Elder Care Services Market Size& Industry Outlook

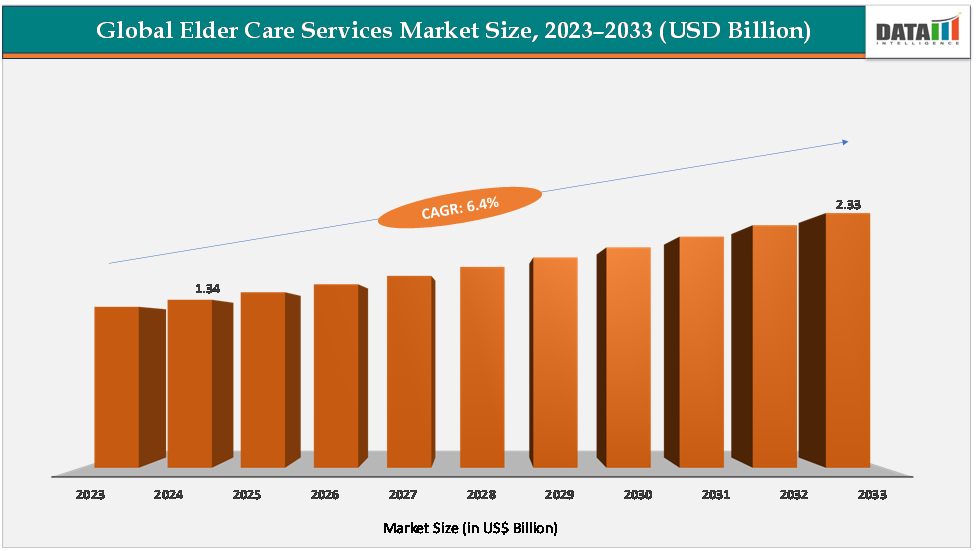

The global elder care services market size reached US$1.34Billion in 2024 from US$1.27Billionin 2023 and is expected to reach US$ 2.33Billion by 2033, growing at a CAGR of 6.4%during the forecast period 2025-2033.

The market is rapidly expanding, driven by the growing aging population, rising prevalence of chronic illnesses, and increasing preference for home-based care. Key services include home care (personal assistance, nursing, rehabilitation, telehealth), institutional care (nursing homes, assisted living, long-term hospitals), and adult day care, alongside ancillary services like transportation, nutrition, and mental health support. For instance, providers such as Brookdale Senior Living and Home Instead Senior Care are scaling innovative models that integrate telemedicine and personalized wellness programs, reflecting the industry’s shift toward affordable, accessible, and holistic senior care.

Key Market Highlights

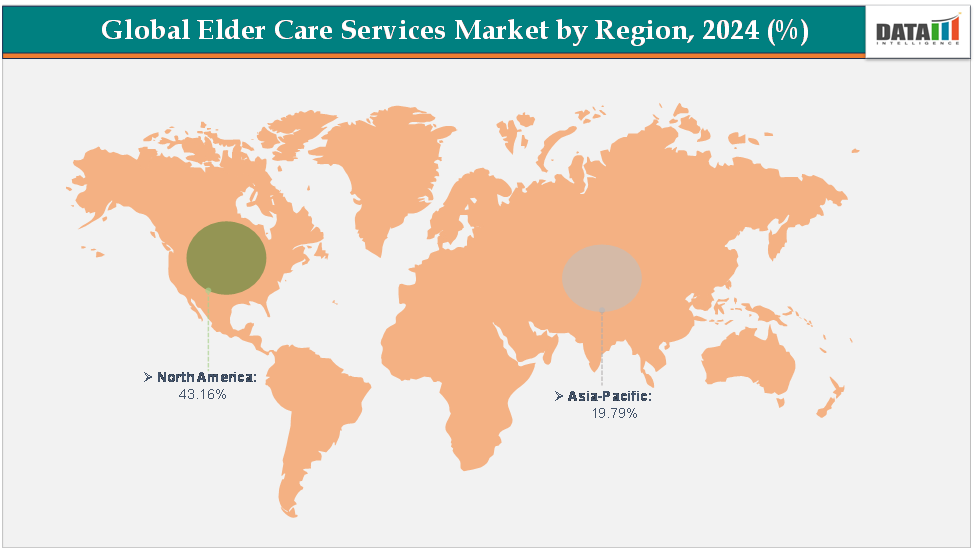

- North America dominates the elder care Services Market with the largest revenue share of 43.16% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of6.5% over the forecast period.

