Cardiomyopathy Market Size and Trends

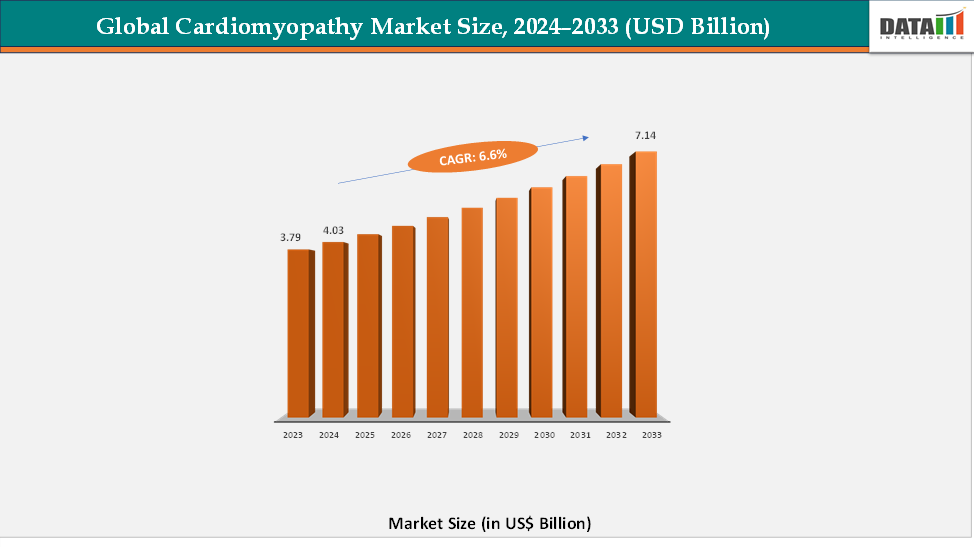

The global cardiomyopathy market reached US$ 3.79 billion in 2023, with a rise to US$ 4.03 billion in 2024, and is expected to reach US$ 7.14 billion by 2033, growing at a CAGR of 6.6% during the forecast period 2025–2033. The global cardiomyopathy market is witnessing steady growth, fueled by the increasing prevalence of cardiovascular diseases and a growing emphasis on early diagnosis and effective disease management. Rising awareness about genetic testing, advancements in imaging technologies, and the availability of novel pharmacological therapies are driving demand for innovative cardiomyopathy treatments. Market players are introducing targeted therapies, personalized treatment plans, and advanced medical devices to address diverse patient needs across hospitals, specialty clinics, and cardiac care centers. The adoption of digital health solutions, remote patient monitoring, and telemedicine is further enhancing the management of cardiomyopathy, enabling timely interventions and improved patient outcomes.

Key Market highlights

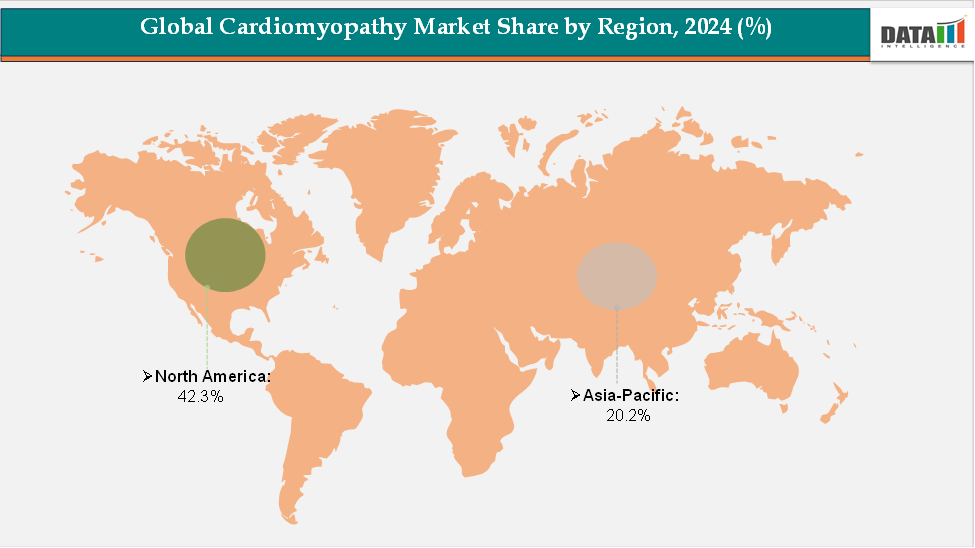

- North America accounted for approximately 42.3% of the global cardiomyopathy market in 2024 and is expected to maintain its dominant position throughout the forecast period. The region’s leadership is supported by strong regulatory frameworks, high diagnosis and treatment rates for cardiomyopathy subtypes, and significant research and development investments from leading biopharmaceutical and medical device companies.

