Dilated Cardiomyopathy Therapeutics Market Size & Industry Outlook

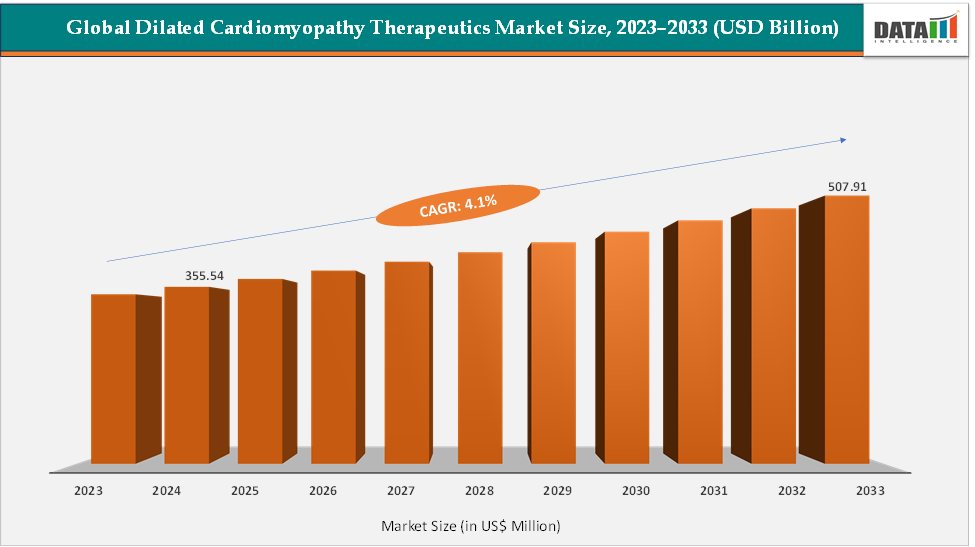

The global dilated cardiomyopathy therapeutics market size reached US$ 355.54 Million in 2024 from US$ 342.76 Million in 2023 and is expected to reach US$ 507.91 Million by 2033, growing at a CAGR of 4.1% during the forecast period 2025-2033. The market is being driven by the rising global prevalence of heart failure and cardiomyopathy. Established heart-failure drugs like Entresto (Novartis) and SGLT2 inhibitors (Farxiga) are expanding their reach as standard-of-care therapies for systolic dysfunction, which includes many dilated cardiomyopathy cases.

At the same time, next-generation options such as Verquvo (Merck) for worsening heart failure and investigational myosin modulators (Cytokinetics) are broadening the treatment toolbox. A major growth catalyst is the emergence of gene and cell therapies, for instance, in June 2025, Rocket Pharmaceuticals, Inc. received clearance from the U.S. Food and Drug Administration (FDA) for the Company’s Investigational New Drug (IND) application for RP-A701, an AAVrh.74-based gene therapy candidate for the treatment of BAG3-associated Dilated Cardiomyopathy (BAG3-DCM). Overall, the market is transitioning from symptomatic management toward precision and disease-modifying approaches, reshaping long-term growth potential.

