Population Health Management Market Size & Industry Outlook

The Population Health Management (PHM) market is witnessing rapid growth driven by the rising use of cloud-based analytics and interoperable healthcare systems. Cloud platforms facilitate the smooth integration of data from electronic health records, claims, and remote monitoring devices, enabling providers to obtain real-time insights into patient demographics. Interoperable systems further improve data exchange among hospitals, clinics, and insurers, promoting coordinated care delivery.

At the same time, the global transition towards value-based care and risk-sharing reimbursement models is prompting healthcare organizations to invest in PHM solutions that enhance patient outcomes while managing costs. By merging advanced analytics with these evolving care models, providers can pinpoint high-risk populations, optimize interventions, and improve overall healthcare efficiency, propelling market growth on a global scale.

Key Highlights

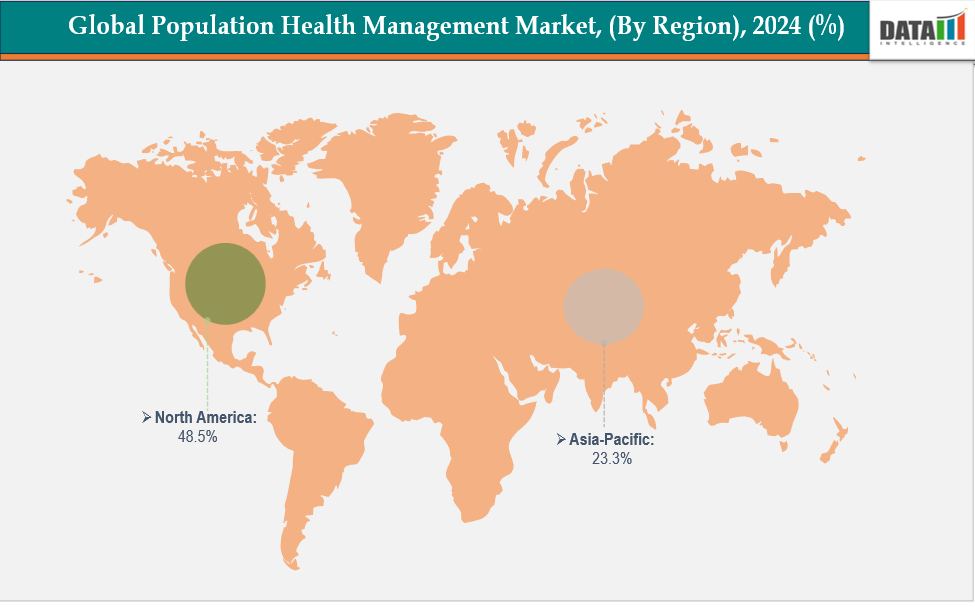

- North America is dominating the global population health management market with the largest revenue share of 48.5% in 2024.

- The Asia Pacific region is the fastest-growing region in the global population health management market, with a CAGR of 7.7% in 2024.

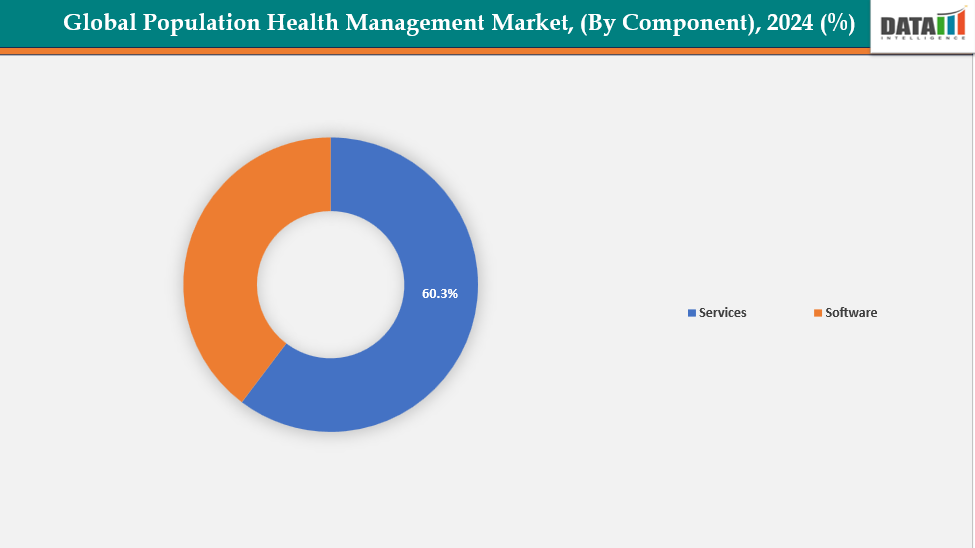

- The services segment is dominating the population health management market with a 60.3% share in 2024

- The cloud-based solutions are dominating the population health management market with a 58.3% share in 2024

- Top companies in the population health management market include Oracle, Veradigm LLC, Conifer Health Solutions, Epic Systems Corporation, Health Catalyst, Koninklijke Philips N.V., Optum, Inc., Verisk Analytics, Inc., Innovaccer, Inc., and Medecision, among others.

