Healthcare Analytics Market Size

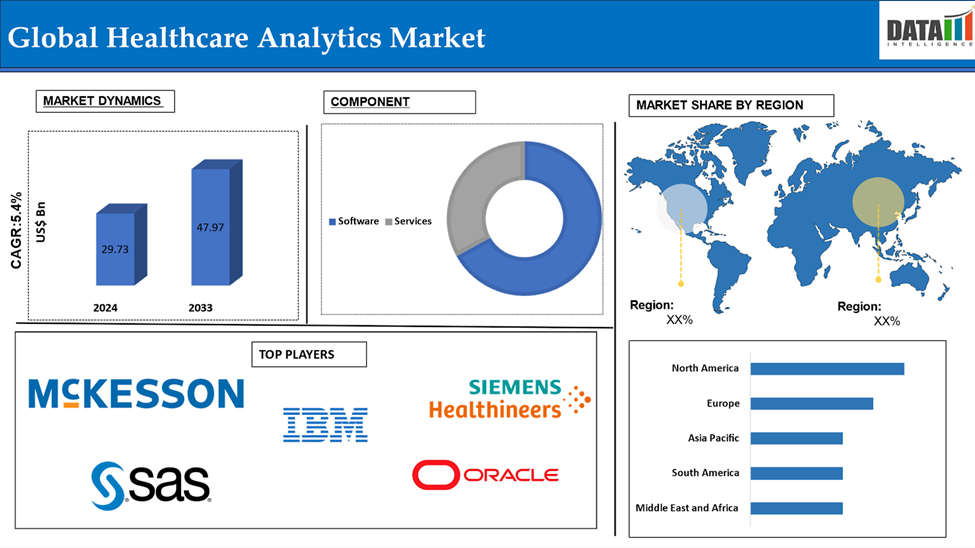

The Global Healthcare Analytics Market reached US$ 29.73 Billion in 2024 and is expected to reach US$ 47.97 Billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025-2033.

Healthcare Analytics is a method of analyzing large amounts of healthcare data to improve decision-making and outcomes. It uses tools like descriptive, predictive, and prescriptive analytics to transform raw data from sources like EHRs, medical imaging, and patient monitoring systems into actionable insights. Healthcare analytics optimizes patient care, enhances operational efficiency, reduces costs, and supports evidence-based decision-making. It uses big data, AI, and machine learning to improve outcomes while minimizing risks.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Increasing Adoption of Data-driven Decision Making in Healthcare

The Global Healthcare Analytics Market is driven by the growing adoption of data-driven decision making in the healthcare industry. Healthcare organizations, including hospitals, payers, and pharmaceutical companies, are using analytics to improve operational efficiencies, enhance patient care, and reduce costs. With the growing volume of healthcare data, analytics solutions enable predictive analysis to identify health trends, risks, and treatment outcomes. This helps healthcare providers make informed decisions, leading to better clinical and financial outcomes. Governments and healthcare organizations are investing in healthcare digitization and data infrastructure, further supporting the growth of the healthcare analytics market.

For instance, in August 2024, Innovaccer Inc., a leading healthcare AI company, has launched the Government Health AI Data and Analytics Platform (GHAAP), an award-winning platform for the public sector. The platform focuses on Medicaid and Public Health Modernization and has been ranked as the top data and analytics platform for Population Health by KLAS Research and Black Book three years in a row.

Data Privacy and Security Concerns

Healthcare analytics solutions often involve the collection and processing of large volumes of patient data, which can lead to data breaches and unauthorized access. This poses serious risks to patient privacy and trust. Healthcare organizations must comply with stringent regulatory requirements like HIPAA and GDPR, adding complexity to data management. These regulations require robust security measures, which can be costly and time-consuming. As a result, concerns over the security and confidentiality of patient data can hinder the widespread adoption of healthcare analytics, especially in regions with less mature data protection infrastructure.

Market Segment Analysis

The global healthcare analytics market is segmented based on Component, Type, Application, End User and Region.

Component:

Software segment is expected to dominate the Healthcare Analytics market share

The software segment holds a major portion of the Healthcare Analytics market share and is expected to continue to hold a significant portion of the Healthcare Analytics market share during the forecast period.

