Immunology Drugs Market Size & Industry Outlook

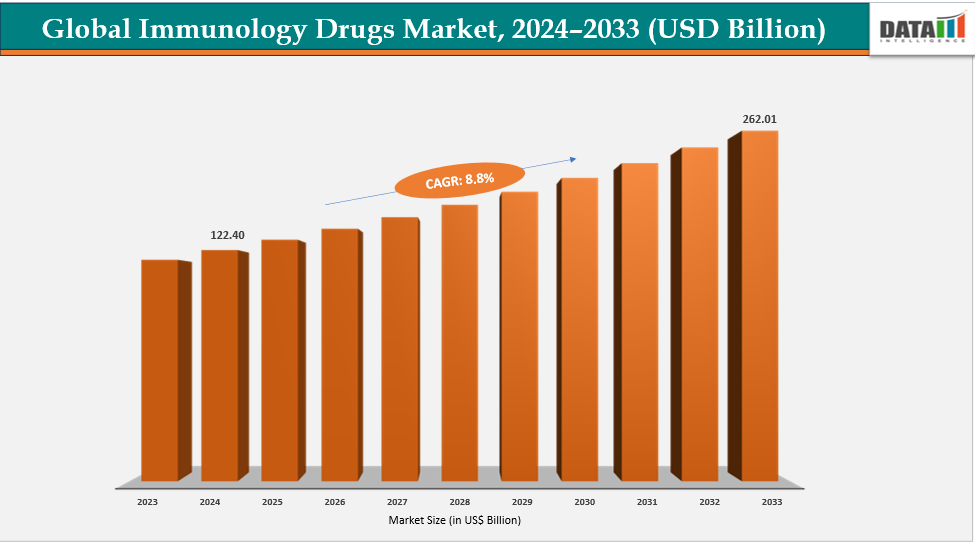

The global immunology drugs market size was US$ 122.40 Billion in 2024 and is expected to reach US$ 262.01 Billion by 2033, growing at a CAGR of 8.8% during the forecast period 2025-2033.

The market for immunology medications growing rapidly due to biosimilars and generics, which made treatments more accessible and affordable. Their accessibility increased patient reach and decreased healthcare expenditures, particularly in developing nations. By offering competitive prices and expanding their distribution networks, pharmaceutical businesses were able to gain a larger market share. Concurrently, the increasing use of targeted treatments, including JAK inhibitors and monoclonal antibodies, improved the accuracy and results of treatment for inflammatory and autoimmune disorders. Physician preference and patient adherence increased as a result of these treatments' increased efficacy and decreased side effects.

Key Highlights

- North America is dominating the global immunology drugs market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global immunology drugs market, with a CAGR of 7.7% in 2024

- The monoclonal antibodies segment is dominating the immunology drugs market with a 40.2% share in 2024

- The rheumatoid arthritis segment is dominating the immunology drugs market with a 41.3% share in 2024

- Top companies in the immunology drugs market include Eli Lilly and Company, AbbVie Inc., Novartis Pharmaceuticals Corporation, Sun Pharmaceutical Industries, Inc., Johnson & Johnson, Genentech USA, Inc., Bristol-Myers Squibb Company, Sanofi, Pfizer Inc., and GlaxoSmithKline plc, among others.

Market Dynamics

Drivers: Strong research and development pipeline and biologics innovation are accelerating the growth of the immunology drugs market

The global market for immunology medications is expanding at a rapid pace due to a robust research and development (R&D) pipeline and rapid biologics innovation. In order to provide precise treatment for complicated autoimmune and inflammatory diseases, pharmaceutical companies are making significant investments in novel targets and next-generation biologics. Enhancing efficacy, safety, patient outcomes, and market penetration are ongoing developments in monoclonal antibodies, bispecifics, BTK, and JAK or S1P inhibitors, as well as the expansion of clinical studies.

