Overview

Duchenne Muscular Dystrophy (DMD) is a severe and progressive genetic disorder that leads to muscle weakness and wasting. It primarily affects young boys and leads to significant disability and a reduced life expectancy. While there is currently no cure for DMD, research into genetic therapies, exon-skipping, cell therapies, and supportive treatments is improving outcomes and offering hope for individuals with DMD. DMD is caused by mutations in the dystrophin gene, which results in a lack of functional dystrophin protein that is essential for maintaining the integrity of muscle cells.

The treatment of Duchenne muscular dystrophy is multi-faceted, aiming to slow the progression of the disease, improve muscle function, and enhance the quality of life for patients. Treatments include corticosteroids, gene therapies, exon-skipping therapies, small molecules, and supportive measures like physical therapy, respiratory care, and cardiac management. While DMD remains a progressive disease with no cure, ongoing advancements in genetic therapies, small molecules, and supportive care offer hope for improving outcomes and potentially delaying or halting disease progression in the future. As research continues, new treatments are likely to provide even more targeted and effective ways to manage DMD.

Executive Summary

Market Dynamics: Drivers & Restraints

Gene therapy has been a breakthrough in DMD treatment by targeting the root cause of the disease, the absence of the dystrophin protein. This approach delivers genetic material to muscle cells, enabling the production of functional dystrophin and significantly slowing disease progression. The approval of gene therapies like Elevidys opens the door to new treatment options, attracting significant investment and research into the market, which drives growth and competition among pharmaceutical companies.

For instance, in June 2024, Sarepta Therapeutics, Inc. announced U.S. Food and Drug Administration (FDA) approval of an expansion to the labeled indication for ELEVIDYS (delandistrogene moxeparvovec-rokl) to include individuals with Duchenne muscular dystrophy (DMD) with a confirmed mutation in the DMD gene who are at least 4 years of age. Confirming the functional benefits, the FDA granted traditional approval for ambulatory patients. The FDA granted accelerated approval for non-ambulatory patients. Continued approval for non-ambulatory Duchenne patients may be contingent upon verification of clinical benefit in a confirmatory trial. ELEVIDYS is contraindicated in patients with any deletion in exon 8 and/or exon 9 in the DMD gene.

Additionally, in January 2025, Roche announced positive topline results from year two of the EMBARK trial, a global, randomised, double-blind phase III study of Elevidys (delandistrogene moxeparvovec), the first approved gene therapy for the treatment of individuals with Duchenne muscular dystrophy. Functional differences between individuals treated with Elevidys and those in the external control group increased between one and two years after dosing. Together, these results demonstrate consistent, sustained benefit in favour of Elevidys.

Exon-skipping therapies work by bypassing mutated sections of the dystrophin gene, allowing the production of a shortened but functional version of the dystrophin protein. This can slow disease progression and improve muscle function, particularly in patients with specific gene mutations. For instance, Exondys 51 (eteplirsen) and Vyondys 53 (golodirsen) are FDA-approved exon-skipping therapies that target specific mutations. These therapies have demonstrated positive clinical outcomes, such as improved motor function in younger patients. The approval of these therapies has increased awareness of DMD treatments and catalyzed further investment into research, fueling market expansion.

High drug costs for DMD treatment are hampering the market growth.

High drug costs for Duchenne muscular dystrophy treatment are a significant barrier to market growth. Although advancements in DMD therapies have been groundbreaking, the expensive nature of many treatments is limiting their accessibility and adoption, especially in low- and middle-income regions. This is affecting patients' ability to afford treatment, and thereby, limiting overall market expansion.

Gene therapies, such as Elevidys, have shown great promise in treating DMD by targeting the root cause of the disease—lack of dystrophin. However, the costs of gene therapies are extremely high. While the therapy offers long-term benefits, the upfront cost can make it financially unfeasible for many patients, particularly in regions with limited healthcare funding.

For instance, the FDA-approved gene therapy Elevidys carries a list price of approximately $3.2 million per patient, making it one of the most expensive treatments ever developed. Other DMD drugs, such as Exondys 51 and Vyondys 53, also come with annual costs exceeding $300,000, even though their efficacy may vary depending on the patient’s specific genetic mutation.

