Meningococcal Vaccine Market Size

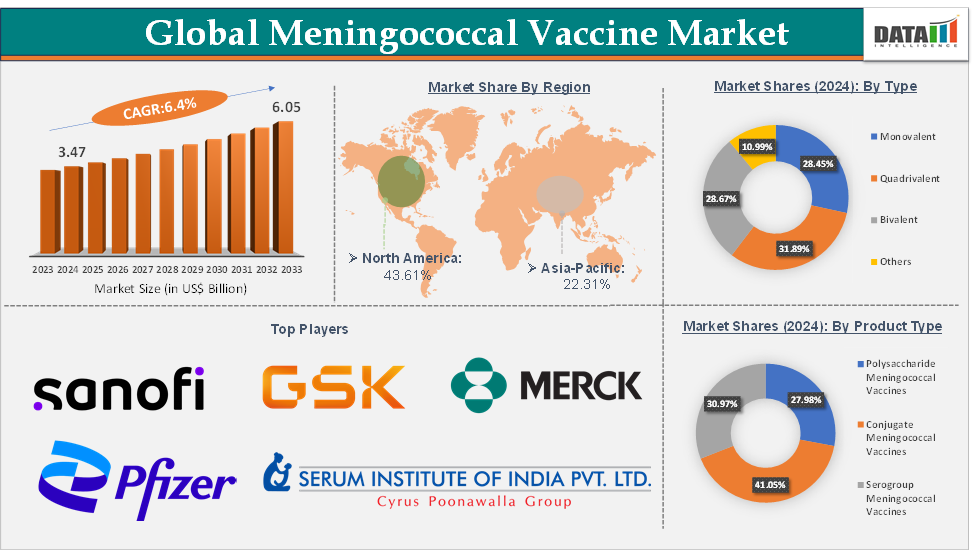

Meningococcal Vaccine Market Size reached US$ 3.47 Billion in 2024 and is expected to reach US$ 6.05 Billion by 2033, growing at a CAGR of 6.4% during the forecast period 2025-2033.

Meningococcal Vaccine Market Overview

The global meningococcal vaccine market is poised for robust growth, driven by technological advancements, increased disease awareness, and supportive governmental and non-governmental initiatives. Continued investment in research and development, along with strategic collaborations, will be pivotal in addressing unmet needs and expanding vaccine accessibility worldwide.

The surge in life-threatening meningococcal diseases, particularly among infants and adolescents, has heightened the demand for effective vaccines. Government-led immunization programs and support from organizations like the World Health Organization (WHO) and GAVI have further propelled market growth. Challenges such as stringent regulatory approvals, high costs associated with vaccine development and distribution, and safety concerns may impede market expansion.

Executive Summary

For more details on this report – Request for Sample

Meningococcal Vaccine Market Dynamics: Drivers & Restraints

The rising incidence of meningococcal disease is significantly driving the meningococcal vaccine market growth

The rising incidence of meningococcal disease is significantly driving the growth of the meningococcal vaccine market and is expected to drive the market over the forecast period due to increased awareness, proactive vaccination campaigns, and higher public health priority. The rising incidence of meningococcal disease increases the demand for meningococcal vaccines to slow the severity of the condition.

For instance, according to the National Centre for Disease Control, the incidence of meningococcal meningitis during the last 30 years varies from 1-3/100,000 in most developed countries to 10-25/100,000 in developing countries. Globally, nearly half a million cases of meningococcal disease occur each year, accounting for 50,000 deaths.

Additionally, according to the Centers for Disease Control and Prevention (CDC), U.S. cases of meningococcal disease have increased sharply since 2021 and now exceed pre-pandemic levels. In 2023, 438 confirmed and probable cases were reported. Moreover, according to the Institut Pasteur, in 2023 in France, 560 cases of meningococcal meningitis and 59 deaths were recorded. In the first quarter of 2024, 180 people were affected.

High vaccine costs are hampering the meningococcal vaccine market

High vaccine costs are expected to hamper the growth of the meningococcal vaccine market by limiting access, particularly in low- and middle-income countries and affecting vaccine uptake among certain populations. The high cost of the vaccine makes it unaffordable for many individuals, especially in regions where healthcare budgets are limited and where infectious diseases compete for funding with other health priorities.

The higher cost of multivalent vaccines (covering multiple serogroups) reduces their adoption compared to monovalent vaccines. The affordability challenge affects public health budgets, leading to prioritization of single-serogroup vaccines over more comprehensive ones. High vaccine costs can lead to low uptake rates, particularly among vulnerable populations and in regions with limited public health infrastructure. The economic burden is a significant deterrent, especially when individuals face other urgent needs or competing healthcare priorities.

Meningococcal Vaccine Market Segment Analysis

The global meningococcal vaccine market is segmented based on type, product type, end-user, and region.

