Global Cell Analysis Market: Industry Outlook

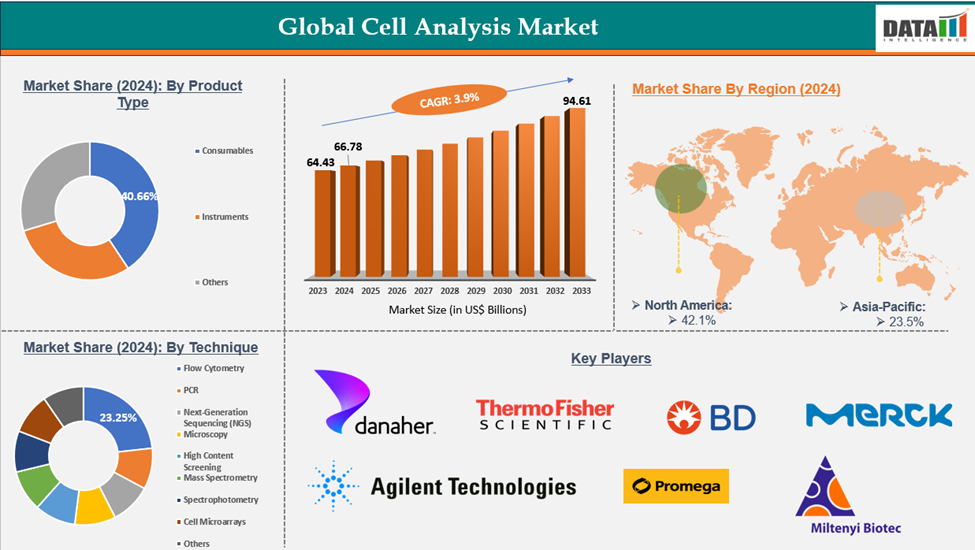

The global cell analysis market reached US$ 64.43 billion in 2023, with a rise of US$ 66.78 billion in 2024, and is expected to reach US$ 94.61 billion by 2033, growing at a CAGR of 3.9% during the forecast period 2025-2033.

The global cell analysis market is experiencing significant growth due to the increasing demand for advanced research and diagnostic solutions in life sciences, biotechnology, and pharmaceutical sectors. Factors contributing to this growth include the rise in chronic and genetic diseases, personalized medicine adoption, and technological advancements in flow cytometry, high-content screening, next-generation sequencing, and single-cell analysis. The market includes instruments, consumables, and software for applications in oncology, immunology, stem cell research, and drug discovery. North America and Europe remain the largest markets due to strong healthcare infrastructure and R&D investments. Despite challenges like high instrument costs and regulatory requirements, cell analysis remains a crucial tool in modern biomedical research and clinical diagnostics.

Executive Summary

Dynamics: Drivers & Restraints

Driver: Increasing Prevalence of Chronic and Genetic Diseases

The global cell analysis market is growing due to the rise in chronic and genetic diseases, such as cancer, cardiovascular disorders, autoimmune diseases, and inherited genetic disorders. Advanced diagnostic tools like flow cytometry, high-content screening, and single-cell analysis help researchers understand disease mechanisms, identify biomarkers, and develop targeted therapies. This demand for accurate disease detection, personalized treatment planning, and efficient drug development drives the adoption of cell analysis instruments, consumables, and services.

For instance, the US has 129 million people with at least one major chronic disease, including heart disease, cancer, diabetes, obesity, and hypertension. Five of the top 10 leading causes of death in the US are associated with preventable and treatable chronic diseases. Over the past two decades, prevalence has steadily increased, and this trend is expected to continue. An increasing proportion of Americans are dealing with multiple chronic conditions, with 42% having two or more and 12% having at least five. Chronic diseases also significantly impact the US healthcare system, accounting for 90% of annual $4.1 trillion expenditure.

