Epilepsy Monitoring Devices Market Size and Trends

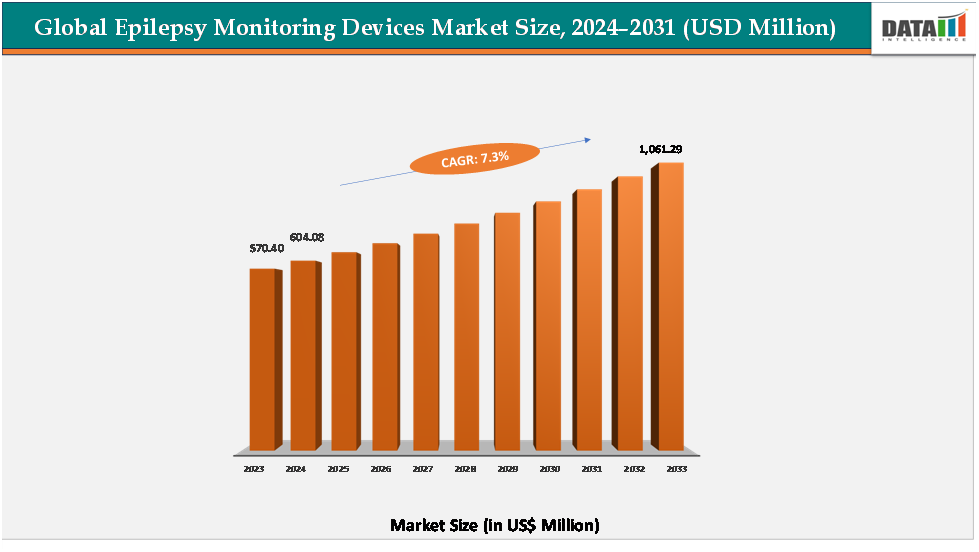

The global epilepsy monitoring devices market reached US$ 570.40 million in 2023, with a rise to US$ 604.08 million in 2024, and is expected to reach US$ 1,061.29 million by 2033, growing at a CAGR of 7.3% during the forecast period 2025–2033.

The growing prevalence of epilepsy and the rising need for continuous, accurate monitoring are driving the rapid adoption of epilepsy monitoring devices, enabling earlier diagnosis, better seizure management, and improved patient outcomes. By providing real-time data, enhancing diagnostic precision, and supporting remote monitoring, these devices are transforming clinical workflows and reducing the burden on specialized epilepsy centers. With advancements in wearable technology, AI integration, and cloud connectivity, epilepsy monitoring devices are becoming an essential component of modern neurological care, supporting personalized treatment strategies and broader healthcare initiatives focused on digital health and patient-centric management.