Market Dynamics

Drivers: Technology advances are accelerating the growth of the population health management market

Technological innovations are significantly accelerating the expansion of the population health management (PHM) industry. Cloud technology provides secure and scalable solutions for storing and accessing patient data in real-time. Big data analysis aids in identifying populations at risk and forecasting health outcomes. Artificial intelligence and machine learning improve decision-making by automating processes for risk stratification and care suggestions. Interoperable electronic health records (EHRs) facilitate smooth data sharing among healthcare providers. Remote monitoring tools and telehealth services enhance access to healthcare and allow for ongoing management of chronic diseases.

Owing to the factors like artificial intelligence and machine learning, for instance, in February 2024, Persistent Systems launched a generative AI-powered Population Health Management solution with Microsoft, leveraging Azure OpenAI Service to analyze social determinants of health, predict care costs, and enhance value-based, patient-centered healthcare delivery for improved outcomes.

Data privacy, security, and compliance concerns are hampering the growth of the population health management market

Concerns regarding data privacy, security, and compliance are anticipated to hinder the expansion of the population health management (PHM) market. PHM systems process significant quantities of sensitive patient information from various sources, rendering them attractive targets for cyber threats and data breaches. Strict regulations such as HIPAA, GDPR, and other national data protection laws create substantial compliance obligations, driving up costs and adding complexity for both vendors and healthcare providers. Numerous organizations do not have adequate cybersecurity measures in place or sufficient trained personnel to protect this information.

For instance, in February 2024, Change Healthcare suffered a significant ransomware attack that was identified on February 21. The company subsequently verified that cybercriminals had infiltrated its systems, stealing data that impacted more than 190 million people, marking it as one of the largest breaches in the healthcare sector. The hackers gained access through an unprotected Citrix remote access service.

For more details on this report, see Request for Sample

Population Health Management Market, Segment Analysis

The global population health management market is segmented based on component, mode of delivery, end-user, and region

By Component: The services segment is dominating the population health management market with a 60.3% share in 2024

The services sector holds a leading position in the global Population Health Management (PHM) market, accounting for 60.3% of the share in 2024. This growth is fueled by a rising need for implementation, consulting, and data integration services as healthcare organizations navigate intricate IT infrastructures and face interoperability issues. Many hospitals and payers opt to outsource to specialized service providers for system deployment, maintenance, and analytics support, which alleviates internal workload and lowers operational expenses.

Moreover, the transition to value-based care models necessitates ongoing technical assistance and the introduction of new service-oriented solutions, which in turn increases service demand. For instance, in September 2025, the PHMI Platform was successfully adopted by several community health centers, including East Valley, Via Care, APLA Health, Northeast Valley, Mendocino, and Omni Family Health, enhancing care quality, equity, and integration with existing health IT solutions.

By Mode of Delivery: The cloud-based solutions are dominating the population health management market with a 58.3% share in 2024

Cloud-based solutions are leading the Population Health Management (PHM) market due to their scalability, flexibility, and cost-effectiveness over traditional on-premise systems. They facilitate effortless data sharing, provide real-time analytics, and enhance interoperability among various healthcare organizations. Cloud platforms lower infrastructure expenses and streamline the integration of electronic health records (EHRs), claims, and data from remote monitoring. They enable extensive data aggregation and AI-driven insights that are crucial for analyzing population-level health.

Moreover, the strategic efforts of companies to provide cloud-based service models equip healthcare providers with scalable, integrated, and economical solutions for managing population health. For instance, in March 2024, Oracle enhanced its Oracle Health Data Intelligence platform by introducing a generative AI service that improved care management efficiency, enabling healthcare and government stakeholders to leverage cloud-based analytics for smarter, data-driven healthcare operations.

Population Health Management Market, Geographical Analysis

North America is dominating the global population health management market with 48.5% in 2024

North America leads the population health management (PHM) market, due to its sophisticated healthcare framework, high acceptance of digital health technologies, and the prompt implementation of value-based care approaches. The region's dominance is further bolstered by favorable government policies, significant investments in research and development, extensive electronic health record (EHR) usage, and the availability of top PHM solution providers.

In the United States, the market for population health management is growing rapidly due to government backing for value-based care, new launches of advanced analytics software, and an increase in service offerings aimed at cloud-based PHM. For instance, in January 2025, Percipio Health, a Plano, Texas-based startup, launched its AI-powered Population Health Monitoring Platform, aimed at reducing healthcare costs and improving outcomes. The platform utilized artificial intelligence and smartphone-based technology to effectively manage growing populations with rising and high-risk health needs across the United States.

Europe is the second region after North America, which is expected to dominate the global population health management market with 34.5% in 2024

The market for population health management in Europe has expanded, driven by the growing number of chronic diseases, greater acceptance of digital health technologies, and an evolving healthcare IT framework. Government initiatives that support the sector, investments in data integration, and the early adoption of value-based care models have also improved patient outcomes and increased the efficiency of healthcare services.