The high drug costs associated with advanced DMD treatments are hampering market growth by limiting patient access to these innovative therapies. Despite the breakthrough nature of treatments like gene therapies, exon-skipping drugs, and small molecules, their high costs create barriers to accessibility, particularly for patients in lower-income countries or those without sufficient insurance coverage. This results in inequitable treatment distribution, delayed adoption, and reduced market expansion, hindering the broader potential growth of the DMD treatment market.

For more details on this report – Request for Sample

Pipeline Analysis

Key pipeline products along with the expected approval dates:

| Sponsor | Product | Modality | Mechanism | RoA | Phase | Expected Approval |

| Deramiocel (CAP-1002) | Cell therapy | Allogeneic cardiosphere-derived cells (CDCs) | IV | Pre-registration (US) | August 2025 | |

| Translarna (ataluren) | Small Molecule | Protein restoration therapy (Enables ribosomal readthrough of mRNA) | Oral | Pre-registration (US) | Q3 2025 | |

| RGX-202 | Gene Therapy | NAV AAV8 vector to deliver microdystrophin | IV | Phase II/III | 2027 (Mid-26: BLA submission) | |

| SGT-003 | Gene Therapy | AAV-SLB101 capsid to deliver h-µD5 | IV | Phase I/II | 2026 Request FDA Meeting | |

| Pizuglanstat (TAS-205) | Small Molecule | PGD synthase inhibitor | Oral | Phase III (Japan) | 2028+ | |

| GNT0004 | Gene Therapy | AAV8 vector to deliver optimized hMD1 transgene | IV | Phase I/II | - |

Segment Analysis

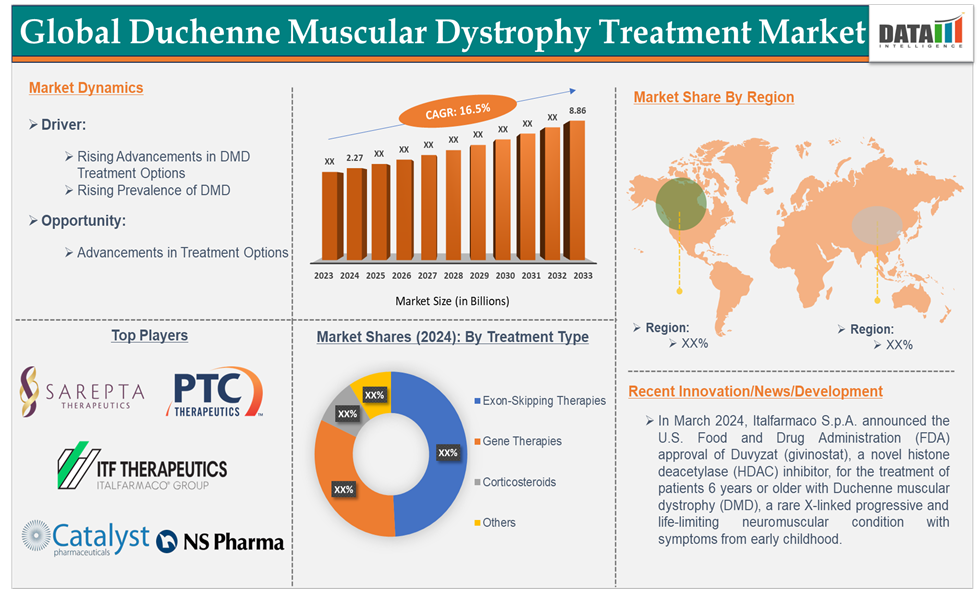

The global Duchenne muscular dystrophy treatment market is segmented based on treatment type, route of administration, and region.

Treatment Type:

The gene therapies segment is expected to be fastest fastest-growing segment of the Duchenne muscular dystrophy treatment market.

Gene therapies are playing a transformative role in the treatment of Duchenne Muscular Dystrophy (DMD) by directly addressing the underlying genetic cause of the disease. These therapies aim to replace or repair the defective dystrophin gene responsible for muscle degeneration, offering the potential to not just manage symptoms but to correct the disease at a molecular level. Gene therapies are emerging as one of the most promising avenues in DMD treatment, and the FDA’s growing support for these therapies is significantly driving the market's growth.

