Healthcare IT Outsourcing Market Size

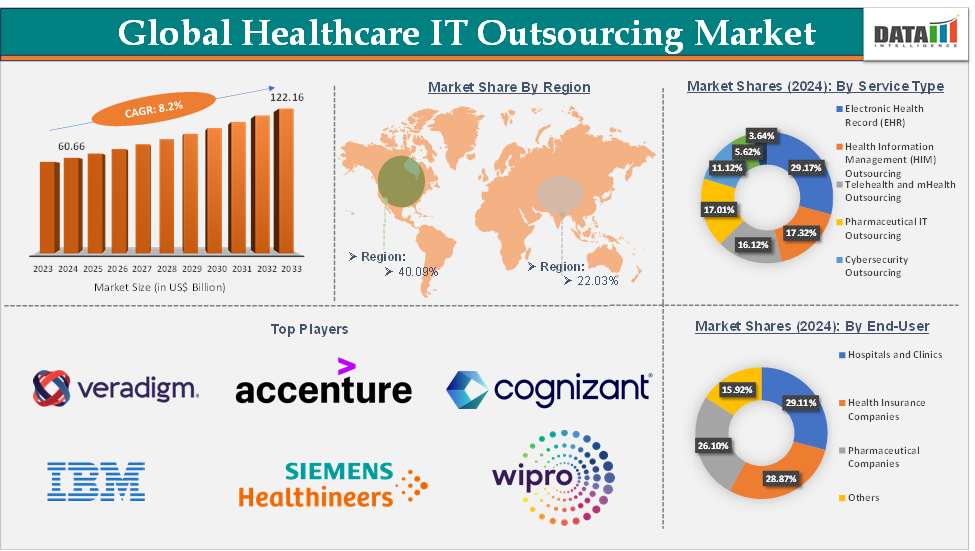

Healthcare IT Outsourcing Market size reached US$ 60.66 Billion in 2024 and is expected to reach US$ 122.16 Billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025-2033.

Healthcare IT Outsourcing Market Overview

The healthcare IT outsourcing market is poised for significant growth, driven by the need for digital transformation, regulatory compliance, and cost efficiency in healthcare delivery. While challenges such as data security and integration complexities exist, the opportunities presented by telemedicine, emerging markets, and advancements in AI and big data analytics offer promising avenues for growth. Healthcare organizations are increasingly turning to specialized IT outsourcing providers to navigate these complexities and enhance their service delivery.

The market is characterized by the presence of several key players, including Accenture, IBM, Cognizant, TATA Consultancy Services Limited, Infosys Limited, Wipro, and HCL Technologies. These companies offer a range of IT outsourcing services, including EHR management, cybersecurity, and cloud-based solutions, catering to the diverse needs of healthcare organizations.

Executive Summary

For more details on this report – Request for Sample

Healthcare IT Outsourcing Market Dynamics: Drivers & Restraints

Increasing demand for remote patient monitoring solutions is significantly driving the healthcare IT outsourcing market growth

Remote patient monitoring (RPM) solutions rely heavily on advanced technologies like AI and big data analytics to interpret patient data and generate actionable insights. Outsourcing these technology-intensive services allows healthcare providers to focus on patient care while leveraging specialized expertise in data processing, machine learning models, and cloud-based infrastructure.

A healthcare provider may outsource the integration of their RPM systems with cloud services or telemedicine platforms to a company like Accenture or Cognizant, which can manage large volumes of data and provide the necessary scalability and security.

RPM enables healthcare providers to monitor patients remotely and intervene early if necessary, which can lead to improved health outcomes and reduced hospital readmission rates. However, managing and analyzing the massive data streams generated by RPM devices is complex and requires robust IT solutions. This need for efficient data management and secure storage is driving healthcare providers to outsource these IT functions to companies with expertise in data analytics, cloud solutions, and patient management systems. Providers like Tata Consultancy Services (TCS) and Wipro help healthcare organizations integrate remote monitoring tools and analyze patient data to enhance patient care.

Security and privacy concerns are hampering the market growth

Healthcare organizations deal with sensitive patient information, including personal and medical records. A security breach leading to the unauthorized access or theft of this data can erode trust in outsourcing services. Clients may become reluctant to outsource critical IT functions if there are concerns about the safety and confidentiality of patient information.