The Global Healthcare Analytics Market is dominated by software solutions that collect, process, and analyze vast amounts of healthcare data. These tools enable organizations to perform descriptive, predictive, and prescriptive analytics, providing insights to improve patient care, reduce operational costs, and enhance clinical decision-making. Key software solutions include EHR management tools, CDSS, and patient monitoring systems. As healthcare providers adopt data-driven strategies, software solutions are becoming indispensable in improving healthcare efficiency and patient outcomes, driving market growth.

For instance, in May 2024, Health Catalyst has launched Health Catalyst Ignite, a next-generation healthcare data and analytics ecosystem that combines best-in-class technologies, healthcare-specific data models, self-service tools, and industry expertise in a modern environment.

End User:-

Hospitals and Healthcare Providers segment is the fastest-growing segment in Healthcare Analytics market share

The hospitals and healthcare providers segment is the fastest-growing segment in the Healthcare Analytics market share and is expected to hold the market share over the forecast period.

The Hospitals & Healthcare Providers segment is driving the Global Healthcare Analytics Market due to the need to improve patient care, operational efficiency, and reduce costs. Healthcare providers are adopting analytics solutions to gain data-driven insights, optimize treatment pathways, and manage resources effectively. The rising prevalence of chronic diseases and growing patient population are driving the need for predictive and prescriptive analytics. The increasing volume of healthcare data from EHRs and medical devices is also driving the need for advanced data analytics tools. Population health management strategies are also driving market growth.

For instance, in October 2024, Growth.Health has launched the G1 Healthcare Data and Analytics Platform, a SaaS engine designed to provide unprecedented insights into the healthcare industry. The platform will be publicly unveiled at HLTH 2024 in Las Vegas, allowing professionals to better understand their customers and identify similar individuals.

Market Geographical Share

North America is expected to hold a significant position in the Healthcare Analytics market share

North America holds a substantial position in the Healthcare Analytics market and is expected to hold most of the market share due to high healthcare spending, and strong technological adoption. Also the region's well-established healthcare system and health tech ecosystem are fuelled by the widespread use of EHRs and cloud-based analytics solutions. The growing prevalence of chronic diseases and focus on value-based care are driving demand for efficient patient care and data management solutions. With supportive government initiatives and a favourable regulatory environment, North America is poised to continue its leadership role in the healthcare analytics market.

For instance, in January 2025, LexisNexis Risk Solutions has launched research-ready real-world datasets to accelerate research timelines, reduce costs, and enable more equitable analyses. These datasets are blended, expertly determined, and certified using referential-based tokenization. This simplifies data enrichment and cohort definition, allowing research teams to benchmark with comparator cohorts. These datasets integrate into clinical research workflows, generating real-world evidence to accelerate innovation and speed-to-market.

Europe is growing at the fastest pace in the Healthcare Analytics market

Europe holds the fastest pace in the Healthcare Analytics market and is expected to hold most of the market share due to government-backed digitization initiatives, increasing demand for data-driven healthcare solutions, and an aging population. Countries are investing in eHealth and health IT systems to improve healthcare delivery, reduce inefficiencies, and enhance patient outcomes. Telemedicine and remote patient monitoring technologies are also contributing to the demand for analytics. Strong regulatory frameworks like GDPR prioritize data privacy and security, making Europe a strong contributor to the market.

Major Global Players

The major global players in the Healthcare Analytics market include IBM Corporation, SAS Institute Inc. McKesson Corporation, HR Insights, Siemens Healthineers, Oracle Corporation, Allscripts Healthcare Solutions, Inc., Philips Healthcare, IQVIA, Flatiron Health and among others.

Key Developments

- In May 2024, mPulse, a leader in conversational AI and digital engagement solutions for healthcare, reported strong growth in Q1 2024 compared to Q1 2023. The company also launched integrated predictive analytics and omnichannel engagement products, establishing a new category within the digital health ecosystem.

| Metrics | Details | |

| CAGR | 5.4% | |

| Market Size Available for Years | 2018-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Volume (Units) | ||

| Segments Covered | Component | Software, Services |

| Type | Descriptive Analytics, Predictive Analytics, Prescriptive Analytics | |

| Application | Financial Analytics, Clinical Analytics, Operational Analytics, Population Health Analytics, Others | |

| End User | Hospitals & Healthcare Providers, Healthcare Payers (Insurance Companies), Pharmaceutical & Biotechnology Companies, Government Organizations | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global Healthcare Analytics market report delivers a detailed analysis with 61 key tables, more than 59 visually impactful figures, and 220 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2025

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Component & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.