Market Overview

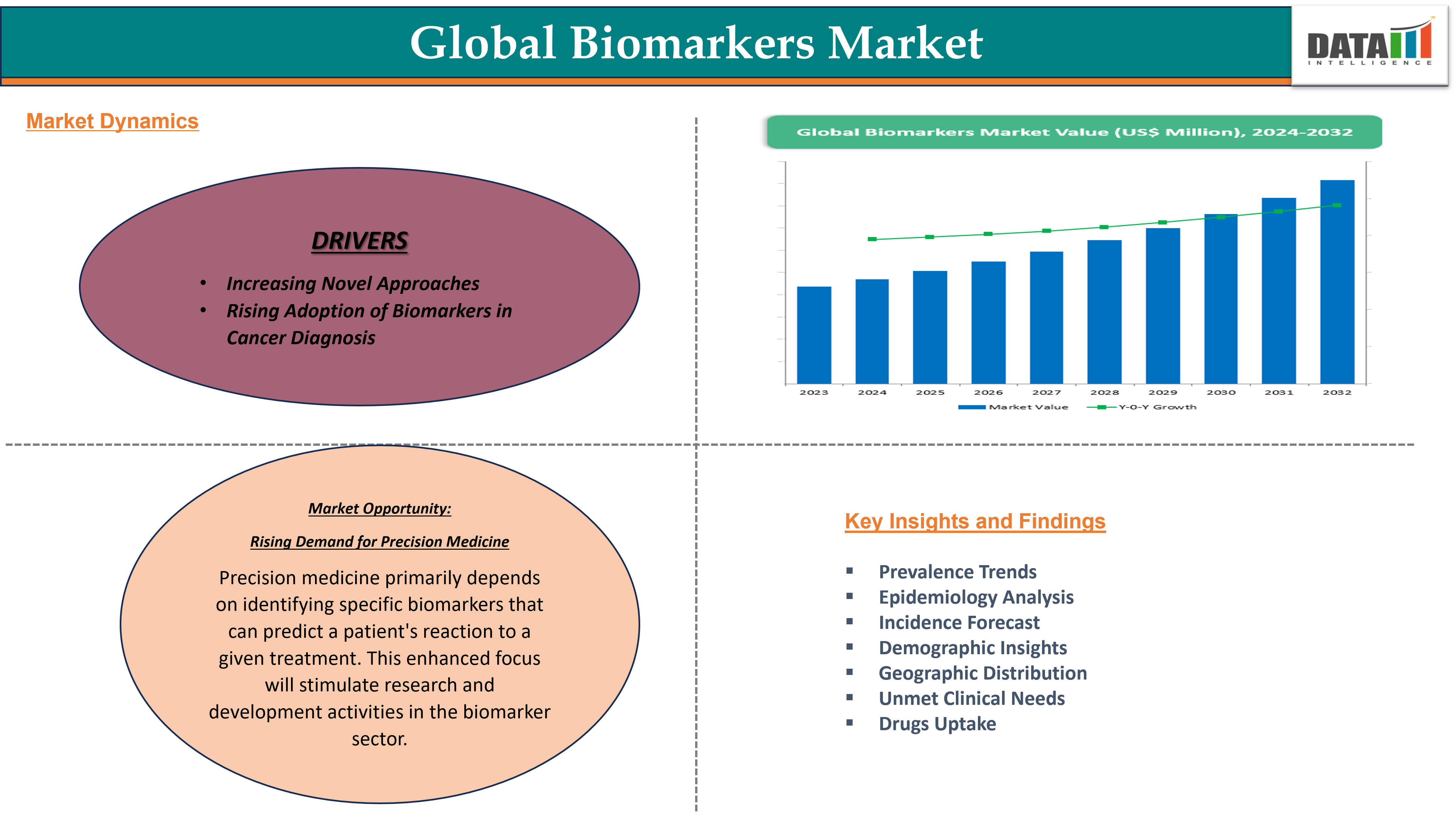

The global Biomarkers market reached US$ 60.76 billion in 2024 and is expected to reach US$ 148.88 billion by 2032, growing at a CAGR of 11.9% during the forecast period 2025-2032.

Biomarkers, or biological markers, are measurable indicators that can be objectively evaluated to assess normal biological processes, pathogenic processes, or responses to therapeutic interventions. They play a pivotal role in diagnosing diseases, monitoring disease progression, predicting outcomes, and assessing the effectiveness of treatment. Biomarkers are crucial for understanding disease mechanisms, identifying novel therapeutic targets, and personalizing medical treatments. In the medical field, biomarkers are often used to detect the presence and severity of diseases, making them invaluable for clinicians, researchers, and pharmaceutical companies.

Market Dynamics: Drivers & Restraints

Increasing Novel Approaches

Novel approaches like next-generation sequencing, proteomics, and metabolomics allow researchers to analyze a broader spectrum of biological signatures, including genetic variations, protein profiles, and metabolic pathways. This leads to the identification of novel and more comprehensive biomarkers for a variety of disorders. Novel techniques show great potential for detecting diseases at an early stage, even before symptoms arise. This is accomplished by detecting tiny changes in biological fingerprints that are associated with disease development in its early stages.

Major companies are introducing innovative products into the market for the diagnosis of various diseases. For instance, in September 2024, Genialis announced the commercial availability of Genialis krasID. This first biomarker algorithm can predict patient response and clinical benefit to KRAS inhibitors (KRASi) across tissue histology and mutation type. Genialis krasID can help guide drug development from early preclinical phases (e.g., compound/MOA differentiation and selection), to clinical trials (e.g., patient selection for clinical trials and identification of combination therapies), to market access and clinical care (e.g., development of CDx and as a clinical decision tool).

In October 2022, Koneksa launched its clinical pipeline, featuring biomarkers across neuroscience, oncology, respiratory, and other therapeutic areas. With 15 digital biomarker programs in development, the company will also launch several upcoming clinical studies. Thus, the above factors are expected to drive market growth during the forecast period.

Segment Analysis

The global biomarkers market is segmented based on type, pain type, application, route of administration, distribution channel, and region.

Type:

Diagnostic biomarkers segment is expected to dominate the global biomarkers market share

The diagnostic biomarkers segment is expected to hold the largest market share over the forecast period. The diagnostic biomarkers play a crucial role in the disease diagnosis. Diagnostic biomarkers are used not only to identify people with a disease but also to redefine the classification of the disease. Diagnostic biomarkers identify disease subtypes and thus often play critical roles when the results of diagnostic classification can be used as prognostic biomarkers and predictive biomarkers.

The manufacturing companies are focusing on developing efficient biomarkers that are expected to meet the patient’s needs. For instance, on July 13, 2023, Quest Diagnostics launched a novel prostate cancer biomarker test through its subspecialty pathology business, AmeriPath, in collaboration with Envision Sciences. Envision Sciences Pty Ltd. is an Australian-based clinical diagnostics company developing a pipeline of biomarker-based cancer diagnostic and prognostic tests in tissue and blood.

In addition on September 08, 2023, Ibex Medical Analytics launched Galen Breast HER2, a novel breast cancer AI-powered biomarker scoring solution developed in collaboration with AstraZeneca and Daiichi Sankyo, to support improved patient outcomes. Galen Breast HER2 allows clinicians to rapidly and accurately identify patients with HER2-low who would benefit from targeted therapies. Thus, the above factors are expected to hold the segment in the dominant position during the forecast period.

