Ulcerative Colitis Treatment Market Size & Industry Outlook

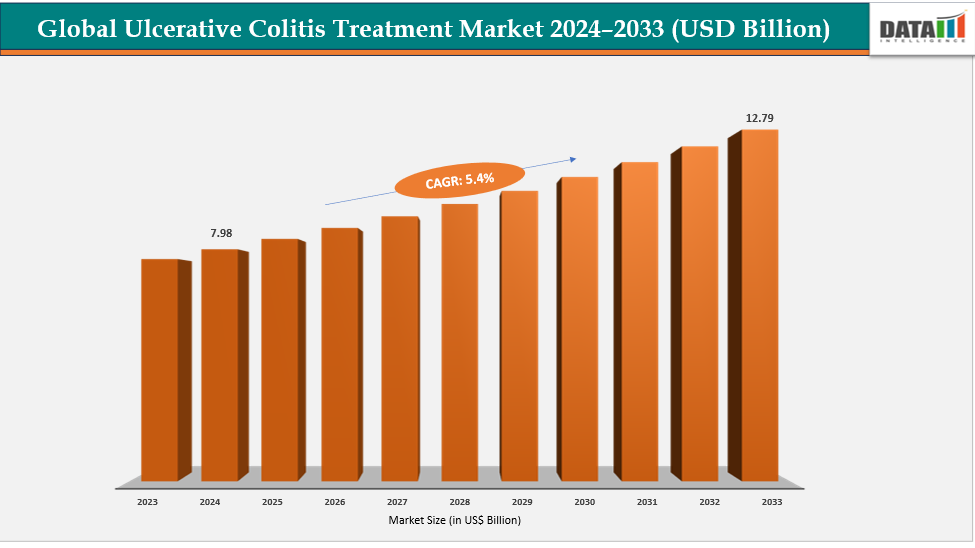

The global ulcerative colitis treatment market size reached US$ 7.60 Billion in 2023 with a rise of US$ 7.98 Billion in 2024 and is expected to reach US$ 12.79 Billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025-2033.

The growth of the ulcerative colitis (UC) treatment market is being significantly driven by rising disease prevalence, improved diagnosis, and increased research and development (R&D) activity. The number of patients in need of treatment has increased as a result of improved awareness and sophisticated diagnostic techniques like colonoscopy and biomarker testing, which have allowed for the earlier and more precise detection of UC. Pharmaceutical companies are making significant investments in research and development at the same time, creating novel treatments with better efficacy and safety profiles, such as S1P modulators, JAK inhibitors, and IL-23 inhibitors. More clinical trial activity speeds up drug approvals and commercialization, giving patients and healthcare professionals more therapeutic options.

Key Highlights

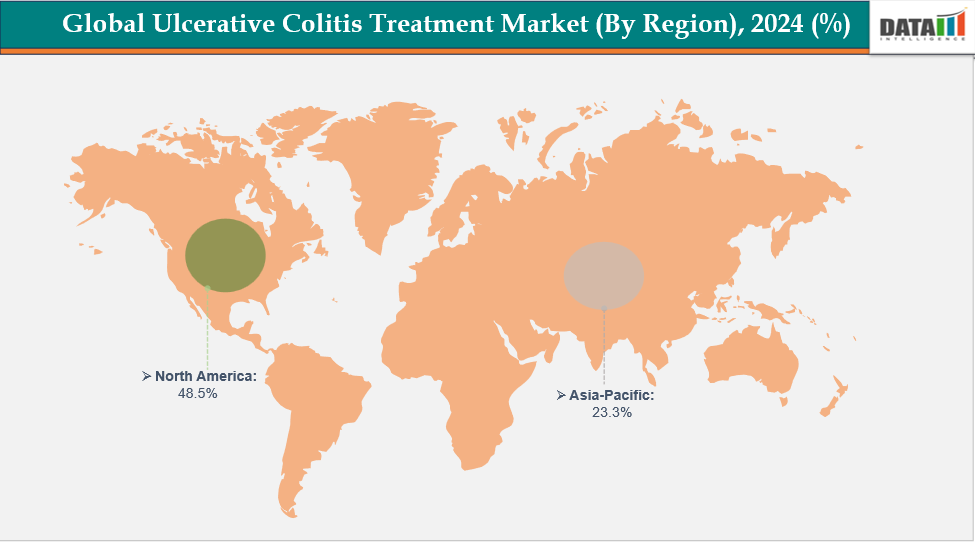

- North America is dominating the global ulcerative colitis treatment market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global ulcerative colitis treatment market, with a CAGR of 7.7% in 2024

