Immunology & Inflammatory Diseases Drugs Market Size

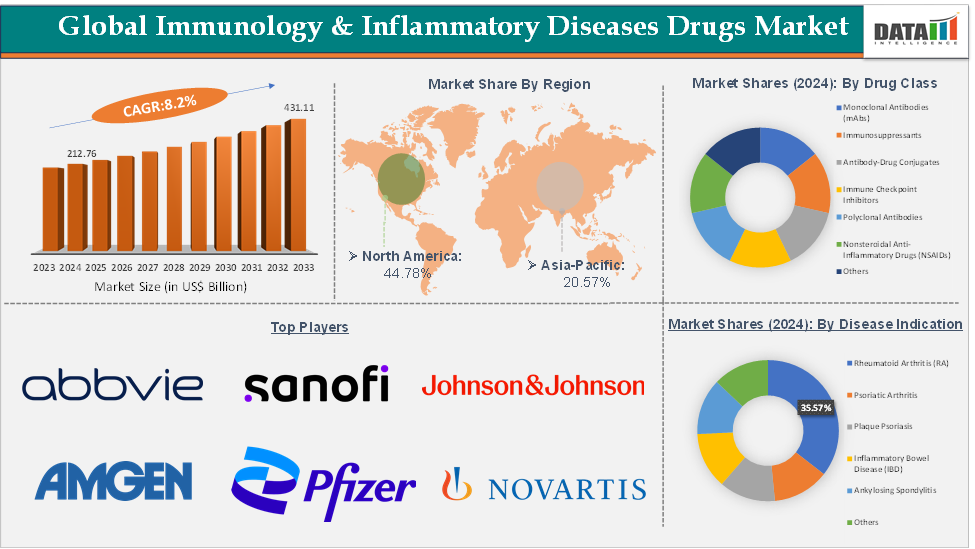

The global immunology & inflammatory diseases drugs market size reached US$ 212.76 Billion in 2024 from US$ 197.84 Billion in 2023 and is expected to reach US$ 431.11 Billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025-2033.

Overview

The global immunology & inflammatory diseases drugs market is experiencing robust growth, driven by a confluence of factors including an aging population, rising prevalence of autoimmune and inflammatory disorders, and significant advancements in biologic therapies. Key therapeutic areas such as rheumatoid arthritis, psoriasis, inflammatory bowel diseases, and multiple sclerosis are witnessing increased treatment demand. Monoclonal antibodies, Janus kinase (JAK) inhibitors, and interleukin inhibitors are leading the innovation front, with drugs like AbbVie’s Rinvoq and Skyrizi, setting new standards in efficacy and patient outcomes. The growing adoption of biologics, including biosimilars, is expected to drive market expansion further, offering more cost-effective treatment options and improving patient access globally.

Executive Summary

Dynamics

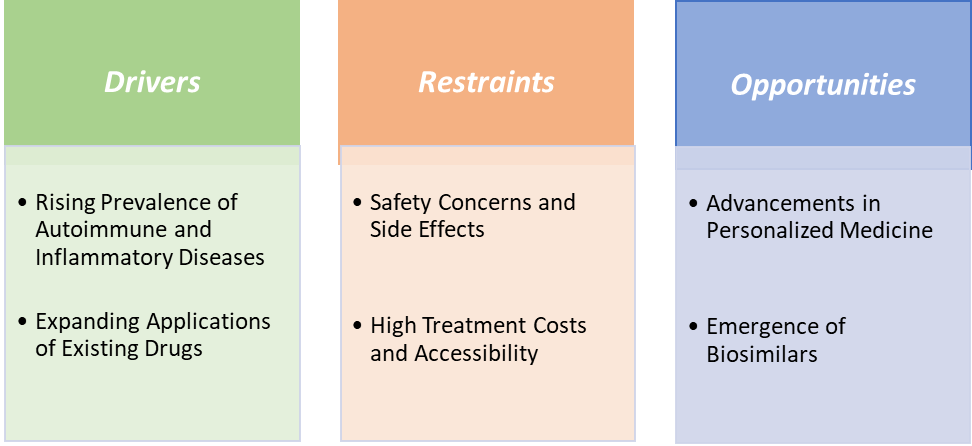

Drivers:

The rising prevalence of autoimmune and inflammatory diseases is significantly driving the immunology & inflammatory diseases drugs market growth

According to the National Institutes of Health, in the United States alone, over 15 million individuals, approximately 4.6% of the population, have been diagnosed with at least one autoimmune disease and 34% of those are diagnosed with more than 1 autoimmune disease, with many affected by multiple conditions simultaneously. This increase in prevalence is contributing to a higher demand for effective treatments.

Recent advancements in drug development have led to the introduction of several innovative therapies targeting these diseases. For instance, in June 2025, Johnson & Johnson announced the submission of a supplemental Biologics License Application (sBLA) to the U.S. Food and Drug Administration (FDA) seeking to expand approval of STELARA (ustekinumab) for the treatment of children two years and older with moderately to severely active Crohn’s disease (CD). STELARA is currently approved for the treatment of adults living with moderately to severely active CD and ulcerative colitis, in addition to the treatment of adults and children six years and older with active psoriatic arthritis and moderate to severe plaque psoriasis.

These developments underscore the significant impact of the increasing prevalence of autoimmune and inflammatory diseases on the growth of the immunology & inflammatory diseases drugs market. The demand for effective treatments is driving innovation and the introduction of new therapies, thereby expanding the market and offering hope to patients affected by these chronic conditions.

Restraints:

Safety concerns and side effects are hampering the growth of the immunology & inflammatory diseases drugs market

Safety concerns and side effects associated with immunology and inflammatory disease drugs significantly hamper market growth by limiting treatment options, increasing healthcare costs, and affecting patient compliance. Immunosuppressive drugs, such as corticosteroids and biologics, are commonly used to manage autoimmune conditions. However, their long-term use can lead to serious side effects. For instance, corticosteroids may cause weight gain, mood swings, and elevated blood pressure, while biologics can suppress the immune system, increasing susceptibility to infections and potentially leading to reactivation of latent diseases.

The side effects of these treatments can result in poor patient adherence, as individuals may discontinue therapy due to adverse reactions. This non-compliance can lead to disease flares, increased hospitalizations, and a higher overall healthcare burden. Furthermore, the development of new immunology drugs faces challenges in balancing efficacy with safety. While targeted therapies offer promising results, they must undergo rigorous testing to ensure they do not introduce new safety concerns. The need for extensive clinical trials to assess long-term safety profiles can delay the availability of new treatments and increase development costs.

For more details on this report – Request for Sample

Segmentation Analysis

The global immunology & inflammatory diseases drugs market is segmented based on drug class, disease indication, distribution channel, and region.

The rheumatoid arthritis (RA) segment from the disease indication is dominating the immunology & inflammatory diseases drugs market with a 35.57% share in 2024

The rheumatoid arthritis (RA) segment continues to dominate the immunology and inflammatory diseases drugs market due to its high prevalence, chronic burden, and the wide adoption of advanced therapies. Humira (adalimumab) has historically been the market leader with its global sales US$ 8,993 million in 2024. AbbVie has successfully countered the market with its newer immunology blockbusters Skyrizi (risankizumab) and Rinvoq (upadacitinib), which together generated USD 17,689 million in 2024, cementing their position as future leaders. The continuous pipeline expansion, recent product approvals like biosimilars to the available biologics, and the sustained global burden of RA, particularly in aging populations, are ensuring that the RA segment remains the largest and most influential within the immunology and inflammatory diseases drugs market.

For instance, in May 2025,Celltrion Inc. announced that the U.S. Food and Drug Administration (FDA) granted an expanded interchangeable designation for YUFLYMA (adalimumab-aaty), now including prefilled syringe (40mg) and autoinjectors (40mg and 80mg) presentations. With this approval, YUFLYMA is now fully interchangeable with the reference product, Humira (adalimumab), across all marketed dosage forms and strengths. YUFLYMA is a high-concentration, citrate-free biosimilar to Humira, approved for multiple inflammatory indications, including rheumatoid arthritis (RA).

Geographical Share Analysis

North America is expected to dominate the global immunology & inflammatory diseases drugs market with a 44.78% in 2024

North America remains the dominant region in the global immunology & inflammatory diseases drugs market, largely due to its strong healthcare ecosystem, higher prevalence of autoimmune and inflammatory conditions, rapid adoption of biologics and targeted therapies, and consistent flow of FDA approvals that keep the region at the forefront of innovation.

The region’s dominance was reinforced by multiple landmark approvals and strong product uptake. For instance, in August 2024, the FDA approved Nemluvio (nemolizumab) as the first-in-class monoclonal antibody for prurigo nodularis and atopic dermatitis, expanding therapeutic options in dermatologic immunology, in April 2025, Johnson & Johnson’s Imaavy won FDA clearance for generalized myasthenia gravis (gMG), and Amgen’s Uplizna (inebilizumab) secured approval in April 2025 for IgG4-related disease (IgG4-RD).

Meanwhile, North America continues to drive blockbuster revenues through established leaders such as AbbVie’s Humira, Skyrizi and Rinvoq, reflecting the market’s swift embrace of next-generation therapies. Together, these approvals and sales performances illustrate that North America remains the powerhouse of the immunology and inflammatory drugs market. Its combination of cutting-edge research, regulatory efficiency, high treatment uptake, and strong spending power continues to ensure that the region not only leads in revenues but also in shaping the global trajectory of immunology innovation.

Competitive Landscape

Top companies in the immunology & inflammatory diseases drugs market include AbbVie Inc., Sanofi, Regeneron Pharmaceuticals, Inc., Johnson & Johnson, Amgen Inc., Novartis Pharmaceuticals Corporation, Pfizer Inc., Merck & Co., Inc., Bristol-Myers Squibb Company, and Eli Lilly and Company, among others.

Report Scope

Metrics | Details | |

CAGR | 8.2% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Drug Class | Monoclonal Antibodies (mAbs), Immunosuppressants, Antibody-Drug Conjugates, Immune Checkpoint Inhibitors, Polyclonal Antibodies, Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) and Others |

Disease Indication | Rheumatoid Arthritis (RA), Psoriatic Arthritis, Plaque Psoriasis, Inflammatory Bowel Disease (IBD), Ankylosing Spondylitis and Others | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global immunology & inflammatory diseases drugs market report delivers a detailed analysis with 62 key tables, more than 59 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here