Healthcare Cloud Computing Market Size & Industry Outlook

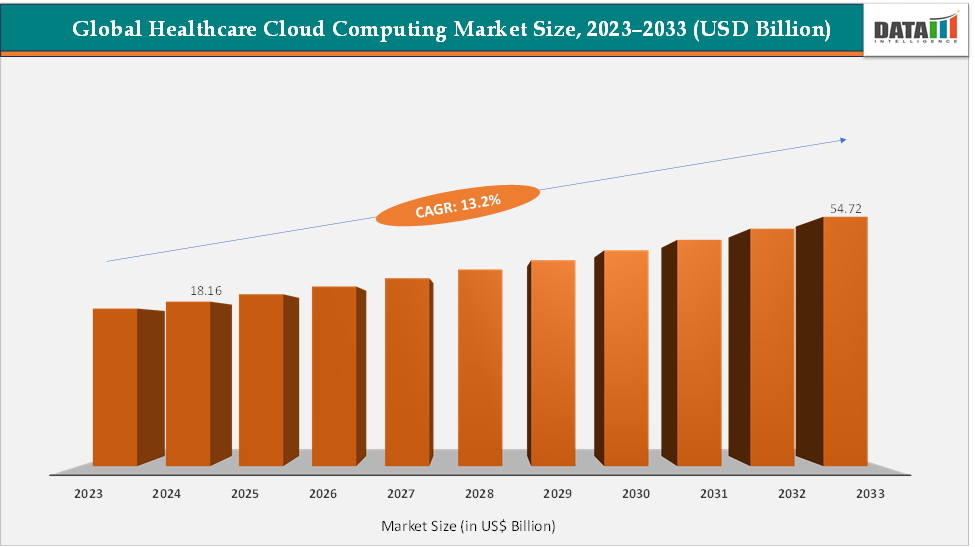

The global healthcare cloud computing market size reached US$ 18.16 Billion in 2024 from US$ 16.20 Billion in 2023 and is expected to reach US$ 54.72 Billion by 2033, growing at a CAGR of 13.2% during the forecast period 2025-2033. The market is experiencing strong expansion as hospitals, clinics, and life sciences companies increasingly migrate to cloud platforms to enhance data accessibility, interoperability, and patient care. The surge in telehealth, remote patient monitoring, and AI-driven analytics has accelerated this shift, enabling providers to manage massive volumes of patient and imaging data more efficiently.

Governments and regulators are also promoting interoperability standards, driving adoption of cloud-based electronic health records and secure data exchanges. Moreover, healthcare organizations are turning to hybrid and multi-cloud architectures to balance compliance, cost, and performance, while major tech providers such as AWS, Microsoft, and Google are launching specialized healthcare clouds to meet stringent security and privacy requirements. Together, these trends are transforming healthcare delivery models, improving collaboration, and fostering innovation across the ecosystem.

