Lead Acid Battery Separator Market Size

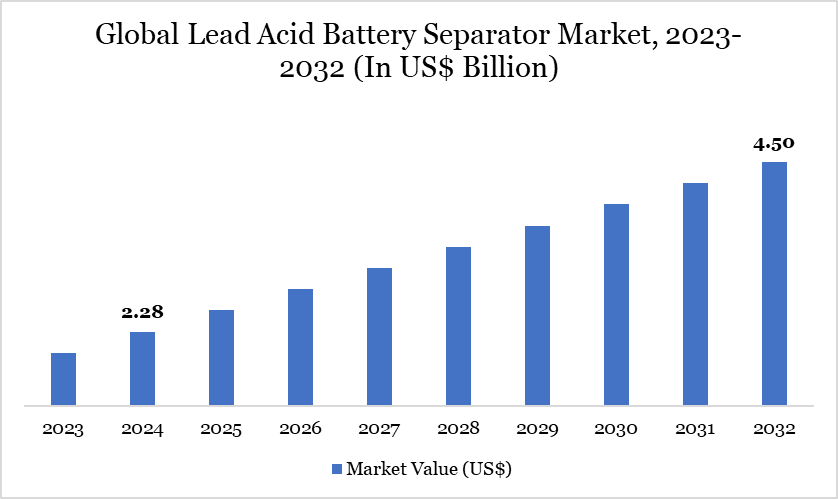

Lead Acid Battery Separator Market reached US$ 2.28 billion in 2024 and is expected to reach US$ 4.50 billion by 2032, growing with a CAGR of 8.88% during the forecast period 2025-2032.

The global Lead Acid Battery Separator Market is witnessing significant expansion, driven by its essential function in high-demand sectors including automotive, consumer electronics, and industrial manufacturing. The increase in electric vehicle (EV) production, particularly in developed economies such as the US, is a significant driver due to the advanced battery systems necessary for EVs.

These systems rely significantly on high-quality separators, hence proportionately elevating their demand. Government incentives and regulatory frameworks designed to decrease carbon emissions and encourage electric vehicle adoption have intensified this trend. In the medium term, areas such as automation and renewable energy storage are anticipated to enhance market demand, especially for Starting, Lighting, and Ignition (SLI) applications.

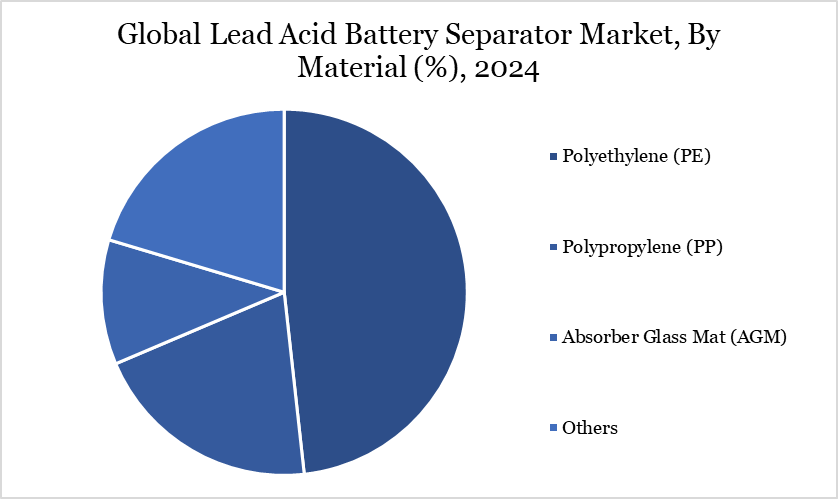

Polypropylene has emerged as a preferred material owing to its cost-effectiveness, chemical resilience, and excellent electrical insulating capabilities, hence reinforcing its significance in battery production. The market is set for ongoing growth throughout the projected period, driven by innovation and regulatory compliance.

Market Trends

The lead-acid battery separator market is experiencing substantial change, influenced by technology advancements and sustainability requirements. Recent research initiatives, including the February 2024 study by Incheon National University, are augmenting separator performance by silicon dioxide graft polymerization, hence strengthening heat stability and lifespan.