Gene therapies like Elevidys (delandistrogene moxeparvovec), and pipeline products such as RGX-202, SGT-003, and GNT0004 are designed to introduce a functional version of the dystrophin gene into muscle cells, either by directly delivering the gene or by using advanced techniques like gene editing. These therapies help restore dystrophin production, which is critical for maintaining the integrity of muscle cells. Without dystrophin, muscle fibers are more prone to damage, leading to the progressive muscle weakness seen in DMD.

For instance, in June 2024, Sarepta Therapeutics, Inc. announced U.S. Food and Drug Administration (FDA) approval of an expansion to the labeled indication for ELEVIDYS (delandistrogene moxeparvovec-rokl) to include individuals with Duchenne muscular dystrophy (DMD) with a confirmed mutation in the DMD gene who are at least 4 years of age. ELEVIDYS is contraindicated in patients with any deletion in exon 8 and/or exon 9 in the DMD gene.

Moreover, RGX-202 by REGENXBIO is expected to be approved in 2027, and SGT-003 by Solid Biosciences is expected to be approved in 2026. These pipeline gene therapies are transforming the market in the coming years with better treatment options.

Geographical Analysis

North America is expected to hold a significant position in the global Duchenne muscular dystrophy treatment market with the highest market share

The FDA's Accelerated Approval and Orphan Drug Designation have expedited the availability of life-changing treatments for DMD patients in North America. These regulatory incentives have shortened the approval timelines, allowing new therapies to reach the market more quickly. The rising FDA drug approvals by major market players are driving the growth of the market in the region.

For instance, in March 2024, Italfarmaco S.p.A. announced the U.S. Food and Drug Administration (FDA) approval of Duvyzat (givinostat), a novel histone deacetylase (HDAC) inhibitor, for the treatment of patients 6 years or older with Duchenne muscular dystrophy (DMD), a rare X-linked progressive and life-limiting neuromuscular condition with symptoms from early childhood.

List of approved therapies for DMD:

| Sponsor | Brand | Drug | Modality | RoA | MoA |

| Givinostat | Small molecule | Oral | HDAC inhibitor | ||

| Casimersen | Antisense oligonucleotide | IV | Skipping exon 45 | ||

| Eteplirsen | Antisense oligonucleotide | IV | Skipping exon 51 | ||

| Viltolarsen | Antisense oligonucleotide | IV | Skipping exon 53 | ||

| Golodirsen | Antisense oligonucleotide | IV | Skipping exon 53 | ||

| Vamorolone | Small molecule | Oral | Glucocorticoid receptor agonist | ||

| Deflazacort | Small molecule | Oral | Glucocorticoid receptor agonist | ||

| Delandistrogene moxeparvovec-rokl | Gene Therapy | IV | AAVrh74-based vector containing the micro-dystrophin transgene |

In North America, the rising FDA drug approvals are playing a pivotal role in driving the Duchenne muscular dystrophy (DMD) treatment market growth. Accelerated approval pathways, the introduction of gene and exon-skipping therapies, and increasing investment in research are significantly expanding treatment options and improving patient outcomes. With the FDA’s continued support for breakthrough therapies and growing access to these treatments, the market is poised for further growth, offering hope for a better quality of life for DMD patients in North America.

Competitive Landscape

Top companies in the Duchenne muscular dystrophy treatment market include Sarepta Therapeutics, Inc., ITF Therapeutics LLC, NS Pharma, Inc., Catalyst Pharmaceuticals, Inc., and PTC Therapeutics. Emerging players in the market include F. Hoffmann-La Roche Ltd, Capricor Therapeutics, Inc., REGENXBIO Inc., Solid Biosciences Inc., Wave Life Sciences, Genethon, and others.

Scope

| Metrics | Details | |

| CAGR | 16.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Treatment Type | Exon-Skipping Therapies, Gene Therapies, Corticosteroids, and others |

| Route of Administration | Oral and Intravenous | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyze product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global Duchenne muscular dystrophy treatment market report delivers a detailed analysis with 57 key tables, more than 43 visually impactful figures, and 168 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.