Key Market Highlights

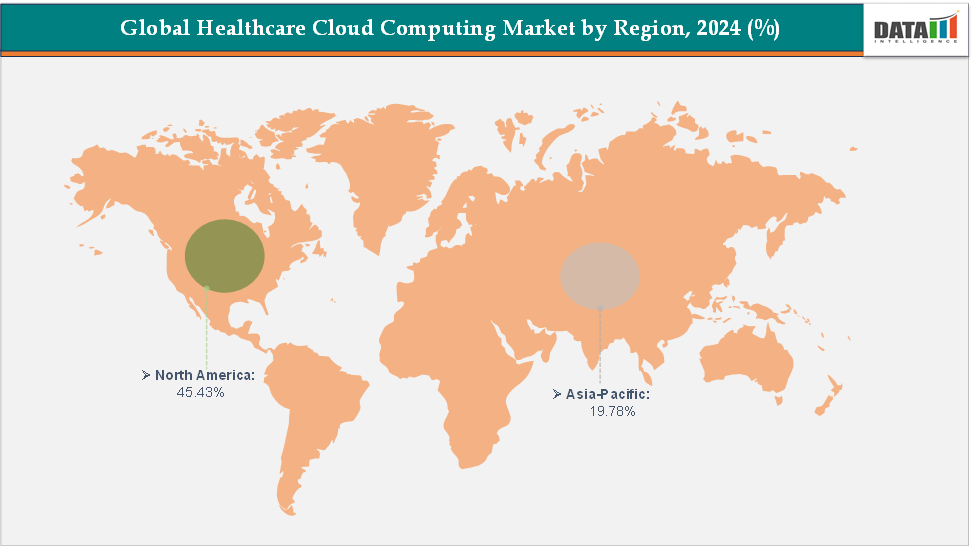

- North America dominates the healthcare cloud computing market with the largest revenue share of 45.43% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 13.7% over the forecast period.

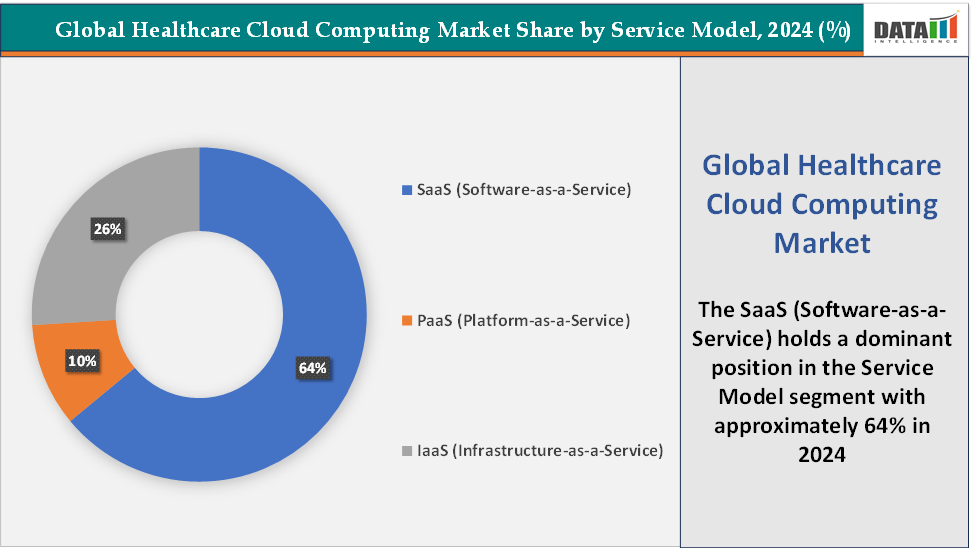

- Based on service model, the SaaS (Software-as-a-Service) segment led the market with the largest revenue share of 64% in 2024.

- The major market players in the healthcare cloud computing market are Amazon Web Services, Inc., Microsoft, Google, Oracle, IBM, Optum, Inc., CareCloud, Inc., athenahealth, Epic Systems Corporation, and Salesforce, Inc., among others

Market Dynamics

Drivers: The explosion of patient-generated data is significantly driving the healthcare cloud computing market growth

The explosion of patient-generated health data is one of the most significant drivers of the healthcare cloud computing market, fundamentally reshaping how healthcare organizations store, manage, and utilize data. With the widespread adoption of wearable devices, mobile health applications, remote monitoring tools, and connected medical devices, patients are now actively contributing vast volumes of health-related information, ranging from daily activity levels and heart rate to glucose readings and post-operative recovery metrics. For instance, smart implants, continuous glucose monitors, and wearable ECG trackers generate high-frequency data that must be captured, stored, and analyzed efficiently.

This massive influx of data necessitates scalable and secure cloud infrastructure capable of handling large, complex datasets while ensuring compliance with regulations like HIPAA and GDPR. Cloud platforms enable real-time access and seamless collaboration among healthcare providers, allowing for personalized care, remote patient monitoring, chronic disease management, and large-scale epidemiological research. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) with cloud systems allows for predictive analytics, early detection of conditions, and decision support, unlocking actionable insights from patient-generated data that were previously impossible to process at scale.

