Global magnesium citrates market size overview

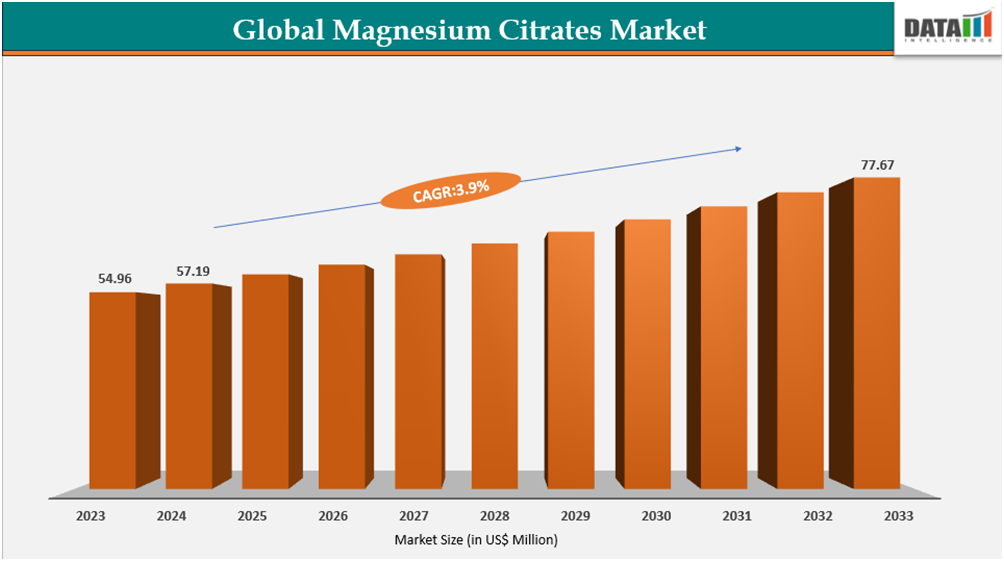

The global magnesium citrates market reached US$57.19million in 2024 and is projected to grow at a CAGR of 3.9% to reach US$77.67million by 2032.

This growth trajectory underscores its transition from a commodity chemical to a specialized, value-added ingredient. The market operates on a global scale, characterized by a complex interplay between large-scale chemical conglomerates and specialized fine chemical producers, all vying for position in a landscape driven by stringent quality standards, cost efficiency, and innovative application development.

Trends and Strategic Insights

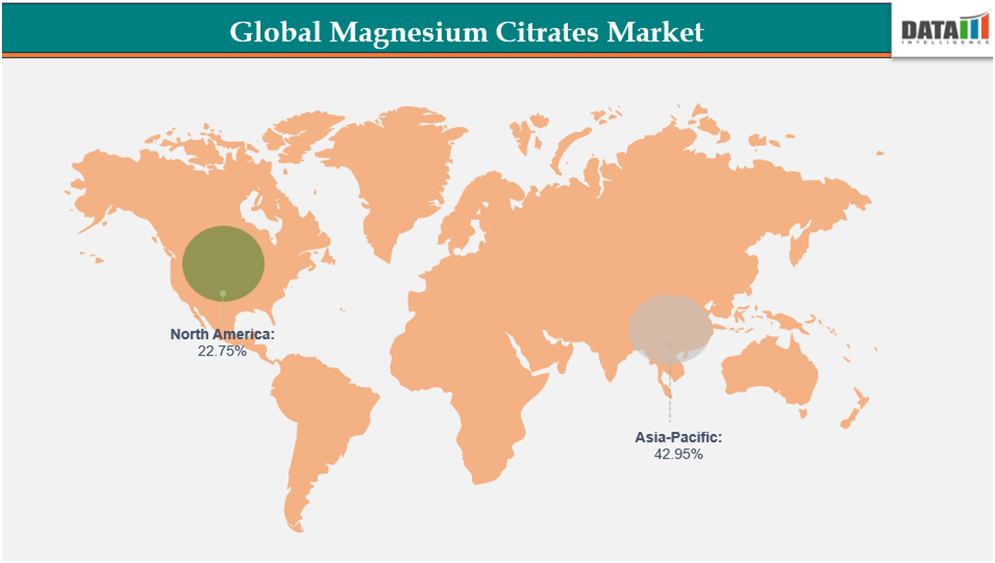

- Asia Pacific region dominates the market, capturing the largest revenue share of 42.95% in 2024.

