Healthcare IT Integration Systems Market Size

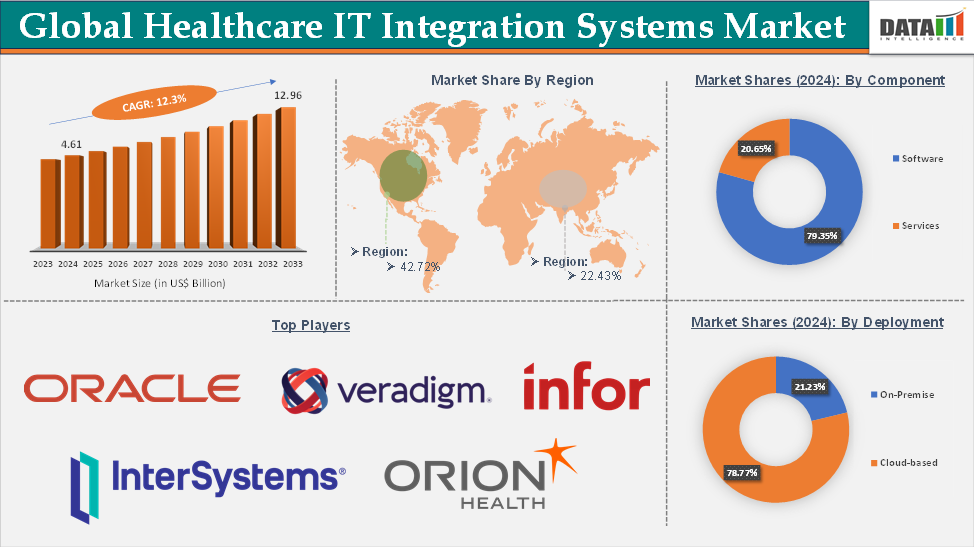

Healthcare IT Integration Systems Market size reached US$ 4.61 Billion in 2024 and is expected to reach US$ 12.96 Billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025-2033.

Healthcare IT Integration Systems Market Overview

The healthcare IT integration systems market is witnessing significant growth driven by the increasing adoption of advanced digital technologies in the healthcare sector aimed at enhancing interoperability, improving patient outcomes, and optimizing operational efficiency. Integration systems play a pivotal role in seamlessly connecting disparate healthcare IT systems such as Electronic Health Records (EHR), Picture Archiving and Communication Systems (PACS), Laboratory Information Systems (LIS), and various medical devices, enabling the smooth exchange of critical clinical and administrative data.

The global healthcare IT integration systems market is fueled by rising demand for unified healthcare IT infrastructures that support data-driven decision-making and regulatory compliance. Increasing healthcare IT investments, the proliferation of cloud-based solutions, and evolving healthcare interoperability standards (such as HL7, FHIR, and DICOM) are key factors propelling market growth.

Executive Summary

For more details on this report – Request for Sample

Healthcare IT Integration Systems Market Dynamics: Drivers & Restraints

The explosion of wearable and remote patient monitoring (RPM) devices is significantly driving the healthcare IT integration systems market growth

The rapid adoption of wearable devices (like smartwatches, fitness trackers) and remote patient monitoring (RPM) tools (such as continuous glucose monitors, blood pressure monitors, and cardiac monitors) is generating vast volumes of real-time health data outside traditional clinical settings. This trend is transforming healthcare from reactive episodic care to proactive, continuous patient management. As the wearable devices trend rises, market players are developing advanced products, which further accelerates the market growth.

For instance, in February 2025, Validic, a leader in healthcare technology innovation, announces the launch of its patent-pending solution, a cutting-edge digital remote patient monitoring (RPM) assistant that harnesses the power of Generative AI (GenAI) to analyze and summarize patient data trends. This first-of-its-kind feature is a new addition to Validic Impact™, the award-winning, EHR-integrated RPM solution. This capability helps healthcare providers quickly gain a more complete understanding of their patients’ health with ease.

Integration systems enable continuous monitoring of patients with chronic conditions like diabetes, heart failure, or hypertension, facilitating early interventions and reducing hospital readmissions. For instance, in March 2025, Prevounce Health announced that patients have transmitted more than 15 million vital readings using the company's Pylo remote patient monitoring (RPM) devices. Pylo RPM devices include blood pressure monitors, weight scales, blood glucose meters, and pulse oximeters.