These capabilities not only improve clinical outcomes but also reduce operational inefficiencies, making cloud adoption a strategic imperative. As more patients embrace digital health tools and the volume of patient-generated health data continues to rise, healthcare providers and life sciences organizations increasingly rely on cloud computing solutions to store, process, and analyze this data efficiently, thereby driving robust growth in the healthcare cloud computing market. The convergence of patient empowerment, digital health adoption, and advanced cloud-enabled analytics ensures that patient-generated health data will remain a critical market driver for years to come.

Restraints: Data privacy and regulatory complexity are hampering the growth of the market

Data privacy and regulatory complexity significantly hamper the growth of the healthcare cloud computing market by creating both financial and operational barriers for providers and cloud adopters. Healthcare organizations must navigate stringent frameworks like HIPAA in the U.S. and GDPR in Europe, which impose demanding requirements on data encryption, access controls, breach reporting, and cross-border data transfers.

For instance, according to the HIPAA Journal, in August 2023, 23 million breached healthcare records are noticed. Over the past 12 months, an average of 9,989,003 healthcare records were breached each month. In the year to August 31, 2024, there have been 491 data breaches of 500 or more records, and at least 58,668,002 records are known to have been breached. The average breach size in 2024 is currently 119,487 records and the median breach size is 4,109 records. These regulatory and privacy challenges slow cloud adoption, increase costs, and force many healthcare institutions to delay or limit their migration to cloud platforms until they can more confidently manage the compliance burden.

For more details on this report – Request for Sample

Healthcare Cloud Computing Market, Segment Analysis

The global healthcare cloud computing market is segmented based on component, service model, application, end-user, and region.

Service Model: The SaaS (Software-as-a-Service) segment is dominating and fastest-growing in the healthcare cloud computing market with a 64% share in 2024

The SaaS (Software-as-a-Service) segment is dominating and expanding at the fastest pace in the healthcare cloud computing market because it offers healthcare organizations immediate access to fully managed, subscription-based software without the need for heavy infrastructure, long deployment cycles, or specialized IT teams. Hospitals, clinics, payers, and digital health startups increasingly prefer SaaS solutions for EHR systems, telehealth platforms, medical billing, patient engagement tools, laboratory information systems, and AI-driven clinical decision support because these applications can be rapidly deployed, automatically updated, and scaled on demand.

Growing cost pressures, staffing shortages, and the need to improve operational efficiency further accelerate SaaS adoption, as organizations can shift from high-cost CAPEX models to predictable OPEX subscriptions. The market has also been energized by recent SaaS innovations and launches, for instance, new cloud-native telehealth platforms, AI-enabled clinical documentation SaaS tools, digital patient-experience solutions, and SaaS-based population health analytics suites introduced by major players and emerging health-tech companies.

Additionally, SaaS plays a critical role in supporting regulatory compliance by embedding security controls, HIPAA-aligned configurations, and automated auditing features, reducing the burden on healthcare providers. As health systems increasingly prioritize speed, automation, analytics, and remote-care delivery, SaaS continues to outpace other service models such as PaaS and IaaS, making it the clear engine of growth within the healthcare cloud computing market.

Healthcare Cloud Computing Market, Geographical Analysis

North America is dominating the global healthcare cloud computing market with a 45.43% in 2024

North America dominates the global healthcare cloud computing market due to its advanced healthcare infrastructure, rapid adoption of digital health technologies, and strong presence of major cloud providers like AWS, Microsoft, and Google. The region benefits from high healthcare IT spending, widespread use of EHRs, and supportive regulatory frameworks such as HIPAA and interoperability mandates. Frequent cloud-focused innovations, partnerships, and AI-driven healthcare initiatives further accelerate adoption. As a result, North America continues to lead in both cloud deployment and technological modernization across the healthcare ecosystem.

