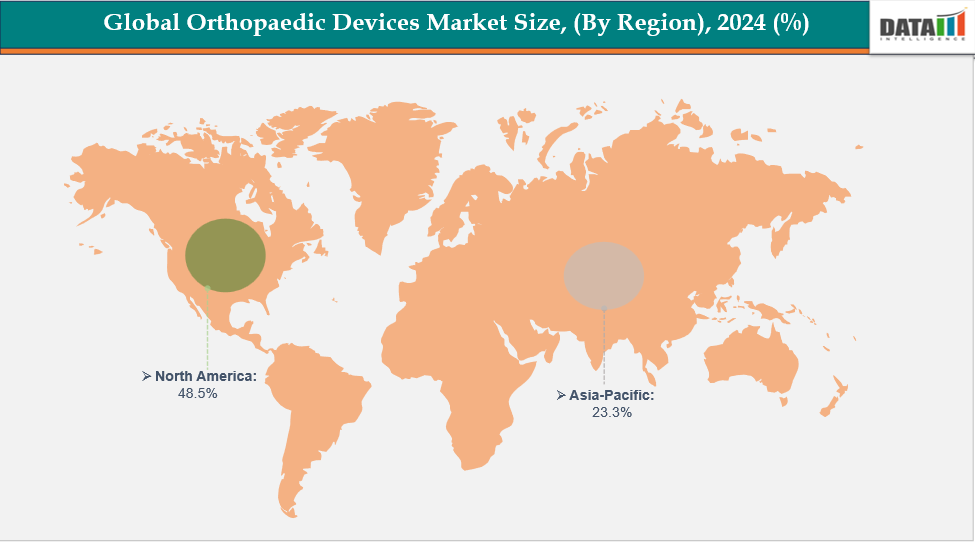

- North America is dominating the global orthopaedic devices market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global orthopaedic devices market, with a CAGR of 7.7% in 2024

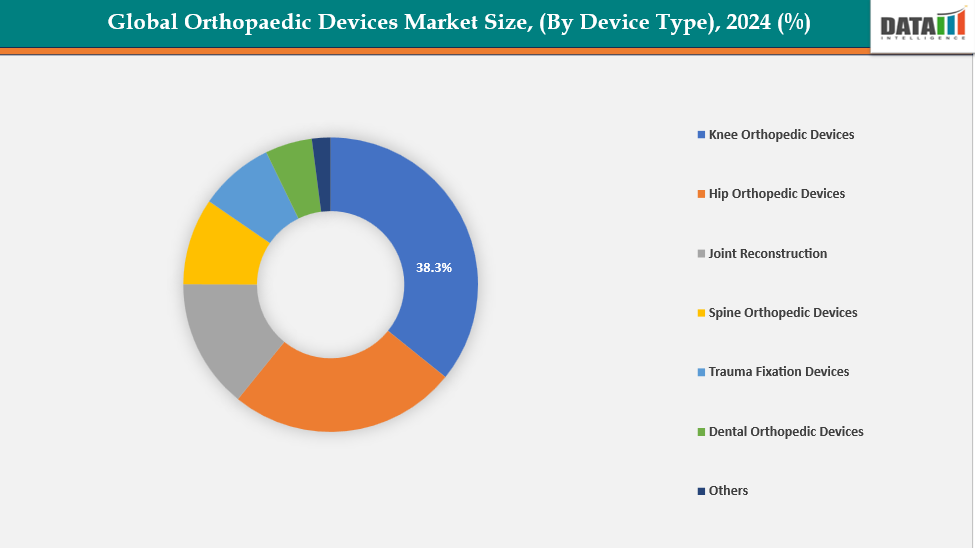

- The knee orthopedic devices segment from device type is dominating the orthopaedic devices market with a 38.3% share in 2024

- The internal fixation segment from fixation type is dominating the orthopaedic devices market with a 46.3% share in 2024

- Top companies in the orthopaedic devices market include B. Braun SE, Zimmer Biomet, CTL Amedica, Arthrex, Inc., Boston Scientific Corporation, Integra LifeSciences Corporation, Johnson & Johnson, Medtronic PLC, Smith & Nephew PLC, and Stryker, among others.

