Market Overview

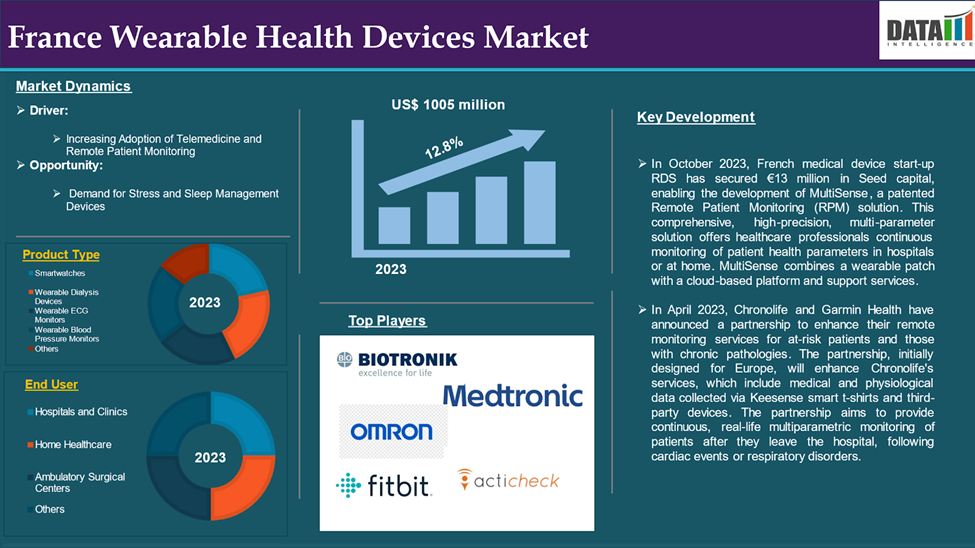

The France wearable health devices market reached US$ 1005 million in 2023 and is expected to reach US$ 2641.2 million by 2031, growing at a CAGR of 12.8% during the forecast period 2024-2031.

Wearable health devices, including fitness trackers, smartwatches, and medical wearables, are advanced technologies that monitor and track health parameters in real time. They measure vital signs like heart rate, blood pressure, glucose levels, sleep patterns, and physical activity. With advanced sensors, Bluetooth and Wi-Fi connectivity, and mobile app integration, these devices provide actionable health insights. Originally popular in fitness and wellness, they have expanded into clinical applications, enabling remote patient monitoring, chronic disease management, and telemedicine.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Increasing Adoption of Telemedicine and Remote Patient Monitoring

With the introduction of telemedicine and remote patient monitoring, France has witnessed increasing adoption of wearable health devices, emphasized by the need for increased accessibility and efficient healthcare facilities. Wearable devices such as smartwatches, fitness bands, and dedicated wearables facilitate constant vital signs monitoring, including heart rate, oxygenation, glucose, and physical activity.

This creates a stream of data between the patient and the healthcare service provider to diagnose and intervene accurately and more timely. In a country like France where certain areas have limited access to healthcare facilities, wearables have made it possible for patients to hold remote consultations or manage chronic illnesses.

In general, the steady rise in adoption of telemedicine as a result of the COVID-19 pandemic underlies the significance of wearable technology anchoring hospital visits and virtual care. With the convergence of state technological 5G and IoT connectivity transformed lives by creating government incentives to embrace digitized modes of healthcare in the future, this made it prominent and inevitable that these wearable health devices would be used widely in telemedicine applications and transform the French landscape.

For instance, in March 2024, RDS, a medical device start-up, has received the CE mark for its wearable solution, MultiSense, for continuous Remote Patient Monitoring. This class IIa medical device certification, in compliance with EU Regulation 2017/745, is a significant regulatory milestone for the company. Stéphanie Hilbold, director of quality assurance and regulatory affairs at RDS, praised the hard work of the technical development teams and the collaboration with the RDS department for quality assurance and regulatory affairs.

Privacy and Data Security Concerns

Privacy and data security concerns are key restrictions in the France wearable health devices market. As wearable health devices potentially collect personal and sensitive data, including vital signs, glucose levels, and patterns of physical activity, the chances of a data breach or unauthorized access add serious challenges. These concerns intensified with various data protection laws in France, such as the General Data Protection Regulation (GDPR), requiring manufacturers to guarantee strong measures for data security. The insolvency of loss incurred in legal and financial terms intimidates smaller companies to enter the market. Further hampering adoption of the devices, despite the potential benefits of their use on health, are consumer fear of sharing health data with third parties. It is, therefore, very crucial to attend to such privacy issues, as this would be the key to the private growth of the wearable health devices market in France.