Competitive Landscape

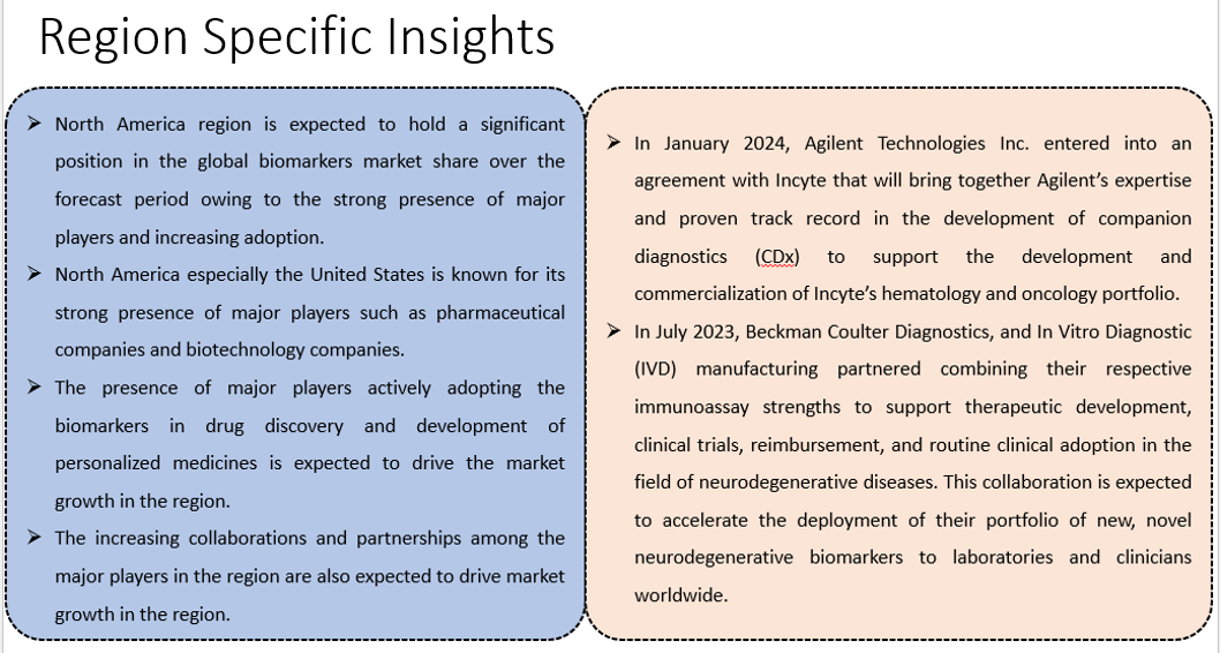

The major global players in the biomarkers market include Thermo Fisher Scientific Inc., QIAGEN NV, Merck KGaA, BRUKER CORPORATION, Bio-Rad Laboratories, Inc., Siemens Healthineers AG, Abbott Laboratories, Agilent Technologies Inc., Myriad Genetics and Somru BioScience Inc. among others.

| Metrics | Details | |

| CAGR | 11.9% | |

| Market Size Available for Years | 2022-2032 | |

| Estimation Forecast Period | 2025-2032 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Diagnostic Biomarkers, Monitoring Biomarkers, Predictive Biomarkers, Susceptibility/Risk Biomarkers, Prognostic Biomarkers, Pharmacodynamic/Response Biomarkers, Safety Biomarkers, Others |

| Product Type | Assays, Kits, Reagents, Others | |

| Application | Drug Discovery and Development, Disease Diagnostics, Disease Risk Assessment, Personalized Medicine, Others | |

| End-User | Pharmaceutical Companies, Biotechnology Companies, Research Centers and Institutes, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Key Developments

- In July 2024, Scipher Medicine, a company focused on proprietary AI and network biology platform solutions to transform patient care launched a new approach to develop biomarkers following the publication of the novel, patent-pending framework PRoBeNet (Predictive Response Biomarkers using Network medicine).

- In October 2023, Mindray introduced new high-sensitivity troponin I (hs-cTnI) and NT-proBNP cardiac biomarkers. The additions have enhanced Mindray's diverse portfolio of cardiac biomarkers for diagnosing and managing cardiovascular diseases (CVDs).

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, and product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The Global Biomarkers market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2023

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.