- Asia-Pacific holds around 20.2% of the global market and is projected to be the fastest-growing region during the forecast period. Growth in this region is driven by improving healthcare infrastructure, increasing awareness and diagnosis of cardiomyopathy, expanding access to advanced therapies, and the development of regional clinical research and treatment networks.

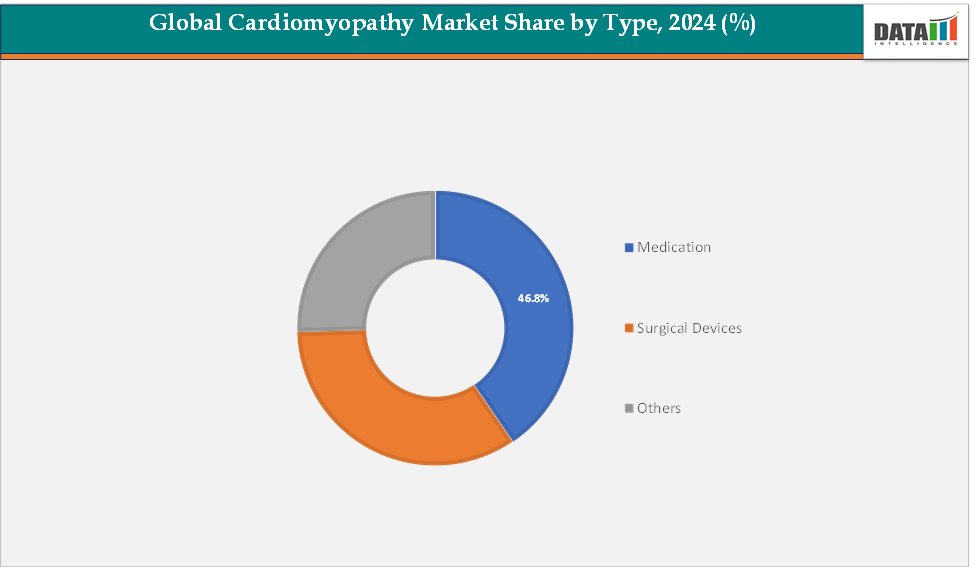

- By treatment type, medication remains the dominant segment, accounting for approximately 46.8% of the global market in 2024. Its leading position is supported by widespread use of pharmacological interventions, including beta-blockers, ACE inhibitors, anticoagulants, and emerging targeted therapies, which are increasingly adopted for long-term management across hypertrophic, dilated, and other cardiomyopathy types.

Market Size & Forecast

- 2024 Market Size: US$4.03 billion

- 2033 Projected Market Size: US$7.14 billion

- CAGR (2025–2033): 6.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Market Dynamics: Drivers & Restraints

Driver: Rising Prevalence of Cardiomyopathy Subtypes

The rising prevalence of cardiomyopathy subtypes, including hypertrophic, dilated, and restrictive cardiomyopathy, is expected to significantly drive the growth of the global cardiomyopathy market. The increasing incidence of cardiovascular diseases and related risk factors such as hypertension, obesity, diabetes, and genetic predispositions has heightened the demand for advanced diagnostic and therapeutic solutions. According to the Heart Disease and Stroke Statistics report published in January 2023, coronary heart disease (CHD) accounted for 41.2% of deaths attributable to cardiovascular diseases (CVD) in the United States, followed by stroke (17.3%), other CVDs (16.8%), high blood pressure (12.9%), heart failure (9.2%), and diseases of the arteries (2.6%).