Key Market Highlights

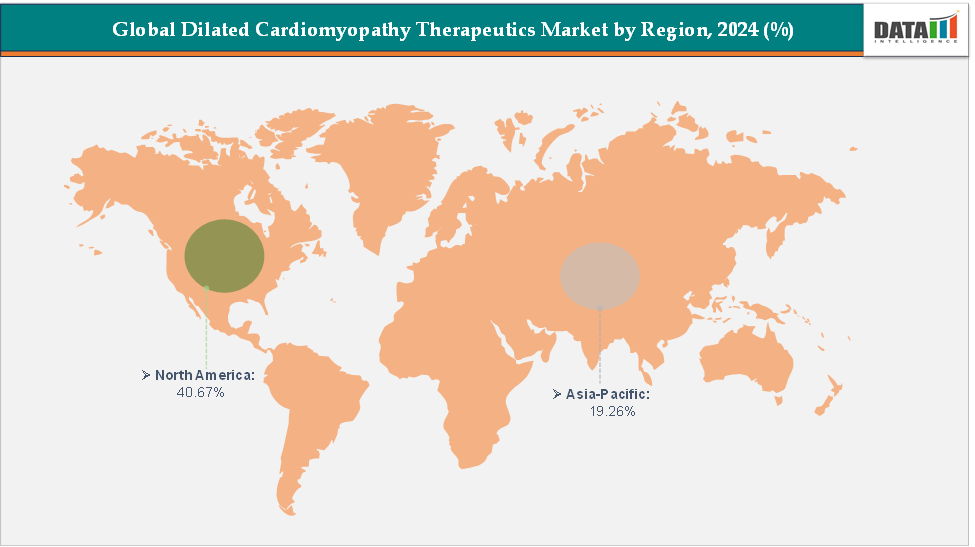

North America dominates the dilated cardiomyopathy therapeutics market with the largest revenue share of 40.67% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 5.1% over the forecast period.

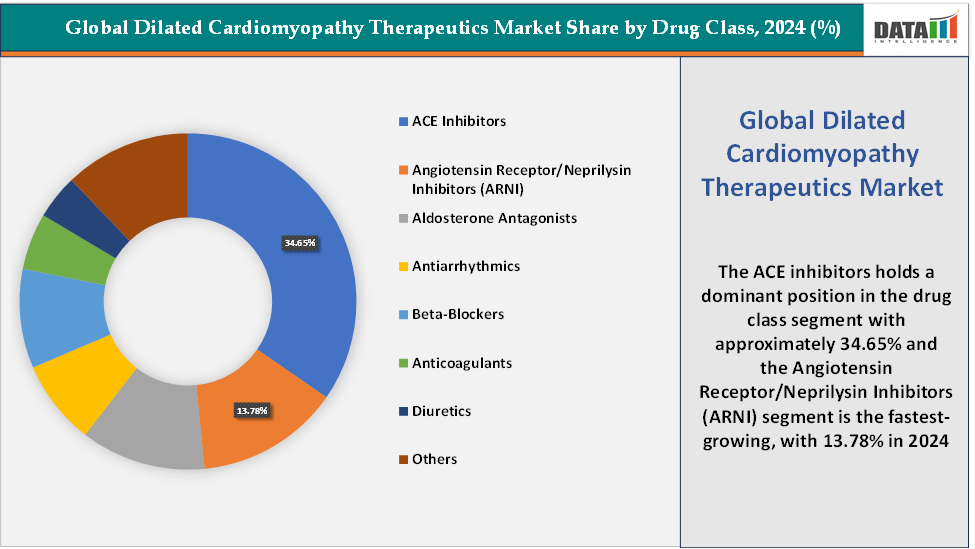

Based on drug class, the ACE inhibitors segment led the market with the largest revenue share of 34.65% in 2024.

The major market players in the dilated cardiomyopathy therapeutics market are Bristol-Myers Squibb Company, Constant Therapeutics LLC, Cumberland Pharmaceuticals, Novartis AG, AstraZeneca, Merck & Co., Inc., and Rocket Pharmaceuticals, among others