Key Market highlights

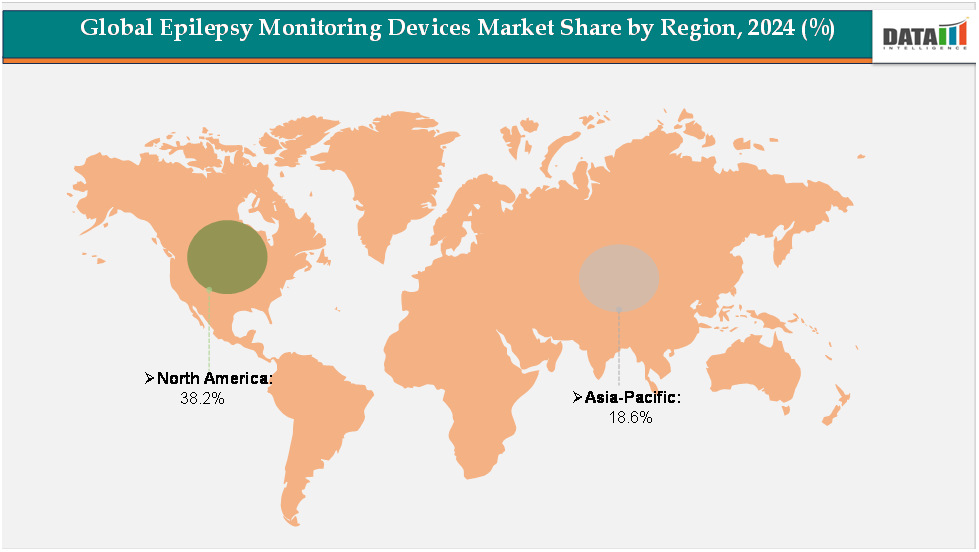

North America dominates the market with a 38.2% revenue share, supported by advanced healthcare infrastructure, high epilepsy diagnosis rates, established reimbursement policies, and the strong presence of leading medical device manufacturers.

Asia-Pacific is emerging as the fastest-growing region with an 18.6% share, driven by a large patient pool, expanding healthcare systems, rising awareness of epilepsy, and increasing adoption of wearable and ambulatory monitoring devices in countries such as China and India.

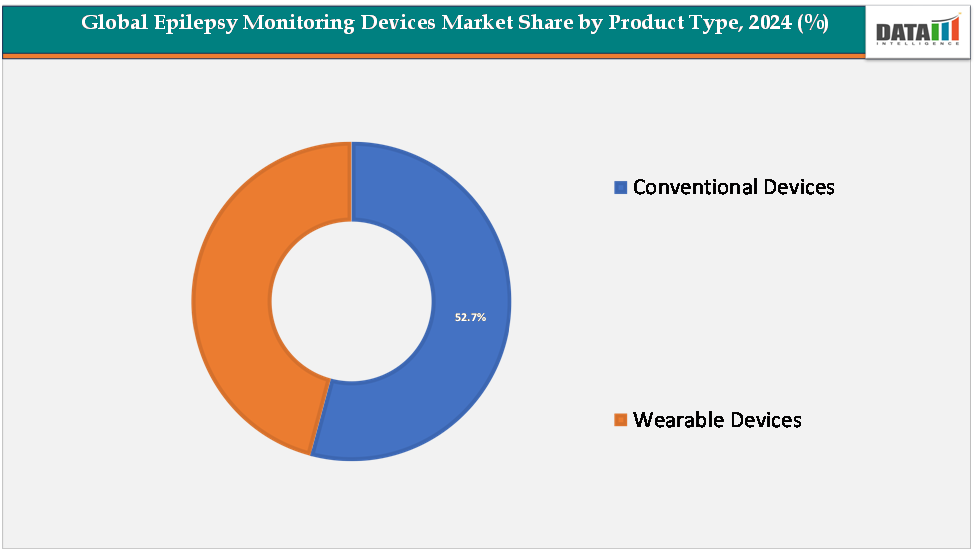

The conventional devices segment leads the market with a 52.7% share, reflecting their clinical reliability, proven diagnostic accuracy, and continued preference among hospitals and epilepsy monitoring units (EMUs) as the gold standard for seizure evaluation and management.

Market Size & Forecast

2024 Market Size: US$604.08Million

2033 Projected Market Size: US$1,061.29 Million

CAGR (2025–2033): 7.3%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Drivers & Restraints

Driver: Rising epilepsy prevalence & diagnosis rates

As epilepsy’s global burden continues to grow, so does the need for accurate diagnosis and continuous monitoring. For instance, according to the World Health Organization, Epilepsy is a chronic, non-communicable brain disorder that can affect individuals of all ages. Globally, it impacts around 50 million people, making it one of the most widespread neurological conditions. Nearly 80% of those with epilepsy reside in low- and middle-income countries, where access to care remains limited. Importantly, studies suggest that up to 70% of patients could achieve a seizure-free life with accurate diagnosis and appropriate treatment.

These rising numbers mean a larger population requires diagnosis (EEG, imaging) and ongoing monitoring (ambulatory EEGs, seizure detection devices, implantable) to manage seizures, tailor treatment, and reduce risks. As awareness improves and more people are diagnosed, demand for advanced monitoring devices and related services increases sharply.