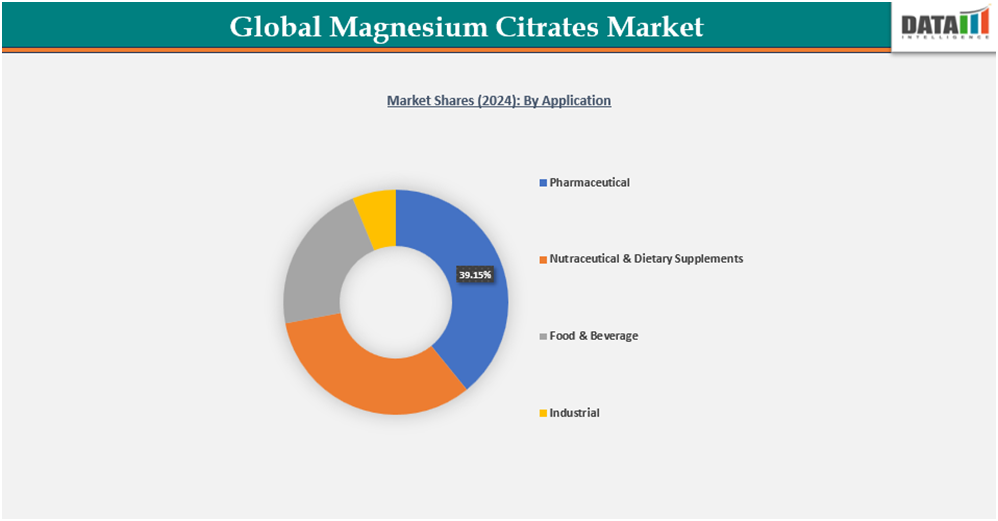

- Pharmaceutical under application segment experienced the largest market, registering a significant 39.15% in 2024.

Market Size and Future Outlook

- 2024 Market Size: US$57.19Million

- 2032 Projected Market Size: US$77.67Million

- CAGR (2025-2032):3.9%

- Largest Market: Asia-Pacific

Fastest Market: North America

Source : DataM Intelligen Email : [email protected]

Market Scope

| Metrics | Details |

| By Type | Anhydrous, Hydrous |

| By Form | Powder, Liquid/Syrup, Capsules/Tablets |

| By Application | Pharmaceutical, Nutraceutical & Dietary Supplements, Food & Beverage, Industrial |

| By Distribution channel | Business-to-Business (B2B), Business-to-Consumer (B2C) |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

The Megatrend of Preventive Healthcare and Self-Care

Consumers are increasingly self-directed, using dietary supplements to address widespread concerns such as stress, sleep quality, and musculoskeletal health. Magnesium is central to these concerns. The high bioavailability of the citrate form makes it a preferred choice for formulators seeking efficacy, directly translating into its dominance in the supplement aisle. This trend is amplified by an aging global population seeking bone health support and effective, gentle laxative solutions, further embedding magnesium citrate into core pharmaceutical and nutraceutical portfolios.

Escalating Demand for Functional, Fortified Foods and Beverages

Beyond the capsule, magnesium citrate is experiencing robust growth as a key ingredient in the functional food and beverage revolution. Its dual functionality is key: it acts as an acidity regulator and a fortifying agent. As consumers seek "health by stealth," manufacturers are fortifying everything from sparkling waters and sports drinks to cereal bars and meal replacements with highly bioavailable magnesium. The citrate form is particularly suitable for liquid applications due to its solubility, making it indispensable for the booming ready-to-drink (RTD) category. This expansion beyond traditional supplement formats significantly widens the total addressable market.

The Double-Edged Sword of Regulatory Scrutiny and Quality Imperatives

Agencies like the FDA (US), EFSA (Europe), and others are imposing stricter guidelines on supplement safety, quality, and labeling claims. This creates a high barrier to entry. While this pressures smaller, non-compliant players, it presents a significant opportunity for established manufacturers with robust Quality Assurance (QA) systems, pharmaceutical-grade (USP/Ph. Eur.) certifications, and transparent supply chains. Compliance is no longer a cost center but a powerful competitive moat and a critical brand differentiator in a market where consumer trust is paramount.