Polypropylene separators are experiencing enhancements in performance via nanocomposite integration and sophisticated surface changes. Furthermore, circular economy practices are progressively shaping industry operations. The EU Battery Directive (Directive 2006/66/EC) mandates recycling, prompting entities such as Ecobat to reclaim and reintegrate lead into battery manufacturing processes.

This closed-loop methodology reduces environmental effect and conforms to increasing global sustainability standards. The utilization of recycled materials in the construction of separators is increasingly prevalent. These industry transformations enhance product reliability and establish lead-acid battery separators as an essential element in sustainable energy systems, encompassing backup power for digital infrastructure and renewable energy installations.

For more details on this report – Request for Sample

Lead Acid Battery Separator Market Scope

| Metrics | Details |

| By Material | Polyethylene (PE), Polypropylene (PP), Absorber Glass Mat (AGM), Others |

| By Thickness | Below 20 micrometers (µm), 20 µm to 50 µm, 50 µm to 100 µm, Above 100 µm |

| By Layer | Single-Layer, Multilayer, Microporous, Others |

| By Technology | Dry, Wet |

| By Application | Industrial, Electronics, Automotive, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Lead Acid Battery Separator Market Dynamics

Increasing Demand from Electric Vehicles and Digital Infrastructure

A primary catalyst for the lead-acid battery separator market is the increasing dependence on electric vehicles and digital backup systems. In the US, favorable federal incentives have stimulated electric vehicle adoption, which necessitates efficient, high-capacity batteries. These batteries, frequently complemented by conventional SLI systems, necessitate sophisticated separator materials-usually polypropylene-for improved endurance and performance.

The simultaneous rise in cloud-based operations and digital services has led to an increase in data center proliferation. Companies such as Google, via Sharpless Enterprises, announced the establishment of new data centers in Northern Virginia in 2024, indicating this growing trend. Such facilities depend significantly on uninterruptible power supply (UPS) systems, with lead-acid batteries favored for their cost-effectiveness. The simultaneous dependence on automotive and digital infrastructure is expected to substantially increase the demand for high-quality, durable separators that improve battery reliability in various operating conditions.

Production Limitations and Supply Chain Weaknesses

The lead-acid battery separator market encounters significant supply chain intricacies that may impede expansion during the projected period. The manufacture of superior separators, especially those utilizing polypropylene, entails complex processes necessitating precise materials and technology. These supply chains are susceptible to disruptions caused by geopolitical conflicts, shortages of raw materials, or logistical delays.

The global manufacturing distribution of these separators is uneven, intensifying reliance on particular locations for critical components. Structural constraints may result in supply-demand discrepancies, postponing product delivery, elevating production costs, and affecting market competitiveness. Stakeholders are consequently encouraged to diversify sourcing tactics and invest in localized manufacturing capabilities to alleviate these supply-side limitations.

Lead Acid Battery Separator Market Segment Analysis

The global biosurfactants market is segmented based on material, thickness, layer, technology, application and region.

The Functionality of Polypropylene as a Structural Backbone in SLI Applications

Polypropylene (PP) has become a fundamental material in the production of lead-acid battery separators, especially for SLI (Starting, Lighting, and Ignition) applications. This thermoplastic polymer provides a combination of chemical resistance, mechanical strength, and electrical insulation, rendering it suitable for rigorous battery applications.

PP can be customized with additives and modified surfaces to enhance its performance, hence providing prolonged battery life and increased efficiency. Increasing customer and regulatory demands on automobile manufacturers to diminish emissions and enhance performance have led to a heightened demand for premium separators utilizing polypropylene.

Furthermore, as electric and hybrid vehicles persist in utilizing conventional lead-acid batteries for 12V systems, the importance of polypropylene in the separator market is anticipated to increase. The material's versatility in accommodating technological innovations, including the incorporation of SiO₂ coatings and nanocomposites, enhances its value in a competitive market.

Lead Acid Battery Separator Market Geographical Share

Asia-Pacific’s Surge in Battery Manufacturing and the Automotive Industry Increases Demand

The Asia-Pacific region is solidifying its status as the epicenter of growth in the worldwide lead-acid battery separator market, especially within the polypropylene sector. The region demonstrates robust downstream demand for battery components, evidenced by an average annual automobile production growth over 12% from 2019 to 2023, culminating in the manufacture of 55.1 million vehicles in 2023 alone.