Restraint: Regulatory pathways & clinical validation requirements

Regulatory pathways and clinical validation requirements can significantly hamper the growth of the Epilepsy Monitoring Devices Market because these devices deal directly with neurological health, where accuracy, safety, and reliability are paramount. To secure approvals from agencies like the U.S. FDA or European CE, companies must conduct extensive clinical trials to demonstrate not only device efficacy but also long-term safety, data accuracy, and low false-positive/false-negative rates in seizure detection. This process is time-consuming and costly, often requiring multicenter trials and large patient cohorts.

For more details on this report, Request for Sample

Segmentation Analysis

The global epilepsy monitoring devices market is segmented by product type,end-user, and region.

Product Type:

The conventional devices segment is estimated to have 52.7% of the epilepsy monitoring devices market share.

Conventional devices such as video-EEG monitoring systems, in-hospital EEG units, and ambulatory EEGs remain the dominant segment in the epilepsy monitoring devices market. This dominance is primarily due to their long-standing clinical acceptance, proven diagnostic accuracy, and established reimbursement pathways in many regions. Hospitals and epilepsy monitoring units (EMUs) continue to rely on these systems as the gold standard for precise seizure detection, classification, and surgical evaluation. Their ability to provide synchronized video and EEG data offers a comprehensive picture of seizure activity, which is essential for accurate diagnosis and pre-surgical planning.

Moreover, clinicians are more comfortable with conventional devices since they have decades of validation, making them the first choice in both developed and emerging healthcare systems. Despite the higher costs and infrastructure requirements, the strong reliability, regulatory approvals, and established clinical workflows of conventional EEG monitoring ensure their continued dominance in the market.

The wearable devices segment is estimated to have 47.3% of the epilepsy monitoring devices market share.

Wearable epilepsy monitoring devices are the fastest-growing segment, propelled by technological advances, patient convenience, and the shift toward remote healthcare. Wearables such as wristbands, headbands, smartwatches, and implantable neurostimulator devices are gaining momentum because they allow continuous, real-time monitoring outside hospital settings, reducing the need for costly and inconvenient inpatient admissions. Their integration with AI algorithms, cloud-based platforms, and telemedicine enables early seizure detection, predictive analytics, and better treatment personalization. The COVID-19 pandemic further accelerated the adoption of remote and home-based monitoring, pushing healthcare providers and payers to consider wearables as cost-effective alternatives.

Additionally, rising epilepsy prevalence, growing acceptance of digital health, and increasing investment from medtech startups are fueling rapid innovation in this segment. As regulatory approvals catch up and reimbursement frameworks expand, wearables are expected to capture a significant share in the near future, transforming epilepsy care from hospital-centric monitoring to a more patient-centered, continuous, and proactive approach.

Geographical Analysis

The North America epilepsy monitoring devices market was valued at 38.2%market share in 2024

North America holds a dominant position in the epilepsy monitoring devices market owing to a combination of advanced healthcare infrastructure, high awareness levels, favorable reimbursement policies, and strong presence of leading device manufacturers. The region has one of the highest diagnosis and treatment rates for epilepsy, supported by specialized epilepsy monitoring units (EMUs) and widespread adoption of conventional EEG and video-EEG systems.

Moreover, North America is at the forefront of technological innovation, with major medtech companies and startups actively developing AI-enabled wearable devices, implantable neurostimulator systems, and cloud-connected platforms. For instance, in March 2025, EpiWatch, a spinout from Johns Hopkins Medicine, has obtained FDA 510(k) premarket clearance for its seizure detection platform powered by the Apple Watch. The solution is designed to continuously track and detect tonic-conic (grand mal) seizures, a severe form of epilepsy characterized by full-body convulsions and loss of consciousness.

Robust R&D investments, clinical trials led by academic medical centers, and faster regulatory approvals from the FDA compared to other regions also drive early adoption of next-generation monitoring solutions. The rising prevalence of epilepsy, with the CDC estimating around 3.4 million people living with epilepsy in the United States alone, continues to fuel the need for accurate, continuous monitoring. Together, these factors make North America the largest and most influential market for epilepsy monitoring devices globally.

