Global CMOS Image Sensor Market: Industry Outlook

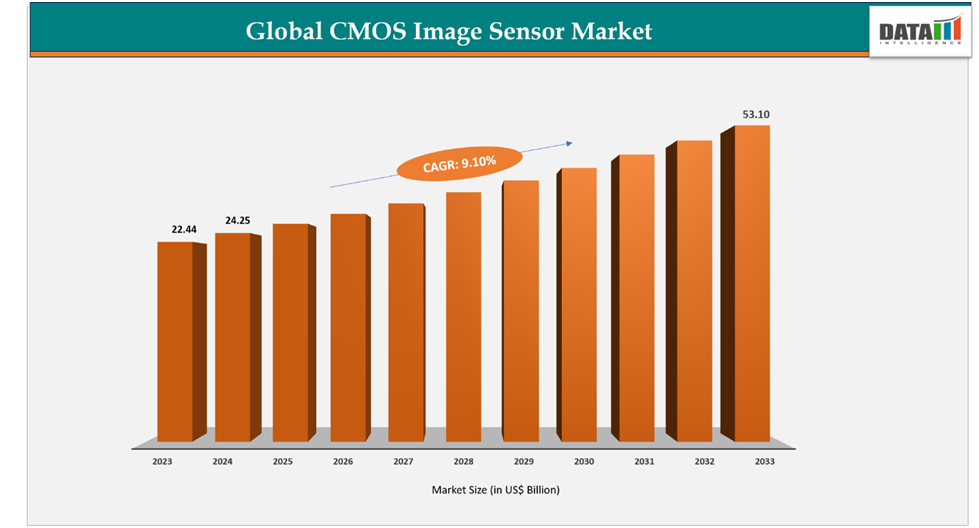

The global CMOS image sensor market reached US$ 22.44 billion in 2023, with a rise to US$ 24.25 billion in 2024, and is expected to reach US$ 53.10 billion by 2033, growing at a CAGR of 9.10% during the forecast period 2025–2033.

The global CMOS image sensor market is expanding steadily, driven by increasing applications in defense, offshore energy, oceanographic research, and environmental monitoring. These drones, also known as Unmanned Underwater Vehicles (UUVs), are becoming vital tools for naval surveillance, subsea inspections, and maritime security. Growth is further supported by technological advancements in autonomy, AI-based navigation, and energy-efficient propulsion systems, alongside rising investments in maritime robotics. Industry dynamics are also being reshaped by strategic collaborations, defense contracts, and partnerships between naval forces and commercial suppliers.

The US remains a dominant player in the CMOS image sensor market, propelled by strong defense demand and technological innovations. Companies are increasingly acquiring specialized imaging solution providers to strengthen their market position and product offerings. For instance, Photonics Management Corp. (Bridgewater, New Jersey, US), a subsidiary of Hamamatsu Photonics K.K. (Hamamatsu City, Japan), acquired the stock of BAE Systems Imaging Solutions, Inc., a subsidiary of BAE Systems, Inc. (Falls Church, Virginia, US). In recognition of its historical roots beginning in 1920 as the Fairchild Aerial Camera Corporation, the company will return to the name first used in 2001, Fairchild Imaging. Such acquisitions highlight the US market’s focus on strengthening imaging capabilities for defense, aerospace, and advanced surveillance applications.

Japan is also establishing a significant presence in the CMOS image sensor market, driven by increased investments in production capacity and imaging technology innovation. For instance, Sony Corp announced plans to invest ~US$ 997 million to expand production of image sensors as part of its strategy to increase revenue from digital imaging. This investment underscores Japan’s commitment to maintaining leadership in high-performance sensor technology, supporting applications in defense, consumer electronics, and industrial imaging.