These alarming statistics highlight the growing burden of heart-related conditions, including cardiomyopathy, which often develops as a consequence of prolonged heart strain or genetic abnormalities. As awareness and diagnosis of cardiomyopathy subtypes increase, there is a rising demand for effective medications, gene-based therapies, and advanced surgical interventions. Furthermore, ongoing research and technological innovations aimed at improving patient management and survival rates are expected to further propel the cardiomyopathy market’s expansion in the coming years.

Restraint: High Treatment Costs

High treatment costs are expected to hamper the growth of the cardiomyopathy market, as advanced therapies, innovative drugs, and specialized medical devices often come with significant price tags. Many patients, particularly in emerging economies, may face limited access to these treatments due to affordability issues and insufficient insurance coverage. The financial burden associated with long-term management of cardiomyopathy, including hospitalizations, follow-ups, and medications, can also discourage timely intervention, potentially limiting market adoption and slowing overall growth.

For more details on this report, Request for Sample

Global Cardiomyopathy Market Segmentation Analysis

The global cardiomyopathy market is segmented by type, treatment and region.

Treatment: The medication segment is estimated to have 46.8% of the cardiomyopathy market share.

The medication segment is expected to dominate the cardiomyopathy market due to its essential role in managing disease progression, alleviating symptoms, and reducing the risk of severe cardiac events. Drug-based therapies such as beta-blockers, ACE inhibitors, angiotensin receptor blockers, and calcium channel blockers remain the cornerstone of cardiomyopathy treatment, offering patients effective, non-invasive options for long-term management. The segment’s dominance is further supported by the rising prevalence of chronic cardiovascular conditions, increased diagnosis rates, and growing accessibility to prescription medications across both developed and emerging economies.

Additionally, pharmaceutical companies are investing heavily in research and development to introduce advanced formulations and innovative therapies, including precision medicine and gene-targeted treatments, aimed at improving patient outcomes. The ease of administration, cost-effectiveness, and wide clinical adoption of medications continue to make them the preferred choice for physicians and patients alike.

The surgical devices segment is estimated to have 29.8% of the cardiomyopathy market share.

The surgical devices segment is projected to be the fastest-growing category in the cardiomyopathy market over the coming years. This growth is driven by increasing demand for advanced cardiac implantable devices such as pacemakers, implantable cardioverter-defibrillators (ICDs), and ventricular assist devices (VADs), which play a critical role in managing severe or end-stage cardiomyopathy cases. Technological advancements in device miniaturization, remote monitoring capabilities, and minimally invasive implantation procedures are further fueling this segment’s expansion.

Moreover, rising healthcare investments, improved surgical expertise, and growing patient acceptance of device-based interventions are enhancing adoption rates globally. While medications continue to hold the dominant market share, the rapid evolution and clinical success of surgical devices are expected to significantly accelerate their contribution to the overall cardiomyopathy market in the near future.

Global Cardiomyopathy Market - Geographical Analysis

The North America cardiomyopathy market was valued at 42.3% market share in 2024

The North America region is expected to hold the largest share of the global cardiomyopathy market over the forecast period, primarily driven by the rising incidence of heart diseases and strong healthcare infrastructure. According to the American Heart Association’s Heart and Stroke Statistics 2022, cardiac arrest remains a major public health concern in the U.S., with more than 356,000 out-of-hospital cardiac arrests (OHCA) occurring annually, nearly 90% of which are fatal. Survival to hospital discharge after EMS-treated cardiac arrest remains low at approximately 10%, highlighting the critical need for effective diagnosis and management of cardiac conditions.

Hypertrophic cardiomyopathy (HCM), the most common inherited genetic heart disease in the U.S., has an estimated prevalence of 1 in 500 individuals, according to a January 2022 study published on NCBI. Similarly, idiopathic dilated cardiomyopathy (DCM) is reported to have a prevalence of 36.5 per 100,000 persons in the general population, with an incidence of 6.0 per 100,000 person-years.

The region’s growth is further supported by the presence of major key players, advanced healthcare infrastructure, government awareness initiatives, and financial support programs. For example, in May 2022, the HealthWell Foundation, a non-profit providing financial assistance to inadequately insured Americans, launched a fund to support individuals living with cardiomyopathy. Through this program, eligible Medicare patients with annual household incomes up to 500% of the federal poverty level could receive up to USD 10,000 in medication copayment or insurance premium assistance over 12 months.