Countries including China, Japan, South Korea, and India are leading this expansion. China, the preeminent global center for automobile and battery production, is paradoxically enhancing the demand for SLI batteries due to the expansion of its hybrid and electric vehicle industry. Japan and South Korea, utilizing their technological supremacy, are spearheading advancements in separator materials.

In January 2024, researchers from Incheon National University unveiled SiO₂-modified polypropylene separators, improving safety and efficiency. This technological improvement, coupled with industrial expansion, establishes Asia-Pacific as the most rapidly rising area in this sector, bolstered by home demand and worldwide export capabilities.

Sustainability Analysis

The sustainability framework of the lead-acid battery separator market is transforming due to the impact of circular economy concepts and the growth of renewable energy applications. Regulatory frameworks, such as the EU’s Battery Directive, necessitate recycling, compelling companies like Ecobat to reclaim and repurpose lead in the construction of separators. This diminishes dependence on raw resources and mitigates environmental impact.

Concurrently, renewable energy systems, such as solar and wind, are becoming dependent on lead-acid batteries for economical energy storage. In 2023, the total global installed wind capacity reached 906 GW, with an addition of 77.6 GW in 2022 alone. China assumed a preeminent position, generating over 82 GW yearly, highlighting the sector's scalability.

Lead-acid batteries, augmented by recycled separators, serve as an effective conduit between energy generation and consumption, hence assuring grid stability. Sustainability initiatives enhance environmental credentials and bolster market resilience by using recycled materials into production and increasing the diversity of end-use applications in green energy systems.

Lead Acid Battery Separator Market Major Players

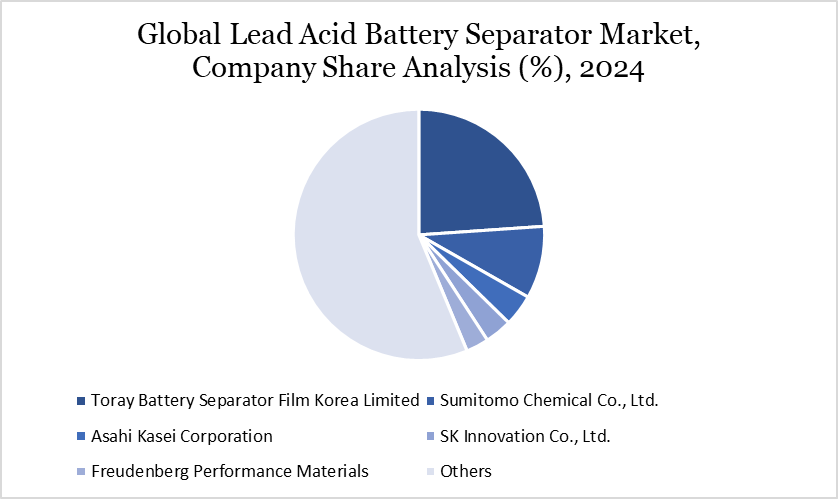

The major global players in the market include Toray Battery Separator Film Korea Limited, Sumitomo Chemical Co., Ltd., Asahi Kasei Corporation, SK Innovation Co., Ltd., Freudenberg Performance Materials, ENTEK International, LLC, W-Scope Corporation, UBE Corporation, Bernard Dumas, Dow, Inc. and among others.

Key Developments

In April 2024, Honda Motor Co. Ltd announced a significant partnership with Asahi Kasei Corporation. This collaboration aims to manufacture lead-acid battery separators specifically designed for automobile SLI batteries in Canada. The companies are prepared to engage in comprehensive discussions, aiming to establish a joint venture by the conclusion of 2024.

In January 2024, SEMCORP's research institute introduced an innovative separator for lead-acid batteries intended for automotive SLI applications. Comprehensive testing has demonstrated its outstanding performance, especially in low-temperature conditions. Significantly, even at -30°C, it enhances the discharge capacity retention of the battery cell by more than 10% relative to industry benchmarks.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies