Neuromuscular Disease Therapeutics Market Outlook

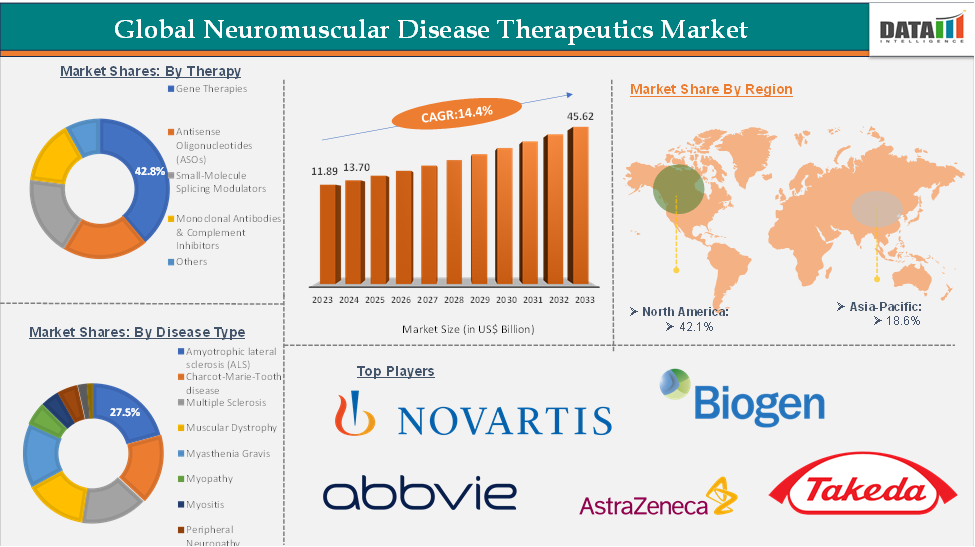

The neuromuscular disease therapeutics market reached US$ 11.89 billion in 2023, with a rise of US$ 13.70 billion in 2024, and is expected to reach US$ 45.62 billion by 2033, growing at a CAGR of 14.4% during the forecast period 2025-2033.

The neuromuscular disease therapeutics market is expanding as advances in genetic medicine and precision therapies redefine treatment possibilities for rare, debilitating disorders. Spinal muscular atrophy (SMA) and Duchenne muscular dystrophy (DMD) currently dominate the market, supported by high-impact approvals such as Spinraza, Zolgensma, Evrysdi, and Elevidys, which have demonstrated both clinical efficacy and commercial success. Growing adoption of newborn screening programs, particularly for SMA, is increasing the number of patients identified at a presymptomatic stage, where treatment can deliver the greatest benefit.

At the same time, drug developers face challenges in scaling manufacturing for viral vector–based therapies and addressing long-term durability and safety questions, which in turn is driving investment in next-generation delivery systems, improved analytics, and alternative modalities. Regulatory frameworks such as orphan drug incentives, priority reviews, and accelerated approvals continue to encourage innovation, while payers and health systems are navigating the complexities of access and affordability for ultra-high-cost therapies.

Executive Summary

Dynamics: Drivers & Restraints

Driver: Breakthrough Approvals Validating New Modalities

Breakthrough approvals are reshaping the neuromuscular disease therapeutics market by proving that advanced modalities can deliver real, disease-modifying outcomes. Treatments such as Spinraza, Zolgensma, Evrysdi, and Elevidys have moved the field beyond symptomatic care, showing that antisense oligonucleotides, gene therapies, and splicing modulators can meaningfully alter disease progression in conditions like spinal muscular atrophy and Duchenne muscular dystrophy. These landmark approvals not only expand treatment options for patients but also build confidence among regulators, payers, and clinicians, creating a more favorable environment for pipeline therapies.

By validating new scientific approaches and attracting sustained investment, they are accelerating innovation and positioning neuromuscular therapeutics as a leading area of growth within rare disease and genetic medicine.

Restraint: Manufacturing & Scalability Challenges

Manufacturing and scalability challenges remain a major restraint for the neuromuscular disease therapeutics market. Advanced modalities such as gene therapies, antisense oligonucleotides, and other complex biologics require sophisticated processes, specialized facilities, and rigorous quality control, all of which drive up production costs and limit scalability. Current capacity constraints often result in supply shortages, long lead times, and significant pricing pressures that impact patient access and slow adoption across global markets.

For more details on this report, Request for Sample

Segmentation Analysis

The global neuromuscular disease therapeutics market is segmented based on therapy, disease type, route of administration, distribution channel, and region.

Gene Therapies:

The gene therapies segment is estimated to have 42.8% of the neuromuscular disease therapeutics market share.

Gene therapies are expected to maintain a dominant position in the neuromuscular disease therapeutics market due to their potential to address the root genetic causes of disease rather than only managing symptoms. Unlike traditional treatments that require continuous administration, gene therapies are often designed as one-time or infrequent interventions that can deliver durable, long-lasting benefits. This unique value proposition has led to strong adoption among clinicians and patients, as well as significant support from regulators through priority review and orphan drug designations.

Moreover, the high unmet need in rare neuromuscular disorders, coupled with the ability of gene therapies to significantly improve survival and functional outcomes, reinforces their competitive advantage. Although high costs and manufacturing complexities remain challenges, ongoing investment in scalable production platforms and broader newborn screening programs is expected to expand patient access. As pipelines mature and additional indications are targeted, gene therapies are set to lead revenue contribution and drive overall market growth in neuromuscular disease therapeutics.

Geographical Share Analysis

The North America neuromuscular disease therapeutics market was valued at 42.1% market share in 2024

North America is expected to dominate the neuromuscular disease therapeutics market due to its strong combination of advanced healthcare infrastructure, favorable regulatory frameworks, and early adoption of innovative therapies. The region benefits from extensive newborn screening programs, particularly for conditions such as spinal muscular atrophy, which enable earlier diagnosis and timely intervention. High levels of investment in research and development, coupled with the presence of leading biopharmaceutical companies and academic research centers, ensure a steady flow of innovation and clinical trial activity.

Additionally, supportive policies such as orphan drug incentives and priority review pathways accelerate approvals, while relatively higher healthcare spending and established reimbursement systems facilitate access to high-cost therapies. Together, these factors position North America as the largest and most influential market for neuromuscular disease therapeutics, setting the pace for global adoption.

Major Players

The major players in the neuromuscular disease therapeutics market include Novartis Pharmaceuticals Corporation, AbbVie Inc., Corium, LLC, AstraZeneca, Argenx, Biogen, Grifols, Nippon Shinyaku Co., Ltd., Takeda Pharmaceutical Company Limited, Sarepta Therapeutics, Inc., among others.

Key Developments

In March 2024, the U.S. approved Ultomiris (ravulizumab-cwvz) as the first and only long-acting C5 complement inhibitor for treating adults with anti-aquaporin-4 (AQP4) antibody-positive neuromyelitis optica spectrum disorder (NMOSD).

In October 2024, AbbVie announced that the U.S. Food and Drug Administration (FDA) approved VYALEV (foscarbidopa and foslevodopa), marking it as the first and only 24-hour subcutaneous infusion of a levodopa-based therapy for managing motor fluctuations in adults with advanced Parkinson’s disease.

Report Scope

Metrics | Details | |

CAGR | 14.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Therapy | Gene Therapies, Antisense Oligonucleotides (ASOs), Small-Molecule Splicing Modulators, Monoclonal Antibodies & Complement Inhibitors, Others |

Disease Type | Amyotrophic Lateral Sclerosis (ALS), Charcot-Marie-Tooth Disease, Multiple Sclerosis, Muscular Dystrophy, Myasthenia Gravis, Myopathy, Myositis, Peripheral Neuropathy, Spinal Muscular Atrophy, Others | |

| Route of Administration | Oral, Intravenous (IV) Infusion, Subcutaneous, Others |

| Distribution Channel | Hospital Pharmacies, Retail / Specialty Pharmacies, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global neuromuscular disease therapeutics market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here