Global Chronic Inflammatory Demyelinating Polyneuropathy Market Size - Industry Trends & Outlook

The chronic inflammatory demyelinating polyneuropathy (CIDP) market is poised for robust growth over the coming years, driven by rising disease prevalence, increasing awareness, and advancements in therapeutic options. A key growth driver is the surge in regulatory approvals of innovative treatments incorporating cutting-edge technologies.

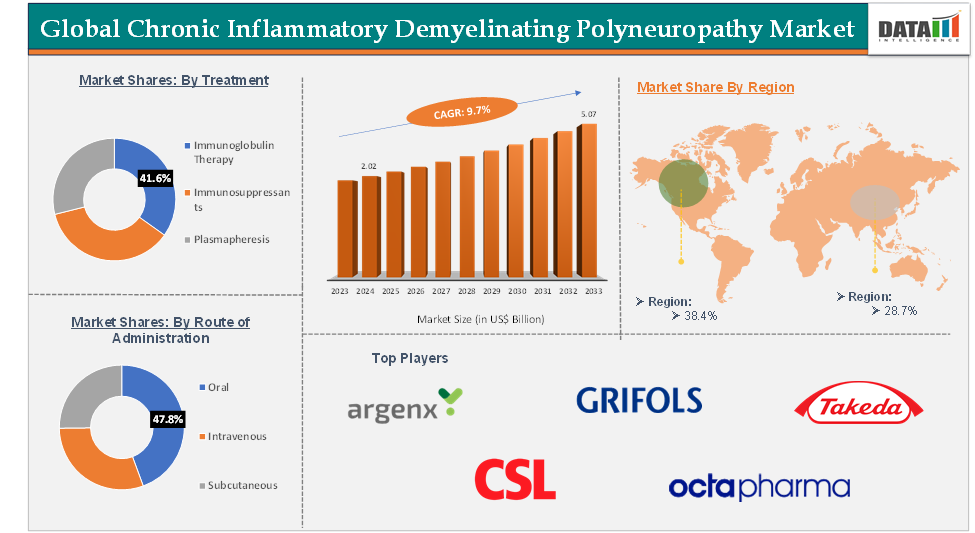

North America currently dominates the global CIDP treatment market, supported by a well-established healthcare infrastructure, high diagnosis rates, and strong presence of leading biopharmaceutical companies. However, Asia-Pacific is expected to witness the fastest growth, propelled by increasing healthcare expenditure, expanding patient access, and growing focus on neurological disorders in emerging economies.

Global Chronic Inflammatory Demyelinating Polyneuropathy Market Executive Summary

Global Chronic Inflammatory Demyelinating Polyneuropathy Market Dynamics: Drivers & Restraints

The chronic inflammatory demyelinating polyneuropathy (CIDP) treatment market is expected to experience steady growth, driven by the increasing approval of new therapies by regulatory authorities. These treatments reflect the latest advancements in medical research and technology, offering more effective options for managing CIDP symptoms and, in some cases, achieving remission.

With more therapies entering the market, the overall outlook for CIDP patients is gradually improving, along with the expansion of the global treatment landscape. For instance, in June 2024, argenx SE announced that the U.S. Food and Drug Administration (FDA) had approved VYVGART Hytrulo (efgartigimod alfa and hyaluronidase-qvfc) for the treatment of adults with chronic inflammatory demyelinating polyneuropathy (CIDP). This marks a significant milestone, as VYVGART Hytrulo becomes the first and only neonatal Fc receptor (FcRn) blocker approved for CIDP.

Similarly, in December 2023, Takeda announced that the European Medicines Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP) had recommended the approval of HYQVIA as a maintenance therapy for patients with CIDP following stabilization with intravenous immunoglobulin (IVIG).

Side effects associated with CIDP drugs are expected to hinder the chronic inflammatory demyelinating polyneuropathy market

Side effects associated with CIDP drugs are expected to hamper the growth of the chronic inflammatory demyelinating polyneuropathy (CIDP) treatment market by limiting patient adherence, increasing treatment discontinuation rates, and raising safety concerns among both patients and healthcare providers.

Commonly used therapies, such as corticosteroids, intravenous immunoglobulins (IVIG), and immunosuppressants, are often linked to adverse effects like weight gain, hypertension, osteoporosis, increased infection risk, and infusion-related reactions. These side effects can deter long-term use and make physicians more cautious in prescribing these treatments, especially for elderly or comorbid patients.

For more details on this report – Request for Sample

Global Chronic Inflammatory Demyelinating Polyneuropathy Market Segment Analysis

The global chronic inflammatory demyelinating polyneuropathy market is segmented based on type, treatment, route of administration, and region.

Treatment:

The immunoglobulin therapy segment is expected to hold 46.7% of the global chronic inflammatory demyelinating polyneuropathy market

The immunoglobulin therapy is a therapy for chronic inflammatory demyelinating polyneuropathy, derived from donated human plasma antibodies that block immune and inflammatory processes that damage myelin.

Immunoglobulin (Ig) therapy is poised to dominate the chronic inflammatory demyelinating polyneuropathy (CIDP) market, driven by recent regulatory approvals and the growing recognition of its efficacy in managing this rare neuromuscular disorder.

For instance, in January 2024, Takeda received FDA approval for GAMMAGARD LIQUID, an intravenous immunoglobulin therapy, to improve neuromuscular disability and impairment in adults with chronic inflammatory demyelinating polyneuropathy (CIDP). The therapy can be used as an induction and maintenance dose, but has not been studied in immunoglobulin-naive patients or as maintenance therapy for longer than six months.

The recent analysis of the primary endpoint highlighted a significant reduction in relapse rates for patients receiving HYQVIA compared to those on placebo, with the relapse rate for the HYQVIA group at 14.0%, versus 32.3% in the placebo group. This substantial difference supports the effectiveness of immunoglobulin therapies in managing chronic inflammatory demyelinating polyneuropathy (CIDP).

Such compelling clinical evidence bolsters the growing dominance of immunoglobulin therapies in the CIDP market, demonstrating their potential to offer better patient outcomes by significantly reducing relapse rates and improving overall disease management.

Global Chronic Inflammatory Demyelinating Polyneuropathy Market - Geographical Analysis

North America is expected to hold 38.4% of the global chronic inflammatory demyelinating polyneuropathy market

North America is expected to hold a significant portion of the global chronic inflammatory demyelinating polyneuropathy market. This dominance is driven by various factors such as novel drug launches, FDA approvals, initiatives from governments, and other organizations that are expected to influence the global chronic inflammatory demyelinating polyneuropathy (CIDP) treatment market growth.

For instance, in May 2024, Zai Lab Limited received a supplemental Biologics License Application (sBLA) from the China National Medical Products Administration (NMPA) for efgartigimod alfa injection (efgartigimod SC) for treating chronic inflammatory demyelinating polyneuropathy (CIDP).

These continuous advancements highlight North America's leadership in both the development and commercialization of CIDP treatments, reinforcing its dominant position in the market and fueling growth in the treatment landscape and therapeutic innovations.

Asia-Pacific is expected to hold 28.7% of the global chronic inflammatory demyelinating polyneuropathy market

The Asia-Pacific region is expected to emerge as the fastest-growing market for chronic inflammatory demyelinating polyneuropathy (CIDP) treatments, driven by a combination of rising disease prevalence, expanding healthcare infrastructure, and increasing healthcare expenditure.

Countries like China, India, and Japan are seeing a growing incidence of autoimmune disorders due to urbanization and lifestyle changes, which is fueling demand for effective CIDP therapies. Improved diagnostic capabilities and greater awareness among healthcare professionals and patients are leading to earlier and more accurate diagnoses.

Global Chronic Inflammatory Demyelinating Polyneuropathy Market Competitive Landscape

The top companies in the chronic inflammatory demyelinating polyneuropathy market include CSL, Argenx, Takeda Pharmaceutical Company Limited, Pfizer Inc., Octapharma AG, Grifols, among others.

Global Chronic Inflammatory Demyelinating Polyneuropathy Market Scope

| Metrics | Details | |

| CAGR | 9.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Progressive, Recurrent, Monophasic |

| Treatment | Immunoglobulin Therapy, Immunosuppressants, Plasmapheresis, Others | |

| Route of Administration | Oral, Intravenous, Subcutaneous | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global chronic inflammatory demyelinating polyneuropathy market report delivers a detailed analysis with 57 key tables, more than 46 visually impactful figures, and 168 pages of expert insights, providing a complete view of the market landscape.