Breast Implants Market Size and Trends

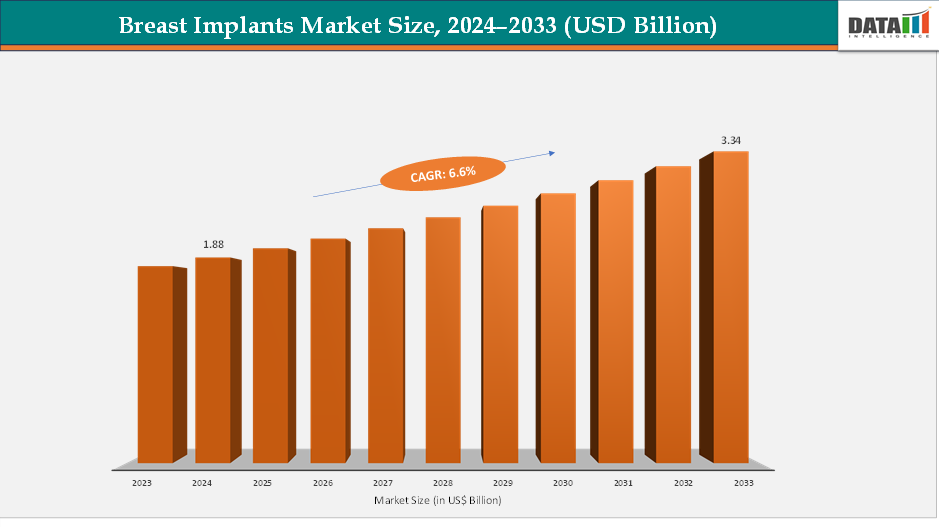

The global breast implants market is projected to grow from US$ 1.88 billion in 2024 to US$ 3.34 billion by 2033, registering a CAGR of 6.6% during the forecast period. The breast implants market is witnessing steady growth, driven by rising demand for cosmetic augmentation and post-mastectomy reconstruction, supported by innovations such as cohesive silicone gels, anatomical designs, and lightweight implants.

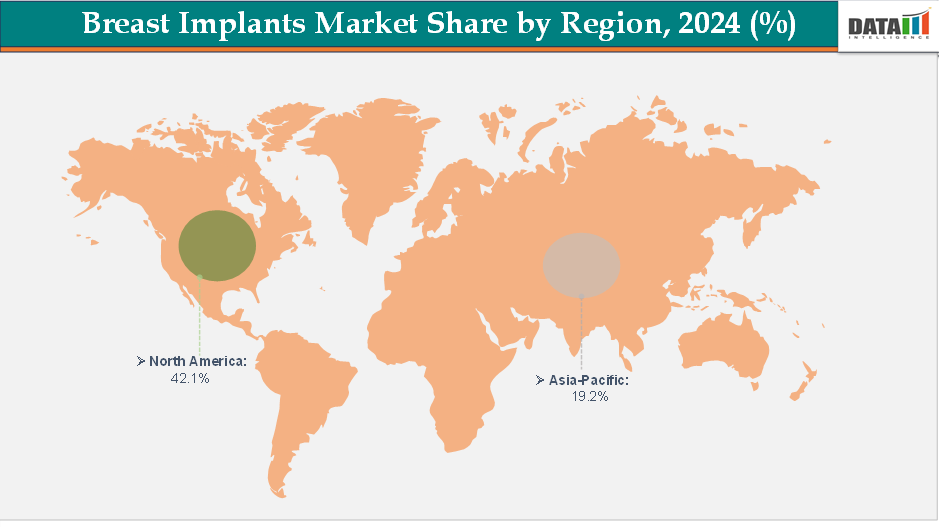

While North America and Europe lead in procedural volumes, Asia-Pacific is emerging as the fastest-growing region due to increasing medical tourism and shifting cultural acceptance. Despite challenges including safety concerns, regulatory hurdles, and high surgical costs, the market remains attractive, with strong opportunities in emerging economies and through the development of advanced, safer implant technologies that enhance patient outcomes.

Breast Implants Market Size, 2024–2033 (USD Billion)

Key Highlights from the Report

North America leads the breast implants market, holding 42.1% share in 2024, driven by strong healthcare systems, major pharmaceutical players like Abbvie and Johnson & Johnson (Mentor), and active clinical research backed by FDA approvals.