Market Dynamics

Drivers: Technological Advancements in orthopaedic devices are accelerating the growth of the orthopaedic devices market

Growth in the orthopaedic devices market is being accelerated by technological developments in these devices. Robotic-assisted surgery, 3D printing, and AI-based navigation systems are examples of innovations that have improved surgical accuracy and patient outcomes.

For instance, in April 2025, Proprio achieved a significant milestone as its AI-powered surgical guidance platform, Paradigm, received a second 510(k) clearance from the U.S. FDA for intraoperative measurements. This breakthrough technology enabled surgeons to obtain real-time, 3D dynamic, and segmental anatomical visualization, marking a historic advancement in surgical precision and assessment.

Furthermore, these technologies allow for customized implants that fit each person's anatomy, enhancing comfort and healing. Bioactive coatings and smart materials improve bone integration and implant longevity.

Restraints: High cost of orthopaedic implants and surgeries are hampering the growth of the orthopaedic devices market

The market expansion for orthopaedic devices is being hampered by the high expense of orthopaedic implants and procedures. Robotic-assisted systems and sophisticated implants require costly materials and technologies. Knee replacement surgery costs between $20,000 and $70,000 in the United States. The expense of purchasing and maintaining equipment is considerable for hospitals. Patients in developing nations frequently lack the funds for spine operations or joint replacements. Adopting contemporary orthopaedic technologies is difficult for small clinics.

Consequently, a lot of people postpone or refrain from surgery. As a result, the total process volume is decreased. As a result, even with rising demand, the market's growth is still being slowed by affordability concerns, particularly in low- and middle-income countries.

For more details on this report, see Request for Sample

Segmentation Analysis

The global orthopaedic devices market is segmented based on device type, fixation type, end user and region

By Device Type: The knee orthopedic devices segment from device type is dominating the orthopaedic devices market with a 38.3% share in 2024

The growing prevalence of rheumatoid arthritis and osteoarthritis has led to the knee orthopedic devices segment dominating the worldwide orthopaedic devices market. Knee joint diseases are very common in the aging population, which makes replacement surgeries more necessary. Owing to the factors like FDA clearance, device launches, technological developments improve surgical accuracy and recovery results, such as robotic-assisted and minimally invasive knee operations. For instance, in July 2024, Globus Medical received FDA 510(k) clearance for its ExcelsiusFlex robotic navigation platform with Total Knee Arthroplasty (TKA) application and the ACTIFY 3D Total Knee System, enhancing surgical precision, resection accuracy, and procedural flexibility within its advanced Excelsis ecosystem.

Furthermore, total and partial knee replacements are the most popular surgeries due to their high success rate, which guarantees that the knee orthopedic devices segment will continue to dominate the global market.

By Fixation Type: The internal fixation segment form fixation type is dominating the orthopaedic devices market with a 46.3% share in 2024

The market for orthopaedic devices is dominated by the internal fixation segment because of its exceptional stability and bone-healing efficacy. These tools, which support precise bone alignment, are widely employed in trauma procedures and fracture care. Their demand has been greatly increased by the rise in traffic accidents, sports injuries, and fractures caused by osteoporosis. Improvements in titanium-based and bioabsorbable implant technology have enhanced surgery safety and results.

For instance, in August 2024, Stryker, a global leader in medical technology, has launched the Pangea Plating System, which received FDA clearance in late 2023. The system features a comprehensive, versatile portfolio that delivers variable-angle plating solutions designed to meet the needs of diverse patient populations. The Pangea Plating System is indicated for the internal fixation and stabilization of bone fractures, osteotomies and arthrodesis in normal and osteopenic bone.

In addition, compared to alternative fixation techniques, internal fixation facilitates early mobilization, reduced hospital stays, and quicker healing. with increasing surgeon preference and great success rates.

Geographical Analysis

North America is dominating the global orthopaedic devices market with a 48.5% in 2024

The market for orthopaedic equipment is dominated by North America due to its sophisticated healthcare system, high rate of trauma and joint replacement surgeries, and robust uptake of cutting-edge technologies. The region's market expansion and dominance are further reinforced by ongoing product introductions, knowledgeable personnel, and advantageous reimbursement rules.

In the USA, market growth is driven by advanced healthcare infrastructure, increasing surgical volumes, continuous product launches, innovative technologies, and favorable FDA approvals in orthopedic devices, improving patient outcomes. For instance, in February 2025, Maxx Orthopedics received FDA 510(k) clearance for its 3D-printed Porous Titanium Tibial Baseplate, part of the Freedom Total Knee System. This innovative, asymmetrical design introduced a cementless tibiofemoral solution, reinforcing the company’s commitment to enhancing implant fixation, longevity, and overall outcomes in total knee arthroplasty.

Europe is the second region after North America which is expected to dominate the global orthopaedic devices market with a 34.5% in 2024

The market for orthopaedic devices in Europe is growing as a result of an older population, improved healthcare infrastructure, and an increase in the number of joint disorders. Strong industry continuous new product launches, attractive reimbursement policies, frequent EU regulatory approvals, and the growing popularity of minimally invasive surgeries are all contributing to the region's increased market growth and innovation.

For instance, in June 2025, Johnson & Johnson MedTech achieved a major milestone as the VELYS Robotic-Assisted Solution was successfully utilized for Unicompartmental Knee Arthroplasty (UKA) procedures across Europe. The system enabled precise partial knee surgeries in nine countries, including France, Germany, Italy, and the United Kingdom, marking a breakthrough in robotic orthopaedic innovation.

Germany’s orthopaedic devices market is driven by advanced healthcare infrastructure, strong regulatory systems, and high clinical expertise. Continuous innovation, government support, and broad hospital access promote rapid adoption of implants, robotics, and minimally invasive technologies, ensuring steady nationwide market growth and patient outcomes improvement.

The Asia Pacific region is the fastest-growing region in the global orthopaedic devices market, with a CAGR of 7.7% in 2024

The market for orthopaedic devices in Asia-Pacific, which includes China, India, South Korea, and Japan, is expanding quickly due to a number of factors, including an increase in joint and trauma disorders, increased healthcare spending, technological advancements, better hospital infrastructure, and growing regional awareness of advanced orthopaedic treatments and surgical techniques.

Japan's market for orthopaedic devices is expanding gradually thanks to its sophisticated healthcare system, cutting-edge technology, and regular PMDA approvals. Smart implants and robotic-assisted systems are two examples of new product debuts that are improving surgical accuracy, patient results, and general adoption in the nation's orthopaedic industry. For instance, in September 2025, Zimmer Biomet received PMDA approval in Japan for its iTaperloc Complete and iG7 Hip System, the world’s first iodine-treated total hip replacement implants designed to inhibit bacterial adhesion and enhance infection resistance in orthopaedic surgeries.

Competitive Landscape

Top companies in the orthopaedic devices market include B. Braun SE, Zimmer Biomet, CTL Amedica, Arthrex, Inc., Boston Scientific Corporation, Integra LifeSciences Corporation, Johnson & Johnson, Medtronic PLC, Smith & Nephew PLC, and Stryker, among others.

B. Braun SE:B. Braun SE is a leading global medical technology company specializing in advanced orthopaedic solutions. The company offers a wide range of products, including joint replacement systems, trauma implants, and spinal devices. Through continuous innovation, precision engineering, and surgeon collaboration, B. Braun enhances surgical outcomes, promotes patient safety, and supports efficient orthopaedic care across hospitals and clinics worldwide.

Key Developments:

- In January 2025, Bioretec Ltd. received CE mark approval for its RemeOs Trauma Screw product portfolio, enabling commercialization across Europe. This approval covers all cannulated and non-cannulated designs, marking a major milestone in advancing absorbable orthopedic implant technology for fracture fixation and bone healing.

- In May 2024, Orthofix Medical Inc. received FDA 510(k) clearance for its innovative Rodeo Telescopic Nail, designed to treat fractures and deformities in patients with osteogenesis imperfecta (OI). The device enables bone stabilization and growth accommodation, enhancing outcomes in pediatric orthopaedic treatments.

Market Scope

| Metrics | Details | |

| CAGR | 4.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Device Type | Knee Orthopedic Devices, Hip Orthopedic Devices, Joint Reconstruction, Spine Orthopedic Devices, Trauma Fixation Devices, Dental Orthopedic Devices and Others |

| By Fixation Type | Internal, External, Intramedullary fixation devices | |

| By End User | Orthopaedic Clinics, Hospitals and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global orthopaedic devices market report delivers a detailed analysis with 62 key tables, more than 56 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here