Market Dynamics

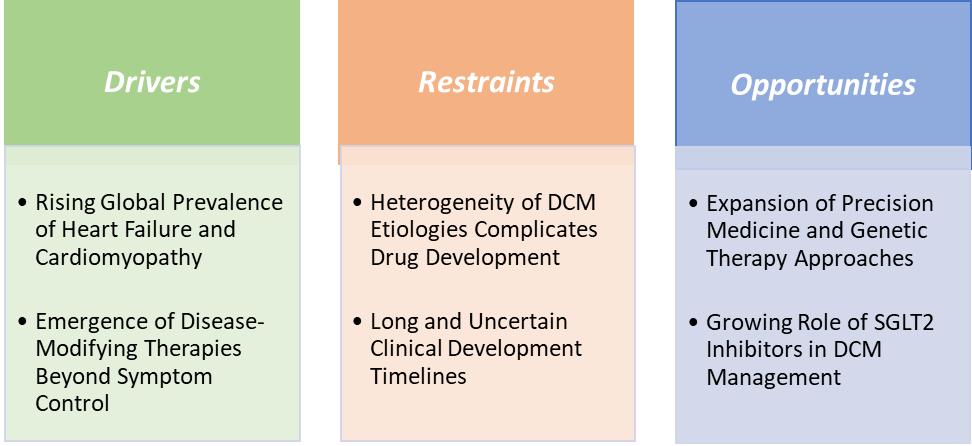

Drivers:The rising global prevalence of heart failure and cardiomyopathy is significantly driving the dilated cardiomyopathy therapeutics market growth

The rising global prevalence of heart failure and cardiomyopathy is one of the strongest drivers of growth in the dilated cardiomyopathy (DCM) therapeutics market. Heart failure currently affects more than 64 million people worldwide, and dilated cardiomyopathy is a leading cause, particularly in patients with reduced ejection fraction. This growing patient pool has increased demand for advanced therapies that improve survival and reduce hospitalizations.

For instance, Entresto (sacubitril/valsartan, Novartis), the first angiotensin receptor–neprilysin inhibitor (ARNI), has become a blockbuster largely due to adoption in DCM-linked heart failure patients. Similarly, SGLT2 inhibitors such as Farxiga (AstraZeneca) have expanded from diabetes into heart failure indications, showing robust efficacy across different patient subgroups, including those with cardiomyopathy. The rising prevalence also boosts uptake of newer agents like Verquvo, targeting patients with worsening heart failure, many of whom have DCM.

Importantly, increased diagnosis of familial and genetic cardiomyopathies through genetic testing is enlarging the addressable market for precision therapies, such as Rocket Pharmaceuticals’ BAG3 gene therapy. As aging populations and comorbidities like hypertension, obesity, and diabetes drive up heart failure incidence, the therapeutic market for DCM is expanding rapidly, creating both high-volume opportunities for established drugs and high-value niches for emerging gene and cell therapies.

Restraints:Heterogeneity of DCM etiologies complicates drug development is hampering the growth of the market

The heterogeneity of dilated cardiomyopathy etiologies is a significant restraint hampering market growth, as it complicates both drug development and commercialization. DCM is not a single disease but a syndrome with multiple causes, including genetic mutations (LMNA, BAG3, TTN, TNNT2), ischemic injury, viral myocarditis, peripartum cardiomyopathy, and toxin-induced forms (alcohol or chemotherapy-related). This diversity means that therapies effective for one subtype may not work in others, limiting the ability to develop a one-size-fits-all treatment.

For instance, Rocket Pharmaceuticals’ BAG3-targeted gene therapy only addresses small subsets of patients with defined mutations, leaving the majority of idiopathic or multifactorial DCM cases untreated. Similarly, traditional drugs such as ACE inhibitors, beta-blockers, and ARNI (Entresto) are widely used but primarily manage symptoms rather than targeting underlying causes, highlighting the gap in disease-modifying options for non-genetic etiologies. This fragmented patient population increases trial costs, prolongs timelines, and limits the commercial scalability of targeted therapies.

For more details on this report – Request for Sample

Dilated Cardiomyopathy Therapeutics Market, Segment Analysis

The global dilated cardiomyopathy therapeutics market is segmented based on drug class, route of administration, distribution channel, and region.