Key Market Trends & Insights

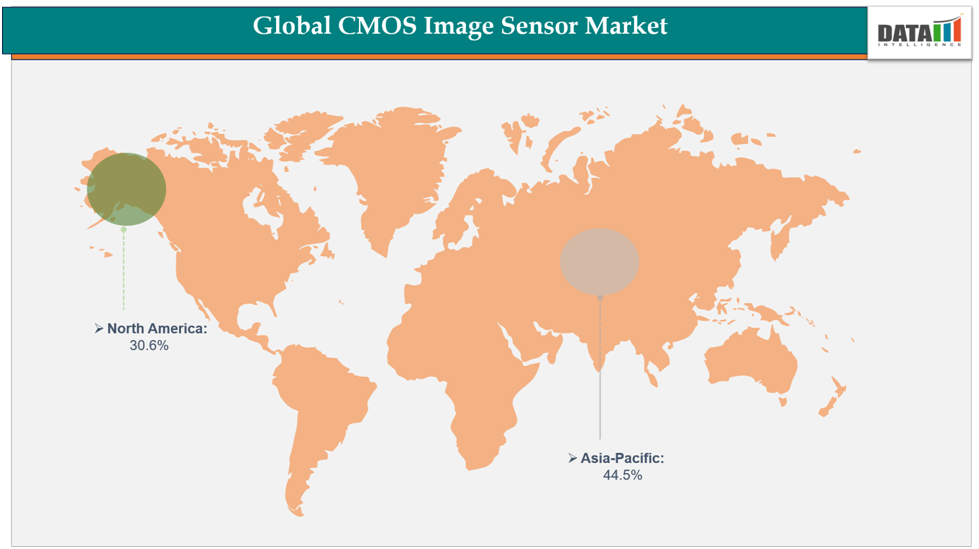

Asia-Pacific held approximately 45.9% of the global CMOS image sensor market in 2024 and is projected to maintain its leadership throughout the forecast period. The region’s dominance is driven by robust growth in consumer electronics, automotive imaging, and industrial applications. For instance, Samsung Electronics has expanded its image sensor production capacity in South Korea to meet increasing global demand for advanced smartphone cameras and automotive vision systems, reflecting the region’s strong manufacturing base and technological expertise..

North America is expected to be the fastest-growing region, propelled by rising investments in automotive ADAS systems, industrial automation, and defense applications. In 2024, Teledyne e2v (a US-based imaging solutions provider) launched a new series of high-performance CMOS sensors optimized for aerospace and defense surveillance, underscoring North America’s focus on next-generation imaging technologies. Strategic partnerships and continuous R&D in sensor design are accelerating market adoption across the region.

The Consumer Electronics segment remains the dominant product category, driven by high demand for smartphone cameras, digital imaging devices, and wearable electronics. Its widespread use across commercial and industrial sectors emphasizes the pivotal role of CMOS sensors in delivering high-resolution imaging, enabling advanced AI-powered applications, and fostering innovation across diverse industries.

Market Size & Forecast

2024 Market Size: US$24.25 Billion

2033 Projected Market Size: US$53.10Billion

CAGR (2025–2033): 9.10%

Asia-Pacific: Largest market in 2024

North America: Fastest-growing market

Drivers & Restraints

Driver: Rising Demand in Consumer Electronics

The global CMOS image sensor market is increasingly fueled by strong demand in consumer electronics. Manufacturers are focusing on delivering high-resolution, energy-efficient, and compact sensors that power smartphones, digital cameras, AR/VR devices, and other smart gadgets. These sensors are essential for enhancing image quality, enabling AI-driven photography, and supporting next-generation consumer applications.

For instance, in 2024, Vivo expanded its collaboration with ZEISS as part of a new imaging strategy, demonstrating how growing consumer expectations for superior camera performance are driving the growth of the CMOS image sensor market and reinforcing its importance in mobile imaging technology.

Restraint: High Manufacturing Costs

Despite strong demand, the CMOS image sensor market faces challenges due to high production costs. Advanced sensors especially those with higher resolutions, back-illuminated architectures, or AI capabilities require sophisticated semiconductor fabrication, expensive materials, and precise quality control processes.

For instance, developing next-generation sensors involves significant R&D investment, state-of-the-art cleanroom facilities, and advanced lithography equipment. These high manufacturing expenses continue to pose a barrier to widespread adoption and sustained market growth.

For more details on this report - Request for Sample

Segmentation Analysis

The global CMOS image sensor market is segmented based on technology, resolution, application and region.

Application: The Consumer Electronics segment accounts for an estimated 28.4% of the global CMOS image sensor market.