Awareness campaigns also play a key role in market growth. In November 2021, Bristol Myers Squibb launched the “Could It Be HCM?” campaign to educate the public on hypertrophic cardiomyopathy. Despite HCM’s reported prevalence of 1 in 200 to 1 in 500 individuals, many patients remain undiagnosed, emphasizing the need for increased awareness and screening programs.

Recent drug approvals have further propelled market growth. In June 2023, the U.S. FDA approved Camzyos (mavacamten, 2.5 mg, 5 mg, 10 mg, 15 mg capsules) for adults with symptomatic NYHA class II-III obstructive HCM. Camzyos is the first and only FDA-approved allosteric and reversible inhibitor selective for cardiac myosin, targeting the underlying pathophysiology of obstructive HCM to improve functional capacity and symptoms. Additional therapies targeting DCM, restrictive cardiomyopathy, and ATTR-CM are also under development or have recently entered the market, supporting long-term growth in the region.

Overall, rising disease prevalence, ongoing awareness campaigns, financial support programs, and recent drug launches position North America as the leading market for cardiomyopathy treatment globally.

The European cardiomyopathy market was valued at 22.7% market share in 2024

The cardiomyopathy market in Europe is highly developed, driven by a strong healthcare infrastructure, robust regulatory environment, and well-established clinical practices. Major countries such as Germany, the United Kingdom, France, and Italy are at the forefront of innovation in cardiomyopathy diagnosis and treatment. These countries have extensive research networks and actively participate in clinical trials, enabling early adoption of advanced therapies and personalized treatment approaches. The market growth is supported by increasing awareness of cardiovascular diseases, improvements in diagnostic tools such as genetic testing and imaging technologies, and government programs aimed at managing chronic health conditions.

Pharmaceutical companies and medical device manufacturers in the region focus on introducing novel drugs and devices targeting hypertrophic, dilated, and restrictive cardiomyopathies. Collaborations between academic institutions, healthcare providers, and industry players further strengthen the market by fostering innovation, improving patient outcomes, and encouraging the development of precision medicine approaches in cardiomyopathy care.

The Asia-Pacific Cardiomyopathy market was valued at 20.2% market share in 2024

The Asia-Pacific cardiomyopathy market is witnessing rapid growth, driven by increasing prevalence of cardiovascular diseases, expanding healthcare infrastructure, and rising awareness of early diagnosis and treatment options. Key countries such as China, India, and Japan are leading the market in terms of healthcare investments, technological adoption, and expansion of diagnostic and treatment capabilities. In many parts of the region, improvements in hospital networks, availability of advanced diagnostic tools, and growing health insurance coverage have significantly increased patient access to cardiomyopathy therapies. Government initiatives, such as China’s Healthy China 2030 program and India’s national health campaigns, are further supporting market growth by enhancing healthcare delivery and promoting cardiovascular health awareness.

Additionally, the region is seeing a surge in the adoption of digital health technologies, remote monitoring solutions, and telemedicine services, which aid in the timely diagnosis and management of cardiomyopathy. Pharmaceutical and biotechnology companies are increasingly investing in research and development within the region, aiming to cater to the growing patient population with innovative therapies, including targeted drugs and personalized treatment approaches.

Competitive Landscape

The major players in the cardiomyopathy market include Pfizer Inc., Bristol Myers Squibb Company, BridgeBio Pharma, Inc., Boston Scientific Corporation, among others.

Key Developments:

- In October 2022, the Health Minister launched the Congenital Heart Disease Research Program. This program creates new academic partnerships that will drive innovative research to enhance the delivery of evidence-based and cost-effective cardiac care to children and young people across the island of Ireland

- In August 2023, Lupin Digital Health (LDH), India’s leading cardiac digital therapeutics company, announced the launch of its newest offering, LyfeTM Digital Heart Failure Clinic in India. This groundbreaking e-clinic aims to help cardiologists and caregivers manage heart failure patients effectively from the comfort of their homes.

Market Scope

| Metrics | Details | |

| CAGR | 6.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Hypertrophic Cardiomyopathy, Dilated Cardiomyopathy, Restrictive Cardiomyopathy, Arrhythmogenic Right Ventricular Dysplasia, Transthyretin Amyloid Cardiomyopathy (ATTR-CM) |

| Treatment | Medication, Surgical Devices, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global cardiomyopathy market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here