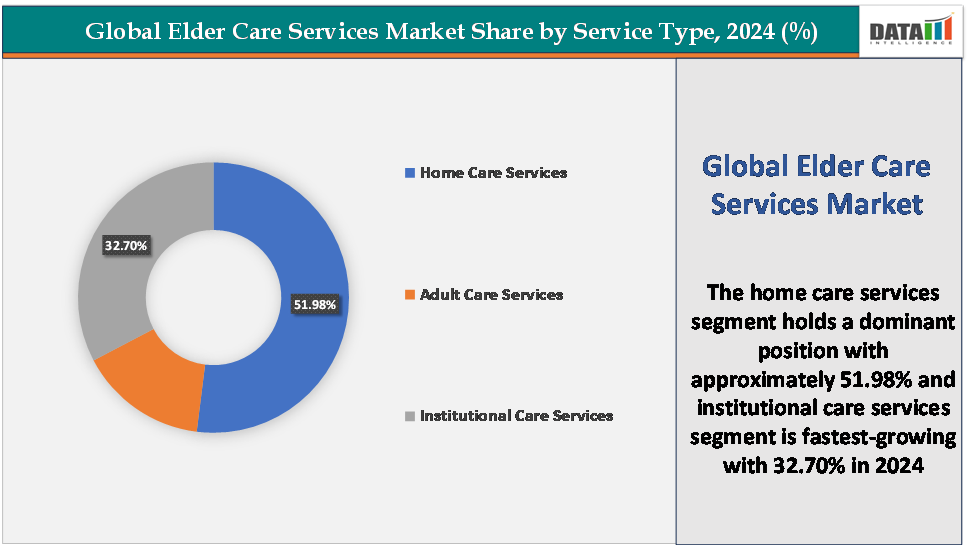

- Based on service type, the home care services segment led the market with the largest revenue share of 51.98% in 2024.

- The major market players in the elder care services market are Brookdale Senior Living Inc., Extendicare, Gentiva, Sunrise Senior Living, Genesis Healthcare, Home Instead, Inc., CK Franchising, Inc., Amedisys, and LHC Group, Inc., among others

Market Dynamics

Drivers:

Rising aging population and prevalence of chronic diseases is significantly driving the elder care services market growth

The rapid rise in the global aging population, coupled with the increasing prevalence of chronic diseases, is a primary force driving growth in the elder care services market. According to the World Health Organization, the number of people aged 60 years and above is expected to double by 2050, creating unprecedented demand for long-term care solutions. With advancing age, seniors face higher risks of chronic conditions such as cardiovascular diseases, diabetes, arthritis, respiratory disorders, and neurodegenerative illnesses like Alzheimer’s and Parkinson’s. These conditions require continuous monitoring, specialized therapies, and often multi-disciplinary care, which families are increasingly unable to manage alone.

For instance, Alzheimer’s disease driving the establishment of specialized memory care units and assisted living facilities. Home care services are being expanded to include rehabilitation therapies, telehealth consultations, and chronic disease management programs, enabling seniors to receive tailored care at home. At the same time, institutional care providers like nursing homes and long-term care hospitals are adapting to provide advanced clinical services for chronic disease patients.

Adult day care centers also play a crucial role by offering supervision and therapeutic activities for seniors living with mobility and cognitive challenges. As these chronic conditions often require not just medical treatment but also nutritional planning, mobility assistance, and emotional support, service providers are diversifying their offerings. Thus, the intersection of rising longevity and chronic disease prevalence is not only increasing demand for elder care but also reshaping it into a comprehensive ecosystem spanning medical, personal, and emotional well-being.

Restraints:

Cultural resistance and social stigma are hampering the growth of the market

Cultural resistance and social stigma remain significant barriers hampering the growth of the elder care services market, particularly in regions where family caregiving is deeply rooted in tradition. In many Asian and Latin American societies, caring for aging parents at home is considered a moral and social duty, and reliance on professional elder care services is often perceived as neglect or abandonment. This stigma discourages families from seeking institutional care, even when professional services could provide better medical and emotional support for seniors.

Even in developed markets, emotional guilt often prevents families from transitioning elders to assisted living facilities, which impacts demand for such services. This cultural barrier not only restricts market expansion but also limits the growth of innovative care models like adult day care centers or respite care, which are designed to support families without replacing them. Additionally, stigma around discussing topics like dementia or mental health further reduces acceptance of specialized services, leading many conditions to go untreated. As a result, providers face challenges in promoting their services, forcing them to invest heavily in awareness campaigns and community engagement to change perceptions.

For more details on this report – Request for Sample

Segmentation Analysis

The global elder care services market is segmented based on service type, application, and region.

Service Type:

The home care services segment is dominating the elder care services market with a 51.98% share in 2024

The home care services segment is currently dominating the elder care services market, primarily due to the strong preference among seniors to “age in place” and maintain independence within familiar surroundings. Unlike institutional care, which often requires relocation and higher costs, home care provides a flexible, cost-effective, and emotionally comforting alternative. Families are increasingly opting for professional caregivers who can deliver personal assistance, daily living support, and medical supervision directly at home, reducing both stress and expenses associated with nursing homes.

Companies like Home Instead Senior Care and Comfort Keepers have expanded globally by offering packages that include companionship, meal preparation, hygiene assistance, and mobility support, addressing both medical and non-medical needs. Technological integration has further fueled this dominance, with telehealth platforms, remote monitoring devices, and medication management apps enabling real-time care delivery at home. Wearables such as fall-detection sensors and health trackers provide added safety, while video consultations with physicians reduce the need for frequent hospital visits.

Adult children, often working and living away from parents, also rely on home care services to ensure consistent support for elders in their absence. The growing popularity of hybrid care models blending professional caregiving with digital tools is further reinforcing home care’s dominance. Ultimately, by combining affordability, convenience, personalized attention, and technology-driven safety, the home care segment continues to lead the elder care services market and is expected to expand even more rapidly in the coming years.