The Europe Epilepsy Monitoring Devices market was valued at 21.7% market share in 2024

Europe represents a significant market for epilepsy monitoring devices, ranking just behind North America, supported by its strong healthcare infrastructure, well-defined regulatory frameworks, and widespread adoption of conventional EEG and video-EEG systems. Rising epilepsy prevalence, estimated at around 4–7 cases per 1,000 people, along with growing awareness and government investment in neurological care, are driving demand for advanced monitoring solutions.

The region is also seeing rapid uptake of wearable and ambulatory devices, as patients and clinicians increasingly prefer non-invasive, home-based monitoring integrated with telemedicine platforms. Countries such as Germany, the UK, France, and Spain lead adoption due to robust reimbursement structures and specialized epilepsy centers, while Eastern and Southern Europe are gradually catching up as healthcare modernization advances.

Europe’s commitment to digital health innovation, research funding, and the shift toward patient-centric care positions it as a key growth region for epilepsy monitoring devices in the coming years.

The Asia-Pacific Epilepsy Monitoring Devices market was valued at 18.6% market share in 2024

Asia-Pacific is projected to be the fastest-growing region in the epilepsy monitoring devices market, driven by a combination of rising epilepsy prevalence, increasing awareness. The region has a large patient pool, with studies estimating epilepsy prevalence ranging between 3–10 cases per 1,000 population in countries like India and China, yet underdiagnoses remains high, creating strong growth potential as access to care expands.

Governments and healthcare providers are investing in digital health and telemedicine initiatives, which complement the rising adoption of wearable and ambulatory monitoring devices, especially in rural and underserved areas. Growing collaborations between global medtech leaders and local players, alongside supportive regulatory reforms in markets such as Japan, South Korea, and Australia, are accelerating the introduction of advanced technologies like AI-enabled seizure detection and remote patient monitoring platforms. Additionally, the increasing affordability of mobile-based EEG devices and the adoption of cloud solutions are making monitoring more accessible. These factors, coupled with expanding insurance coverage and strong private-sector investment in healthcare, position Asia-Pacific as the fastest-growing market for epilepsy monitoring devices over the coming years.

Competitive Landscape

The major players in the epilepsy monitoring devices market include NIHON KOHDEN CORPORATION, Empatica Inc., Compumedics Limited, Natus, Cadwell Industries Inc., Ceribell, Inc., among others.

NIHON KOHDEN CORPORATION:

NIHON KOHDEN CORPORATION is a key player in the epilepsy monitoring devices market, offering advanced neurodiagnostic solutions such as the Neurofax EEG Systems and the EEG-1200 Neurofax System for long-term video-EEG monitoring in epilepsy centers. The company also provides wireless and portable EEG devices for ambulatory care and the Polysmith software platform for data analysis and seizure detection. With its strong focus on innovation and clinical reliability, Nihon Kohden continues to support accurate diagnosis and effective management of epilepsy worldwide.

Key Developments:

In May 2025, Empatica proudly announces that EpiMonitor, its groundbreaking epilepsy monitoring solution, has received CE certification under the EU Medical Device Regulation (MDR 2017/745) and is now available for use across Europe.

In February 2024, Empatica introduced EpiMonitor, an epilepsy monitoring system designed for both adults and children aged six years and older. Cleared by the U.S. Food and Drug Administration (FDA), EpiMonitor is an advanced wearable device engineered to accurately detect generalized tonic-clonic seizures.

Market Scope

Metrics | Details | |

CAGR | 7.3% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US $Mn) | |

Segments Covered | Product Type | Conventional Devices Wearable Devices |

End-User | Hospitals, Ambulatory Surgical Center, Home Care Settings, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global epilepsy monitoring devices market report delivers a detailed analysis with 73 key tables, more than 76visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.