For instance, according to the HIPAA Journal, in March 2025, 1,754,097 individuals had their protected health information exposed, stolen, or impermissibly disclosed in a healthcare data breach. Healthcare is subject to various regulations and compliance standards (e.g., HIPAA in the United States). This security breach could lead to non-compliance, resulting in legal consequences and financial penalties. Thus, security threats restrain the market growth.

Healthcare IT Outsourcing Market Segment Analysis

The global healthcare IT outsourcing market is segmented based on service type, end-user, and region.

Service Type:

The electronic health records from the service type segment are expected to hold 29.17% of the market share in 2024 in the healthcare IT outsourcing market

EHR systems require ongoing maintenance, updates, and technical support. Outsourcing providers can offer 24/7 support services, ensuring that healthcare organizations have continuous access to their EHR systems and addressing any issues promptly. Outsourcing EHR-related services can provide cost efficiencies for healthcare organizations. Instead of investing heavily in in-house IT infrastructure and personnel, organizations can leverage the expertise of outsourcing providers, potentially reducing overall IT costs.

The rising development of technologically advanced electronic health records helps boost the segment growth. For instance, in May 2025, Veradigm, a provider of healthcare data and technology solutions, announced a significant advancement in the application of artificial intelligence (AI) to scale the generation of real-world evidence for the increasingly prevalent GLP-1 receptor agonists (GLP-1 RAs), including widely used medications like semaglutide and tirzepatide. By deploying AI algorithms on de-identified electronic health record (EHR) data within the extensive Veradigm Network, researchers can now efficiently surface rich, contextual insights.

As healthcare organizations continue to rely on EHRs to manage patient information effectively, the demand for outsourcing EHR-related IT functions is expected to remain high. The need for expertise in maintaining, securing, and integrating EHR systems has positioned outsourcing providers as essential partners in the healthcare industry's digital transformation.

Healthcare IT Outsourcing Market Geographical Analysis

North America is expected to dominate the global healthcare IT outsourcing market with a 40.09% share in 2024

North America, particularly the United States, has one of the largest and most complex healthcare markets globally. With numerous hospitals, clinics, insurance companies, and healthcare systems, there is a substantial demand for IT solutions to manage patient data, streamline operations, and comply with regulatory standards.

To handle the growing complexity of healthcare delivery, organizations in the U.S. and Canada frequently outsource IT functions such as electronic health records (EHR) management, revenue cycle management (RCM), cybersecurity, and data analytics. These services are critical to optimizing operations, reducing costs, and ensuring compliance with healthcare regulations.

For instance, companies like Cerner, McKesson, and other market players have established a strong presence in North America, offering comprehensive IT outsourcing solutions, including EHR system management, telemedicine solutions, and healthcare data analytics.

North America is a leader in the adoption of digital health technologies, including Electronic Health Records (EHR), telemedicine, artificial intelligence (AI), and health data analytics. Healthcare providers are increasingly adopting these technologies to enhance patient care and streamline operations.

The complexity of integrating and maintaining these technologies drives healthcare organizations to outsource IT functions to specialized providers who can manage and innovate on their behalf. IT outsourcing helps healthcare providers stay on the cutting edge of digital health innovations without bearing the full cost of internal IT infrastructure.

Healthcare IT Outsourcing Market Top Companies

Top companies in the healthcare IT outsourcing market include Veradigm LLC, Accenture Plc, Cognizant, IBM, Siemens Healthineers, Dell Inc., HCL Technologies Limited, Infosys Limited, TATA Consultancy Services Limited, and Wipro Limited, among others.

Market Scope

| Metrics | Details | |

| CAGR | 8.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Service Type | Electronic Health Record (EHR), Health Information Management (HIM) Outsourcing, Telehealth and mHealth Outsourcing, Pharmaceutical IT Outsourcing, Cybersecurity Outsourcing, Consulting and Advisory Services, and Others |

| End-User | Hospitals and Clinics, Health Insurance Companies, Pharmaceutical Companies, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global healthcare IT outsourcing market report delivers a detailed analysis with 54 key tables, more than 47 visually impactful figures, and 147 pages of expert insights, providing a complete view of the market landscape.