In addition, the acceleration of market growth throughout Europe was driven by strategic alliances and partnerships focused on population health management. For instance, in June 2025, Hims & Hers Health, Inc. announced its acquisition of ZAVA, a leading European digital health platform. This strategic move expanded the company’s presence across the UK, Germany, France, and Ireland, accelerating its global vision to deliver seamless, personalized healthcare experiences worldwide.

The Asia-Pacific region is the fastest-growing region in the global population health management market, with a CAGR of 7.7% in 2024

The market for population health management in the Asia-Pacific region, encompassing China, Japan, South Korea, and India, has experienced swift expansion due to improvements in healthcare infrastructure, a rise in chronic diseases, greater government endorsement of digital health, a wider acceptance of cloud-based analytics, and joint initiatives aimed at enhancing data-driven, value-oriented healthcare service delivery.

China's market for population health management has experienced significant growth, fueled by the rise in chronic diseases, the introduction of new applications, software, and services, the enhancement of healthcare IT infrastructure, substantial investments in research and development, and a growing acceptance of AI-based, cloud-oriented population health analytics and management solutions. Owing to the factors like launching new apps, software, and services, for instance, in October 2025, Ant Group’s AI healthcare platform, AQ, became one of China’s top seven AI-native apps and the leading healthcare app, achieving an impressive 83.4% compound growth rate and launching new features for chronic disease and elderly care management.

Population Health Management Market Competitive Landscape

Top companies in the population health management market include Oracle, Veradigm LLC, Conifer Health Solutions, Epic Systems Corporation, Health Catalyst, Koninklijke Philips N.V., Optum, Inc., Verisk Analytics, Inc., Innovaccer, Inc., and Medecision, among others.

Oracle: Oracle Corporation, through its healthcare division Oracle Health (formerly Cerner), is a key player in the Population Health Management (PHM) market. The company offers cloud-based analytics and data intelligence solutions that integrate electronic health records, clinical data, and social determinants of health to enhance care coordination, improve outcomes, support value-based care models, and enable data-driven healthcare transformation globally.

Key Developments:

- In October 2025, the Department of Health Abu Dhabi, in collaboration with Microsoft, unveiled the world’s first AI-powered Population Health Intelligence platform at GITEX Global 2025, marking a milestone in transforming healthcare from reactive treatment to proactive, data-driven population health management across the emirate.

- In July 2025, Nordic Capital entered a strategic partnership with Arcadia, becoming its majority owner to accelerate data-driven healthcare innovation. The collaboration aimed to advance Arcadia’s mission of transforming healthcare sustainability through predictive insights, AI-powered analytics, and actionable intelligence for improved population health outcomes.

Market Scope

| Metrics | Details | |

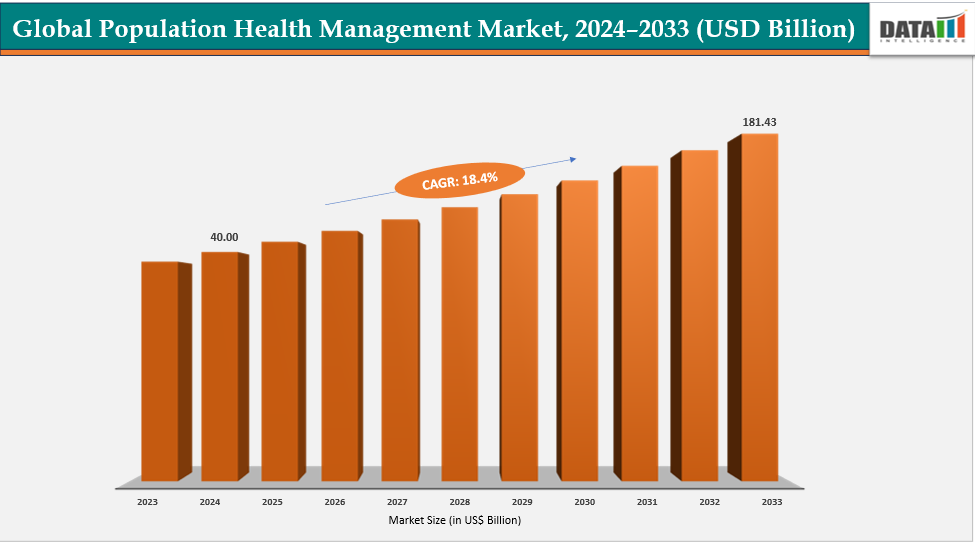

| CAGR | 18.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Component | Services, Software |

| By Mode of Delivery | Cloud-based solutions, On-Premise solutions | |

| By End-User | Healthcare Providers, Healthcare Payers, Employer Groups, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global population health management market report delivers a detailed analysis with 62 key tables, more than 53 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more healthcare IT-related reports, please click here