Non-invasive Glucose Monitoring Devices Market: Industry Outlook

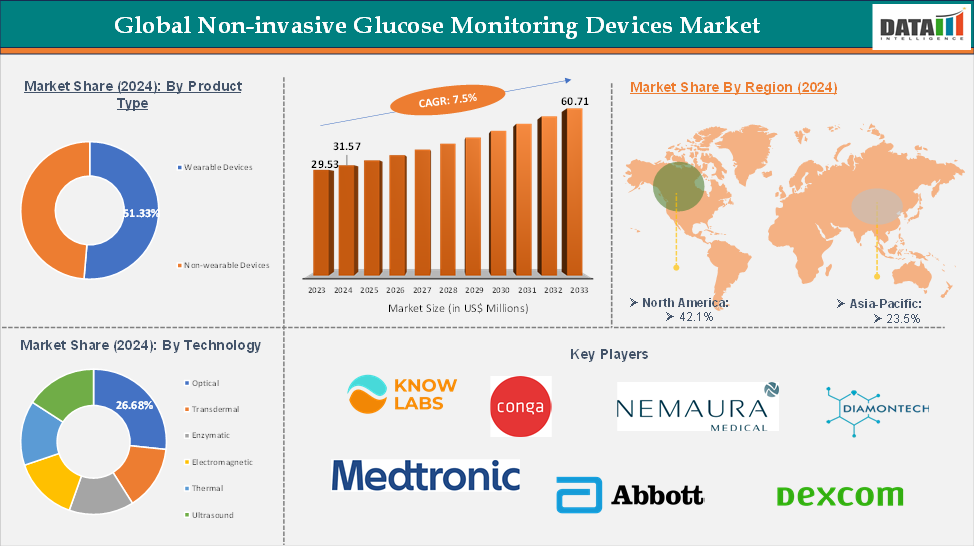

The global non-invasive glucose monitoring devices market reached US$ 29.53 Million in 2023, with a rise of US$ 31.57 Million in 2024 and is expected to reach US$ 60.71 Million by 2033, growing at a CAGR of 7.5% during the forecast period 2025-2033.

The global non-invasive glucose monitoring devices market is experiencing rapid growth due to the increasing prevalence of diabetes, patient preference for pain-free glucose testing, and advancements in sensor and wearable technologies. As of 2024, the market is shifting from traditional invasive methods to innovative non-invasive solutions that offer real-time, continuous glucose monitoring without the need for needles or blood samples.

Technologies like optical sensing, electromagnetic detection, and transdermal analysis are gaining traction, particularly among patients seeking comfort and convenience in diabetes management. The wearable devices segment is driving market momentum due to its seamless integration with digital health platforms and rising consumer adoption of smart health trackers. North America leads the market due to robust healthcare infrastructure and high awareness, while the Asia-Pacific region is emerging as a key growth hub.

Executive Summary

For more details on this report Request for Sample

Non-invasive Glucose Monitoring Devices Market Dynamics: Drivers & Restraints

Driver: Rising global diabetes prevalence

The global diabetes prevalence is a significant driver of growth in the non-invasive glucose monitoring devices market. For instance, with over 537 million adults worldwide living with diabetes, the number is projected to reach 643 million by 2030 and 783 million by 2045. This rise is primarily due to rapid urbanization, aging populations, unhealthy diets, sedentary lifestyles, and increasing obesity rates. The demand for more accessible, convenient, and user-friendly glucose monitoring tools has intensified.

Non-invasive glucose monitoring devices offer needle-free, real-time, and continuous glucose tracking, enhancing patient compliance and quality of life. This enables patients to manage their condition proactively, reducing the burden of monitoring fatigue and poor adherence to testing schedules. As healthcare systems shift towards preventive care and digital health integration, non-invasive glucose monitors are essential tools for population-wide diabetes management strategies.

They support better glycemic control at the individual level and allow healthcare providers and policymakers to collect actionable data for disease surveillance and intervention planning. As the global diabetes burden continues to escalate, the need for scalable, non-invasive, and cost-effective monitoring solutions will play a central role in shaping the future of diabetes care.

Driver: Increasing patient preference for pain-free, needle-free technologies

The global non-invasive glucose monitoring devices market is expanding due to the growing preference for pain-free, needle-free glucose monitoring technologies. Traditional methods, such as finger-prick tests and continuous glucose monitors, are associated with discomfort, skin irritation, infection risk, and needle anxiety, leading to poor compliance among children, elderly patients, and those requiring multiple daily checks.

As awareness of diabetes self-management increases, patients are seeking less invasive, more comfortable solutions that can seamlessly fit into their daily routines without causing physical or psychological stress. Non-invasive glucose monitoring devices, such as optical sensors, electromagnetic fields, and wearable skin patches, offer real-time glucose tracking without the need to pierce the skin. These advancements reduce the burden of daily testing and encourage more frequent monitoring, improving patient engagement and long-term disease management outcomes. The rising demand for personalized, patient-centric healthcare supports this trend, with non-invasive monitors enabling data tracking through smartphones and apps, alerts, trend analysis, and remote access for caregivers and healthcare providers.

Restraint: High cost of advanced therapies

Non-invasive glucose monitoring devices face challenges in their widespread adoption due to their lower accuracy compared to traditional methods like finger-prick blood glucose tests or continuous glucose monitoring systems. These devices, relying on technologies like optical sensing, electromagnetic waves, or bio-impedance, can be influenced by external factors, leading to variability in readings. This inconsistency raises concerns about the clinical reliability of these devices.

As a result, many non-invasive devices face delayed regulatory approvals, limited reimbursement support, and skepticism from physicians and patients. The slow pace of trust and clinical acceptance restricts their integration into mainstream diabetes care pathways, and the need for real-time and highly precise data limits the usability of current non-invasive options.

Opportunity: Growth in early detection and liquid biopsy technologies

The global non-invasive glucose monitoring devices market is experiencing significant growth opportunities in emerging markets with large diabetic populations. Countries like India, China, Brazil, Indonesia, and Mexico are experiencing a rise in diabetes cases due to urbanization, unhealthy dietary habits, sedentary lifestyles, and genetic predisposition. This has led to a pressing need for scalable, affordable, and user-friendly glucose monitoring solutions.

Non-invasive devices, particularly wearable or optical-based technologies, offer an ideal alternative in these regions where access to routine blood tests remains limited. The transformation in healthcare infrastructure across emerging economies, including digital health ecosystems, public-private partnerships, and mobile health outreach programs, is opening up access to innovative diagnostic tools. Global companies are entering these markets through strategic collaborations, localized manufacturing, and distribution partnerships to reduce costs and improve accessibility.

Non-invasive Glucose Monitoring Devices Market Segment Analysis

The global non-invasive glucose monitoring devices market is segmented based on disease type, technology, application, end user, and region.

Technology:

The wearable devices segment from the product type is expected to have 51.33% of the non-invasive glucose monitoring devices market share.

The global non-invasive glucose monitoring devices market is thriving due to the growing demand for convenient, pain-free, and real-time glucose monitoring solutions. Wearable devices like smartwatches, skin patches, and sensor-based bands offer a non-intrusive alternative to traditional finger-prick tests, enhancing patient compliance and comfort. Integration with smartphones and digital health platforms allows for better data tracking, remote monitoring, and timely interventions.

For instance, in June 2025, Garmin, a tech company, filed a patent for estimating glycated haemoglobin levels, a key indicator of long-term blood glucose trends, and may soon introduce non-invasive blood sugar monitoring for its smartwatches.

Advancements in biosensor technology, AI-driven analytics, and miniaturization have led to the development of compact, accurate, and aesthetically appealing wearables. Major market players are investing heavily in R&D to improve device accuracy and functionality. Moreover, the rise of chronic diseases and the global shift towards preventive healthcare are expected to sustain momentum in this segment.

Non-invasive Glucose Monitoring Devices Market Geographical Share

The North America global non-invasive glucose monitoring devices market was valued at 13.2 Million in 2024

The North American region dominates the global non-invasive glucose monitoring devices market due to the high prevalence of diabetes and prediabetes in the US. With over 37 million Americans affected, the need for continuous monitoring tools is urgent. The region's advanced healthcare infrastructure, medical technology availability, and public health awareness contribute to the adoption of non-invasive alternatives.

Moreover, the presence of favorable reimbursement frameworks and FDA initiatives further boosts the market. Patient-centric healthcare approaches, wearable technologies, and remote patient monitoring services post-COVID-19 create a robust ecosystem for non-invasive solutions. Venture capital funding, government grants, and strategic collaborations between tech giants and med-tech firms further strengthen the market's growth trajectory.

For instance, in February 2024, Know Labs unveiled KnowU, a wearable, non-invasive continuous glucose monitor system developed over eight months. The system incorporates the company's sensor, which it plans to submit for FDA clearance, following an accelerated development process.

The Asia-Pacific global non-invasive glucose monitoring devices market was valued at 7.41 Million in 2024

The Asia-Pacific region is experiencing rapid growth in non-invasive glucose monitoring devices due to demographic and economic trends. With over 60% of the world's diabetic population in the region, countries like India and China are experiencing a rise in type 2 diabetes cases due to urbanization, sedentary lifestyles, and changing dietary habits. This has led to a need for scalable, user-friendly, and affordable glucose monitoring solutions.

Governments are promoting digital health and early disease detection, making the region ripe for advanced monitoring technologies. The expanding middle-class population, particularly in Southeast Asia and urban India, is becoming more health-conscious and willing to invest in innovative devices.

Collaborations between global med-tech firms and regional players, along with government initiatives like India's Ayushman Bharat and China's Healthy China 2030 policy, are expected to accelerate the growth of non-invasive glucose monitoring technologies in the Asia-Pacific region.

For instance, in February 2025, Shanghai's Ruijin Hospital developed a non-invasive blood glucose monitoring technology that accurately measures glucose levels through palm placement on a device, eliminating the need for traditional finger pricks and blood draws, and has the potential to revolutionize diabetes management for millions of patients worldwide.

Non-invasive Glucose Monitoring Devices Market Major Players

The major players in the Non-invasive Glucose Monitoring Devices market include Know Labs, Inc., Conga Medical Ltd., Nemaura Medical Inc., DiaMonTech GmbH, Medtronic, Abbott Laboratories, Dexcom, Inc., Afon Technology, Ascensia Diabetes Care, and BlueSemi among others.

Non-invasive Glucose Monitoring Devices Market Key Developments

In May 2025, Afon Technology is a leader in diabetes innovation with its Glucowear device, the world's first non-invasive glucose sensor for real-time monitoring.

In January 2025, Researchers at BITS Pilani have developed a non-invasive device using Machine Learning to detect and manage diabetes. The device eliminates the need for painful finger-pricking and allows simultaneous monitoring of critical diabetes biomarkers like glucose, lactate, uric acid, and hydrogen peroxide using sweat or urine.

Market Scope

Metrics | Details | |

CAGR | 7.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Product Type | Wearable Devices, Non-wearable Devices |

Technology | Optical, Transdermal, Enzymatic, Electromagnetic, Thermal, Ultrasound | |

| Application | Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes, Prediabetes |

| End User | Hospitals & Clinics, Home Care Settings, Diagnostic Centers, Research Institutes |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights:

The global market for non-invasive glucose monitoring devices is poised for robust growth, projected to expand at a CAGR of 7.5% from 2025 to 2033, reaching US$ 60.71 Million by 2033. This reflects a pivotal shift in diabetes management, driven by the rising global prevalence of diabetes, the growing demand for needle-free alternatives, and innovations in wearable biosensor technologies.

As patients increasingly seek real-time, pain-free glucose monitoring integrated with digital health ecosystems, non-invasive solutions are reshaping self-care and clinical decision-making. Wearable smart patches and optical sensors are at the forefront of this evolution, supported by favorable regulatory trends and rapid adoption in both developed and emerging markets. The sector’s transformation marks a new era in preventive, personalized diabetes care.

The global non-invasive glucose monitoring devices market report delivers a detailed analysis with 70 key tables, more than 61 visually impactful figures, and 205 pages of expert insights, providing a complete view of the market landscape.