Drug Class:The ACE inhibitors segment is dominating the dilated cardiomyopathy therapeutics market with a 34.65% share in 2024

The ACE inhibitors segment has historically dominated the dilated cardiomyopathy (DCM) therapeutics market, owing to its long-standing role as the first-line standard of care for heart failure management. ACE inhibitors such as enalapril, lisinopril, ramipril, captopril, and perindopril are among the most widely prescribed cardiovascular drugs globally, and they remain foundational in treating patients with heart failure with reduced ejection fraction (HFrEF), a clinical manifestation strongly associated with DCM. Their mechanism of action, blocking the renin-angiotensin-aldosterone system (RAAS), reduces ventricular remodeling, lowers blood pressure, and decreases afterload, leading to improved cardiac output and reduced progression of DCM.

Even with the emergence of newer classes such as ARNI and SGLT2 inhibitors, ACE inhibitors continue to dominate in terms of patient volume due to their low cost, wide availability, and strong physician familiarity. In emerging markets, where affordability and access are critical, ACE inhibitors are often the first prescribed therapy, ensuring their sustained dominance in patient penetration. While the segment’s revenue growth is limited by generic competition, its market dominance by usage volume and global accessibility remains unchallenged, making ACE inhibitors the bedrock of dilated cardiomyopathy therapeutics worldwide.

The angiotensin receptor/neprilysin inhibitors (ARNI) segment is the fastest-growing segment in the dilated cardiomyopathy therapeutics market, with a 13.78% share in 2024

The Angiotensin Receptor/Neprilysin Inhibitors (ARNI) segment has emerged as the fastest growing segment in the dilated cardiomyopathy (DCM) therapeutics market, largely due to the unprecedented success of Entresto (sacubitril/valsartan), marketed by Novartis. Unlike conventional therapies such as ACE inhibitors or beta-blockers, which primarily manage symptoms and slow progression, ARNI has demonstrated superior survival benefits and significant reductions in hospitalizations in heart failure patients, many of whom suffer from DCM. The landmark PARADIGM-HF trial established Entresto as a superior alternative to enalapril in reducing cardiovascular death and hospitalization rates, which drove rapid global uptake.

Since DCM is a leading cause of heart failure with reduced ejection fraction (HFrEF), Entresto has become a cornerstone in treatment guidelines issued by both the American Heart Association (AHA) and the European Society of Cardiology (ESC). Commercially, Entresto’s trajectory underscores its dominance, positioning it as the most valuable branded drug in the cardiomyopathy/heart failure space. Its wide applicability across idiopathic, genetic, and ischemic DCM subtypes has further broadened its adoption, unlike niche therapies limited to genetic mutations or rare etiologies.

In clinical practice, physicians have increasingly replaced ACE inhibitors with ARNI as a first-line therapy for eligible patients, supported by real-world data showing better outcomes even in complex comorbidity settings. The combination of robust clinical evidence, strong guideline endorsements, and wide patient applicability has firmly established the ARNI segment, particularly Entresto, as the fastest growth driver in the dilated cardiomyopathy therapeutics market, setting a high benchmark for competitors and future entrants.

Geographical Analysis

North America is expected to dominate the global dilated cardiomyopathy therapeutics market with a 40.67% in 2024

North America stands out as the dominant region in the dilated cardiomyopathy (DCM) therapeutics market, driven by its high disease prevalence, strong adoption of novel therapies, and supportive reimbursement frameworks. Together, these factors, such as a large patient pool, rapid uptake of advanced therapies, robust clinical pipeline, and strong reimbursement support, firmly establish North America as the dominant region in the global dilated cardiomyopathy therapeutics market.

US Dilated Cardiomyopathy Therapeutics Market Trends

According to the National Institutes of Health (NIH), approximately 6.7 million Americans over 20 years of age have heart failure, and the prevalence is expected to rise to 8.5 million Americans by 2030, with DCM being a leading cause, and prevalence is rising with an aging population and lifestyle-related risk factors such as obesity, diabetes, and hypertension. This large patient base creates strong demand for advanced DCM therapies. The region has been at the forefront of adopting novel drugs such as Entresto (sacubitril/valsartan). Similarly, SGLT2 inhibitors like Farxiga have gained rapid traction after FDA approvals for heart failure, extending their use from diabetes into cardiomyopathy-linked heart failure patients.