US Healthcare Cloud Computing Market Trends

The United States dominates the global healthcare cloud computing market due to its advanced digital infrastructure, rapid adoption of health IT, and strong presence of major cloud providers such as AWS, Microsoft Azure, Google Cloud, and IBM. The US healthcare providers are aggressively implementing cloud-based EHRs, telehealth systems, AI-powered analytics, and revenue cycle management tools to address clinical workflow pressures, regulatory demands, and the need for cost-efficient scalability.

The nation is also at the forefront of innovation: Microsoft recently launched Dragon Copilot, an AI-driven clinical assistant built on Nuance technology to automate documentation and reduce physician burnout, while Google Cloud partnered with Adtalem Global Education to create a healthcare AI credentialing program that trains clinicians to use cloud-based AI tools like Gemini and Vertex AI. In addition, frequent investments in cybersecurity, interoperability initiatives like TEFCA, and the push for AI-integrated care models continue to strengthen cloud adoption across U.S. hospitals, payers, and life sciences organizations.

The Asia Pacific region is the fastest-growing region in the global healthcare cloud computing market, with a CAGR of 13.7% in 2024

The Asia-Pacific (APAC) region is the fastest-growing market in global healthcare cloud computing, driven by rapid digital transformation, expanding healthcare infrastructure, and strong government-backed health IT initiatives. Major cloud providers are aggressively scaling infrastructure, Amazon.com Inc. is setting aside another $5 billion for investment in South Korean data centers, sharply ramping up the spending it’s already devoting toward building AI infrastructure in the country.

Countries across APAC are deploying 5G, edge computing, and national digital health platforms, enabling real-time patient monitoring and large-scale health data integration. For instance, India’s Ayushman Bharat Digital Mission and China’s smart-hospital initiatives are driving hospitals to migrate to cloud-based systems to manage population-scale data. With rising chronic disease burdens, increased insurance penetration, and a surge in digital-first healthcare startups, the APAC region continues to outpace all others in healthcare cloud adoption, solidifying its position as the fastest-growing engine of global market expansion.

Europe Healthcare Cloud Computing Market Trends

Europe is becoming one of the most dynamic growth regions in the global healthcare cloud computing market, driven by accelerating digital-health initiatives, strict regulatory frameworks, and major investments in cloud infrastructure. European healthcare systems are increasingly shifting to cloud platforms to handle rising chronic disease burdens, aging populations, and the need for efficient, interoperable digital care pathways. The EU’s stringent GDPR regulations, which mandate robust data privacy and sovereignty standards, are encouraging demand for secure, localized cloud solutions prompting hyperscalers.

For instance, the AWS European Sovereign Cloud is planning to launch its first AWS Region in the State of Brandenburg, Germany by the end of 2025. Available to all AWS customers, this effort is backed by a €7.8B investment in infrastructure, jobs creation, and skills development. The growth is further supported by continent-wide frameworks such as the EU Cloud Code of Conduct, which simplifies GDPR alignment for cloud providers and accelerates adoption by hospitals and payers. Together, rising investment, regulatory clarity, expanding infrastructure, and strong digital-health demand position Europe as a rapidly advancing and increasingly influential region in global healthcare cloud computing.

Healthcare Cloud Computing Market Competitive Landscape

Top companies in the healthcare cloud computing market include Amazon Web Services, Inc., Microsoft, Google, Oracle, IBM, Optum, Inc., CareCloud, Inc., athenahealth, Epic Systems Corporation, and Salesforce, Inc., among others.

Market Scope

| Metrics | Details | |

| CAGR | 13.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Component | Software Solutions and Services |

| Service Model | SaaS (Software-as-a-Service), PaaS (Platform-as-a-Service), and IaaS (Infrastructure-as-a-Service) | |

| Application | Clinical Applications, Analytics & AI/ML, Medical Billing, Healthcare Data Storage, and Others | |

| End-User | Healthcare Providers, Healthcare Payers, Pharmaceuticals and Biotech Companies, and Medical Devices Companies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global healthcare cloud computing market report delivers a detailed analysis with 70 key tables, more than 64 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more healthcare IT-related reports, please click here