The conjugate meningococcal vaccines from the product type segment are expected to hold 41.05% of the market share in 2024 in the meningococcal vaccine market

Conjugate vaccines are more effective in stimulating an immune response, particularly in young children and infants. This segment includes vaccines like MenACWY (covering A, C, W, and Y serogroups) and MenB (covering serogroup B). There is an increasing demand for conjugate meningococcal vaccines, thus it’s a dominating segment in the market. For instance, according to the study conducted by ScienceDirect, in total, 14,832,054 meningococcal C conjugate vaccine doses were administered throughout the study investigated period.

Conjugate vaccines provide broader serogroup coverage, which is crucial for controlling outbreaks in high-risk populations. These vaccines have been developed to cover multiple serogroups (A, C, W, Y), making them more versatile compared to other vaccine types that cover fewer serogroups.

For instance, the introduction of MenACWY vaccines in Africa, such as the MenAfriVac, has significantly reduced the incidence of serogroup A meningococcal disease. MenAfriVac, developed by the Serum Institute of India and supported by Gavi, targets serogroup A and has been widely distributed across the African meningitis belt (Gavi).

Meningococcal Vaccine Market Geographical Analysis

North America is expected to dominate the global meningococcal vaccine market with a 43.61% share in 2024

Major pharmaceutical companies, including GSK, Pfizer, and Sanofi, are heavily investing in North America due to the region’s large market size and demand for high-quality vaccines. This has led to the availability of advanced conjugate vaccines, like MenACWY and MenB, which are specifically targeted to control outbreaks in the region.

For instance, in November 2024, GSK plc announced that the European Commission (EC) approved a single-vial, fully liquid presentation of Menveo (Meningococcal Group A, C, W-135 and Y conjugate vaccine, MenACWY vaccine) to help protect against invasive meningococcal disease (IMD) caused by bacterial serogroups A, C, W and Y.

In February 2025, GSK plc announced that the US Food and Drug Administration (FDA) approved Penmenvy (Meningococcal Groups A, B, C, W, and Y Vaccine) for use in individuals aged 10 through 25 years. The vaccine targets five major serogroups of Neisseria meningitidis (A, B, C, W, and Y), which commonly cause invasive meningococcal disease (IMD). The vaccine combines the antigenic components of GSK’s two well-established meningococcal vaccines, Bexsero (Meningococcal Group B Vaccine) and Menveo (Meningococcal [Groups A, C, Y, and W-135] Oligosaccharide Diphtheria CRM197 Conjugate Vaccine).

Asia-Pacific is growing at the fastest pace in the meningococcal vaccine market, holding 22.31% of the market share

The role of organizations like Gavi has been crucial in facilitating access to affordable vaccines in the Asia Pacific. Gavi’s support has helped countries in the region secure vaccines through pooled procurement programs, thus reducing costs and improving availability. For instance, Gavi has supported large-scale vaccination campaigns in Southeast Asia to control outbreaks, such as the one seen in Papua New Guinea in 2021. The partnership has enabled the introduction of MenAfriVac and other vaccines, contributing to better coverage and control of the disease.

Major players like GSK, Pfizer, and Sanofi are focusing on the Asia Pacific market, driven by the rapid growth potential. These companies are expanding their product portfolios and increasing production capacity to meet the rising demand. For instance, GSK’s MenACWY vaccine has been widely adopted across Asia Pacific countries, driven by its effectiveness and integration into public health programs. Pfizer’s MenB vaccines, such as Bexsero, are also gaining traction in the region due to increasing awareness and vaccination campaigns targeting university students and military personnel.

Meningococcal Vaccine Market Top Companies

Top companies in the meningococcal vaccine market include Sanofi S.A., GlaxoSmithKline Inc., Merck & Co., Inc., Pfizer Inc., Bio-Med (P) Limited, Serum Institute of India Pvt. Ltd., Walvax Biotechnology Co., Ltd., and Incepta Pharmaceuticals Ltd., among others.

Key Developments

In February 2025, GSK plc announced that the US Food and Drug Administration (FDA) approved Penmenvy (Meningococcal Groups A, B, C, W, and Y Vaccine) for use in individuals aged 10 through 25 years. The vaccine targets five major serogroups of Neisseria meningitidis (A, B, C, W, and Y), which commonly cause invasive meningococcal disease (IMD). The vaccine combines the antigenic components of GSK’s two well-established meningococcal vaccines, Bexsero (Meningococcal Group B Vaccine) and Menveo (Meningococcal [Groups A, C, Y, and W-135] Oligosaccharide Diphtheria CRM197 Conjugate Vaccine).

In June 2024, Gavi, the Vaccine Alliance, announced that the lower-income countries it supports can apply to introduce four additional vaccines, including multivalent meningococcal conjugate. These four vaccine programmes were previously approved by the Gavi Board.

Market Scope

Metrics | Details | |

CAGR | 6.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Monovalent, Quadrivalent, Bivalent, Others |

Product Type | Polysaccharide Meningococcal Vaccines, Conjugate Meningococcal Vaccines, Serogroup Meningococcal Vaccines | |

End-User | Hospitals, Specialty Clinics, Public Health Agencies, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global meningococcal vaccine market report delivers a detailed analysis with 56 key tables, more than 51 visually impactful figures, and 147 pages of expert insights, providing a complete view of the market landscape.