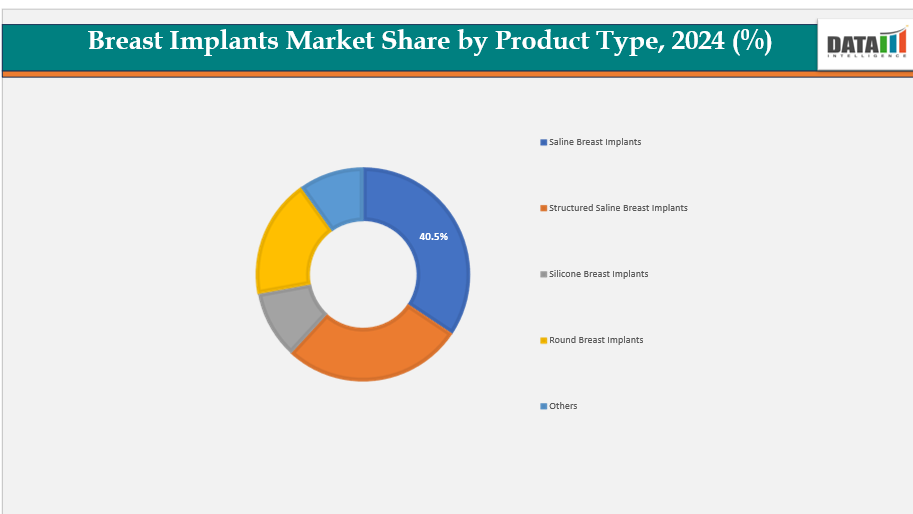

Saline breast implants expected to be the leading product type, capturing 40.5% share in 2024, supported by product launches, collaborations, and partnerships that strengthen its dominance.

Market Dynamics

Drivers - Rising Incidence of Breast Cancers

Rise in breast cancer incidence worldwide is driving the breast implants market, as more women undergo reconstruction after mastectomy. Reconstruction not only restores physical appearance but also improves psychological well-being and quality of life. Advances in surgical techniques and innovative implant options are attracting more patients, complementing cosmetic augmentation procedures and strengthening the overall growth of the market. For instance, globally, an estimated 2,964,197 new female breast cancer cases are projected to occur in 2040, a 31% increase from the corresponding 2,260,127 cases in 2020.

Restraints: Risk of Implant-related Complications

The market faces challenges from increasing awareness of risks and complications associated with implants. Common issues include implant rupture, deflation, capsular contracture, breast pain, and changes in sensation, often requiring additional surgeries or device removal. More serious concerns involve breast implant–associated anaplastic large cell lymphoma (BIA-ALCL), reports of squamous cell carcinoma and other rare lymphomas, as well as potential systemic symptoms. Recent FDA updates have further emphasized safety requirements, labeling, and long-term monitoring, which may restrain adoption and influence patient decision-making.

Opportunities: Untapped Potential in Emerging Economies with Rising Disposable Incomes

Emerging economies are boosting the market due to rising disposable incomes and improved healthcare access. Cultural perceptions and medical tourism in Asia-Pacific and Latin America are driving increased acceptance of cosmetic procedures. Manufacturers can expand their presence by introducing cost-effective products and partnering with local clinics to meet growing demand.

Segmentation Analysis

By Product Type - Saline breast implants segment is expected to lead the market

Saline breast implants segment is expected to dominant the market, accounting for nearly 40.5% share in 2024. The saline breast implant market is gaining momentum due to new product launches and marketing campaigns highlighting their safety, affordability, and surgical flexibility. Manufacturers are introducing advanced shell technology to reduce rupture risks and improve aesthetic outcomes, making them more competitive with silicone options. Healthcare providers and regulatory bodies are promoting the safety advantage of saline implants, including their harmless absorption in case of rupture. Educational campaigns and surgeon training programs are also being implemented to promote the benefits of saline implants in cosmetic augmentation and reconstruction.

For instance, in August 2025, Allergan Aesthetics, an AbbVie company, is launched its Faces of Natrelle campaign, featuring nine inspiring women who share their breast augmentation and reconstruction journeys with Natrelle breast implants, aiming to reshape the narrative around breast procedures.

Breast Implants Market Share by Product Type, 2024 (%)

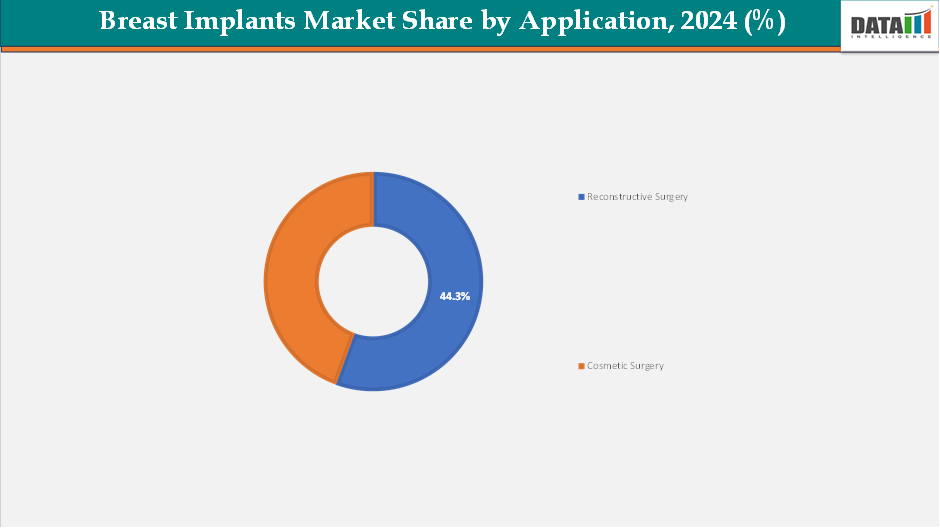

By Application – Reconstructive Surgery is expected to lead the market with strong growth potential

The reconstructive surgery segment is projected to register the stable growth, with a CAGR of 4.5% from 2024 to 2033. The global rise in breast cancer and the increasing number of mastectomy procedures has driven a surge in demand for breast reconstruction with implants. The psychological and quality-of-life benefits of reconstruction are attracting more patients. Advancements in implant technology, such as silicone gels and anatomically shaped designs, are improving aesthetic outcomes and boosting confidence.

Moreover, government healthcare initiatives, insurance coverage, and patient education campaigns are accelerating adoption. The availability of specialized breast centers and skilled surgeons, along with collaborations between implant manufacturers and oncology care providers, is expanding access to reconstructive options.

Breast Implants Market Share by Application, 2024 (%)

Regional Insights

Breast Implants Market Share by Region, 2024 (%)

North America Breast Implants Market Trends

North America's breast implants market is expanding due to due to high procedural volumes, key players like AbbVie and Johnson & Johnson, FDA-regulated product innovations, and rising awareness about post-mastectomy breast reconstruction. Benefits like favorable reimbursement policies and insurance coverage have boosted procedures in the U.S. and Canada. A well-established network of plastic surgeons, high patient affordability, and aggressive aesthetic marketing campaigns further strengthen demand for cosmetic augmentation and reconstruction implants.

For instance, in May 2025, Johnson & Johnson MedTech has launched MENTOR MemoryGel Enhance Breast Implants in the U.S., addressing a critical gap in comprehensive breast cancer care for women who have undergone a mastectomy.

Asia-Pacific Breast Implants Market Trends

The Asia-Pacific region is experiencing rapid growth in the breast implant market, driven by medical tourism hubs in Thailand, South Korea, and India. Rising disposable incomes, changing cultural attitudes, and increased awareness of reconstructive options after breast cancer treatment are driving adoption. Global and regional manufacturers are targeting this market with localized marketing campaigns, new product launches, and partnerships with aesthetic clinics. The growing middle-class population and investments in healthcare infrastructure are expected to sustain this growth.

For instance, in September 2024, GC Aesthetics, a leading medical technology company, has launched the YOUTHLY brand in China, featuring its latest breast implant innovations, including PERLE, Luna XT, and the 100% filled version of The Round Collection.

Competitive Landscape:

The following are the major companies operating in the breast implants market. These players hold a significant share and play an important role in shaping market growth and trends.

AbbVie Inc (Allergan Aesthetics)

Establishment Labs SA

Laboratories Arion

Johnson & Johnson (Mentor Worldwide LLC )

Sientra Inc

POLYTECH Health & Aesthetics

Bimini Health Tech

The global breast implants market is dominated by multinational corporations and specialized aesthetic companies, with key players like AbbVie Inc. and Johnson & Johnson dominating with established product portfolios. Specialty manufacturers like Establishment Labs SA, Sientra Inc, GC Aesthetics, and POLYTECH Health & Aesthetics are driving innovation with next-generation implants and expanding into emerging markets. Regional players like Laboratoires Arion in Europe and Bimini Health Tech in the U.S. diversify the market by offering niche solutions.

Key Developments

In September 2025, POLYTECH Health & Aesthetics, a global leader in breast implant innovation, is establishing a wholly owned subsidiary in Poland, making it the only breast implant company operating directly in the country, enhancing its commitment to providing world-class service, education, and innovation.

In October 2024, Establishment Labs Holdings Inc., a global medical technology company, has successfully treated the first US patients with breast augmentation using Motiva Implants, focusing on improving women's health and wellness.

Suggestions for Related Report

For more medical devices-related reports, please click here