The institutional care services segment is fastest-growing in the elder care services market with a 32.70% share in 2024

The institutional care services segment is emerging as the fastest-growing category in the elder care services market, fueled by the rising prevalence of chronic illnesses, increased life expectancy, and the growing need for specialized medical supervision that home care cannot always provide. Nursing homes, assisted living facilities, and long-term care hospitals are witnessing strong demand as they offer 24/7 clinical support, rehabilitation services, memory care units, and palliative care for seniors with complex health conditions such as Alzheimer’s, Parkinson’s, or advanced cardiovascular diseases.

Institutional care also addresses the widening caregiver gap, as families are less able to provide continuous care due to smaller household structures and urban migration. Additionally, institutional facilities are increasingly integrating modern products and services such as electronic health record (EHR) systems, remote monitoring tools, and specialized mobility equipment to enhance patient outcomes. Collectively, these factors position institutional care services as the fastest-growing segment, meeting the rising demand for comprehensive, high-quality, and specialized elder care.

Geographical Analysis

North America is expected to dominate the global elder care Services Market with a 43.16% in 2024

North America stands as the dominant region in the elder care services market, driven by its rapidly aging population, advanced healthcare infrastructure, and strong insurance and reimbursement systems. Favorable policy frameworks, strong private sector investments, and innovation in service delivery further consolidate North America’s leadership in the market, positioning it as the benchmark region for elder care solutions.

US Elder Care Services Market Trends

Leading providers such as Brookdale Senior Living, Amedisys, and LHC Group have established expansive networks that deliver services ranging from in-home nursing and rehabilitation to specialized institutional care. The US is also at the forefront of integrating technology into elder care, with telehealth platforms, wearable monitoring devices, and AI-driven health assistants being widely adopted.

Memory care units for Alzheimer’s and dementia patients, offered by facilities like Sunrise Senior Living, are expanding rapidly in response to the rising prevalence of cognitive disorders. Moreover, the cultural acceptance of professional elder care, combined with rising numbers of dual-income families unable to provide home caregiving, fuels demand for institutional and adult day care services.

The Asia Pacific region is the fastest-growing region in the global elder care Services Market, with a CAGR of 6.5% in 2024

The Asia Pacific region is the fastest-growing market for elder care services, fueled by its rapidly aging population, increasing life expectancy, and shifting family dynamics. Countries like Japan, China, and India are witnessing unprecedented demographic changes, with Japan already having one of the world’s highest proportions of elderly citizens. Rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and dementia is driving demand for specialized institutional care, nursing homes, and memory care facilities.

In China, government initiatives like the “9073” elder care policy are spurring large-scale development of home and community elder care infrastructure. Meanwhile, India’s growing middle class and urban migration are reducing traditional family caregiving, creating opportunities for private players like Portea Medical and Nightingales Home Health Services to expand home-based elder care offerings such as nursing, physiotherapy, and telehealth.

Japan, a global leader in elder care innovation, is widely deploying robotic assistants, AI-driven monitoring systems, and smart elder care homes to support its shrinking caregiver workforce. The rising acceptance of adult day care services across urban centers in Asia further demonstrates the region’s shift toward professional care solutions. With increasing government investments, public-private partnerships, and growing insurance penetration, Asia Pacific is not only addressing its massive aging population but also redefining elder care delivery models, making it the fastest-growing region in the global market.

Europe Elder Care Services Market Trends

In Europe, the elder care services market is witnessing steady growth, driven by an aging population, rising life expectancy, and strong government-backed social care models. According to Eurostat, more than 20% of the EU population is already aged 65 or older, making elderly care one of the region’s top healthcare priorities. European countries like Germany, France, and the U.K. have well-established institutional care frameworks, with nursing homes and assisted living facilities providing specialized services such as dementia care, rehabilitation, and palliative care.

The region is also witnessing rapid growth in home care services, supported by organizations, which offer personal assistance, in-home nursing, and chronic disease management. Additionally, adult day care centers are expanding in European countries, where social inclusion and mental health are emphasized as part of holistic senior care. Europe is also integrating digital health technologies, with telehealth, electronic health records, and remote monitoring becoming common in elderly care facilities. The combination of a growing elderly population, strong policy frameworks, and adoption of innovative care solutions positions Europe as a mature yet steadily expanding market within the global elder care services landscape.

Competitive Landscape

Top companies in the elder care Services Market include Brookdale Senior Living Inc., Extendicare, Gentiva, Sunrise Senior Living, Genesis Healthcare, Home Instead, Inc., Amedisys, LHC Group, Inc., and CK Franchising, Inc., among others.

Market Scope

| Metrics | Details | |

| CAGR | 6.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Service Type | Home Care Services, Adult Care Services, and Institutional Care Services |

| Application | Chronic Disease Management, Mobility Assistance, Mental Health Support, General Wellness and Preventive Care, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global elder care Services Market report delivers a detailed analysis with 51 key tables, more than 43visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more healthcare IT-related reports, please click here