Segmentation Analysis

The global magnesium citrates market is segmented based on type, form, application, distribution channel, and region.

Dominating Segment: Pharmaceutical-Grade Applications

The pharmaceutical segment constitutes the largest and most defensible portion of the magnesium citrate market. This dominance is anchored in its well-established efficacy as a saline laxative, a use case supported by decades of clinical evidence and pharmacopoeial standards. Its role in bowel preparation for diagnostic procedures like colonoscopies remains non-negotiable. The critical need for guaranteed purity, batch-to-batch consistency, and adherence to Good Manufacturing Practice (GMP) makes this a high-value, relationship-driven segment. Its revenue streams are resilient, often tied to long-term supply contracts with large pharmaceutical companies, insulating it from the volatility seen in consumer-facing segments.

Fastest Growing Segment: Nutraceuticals and Dietary Supplements

The nutraceutical segment is the primary engine of growth. Driven by the preventive health megatrend, this segment demands versatility—available in powder, capsule, and tablet forms—and marketing-friendly attributes like "high absorption." Innovation here is rapid, with manufacturers developing highly bioavailable blends and targeted formulations (e.g., magnesium citrate with added B-vitamins for stress). The rise of e-commerce and direct-to-consumer (D2C) supplement brands has further accelerated this growth, creating a dynamic and brand-sensitive landscape where ingredient provenance and quality claims are critical purchasing factors.

Geographical Penetration

Asia Pacific's Manufacturing Prowess and Burgeoning Domestic Demand

The APAC region is the epicenter of global market growth for magnesium citrates, driven by its dominance as a manufacturing hub and rapidly increasing domestic consumption. The region presents a dual engine of growth: cost-competitive production and a swelling consumer base with growing disposable income, fueling demand for fortified foods and dietary supplements.

India magnesium citrates Market Outlook

India represents a high-growth market, propelled by its massive pharmaceutical industry ("Pharmacy of the World"), a burgeoning nutraceutical sector, and government initiatives like "Make in India." The domestic demand is accelerating due to increasing awareness of mineral deficiencies and a growing middle class investing in preventive healthcare. The market is highly competitive, with a strong presence of domestic manufacturers like Global Calcium meeting both local and export demand, while international players are seeking partnerships to tap into this demographic opportunity.

China magnesium citrates Market Trends

China is the dominant global player, functioning as both the largest producer and a rapidly expanding consumer market. Its massive chemical manufacturing infrastructure ensures a steady, cost-effective supply of magnesium citrates for the global market. Domestically, demand is fueled by a sophisticated pharmaceutical sector, a vast food processing industry, and a growing consumer focus on health and wellness. The market is evolving with stricter national quality and safety standards (GB standards), pushing manufacturers towards higher purity grades suitable for pharmaceutical and premium export markets.

Southeast Asia magnesium citrates Market Trends

The ASEAN region is an emerging growth frontier, characterized by an expanding food & beverage processing sector and increasing investment in pharmaceutical production. Growth is driven by urbanization, changing dietary patterns, and economic development. The region serves as both a consumption market and an increasingly important manufacturing location, with countries like Malaysia and Thailand attracting investment in ingredient production.

North America's Mature Market Driven by Quality and Innovation

North America holds a significant revenue share, characterized by a mature, quality-conscious market with high demand for pharmaceutical and USP-grade ingredients. Growth is steady, driven by well-established dietary supplement habits, a robust pharmaceutical industry, and consumer preference for clean-label and high-bioavailability mineral supplements.

United States magnesium citrates Market Insights

The U.S. is the most sophisticated and value-driven market globally. Demand is primarily anchored in the well-developed dietary supplement sector, where magnesium citrate is a leading form due to its high bioavailability and recognized laxative effect. The pharmaceutical industry remains a stable, high-value segment for OTC laxatives. Key market trends include a strong preference for non-GMO, third-party verified ingredients, and innovation in delivery formats (e.g., gummies, powders) within the supplement space. The presence of major distributors and stringent FDA oversight underpins a demand for consistent, high-quality supply.

Canada magnesium citrates Industry Growth

Canada mirrors the U.S. market in its maturity and health-conscious consumer base but operates at a smaller scale. Demand is driven by the nutraceutical and functional food industries, with a particular emphasis on natural health products (NHPs) regulated by Health Canada. The market is characterized by a preference for trusted brands and ingredients with scientific backing, presenting opportunities for suppliers who can provide comprehensive documentation and compliance support.

Sustainability Analysis

The tailwinds of health consciousness and functional food demand are structural and long-term. Companies that invest in backward integration (securing raw material supply), green chemistry initiatives (optimizing production efficiency and reducing environmental footprint), and transparent sourcing are building sustainable competitive advantages. These factors resonate powerfully with B2B customers and end-consumers alike.

The market faces persistent pressure from price volatility of raw materials (magnesium oxide, citric acid) and intense competition, particularly from lower-cost producers. The key challenge for all players is to navigate these cost pressures while simultaneously investing in the quality and certification standards required to compete in high-value regulated markets. The strategic imperative is to move up the value chain—from being a bulk supplier to becoming a solutions provider offering technical support, regulatory guidance, and customized formulations.

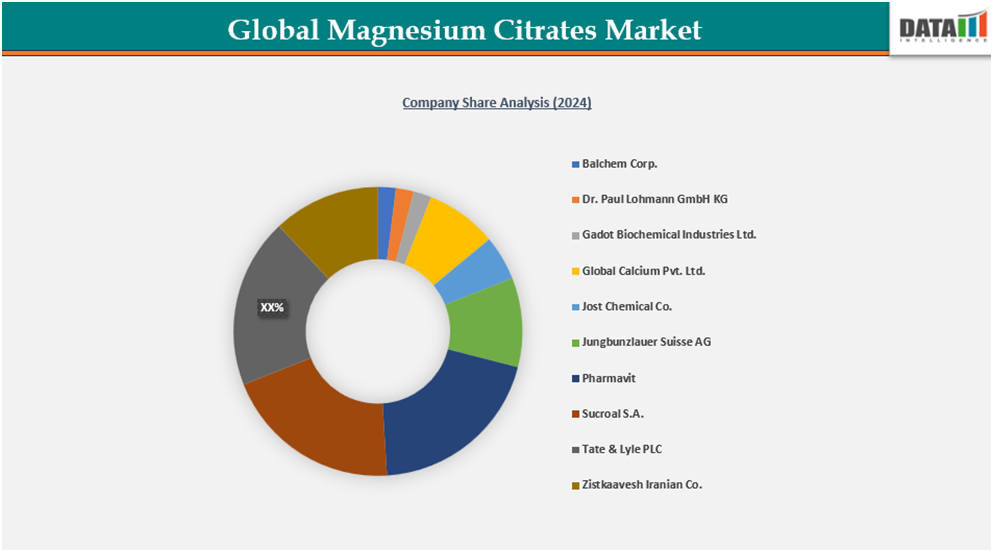

Competitive Landscape

- The competitive arena is moderately fragmented, featuring a strategic dichotomy. On one side are global chemical titans like BASF SE and Corbion N.V., who leverage immense scale, broad distribution networks, and diverse product portfolios. On the other are specialized pure-play leaders like Jungbunzlauer, Gadot Biochemical Industries, and Dr. Paul Lohmann, who compete on deep technical expertise, exceptionally high purity standards, and a focus on pharmaceutical and high-end nutraceutical customers.

- Competitive Levers: Success is determined by a combination of cost-competitiveness, technical service capability, and the ability to guarantee regulatory compliance across multiple jurisdictions (FDA, EFSA, etc.). Scale matters for commodity sales, but specialization and quality command premium margins.

- Strategic Moves: The landscape is witnessing strategic consolidation as larger entities acquire specialized manufacturers to gain technology and market access. Innovation is focused on developing highly bioavailable mineral complexes and improving the organoleptic properties (taste, texture) of magnesium citrate to expand its use in palatable food and beverage applications.

- The focus for winning players is on providing tangible value beyond the product itself. This includes ensuring supply chain resilience, offering consistent quality that reduces customers' regulatory risk, and providing formulation expertise that enables clients to innovate and capture market share in the booming health and wellness space.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies