Global Flow Cytometry Market: Industry Outlook

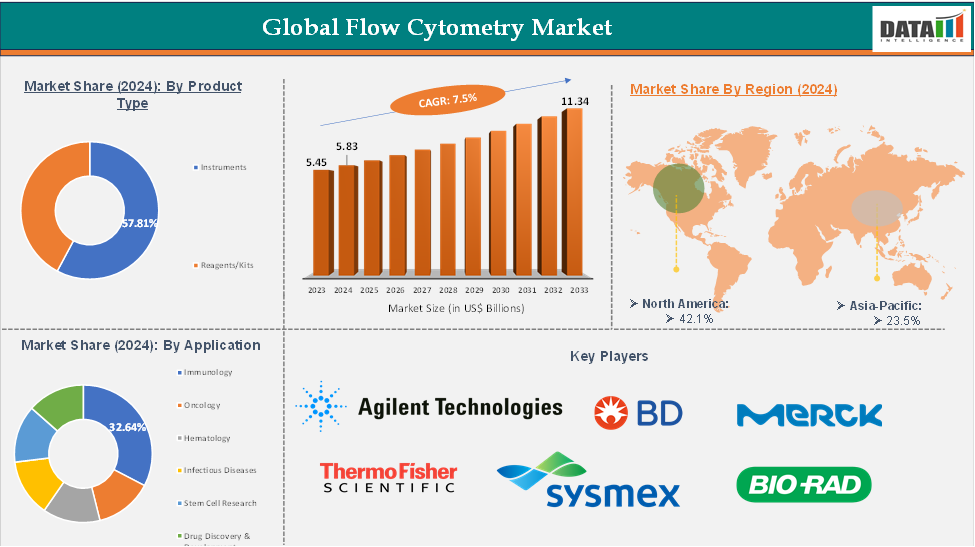

The global flow cytometry market reached US $ 5.45 billion in 2023, with a rise of US $ 5.83 billion in 2024, and is expected to reach US $ 11.34 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025-2033.

The global flow cytometry market is experiencing significant growth due to the increasing use of advanced cellular analysis techniques in clinical diagnostics, research, and drug discovery. Technological advancements like multi-parameter and high-throughput cytometers, imaging systems integration, and AI-powered data analysis are improving the precision, speed, and efficiency of cell-based studies. North America leads the market due to its strong research infrastructure and R&D investments, while emerging markets offer growth opportunities. Challenges include high instrument and reagent costs and a shortage of skilled professionals.

Executive Summary

Dynamics: Drivers & Restraints

Driver: Technological Advancements in Multi-Parameter And High-Throughput Cytometry Instruments

The development of multi-parameter and high-throughput flow cytometry instruments is driving global market growth by improving cellular analysis capabilities. These instruments enable simultaneous detection of biomarkers, enabling detailed immunophenotyping and precise characterization of cell populations. High-throughput systems can process hundreds to thousands of samples per day, reducing turnaround time and increasing productivity. Automated sample handling minimizes human error and improves reproducibility.

For instance, in March 2025, Beckman Coulter Life Sciences, a leading laboratory automation company, has introduced the CytoFLEX mosaic Spectral Detection Module, the first modular solution in spectral flow cytometry.

Restraint: High Cost of Flow Cytometry Instruments and Reagents

The high cost of flow cytometry instruments and reagents, particularly in emerging markets, poses a significant challenge for laboratories. Advanced multi-parameter cytometers can cost over USD 500,000, while reagents and kits add recurring expenses of USD 5,000–USD 20,000 annually. This cost barrier hinders adoption among smaller research institutes and clinical labs.

For more details on this report, Request for Sample

Segmentation Analysis

The global flow cytometry market is segmented based on product type, application, end user, and region.

Product Type:

The instruments from the product type segment the expected to have 57.81% of the flow cytometry market share.

The instruments segment of the flow cytometry market is experiencing significant growth due to technological advancements, high-throughput cytometers, automated sample handling, imaging capabilities, and enhanced data analysis software. The demand for precise cell analysis in immunology, oncology, and stem cell research, along with increased funding for advanced diagnostic tools, is driving global instrument expansion.

For instance, in May 2025, Cytek Biosciences has launched the Cytek Aurora Evo system, a full spectrum flow cytometer that improves on its flagship Cytek Aurora system. Launched in 2017, Cytek's Full Spectrum Profiling systems have become the spectral technology of choice for researchers worldwide, with over 2,600 peer-reviewed publications citing its use. The new system aims to shape the future of cell analysis.

Geographical Share Analysis

The North America global flow cytometry market was valued at 42.1% market share in 2024

The North American flow cytometry market is fueled by a strong research infrastructure, advanced technologies, and significant investments in life sciences and biotechnology. The presence of leading pharmaceutical companies and government funding for immunology, oncology, and infectious disease research has increased demand for flow cytometry solutions. The growing prevalence of chronic and infectious diseases, personalized medicine, and academic research initiatives further fuel market growth.

For instance, in March 2024, Beckman Coulter Life Sciences has received FDA clearance to distribute its DxFLEX Clinical Flow Cytometer in the US, bringing the popular benchtop IVD flow cytometry system to American labs. The system offers up to 13-colors and allows for additional detector activation without the need for additional hardware.

Major Players

The major players in the flow cytometry market include Thermo Fisher Scientific, Merck KGaA (MilliporeSigma), Sysmex Corporation, Bio-Rad Laboratories, Beckman Coulter, Agilent Technologies, Sony Biotechnology, Luminex Corporation, Biocompare and among others.

Key Developments

In May 2025, Thermo Fisher Scientific has introduced the Invitrogen Attune Xenith Flow Cytometer, a spectral-enabled tool for immunology and immuno-oncology researchers. This tool automates workflows, providing detailed insights from cellular samples. Thermo Fisher's acoustic focusing technology improves time to results, enabling researchers to tackle a wider range of applications with greater flexibility and sensitivity.

Report Scope

Metrics | Details | |

CAGR | 7.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segmentation | Product Type | Instruments, Reagents/Kits |

Application | Immunology, Oncology, Hematology, Infectious Diseases Stem Cell Research, Drug Discovery & Development | |

End User | Hospitals & Clinics, Research & Academic Institutes, Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs) | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global flow cytometry market report delivers a detailed analysis with 59 key tables, more than 56 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here