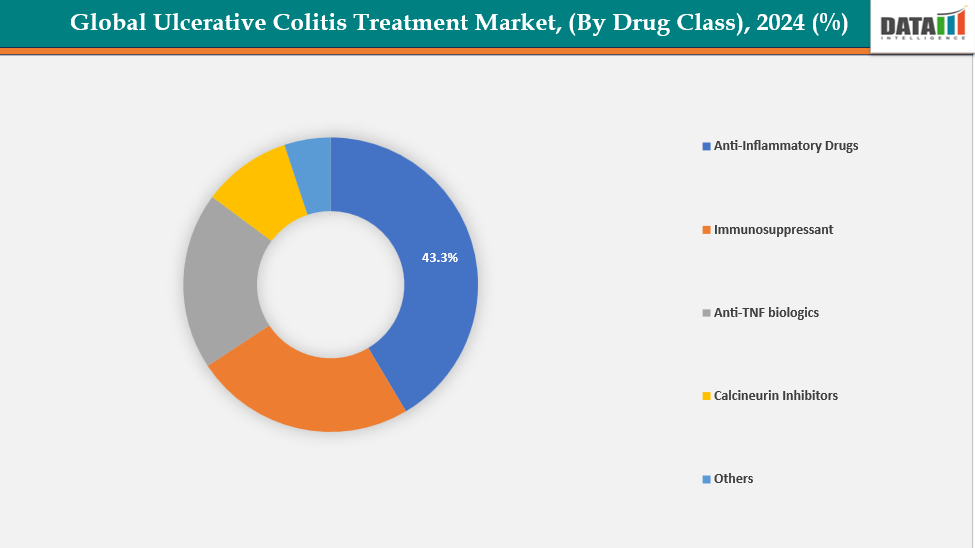

- The Anti-Inflammatory drugs segment from drug class is dominating the ulcerative colitis treatment market with a 43.3% share in 2024.

- The Left-sided colitis segment form of the disease type is dominating the ulcerative colitis treatment market with a 42.5% share in 2024.

- Top companies in the ulcerative colitis treatment market include Teva Pharmaceuticals, Inc.; Ferring; Salix Pharmaceuticals; Pfizer Inc.; Johnson & Johnson, Inc.; AbbVie Inc.; Takeda Pharmaceuticals U.S.A., Inc.; Viatris Inc.; Novartis AG; and Gilead Sciences, Inc., among others.

Market Dynamics

Drivers: Biologic innovations and targeted therapeutic advancements are accelerating the growth of the ulcerative colitis market

Biologic innovations and targeted therapeutic advancements are transforming ulcerative colitis management by providing more effective, personalized, and durable treatment options. The inability of conventional anti-inflammatory and immunosuppressive medications to produce long-lasting remission has prompted a move toward biologics that specifically target particular immune pathways, such as anti-TNF, anti-integrin, and IL-12/23 inhibitors. These medications are more widely used by patients and clinicians because they increase efficacy, lower relapse rates, and improve quality of life.

For instance, in June 2024, AbbVie announced that the U.S. FDA approved SKYRIZI (risankizumab-rzaa) for adults with moderately to severely active ulcerative colitis, making it the first IL-23 inhibitor approved for both moderate-to-severe ulcerative colitis and Crohn’s disease, expanding AbbVie’s portfolio across immune-mediated inflammatory diseases.

Restraints: Safety concerns and monitoring requirements are hampering the growth of the ulcerative colitis treatment market

Safety concerns, particularly associated with JAK inhibitors and other advanced therapies, are restricting market growth by limiting widespread adoption. Infections, thrombosis, cancers, and cardiovascular events are among the severe side effects associated with JAK inhibitors (e.g., tofacitinib, upadacitinib). The burden on patients and healthcare providers is increased by these dangers, which call for stringent patient screening, frequent laboratory monitoring, and continuous clinical supervision.

For instance, the FDA required warnings for JAK inhibitors after reviewing a large, randomized safety trial, concluding that Xeljanz and Xeljanz XR, used for arthritis and ulcerative colitis, carried increased risks of serious heart events, cancer, blood clots, and death.

For more details on this report, see Request for Sample

Segmentation Analysis

The global ulcerative colitis treatment market is segmented based on disease type, drug class, route of administration, distribution channel and region

By Drug Class: The Anti-Inflammatory drugs segment from drug class is dominating the ulcerative colitis treatment market with a 43.3% share in 2024

The anti-inflammatory drugs segment, primarily 5-aminosalicylic acid (5-ASA) agents like mesalamine, sulfasalazine, olsalazine, and balsalazide, dominates the ulcerative colitis (UC) market due to their role as first-line therapy for mild to moderate UC. Due to their proven safety profile, ability to induce and sustain remission, and availability in oral and rectal formulations that improve patient compliance, these medications are frequently prescribed.

Additionally, the dominance of the anti-inflammatory drug segment is further reinforced by recent regulatory approvals and market development. For instance, in July 2024, the FDA approved the biosimilar Pyzchiva (ustekinumab-ttwe), commercialized by Sandoz in the US, as an IL-12/IL-23 antagonist for adults with moderate-to-severe plaque psoriasis, active psoriatic arthritis, Crohn’s disease, and ulcerative colitis.

By Disease Type: The Left-sided colitis segment form disease type is dominating the ulcerative colitis treatment market with a 42.5% share in 2024

The left-sided colitis segment dominates the ulcerative colitis (UC) treatment market due to its high prevalence and symptomatic burden, affecting approximately 30–50% of UC patients. For instance, according to one study in the Lancet, in 2023, proctitis (25%), left-sided colitis (42%), and extensive colitis (33%) cases are there.

Moreover, compared to distal variants such as ulcerative proctitis, this disease type usually affects the descending colon up to the splenic flexure and necessitates more rigorous treatment. To induce and sustain remission, patients frequently require a combination of immunosuppressants, oral and topical anti-inflammatory medications, or biologics. Prescription volume and market revenue are driven by the progression risk to moderate or severe disease, increasing medicine usage, and higher healthcare resource utilization.

Geographical Analysis

North America is dominating the global ulcerative colitis treatment market with a 48.5% in 2024

North America leads the global ulcerative colitis treatment market due to advanced healthcare infrastructure, high healthcare expenditure, and growing disease awareness. The rising incidence of ulcerative colitis in the area and the need for efficient treatments, such as immunosuppressants, 5-ASA medications, and biologics, propel the market's steady expansion and uptake of cutting-edge medicines.

Additionally, continuous research, innovation, and regulatory approvals in North America further strengthen market penetration. For instance, in April 2025, AbbVie announced that the FDA approved RINVOQ (upadacitinib) for adults with moderate to severe ulcerative colitis, following recent European Commission authorization for giant cell arteritis treatment in adults.

Europe is the second region after North America which is expected to dominate the global ulcerative colitis treatment market with a 34.5% in 2024

Europe’s ulcerative colitis treatment market is growing due to high disease awareness, well-established healthcare infrastructure, and easy access to hospitals, clinics, and pharmacies. The market is expanding among at-risk and adult populations due to supportive government policies, public health campaigns, and rising use of cutting-edge treatments including immunosuppressants and biologics.

Germany’s ulcerative colitis treatment market is driven by advanced healthcare infrastructure, supportive regulations, and high public awareness of inflammatory bowel diseases. Widespread access through hospitals, clinics, pharmacies, and digital platforms, along with government initiatives and continuous research, innovation, and regulatory approvals, further strengthens market penetration. For instance, in February 2025, Sanofi and Teva Pharmaceuticals presented detailed results from the Phase 2b RELIEVE UCCD study of duvakitug, a human IgG1-λ2 monoclonal antibody targeting TL1A, in patients with moderate-to-severe ulcerative colitis and Crohn’s disease at the 20th European Crohn’s and Colitis Organisation Congress in Berlin, Germany.

The Asia Pacific region is the fastest-growing region in the global ulcerative colitis treatment market, with a CAGR of 7.7% in 2024

The Asia-Pacific ulcerative colitis treatment market, including Japan, China, India, and South Korea, is expanding due to increasing disease awareness, urbanization, and enhanced healthcare access. Throughout the region, early diagnosis, treatment uptake, and better ulcerative colitis management are being encouraged by public health campaigns, governmental initiatives, and pharmaceutical developments.

China is the fastest-growing region in the global ulcerative colitis treatment market due to rising disease prevalence, increasing patient and physician awareness, and expanding healthcare infrastructure. Strategic pharmaceutical partnerships, licensing agreements, and the introduction of advanced therapies are accelerating treatment adoption and driving rapid market growth nationwide. For instance, in April 2025, Everest Medicines announced that Hong Kong’s Department of Health approved VELSIPITY (etrasimod) for adults with moderately to severely active ulcerative colitis, and China’s NMPA officially accepted the New Drug Application for the same indication in December 2024.

Competitive Landscape

Top companies in the ulcerative colitis treatment market include Teva Pharmaceuticals, Inc.; Ferring; Salix Pharmaceuticals; Pfizer Inc.; Johnson & Johnson, Inc.; AbbVie Inc.; Takeda Pharmaceuticals U.S.A., Inc.; Viatris Inc.; Novartis AG; and Gilead Sciences, Inc., among others.

Teva Pharmaceuticals, Inc.: Teva Pharmaceuticals, Inc. is a global pharmaceutical company actively engaged in developing and commercializing therapies for ulcerative colitis and other inflammatory bowel diseases. The company focuses on innovative biologics and small-molecule treatments, including monoclonal antibodies targeting TL1A and other immune pathways. Through clinical trials, collaborations, and strategic partnerships, Teva aims to expand treatment options and improve patient outcomes in UC worldwide.

Key Developments:

- In October 2025, Johnson & Johnson reported Week 12 results from the Phase 2b ANTHEM-UC study of icotrokinra, a first-in-class oral IL-23 receptor blocker, showing all dose groups achieved clinical response and meaningful improvements versus placebo, highlighting its potential efficacy, safety, and once-daily oral dosing in moderate-to-severe ulcerative colitis.

Market Scope

| Metrics | Details | |

| CAGR | 5.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Disease Type | Left-sided Colitis, Proctosigmoiditis, Ulcerative Proctitis, Pancolitis or Universal Colitis, Fulminant Colitis |

| By Drug Class | Anti-Inflammatory Drugs, Immunosuppressant, Anti-TNF Biologics, Calcineurin Inhibitors and Others | |

| By Route of Administration | Oral, Intravenous, Intramuscular | |

| By Distribution Channel | Retail Pharmacies, Hospital Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global ulcerative colitis treatment market report delivers a detailed analysis with 70 key tables, more than 67 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here