Dental Implants Market Size

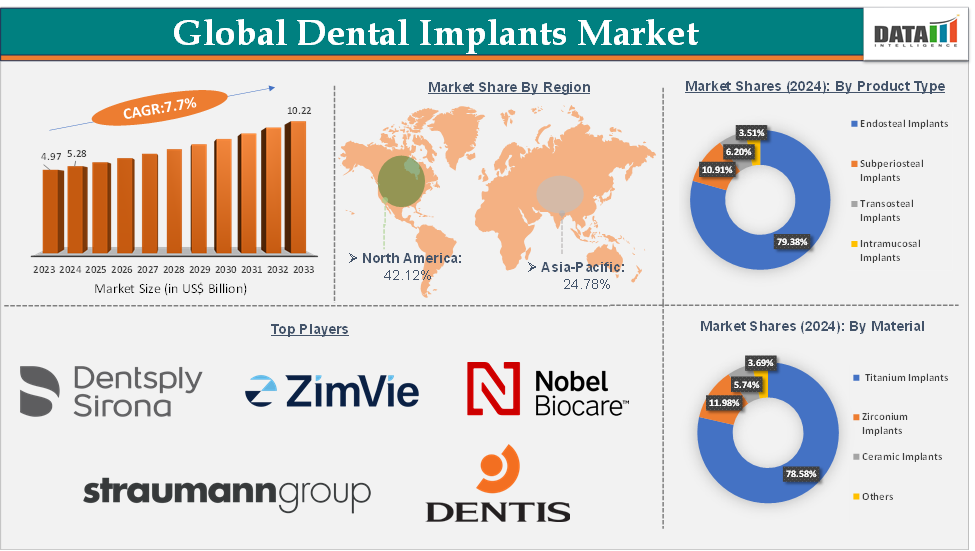

The global dental implants market size reached US$ 5.28 Billion in 2024 from US$ 4.97 Billion in 2023 and is expected to reach US$ 10.22 Billion by 2033, growing at a CAGR of 7.7% during the forecast period 2025-2033.

Dental Implants Market Overview

The global dental implants market is experiencing robust growth, driven by increasing incidences of tooth loss, rising geriatric population, and heightened awareness of oral health and aesthetic dentistry. Technological advancements, including 3D printing, digital surgical guides, and biocompatible materials like zirconia, are transforming treatment outcomes and adoption rates. Titanium implants continue to dominate due to their durability, while zirconia implants are gaining traction for their aesthetic appeal.

Key players such as Straumann, Nobel Biocare, Dentsply Sirona, and others are actively driving innovation through R&D and strategic acquisitions. Despite high treatment costs and regulatory hurdles acting as barriers, growing demand for minimally invasive and permanent tooth replacement options positions the dental implants market for continued long-term growth.

Dental Implants Market Executive Summary

Dental Implants Market Dynamics

Drivers:

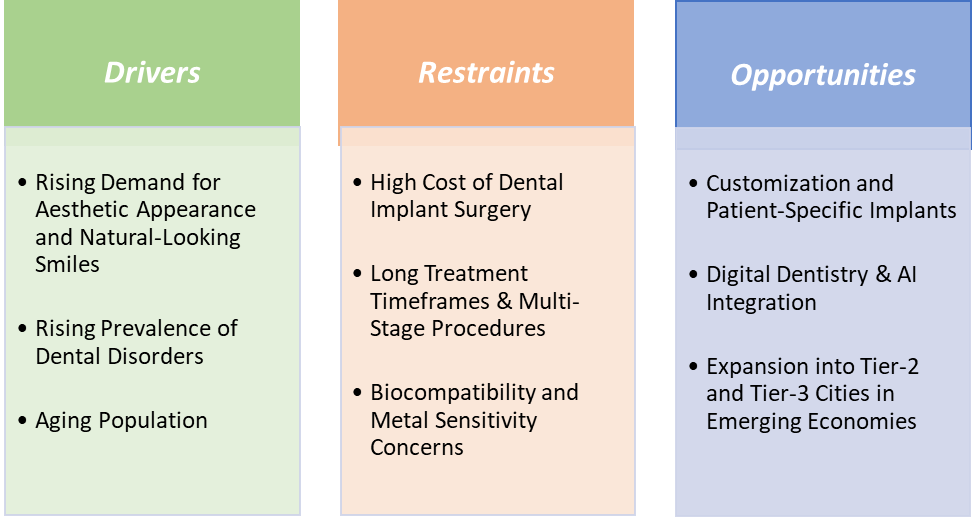

Rising demand for aesthetic appearance and natural-looking smiles is significantly driving the dental implants market growth

Patients nowadays place great importance on the visual appeal of their smiles, and dental implants provide a solution that closely mimics natural teeth in terms of aesthetics and functionality. Patients can achieve a more natural-looking smile with dental implants compared to other tooth replacement options such as dentures or bridges. Implants are designed to blend seamlessly with existing teeth, providing a harmonious appearance and restoring confidence in one's smile.

According to an article published in Health Magazine, only 6% of Americans have implants now, and by 2026, that number is set to grow to 23%. Similarly, according to the American Association of Oral and Maxillofacial Surgeons, over 69 percent of Americans between the ages of 35 and 44 have already lost at least one permanent tooth, which increases the demand for dental implants.

Restraints:

The high cost of dental implant surgery is hampering the growth of the dental implants market

The cost of dental implants can vary depending on the particular patient; a single dental implant normally costs from $1,500 to $2,000 per implant, excluding surgery costs. Other expenses to assess include the crown, abutment, tooth and root extraction, dentistry visits, pre-op and post-op consideration, which can vary from $1,500 to $2,800. Thus, the whole expense for a single implant goes from $3,000 to $4,800.

Similarly, from beginning to end, one can anticipate expending US$3,000 to US$45,000 per tooth in a dental implant procedure. For the whole mouthful of implants, the expense label could advance up to US$60,000 to 90,000. The intermediate cost of dental implants in Canada is around $3000. A full jaw implant for the dentition can cost over $50,000. The exact cost relies on aspects such as the position of the tooth and the choice of dentist. Thus, the high cost of dental implants and implant procedures is hampering the market growth.

Opportunities:

Customization and patient-specific implants create a market opportunity for the dental implants market

Dental implant patients increasingly expect solutions tailored to their anatomy, lifestyle, and aesthetic needs. Standard, one-size-fits-all implants may lead to fit issues, longer healing times, or suboptimal cosmetic results, especially in complex cases. Custom implants offer better integration, reduced surgery time, and improved long-term success rates.

Custom abutments (the connector between implant and crown) allow perfect angulation and contour for individual patients, especially in aesthetically sensitive zones (e.g., front teeth). These reduce the risk of implant failure and improve gingival health and appearance. Customized surgical guides and implants reduce intraoperative guesswork, shorten chair time, and lower the need for corrective procedures.

Customization and patient-specific implants are transforming the dental implants market by aligning with precision medicine trends and digital dentistry. With growing demand for faster, safer, and more aesthetic outcomes, especially among younger and more discerning patients, this segment is set to drive high-margin growth for innovative manufacturers and providers worldwide.

For more details on this report, Request for Sample

Dental Implants Market, Segment Analysis

The global dental implants market is segmented based on product type, material, end-user, and region.

The titanium implants from the material segment reached US$ 4.15 Billion in 2024 in the dental implants market

Titanium dental implants are typically used to replace damaged or missing teeth. They tend to work best in candidates who are in overall good health. The surface of titanium implants is important because of its influence on interaction with the bone. The surface of the main materials used as dental implants is composed of the oxide TiO2, which allows high resistance to corrosion with a clinical success rate of up to 99%.

Titanium is the gold standard for dental implants. The material can be pure titanium or an alloy. When titanium includes trace elements of iron, nitrogen, oxygen, and carbon, it improves its mechanical qualities. Titanium alloys can mix with elements such as aluminium to improve their strength. The result is a low-density material that is resistant to both corrosion and fatigue. According to the study conducted by the National Institutes of Health, the success rate ranged from 92.5% to 97% for titanium implants and 51.7% to 96.9% for zirconia implants, making it a dominant segment.

The advantages of using titanium in dental implants are extensive, which helps the market to grow during the forecast period. Some of the key advantages include the ability to ossify where the titanium integrates with the bone tissue in a process called osseointegration, which means that it essentially becomes a part of the bone. Strong and light titanium is extremely strong but lighter than even gold alloys, making it perfect for patients who need a comfortable, secure dental restoration.

Dental Implants Market, Geographical Analysis

North America is expected to dominate the global dental implants market with a US$ 2.22 Billion in 2024

The American College of Prosthodontists estimates that in the US, more than 150 million people are missing at least one tooth, yet just over a million are treated each year (corresponding to 2.5 million implants). This is driving the growth of dental implants in the region. Dental implants are available from Laguna Dental Center to replace missing teeth. When we eat, speak, or smile, we no longer have to be concerned about our teeth or the gaps between them. Users don’t have to be concerned about their fixed artificial teeth getting damaged while they eat whatever they want.

The position of patients missing teeth, age, and health are a few variables that may affect the success of dental implants. Nevertheless, the typical success rate is quite high. It is more than 95% successful, according to the American Association of Oral and Maxillofacial Surgeons (AAOMS). Since the implant pierces the gum and jawbone, some people who are predisposed to gum disease might not be appropriate candidates for the treatment.

The success rate and beneficial effects on many people’s lives, even though receiving dental implants is a significant decision, are quite encouraging. It's great that permanent tooth replacements have been developed because tooth loss affects millions of Americans. There is no reason to endure the discomfort or worry of living with a missing tooth when there is an option for a permanent fix.

Asia-Pacific is growing at the fastest pace in the dental implants market, holding 24.78% of the market share

The active major players are driving the dental implants market in the Asia Pacific region. For instance, Noris Medical offers the S-implant, which has features including an internal hex implant with a 6mm length; a variety of implant designs for soft or hard bone; changeable condensing thread design; wide threads; and high surface area. Its benefits include avoiding the mandibular nerve, avoiding the maxillary sinus, maintaining crestal bone, having high primary stability, and distributing occlusal stress. Additionally, Zygomatic Implants - An anchoring in the zygomatic bone provides a treatment for atrophic maxilla.

The T3 Short Implant is a length and feature combination offered by ZimVie Inc. that is intended to offer an implant treatment option in some difficult clinical circumstances where the bone height is insufficient for regular-length implants. It offers a modern hybrid surface with intricate multi-surface topography. A secure and tight implant/abutment interface ensures seal integrity, and a medialized implant junction ensures integrated platform switching.

Dental Implants Market Competitive Landscape

Top companies in the dental implants market include BioHorizons, Nobel Biocare Services AG, ZimVie Inc., OSSTEM IMPLANT CO., LTD., Institut Straumann AG, Bicon, LeaderMedica SRL, OrganTech Inc., Dentsply Sirona, Dentis USA, Zircon Medical Management AG, and TAV Medical, among others.

Dental Implants Market Key Developments

In May 2025, ZimVie Inc. launched its RealGUIDE Software Suite and Implant Concierge service in Japan, expanding its digital dental implant ecosystem. RealGUIDE, the first complete cloud-based solution of its kind, offers comprehensive implant planning, surgical guides, and restorative design capabilities. The software will integrate with ZimVie's Dental Technology Institute in Japan and its CAD/CAM milling workflow.

In March 2025, Dentsply Sirona announced the US market launch of MIS LYNX, a cost-effective dental implant solution designed by MIS Implants Technologies. MIS LYNX is a reliable choice for a wide range of clinical applications. Its dimension range and prosthetic line match those of MIS C1 implants, and the system has been designed to provide sufficient primary stability in different bone qualities and for immediate placement in extraction sockets.

Dental Implants Market Scope

Metrics | Details | |

CAGR | 7.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Endosteal Implants, Subperiosteal Implants, Transosteal Implants, and Intramucosal Implants |

Material | Titanium Implants, Zirconium Implants, Ceramic Implants, and Others | |

End-User | Hospitals, Dental Clinics, Academic & Research Institutes, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights on Dental Implants Market

Our research indicates that the market for dental implants is expected to expand at a compound annual growth rate (CAGR) of 7.7% from 2025 to 2033.

This prediction signifies a strong investment opportunity, fueled by rising global demand for aesthetic, permanent dental solutions and rapid adoption of digital technologies like CAD/CAM and 3D printing. With the market projected to US$ US$ 10.22 Billion by 2033, investors should focus on companies that lead in innovation, patient-specific implants, and AI-integrated workflows. Investors are advised to prioritize firms with strong R&D pipelines, digital integration, and regional expansion strategies, particularly in Asia-Pacific and Latin America, where untapped volume potential remains high.

The global dental implants market report delivers a detailed analysis with 68 key tables, more than 57 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here