Owing to the factors like robust research and development (R&D) pipeline and rapid biologics innovation. For instance, in October 2025, Novartis announced that Cosentyx (secukinumab) had successfully met its primary and all secondary endpoints in the Phase III REPLENISH trial, demonstrating statistically significant and clinically meaningful sustained remission at Week 52 in adults with polymyalgia rheumatica (PMR) compared with placebo.

Restraints: Safety concerns and long-term adverse effects are hampering the growth of the immunology drugs market

The growth of the global market for immunology medications is being hampered by safety concerns and long-term negative consequences. Long-term usage of many biologics and JAK inhibitors used to treat autoimmune illnesses can result in liver damage, severe infections, cancer, or cardiovascular hazards. For instance, Xeljanz/Xeljanz XR (tofacitinib), a Janus Kinase (JAK) inhibitor, has been linked to serious adverse effects, including increased risks of heart-related events, cancer, blood clots, and death, prompting FDA safety warnings.

Additionally, persistent immune suppression impairs patients' innate defenses, increasing the risk of hospitalization and shortening the course of treatment. Black box warnings, stringent monitoring measures, and cautious prescribing by doctors are frequently the results of these safety concerns.

For more details on this report, see Request for Sample

Immunology Drugs Market, Segment Analysis

The global immunology drugs market is segmented based on drug class, indication, distribution channel and region

By Drug Class: The monoclonal antibodies segment is dominating the immunology drugs market with a 40.2% share in 2024

The market for immunology medications is dominated by monoclonal antibodies (mAbs) due to their broad use in autoimmune and inflammatory illnesses, excellent specificity, and potent clinical efficacy. Compared to conventional immunosuppressants, mAbs provide better results and fewer adverse effects by precisely targeting immunological pathways such TNF-α, IL-6, IL-17, and IL-23. Their proven ability to cure inflammatory bowel disease, psoriasis, and rheumatoid arthritis has given doctors great confidence.

Moreover, continuous research and development for monoclonal antibodies and their regulatory approval make them dominant. For instance, in September 2025, Johnson & Johnson announced that the U.S. FDA had approved TREMFYA (guselkumab) for treating pediatric patients aged six years and older with moderate to severe plaque psoriasis and active psoriatic arthritis, marking the first and only IL-23 inhibitor approved for this population.

By Indication: The rheumatoid arthritis segment is dominating the immunology drugs market with a 41.3% share in 2024

The market for immunology medications is dominated by the rheumatoid arthritis (RA) segment due to the disease's high prevalence and well-established treatment options. Millions of people worldwide suffer with RA, which fuels the ongoing need for long-term immunomodulatory treatment. Strong market penetration is supported by the availability of several biologics and cutting-edge JAK inhibitors, including Humira, Rinvoq, and Olumiant. Adoption of treatment is further accelerated by early diagnosis, more knowledge, and better reimbursement practices.

Moreover, extensive clinical research and frequent product launches sustain innovation in this category. For instance, in October 2025, AbbVie announced that RINVOQ (upadacitinib) outperformed HUMIRA (adalimumab) in the Phase 3b/4 SELECT-SWITCH trial for rheumatoid arthritis, achieving primary and secondary endpoints with no new safety concerns, underscoring its superior efficacy and clinical potential.

Immunology Drugs Market, Geographical Analysis

North America is dominating the global immunology drugs market with a 48.5% in 2024

North America leads the market for immunology medications due to its robust healthcare system, high frequency of autoimmune and inflammatory illnesses, and advanced biologic acceptance. Significant R&D expenditures, a dominant pharmaceutical presence, advantageous reimbursement practices, and an increasing emphasis on customized medicine all contributed to the region's market dominance.

In the USA, the immunology drug market growth was fueled by rising FDA approvals, robust R&D funding, and expanding biotech innovations targeting autoimmune and inflammatory diseases. For instance, in April 2025, Amgen announced that the FDA approved UPLIZNA (inebilizumab-cdon) as the first and only treatment for Immunoglobulin G4-related disease (IgG4-RD). The approval, supported by Breakthrough Therapy Designation, addressed a significant unmet need in this chronic, immune-mediated inflammatory condition affecting multiple organs.