Each is clinically validated, comes with 5G/4G-LTE cellular connectivity, and seamlessly transmits readings to the Prevounce remote care platform or third-party platforms via API connectivity. These integration systems enable this seamless flow, ensuring clinicians have a holistic, timely view of patient health, boosting the market growth.

Security fatigue and alert overload are hampering the healthcare IT integration systems market's growth

As healthcare IT integration systems connect more devices, applications, and data sources, the number of security alerts and system notifications increases dramatically. This security fatigue, where IT staff and clinicians become overwhelmed by the volume of alerts, leads to slower response times, missed threats, and reduced overall system effectiveness.

Integration systems link multiple endpoints (EHRs, RPM devices, cloud platforms, third-party apps), each generating security and operational alerts. The flood of notifications can desensitize security teams and clinicians, leading to critical issues being overlooked. For instance, in large hospital networks, security teams often face thousands of alerts daily from integrated systems. According to studies, over 50% of security alerts in healthcare are false positives, which contributes to fatigue and inefficient resource allocation.

Healthcare IT Integration Systems Market, Segment Analysis

The global healthcare IT integration systems market is segmented based on component, deployment mode, end-user, and region.

The software from the component segment is expected to hold 79.35% of the market share in 2024 in the healthcare IT integration systems market

Software products like integration engines and middleware platforms are essential to connect Electronic Health Records (EHRs), medical devices, lab systems, and other healthcare applications. These tools translate data formats, enforce standards (HL7, FHIR), and facilitate real-time data flow. These integration engines, such as Rhapsody (Orion Health) or Corepoint, act as the “traffic controllers” between EHRs, lab systems, imaging archives, and third-party apps. Hospitals rely on these engines to normalize HL7, FHIR, DICOM, and proprietary device data in real time, making them indispensable.

Software forms the backbone of healthcare IT integration, enabling seamless, standardized data exchange across complex healthcare ecosystems. Its flexibility, essential functionality, and continuous innovations and development by market players make the software segment the dominant force driving market growth.

For instance, in January 2025, IntelligentDX launched its revolutionary AI-based deep learning software designed to optimize Electronic Health Records (EHR) and Electronic Medical Records (EMR) systems. This cutting-edge solution aims to streamline operations, enhance revenue cycle management (RCM), and significantly reduce insurance claim rejections and denials, positioning IntelligentDX as a game-changer in the healthcare IT landscape. These novel software advancements are accelerating the segment's growth.

Healthcare IT Integration Systems Market, Geographical Analysis

North America is expected to dominate the global healthcare IT integration systems market with a 42.72% share in 2024

North America, particularly the United States, spends more on IT per capita than any other country, and Canada similarly invests heavily in digital health. This depth of spending supports large-scale roll-outs of integration engines and middleware, from on-premise solutions to enterprise-grade cloud platforms. For instance, based on data from more than 5,000 U.S. hospitals in HospitalView, the average hospital IT expense for U.S. hospitals in 2023 was $9.51 million. When factoring in IT expenses from 2017 – 2023, the average hospital IT operating expense was about $7.97 million.

Key players such as Epic, InterSystems, and other emerging players all have headquarters or major R&D operations in North America. Their proximity to large health systems accelerates product development and real-world testing. For instance, in August 2024, US-based Carematix unveiled its Cellular Weight Scale, a new remote patient monitoring (RPM) weight scale that tracks and shares patient weight measurements with healthcare professionals in real time. The scale is intended to help monitor weight fluctuations in patients with chronic conditions such as heart disease, diabetes, and obesity, and assist healthcare professionals in developing personalised patient care plans.

Healthcare IT Integration Systems Market Top Companies

Top companies in the healthcare IT integration systems market include Oracle, Rhapsody, Veradigm, Infor, InterSystems Corporation, Orion Health Group of Companies, Epic Systems Corporation, NextGen Healthcare, iNTERFACEWARE Inc., and Harmony Healthcare IT, among others.

Market Scope

Metrics | Details | |

CAGR | 12.3% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Component | Software and Services |

Deployment Mode | On-Premise and Cloud-based | |

End-User | Hospitals, Clinics and Diagnostic Centers, Pharmaceutical Companies, Research Institutes, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global healthcare IT integration systems market report delivers a detailed analysis with 62 key tables, more than 52 visually impactful figures, and 147 pages of expert insights, providing a complete view of the market landscape.