The consumer electronics segment represents a major portion of the global CMOS image sensor market, driven by rising demand for high-resolution cameras in smartphones, smart glasses, AR/VR devices, and other connected gadgets. Growth is fueled by consumers’ preference for advanced imaging, compact form factors, low power consumption, and AI-enabled functionalities that enhance photography, video recording, and interactive experiences.

Key players are focusing on developing CMOS sensors that combine performance, efficiency, and miniaturization to meet the requirements of next-generation devices. For instance, Smart Sens (Shanghai) Electronic Technology Co., Ltd. recently introduced the 12-megapixel SC1200IOT CMOS image sensor for AI glasses. Leveraging Smart Sens’ SmartClarity-3 platform and patented SFC Pixel technology, the sensor offers high sensitivity, low noise, compact size, and low power consumption, fully supporting the imaging needs of lightweight, high-quality AI glasses.

The widespread adoption of advanced CMOS sensors in consumer electronics enhances user experience while driving innovation in wearable technology, mobile imaging, and AR/VR applications. As consumer demand for superior imaging performance grows, this segment is expected to remain a key driver of the global CMOS image sensor market, prompting further development of energy-efficient, compact, and AI-enabled sensor solutions.

Geographical Analysis

The Asia-Pacific CMOS image sensor market was valued at 44.9%market share in 2024

Asia-Pacific accounted for a substantial share of the global CMOS image sensor market in 2024 and is expected to remain the dominant region throughout the forecast period. Growth is primarily driven by increasing demand for automotive, consumer electronics, and industrial imaging applications, as well as significant investments in research and technological development.

For instance, Sony Semiconductor Solutions Corporation (SSS) announced the upcoming release of the ISX038 CMOS image sensor for automotive cameras, the industry’s first product capable of simultaneously processing and outputting RAW and YUV images. This innovation reflects the region’s leadership in high-performance imaging technologies and underscores the adoption of advanced CMOS sensors in automotive safety, driver-assistance systems, and smart mobility solutions.

Government initiatives, industrial adoption, and strong presence of leading semiconductor companies are expected to continue driving Asia-Pacific’s market share, making it the fastest-growing region in the global CMOS image sensor market.

The North America CMOS image sensor market was valued at 30.6% market share in 2024

Asia-Pacific is projected to be the fastest-growing region, driven by rising investments in defense, consumer electronics, and industrial applications, alongside expanding adoption of high-performance imaging technologies in mobile devices and cameras.

For instance, ESS Technology Inc., a US-based consumer-chip manufacturer, entered the CMOS imaging sensor market by acquiring Pictos Technologies Inc. for US$27 million in cash. This acquisition gives ESS a strong foothold in the market for CMOS imaging sensors used in still cameras, cellular phones, and related modules, positioning North America as a hub for innovation and commercialization in the CMOS imaging sector.

Robust R&D capabilities, strategic acquisitions, and strong demand for imaging solutions across consumer electronics and defense applications continue to reinforce North America’s leadership in the global CMOS image sensor market.

Competitive Landscape

The major players in the CMOS image sensor market include Sony Semiconductor Solutions Corporation, ams-OSRAM AG, STMicroelectronics, Samsung, Tokyo Electron Limited, OMNIVISION, Semiconductor Components Industries, LLC, Canon U.S.A., Inc, Panasonic Corporation of North America., Hamamatsu Photonics K.K.

Sony Semiconductor Solutions Corporation: Sony Semiconductor Solutions Corporation is a global leader in CMOS image sensor technology, renowned for its innovation in digital imaging and sensing solutions. The company designs and manufactures high-performance CMOS sensors for applications in consumer electronics, automotive, industrial, and healthcare sectors.

Market Scope

Metrics | Details | |

CAGR | 9.10% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US $Bn) | |

Segments Covered | Technology | Front-Illuminated (FI-CMOS), Backside-Illuminated (BSI-CMOS), Stacked CMOS Sensors |

| Resolution | Up to 5 MP, 5 MP to 16 MP, Above 16 MP |

| Application | Consumer Electronics, Aerospace & Defense, Automotive, Industrial, Healthcare, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global CMOS image sensor market report delivers a detailed analysis with 62 key tables, more than 55visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions For Related Reports

For more CMOS image sensor-related reports, please click here