Market Segment Analysis

The France wearable health devices market is segmented based on product type, application and end user.

Product Type:

Continuous glucose monitoring devices segment is expected to dominate the wearable health devices market share

The continuous glucose monitoring devices segment holds a major portion of the wearable health devices market share and is expected to continue to hold a significant portion of the wearable health devices market share during the forecast period.

In France, Continuous Glucose Monitoring devices are vital equations in the wearable health devices market. This is supported largely by increasing diabetes prevalence and more emphasis on proactive healthcare. It allows real-time access to such actions like blood sugar level tracking that will improve the efficacy of managing blood sugar levels while reducing complications related to diabetes. Improvements in sensor technology, improved accuracy of devices, and the connecting with smartphones and wearable platforms are also encouraging adoption, together with enhanced use and patient adherence.

In addition, the introduction of several government initiatives to promote diabetes management and generating awareness among consumers regarding health monitoring would further drive the CGM market in France's wearable health sector.

For instance, in June 2024, Insulet Corporation, a global leader in tubeless insulin pump technology, has announced the availability of the Omnipod 5 Automated Insulin Delivery System (Omnipod 5). The system will be available in France with Dexcom G6 compatibility, and in the U.S., the full commercial launch of the Omnipod 5 with Dexcom G7 integration will begin, along with the limited market release of the Omnipod 5 App for iPhone.

Hospitals and clinics segment is the fastest-growing segment in the wearable health devices market share

The hospitals and clinics segment is the fastest-growing segment in the wearable health devices market share and is expected to hold the market share over the forecast period.

Hospitals and clinics will be important factors of adoption and further integration of wearable health devices within the health system in France, since they will capture patients towards the use of wearable devices for their health conditions.

Most of them would regularly use these devices to monitor their patients so that they can help manage chronic conditions like cardiovascular diseases, diabetes, and respiratory disorders. Real-time personal mind data available from the wearable health device helps healthcare providers impart timely and meaningful treatment while lowering frequent hospital admissions, thereby driving better treatment outcomes.

Hospitals and clinics are also increasingly using wearables for remote patient monitoring and telemedicine services, broadening their scope of use. Digital health reform in the French healthcare system, which is currently being backed by government funding and programs, makes hospitals and clinics the most important actors in the adoption of wearable devices in health.

Market Competitive Landscape

The major Japan players in the wearable health devices market include Medtronic plc, Withings, Acticheck Ltd, Garmin Ltd, Fitbit (Google), Apple Inc., Samsung Electronics Co., Ltd., Polar Electro, Biotronik SE & Co. KG, OMRON Healthcare Europe among others.

Emerging Players

The emerging players in the wearable health devices market include PKvitality, MyVitali, BioSerenity, Hexoskin, Sensoria Health and among others.

| Metrics | Details | |

| CAGR | 12.8% | |

| Market Size Available for Years | 2022-2031 | |

| Estimation Forecast Period | 2024-2031 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Product Type | Continuous Glucose Monitoring Devices, Smartwatches, Wearable Dialysis Devices, Wearable ECG Monitors, Wearable Blood Pressure Monitors, Others |

| Application | Chronic Disease Management, Diabetes, Cardiovascular Diseases, Respiratory Disorders, Others | |

| End User | Hospitals and Clinics, Home Healthcare, Ambulatory Surgical Centers, Others | |

Key Developments

- In October 2023, French medical device start-up RDS has secured €13 million in Seed capital, enabling the development of MultiSense, a patented Remote Patient Monitoring (RPM) solution. This comprehensive, high-precision, multi-parameter solution offers healthcare professionals continuous monitoring of patient health parameters in hospitals or at home. MultiSense combines a wearable patch with a cloud-based platform and support services.

- In April 2023, Chronolife and Garmin Health have announced a partnership to enhance their remote monitoring services for at-risk patients and those with chronic pathologies. The partnership, initially designed for Europe, will enhance Chronolife's services, which include medical and physiological data collected via Keesense smart t-shirts and third-party devices. The partnership aims to provide continuous, real-life multiparametric monitoring of patients after they leave the hospital, following cardiac events or respiratory disorders.

Why Purchase the Report?

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.

The France wearable health devices market report would provide approximately 70 tables, 65 figures, and 184 pages.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.