Europe is the second region after North America which is expected to dominate the global immunology drugs market with a 34.5% in 2024

In Europe, due to a strong biotech ecosystem, significant research investments, and an increase in the prevalence of autoimmune and respiratory diseases, the market for immunology medications grew rapidly. Prolonged biologic innovation, favorable regulatory frameworks, and pharmaceutical and biotech company acquisitions all contributed to the region's rapid product development, market expansion, and commercialization.

Moreover, owing to factors like strategic partnerships and acquisitions, pharmaceutical companies, for instance, in July 2025, Sanofi completed the acquisition of Blueprint Medicines, strengthening its position in the immunology and rare disease market. The deal added a marketed therapy, a robust pipeline, and specialized expertise in systemic mastocytosis and KIT-driven diseases, enhancing Sanofi’s capabilities across immunology, allergy, and dermatology segments.

The Asia Pacific region is the fastest-growing region in the global immunology drugs market, with a CAGR of 7.7% in 2024

The market for immunology medications in Asia-Pacific growing fast due to supportive government initiatives, rising healthcare costs, and the prevalence of autoimmune and respiratory disorders. Biotechnology developments, the rising need for focused biologic treatments, and strategic alliances between top pharmaceutical firms in South Korea, China, India, and Japan all contributed to the region's rapid innovation and market expansion.

China’s immunology drug market grew rapidly, driven by increasing NMPA approvals, robust R&D investments, and rising autoimmune disease prevalence. Government healthcare reforms, expanding biotech capabilities, and global-local pharmaceutical collaborations further accelerated innovation, market expansion, and commercialization across the immunology sector. Owing to factors like NMPA approvals, for instance, in March 2025, Innovent Biologics announced that China’s NMPA approved SYCUME (teprotumumab-N01), the country’s first IGF-1R monoclonal antibody, for treating thyroid eye disease. The approval marked a significant milestone in advancing biologic therapies for autoimmune and ophthalmologic disorders in China’s immunology landscape.

Competitive Landscape

Top companies in the immunology drugs market include Eli Lilly and Company, AbbVie Inc., Novartis Pharmaceuticals Corporation, Sun Pharmaceutical Industries, Inc., Johnson & Johnson, Genentech USA, Inc., Bristol-Myers Squibb Company, Sanofi, Pfizer Inc., and GlaxoSmithKline plc, among others.

Eli Lilly and Company: Eli Lilly and Company is a global pharmaceutical leader with a growing focus on immunology drugs, addressing autoimmune and inflammatory diseases. The company’s portfolio includes innovative therapies like Olumiant (baricitinib) and Taltz (ixekizumab), targeting conditions such as rheumatoid arthritis, psoriasis, and atopic dermatitis. Through continuous R&D investment and biologic innovation, Lilly strengthens its global immunology presence.

Key Developments:

- In October 2025, Biogen entered a licensing agreement with Vanqua Bio, securing exclusive global rights to its preclinical oral C5aR1 antagonist. The deal strengthened Biogen’s immunology portfolio by advancing a validated immune pathway with the potential to treat a wide range of inflammatory and autoimmune disorders with unmet medical needs.

- In September 2025, Novartis announced that the FDA approved Rhapsido (remibrutinib) as the first oral Bruton's tyrosine kinase inhibitor (BTKi) for adults with chronic spontaneous urticaria (CSU). The twice-daily pill offers a novel, targeted approach by inhibiting histamine and proinflammatory mediator release in patients unresponsive to antihistamines.

Market Scope

| Metrics | Details | |

| CAGR | 8.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Drug Class | Monoclonal Antibodies, Antibody Drug Conjugates, Immunosuppressive Medication, Interferon and Cytokine Therapies and Others |

| By Indication | Rheumatoid Arthritis, Psoriasis, Inflammatory Bowel Disease, Graft Versus Host Disease and Others | |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global immunology drugs market report delivers a detailed analysis with 62 key tables, more than 54 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here