Restraint: High Cost of Instruments and Consumables

The global cell analysis market faces challenges due to high costs of instruments and consumables. Advanced systems can cost between USD 50,000 and USD 500,000 per unit, and recurring expenses for specialized reagents, kits, and consumables can range from USD 5,000 to USD 50,000 annually. These high costs limit adoption, especially among smaller labs, and slow market expansion despite the growing demand for cell analysis technologies.

For more details on this report, Request for Sample

Segmentation Analysis

The global cell analysis market is segmented based on product type, technique, indication, end user, and region.

Product Type:

The consumables from the product type segment the expected to have 40.66% of the cell analysis market share.

The consumables segment is experiencing significant growth due to increasing research activities and clinical applications, advanced cell analysis technologies like flow cytometry, high-content screening, and next-generation sequencing, and the growing focus on personalized medicine, stem cell research, and drug discovery. Market players' continuous innovations in efficiency, accuracy, and ease of use contribute to the rapid expansion of this segment.

For instance, in September 2024, PHC Corporation's Biomedical Division has launched LiCellMo, a live cell metabolic analyzer that enables researchers to visualize metabolic changes in cell cultures, providing a more comprehensive picture of cell activity for cell and gene therapies. LiCellMo uses PHC's proprietary high-precision In-Line monitoring technology, allowing continuous measurement of cellular metabolites without interrupting the experiment for sampling.

Geographical Share Analysis

The North America global cell analysis market was valued at 42.1% market share in 2024

The North American cell analysis market is expanding due to advanced technologies, major market players, biopharmaceutical research, and personalized medicine demand. The region's well-established healthcare infrastructure, advanced research facilities, skilled workforce, and favorable regulatory support for innovative tools contribute to market growth. The region also benefits from a skilled workforce and expertise in life sciences. The market's growth is further fueled by the region's well-established healthcare infrastructure.

For instance, in February 2025, Scale Biosciences has introduced QuantumScale Single Cell RNA kits, a set of next-generation single cell products capable of processing from 84,000 to 4 million cells without specialized partitioning instrumentation. The Quantum Barcoding technology-based platform is the most cost-effective single cell solution on the market, offering a simple and efficient workflow for any project or research vision.

Moreover, in October 2024, Cell Signaling Technology (CST) has launched InTraSeq Single Cell Analysis Reagents, a reliable and efficient method for detecting and studying intracellular proteins and the transcriptome in single-cell experiments. The combination of InTraSeq technology with the 10x Genomics Single Cell Gene Expression Assay allows researchers to categorize sub-populations of cells and resolve signaling pathways with single-cell resolution.

Major Players

The major players in the cell analysis market include Danaher, Thermo Fisher Scientific, Becton, Dickinson and Company (BD), Merck KGaA, Agilent Technologies, Promega Corporation, Tecan Trading AG, Miltenyi Biotec, Carl Zeiss AG, and NanoCellect Biomedical among others.

Key Developments

In May 2025, BD, a global medical technology company, has launched the world's first cell analyzer, featuring advanced spectral and real-time imaging technologies. This allows researchers to uncover deeper insights and dynamics from cells previously invisible in flow cytometry experiments with increased ease and throughput.

In January 2025, ThinkCyte, a biotechnology company, launched its new AI-based cell analysis platform, VisionCyte, which expands its life science research portfolio beyond its flagship product, VisionSort, launched in 2023.

Report Scope

Metrics | Details | |

CAGR | 3.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segmentation | Product Type | Consumables, Instruments, Others |

Technique | Flow Cytometry, PCR, Next-Generation Sequencing (NGS) Microscopy, High Content Screening, Mass Spectrometry, Spectrophotometry, Cell Microarrays | |

Application | Oncology, Immunology, Genetic Disease/Rare Diseases, Cardiology, Others | |

End User | Pharmaceutical & Biotechnology Companies, Hospitals & Diagnostic Laboratories, Academic & Research Institutes, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global cell analysis market report delivers a detailed analysis with 59 key tables, more than 56 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here