Major and emerging market players are headquartered in the United States, which develops advanced therapies with FDA support. For instance, in July 2025, Longeveron Inc., a clinical-stage regenerative medicine biotechnology company developing cellular therapies for life-threatening and chronic aging-related conditions, announced that the U.S. Food and Drug Administration (FDA) approved the Investigational New Drug (IND) application for its stem cell therapy laromestrocel as a potential treatment for pediatric dilated cardiomyopathy (DCM). The accepted IND application provides for moving directly to a single Phase 2 pivotal registration clinical trial.

The Asia Pacific region is the fastest-growing region in the global dilated cardiomyopathy therapeutics market, with a CAGR of 5.1% in 2024

The Asia-Pacific region is emerging as the fastest-growing market for dilated cardiomyopathy therapeutics, fueled by rising cardiovascular disease prevalence, growing healthcare expenditure, and improved access to advanced treatments. The region is home to more than half of the world’s population, with a rapidly aging demographic and increasing incidence of diabetes, hypertension, and obesity, all major contributors to heart failure and DCM.

Countries such as China, India, and Japan are seeing a sharp rise in heart failure cases, creating a significant patient pool for DCM therapies. Additionally, Farxiga and Jardiance have gained approvals for heart failure in several Asia-Pacific countries, further boosting uptake of innovative therapies. Japan, in particular, has become a hub for clinical trials in cardiomyopathies and gene therapies, while China’s accelerated regulatory pathways are enabling quicker market entry for cardiovascular drugs. The growing presence of multinational pharma companies, alongside local manufacturers producing cost-effective generics, ensures a dynamic, competitive landscape. Together, these factors position Asia-Pacific as the fastest-growing region.

Europe Dilated Cardiomyopathy Therapeutics Market Trends

In Europe, the dilated cardiomyopathy therapeutics market is being driven by a combination of rising cardiovascular disease burden, strong clinical adoption of advanced therapies, and supportive healthcare systems. Heart failure affects more than 15 million Europeans, with DCM accounting for a significant proportion of cases, particularly in younger populations with genetic predispositions. The European Society of Cardiology (ESC) guidelines strongly endorse the use of ARNI (Entresto, Novartis), beta-blockers, ACE inhibitors, and mineralocorticoid receptor antagonists, ensuring consistent uptake of evidence-based therapies across the region.

Countries such as Germany, France, and the UK have been early adopters of Entresto, which rapidly replaced ACE inhibitors in eligible patients after landmark trial results. Moreover, widespread access to universal healthcare systems ensures high treatment penetration and supports the adoption of premium therapies without the same affordability barriers seen in emerging regions. Collectively, these drivers, clinical guideline support, rapid uptake of novel therapies, strong healthcare infrastructure, and advances in genetic screening, are propelling the growth of the DCM therapeutics market across Europe.

Dilated Cardiomyopathy Therapeutics Market Competitive Landscape

Top companies in the dilated cardiomyopathy therapeutics market include Bristol-Myers Squibb Company, Constant Therapeutics LLC, Cumberland Pharmaceuticals, Novartis AG, AstraZeneca, Merck & Co., Inc., and Rocket Pharmaceuticals, among others.

Market Scope

Metrics | Details | |

CAGR | 4.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Drug Class | Angiotensin Receptor/Neprilysin Inhibitors (ARNI), Aldosterone Antagonists, Antiarrhythmics, ACE Inhibitors, Beta-Blockers, Anticoagulants, Diuretics, and Others |

Route of Administration | Oral, Parenteral, and Others | |

Distribution Channel | Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global dilated cardiomyopathy therapeutics market report delivers a detailed analysis with 53 key tables, more than 54 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here