Cardiac Rhythm Management Devices Market Overview

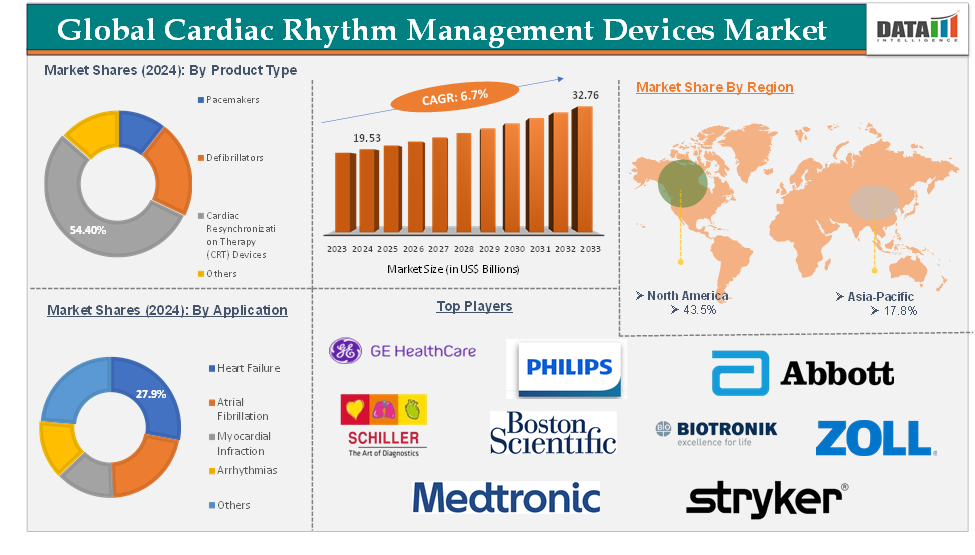

Cardiac Rhythm Management Devices Market reached US$ 19.53 Billion in 2024 and is expected to reach US$ 32.76 Billion by 2033, growing at a CAGR of 6.7% during the forecast period 2025-2033.

The global cardiac rhythm management (CRM) devices market encompasses medical devices designed to monitor, regulate, and restore normal heart rhythms in patients with arrhythmias or other cardiac rhythm disorders. These devices include pacemakers, implantable cardioverter defibrillators (ICDs), cardiac resynchronization therapy (CRT) devices, and external defibrillators, which can be used for both temporary and long-term management of cardiac conditions.

Key drivers of the CRM devices market include the rising prevalence of cardiovascular diseases such as arrhythmias, heart failure, and atrial fibrillation, which are increasingly common due to the aging global population and the growing incidence of lifestyle-related conditions like hypertension, diabetes, and obesity.

Opportunities in the CRM devices market arise from the growing adoption of minimally invasive procedures, the integration of telemedicine and remote monitoring capabilities, and the increasing demand for wearable cardiac rhythm monitoring devices. The expansion of healthcare infrastructure in developing regions and ongoing innovations in device design and data-driven personalized medicine further open new avenues for market growth.

Major trends shaping the CRM devices market include the miniaturization of devices, enhanced battery life, wireless connectivity, and the widespread use of remote supervision and telemedicine. The integration of artificial intelligence for predictive analytics and personalized treatment is transforming patient care, enabling real-time monitoring and tailored interventions.

Executive Summary

For more details on this report – Request for Sample

Cardiac Rhythm Management Devices Market Dynamics: Drivers

Rising prevalence of cardiovascular diseases

The demand for the global cardiac rhythm management devices market is driven by multiple factors. The rising prevalence of cardiovascular diseases (CVDs) is a significant driving factor for the global cardiac rhythm management (CRM) devices market. This increase in cases of CVDs leads to a higher demand for effective monitoring and treatment solutions, directly impacting the growth and expansion of the cardiac rhythm management devices market.

According to World Health Organization (WHO) data in May 2024, Cardiovascular diseases (CVDs) are the leading cause of death and disability in the WHO European Region, responsible for approximately 10,000 deaths every day, accounting for over 42% of all deaths in the region. These diseases include heart attacks and strokes, which together make up the vast majority of CVD-related deaths.

CVDs frequently lead to heart rhythm disorders (arrhythmias), which can result in life-threatening events like sudden cardiac arrest or heart failure. CRM devices such as pacemakers, implantable cardioverter-defibrillators (ICDs), and cardiac resynchronization therapy (CRT) devices are critical for monitoring and correcting abnormal heart rhythms, thereby preventing fatal outcomes.

The high and rising burden of cardiovascular diseases, especially heart attacks and strokes, creates a sustained and growing need for cardiac rhythm management devices. This demand is amplified by an aging population, technological advancements, and proactive healthcare system responses, making the CRM devices market one of the fastest-growing segments in medical technology globally.

Cardiac Rhythm Management Devices Market Dynamics: Restraints

Product recalls

The product recalls will hinder the growth of the global cardiac rhythm management devices market. Product recalls in the global cardiac rhythm management devices market, particularly for implantable cardioverter defibrillators (ICDs) and cardiac resynchronization therapy defibrillators (CRT-Ds), are primarily driven by safety concerns related to device malfunctions.

For instance, in February 2025, the U.S. Food and Drug Administration (FDA) classified safety concerns with certain Boston Scientific pacemakers as a Class I recall, the most serious type, indicating that use of these devices may result in serious injury or death if agency instructions are not followed. These issues, first made public in December 2024, have been linked to more than 800 injuries and two deaths.

The recall affects specific models, including Accolade, Proponent, Essentio, and Altrua 2 pacemakers, as well as Visionist and Valitude cardiac resynchronization therapy pacemakers, due to a manufacturing issue that can cause the devices to enter an irreversible Safety Mode, which limits their ability to properly regulate heart rhythm and may require device replacement.

This malfunction occurs because of the inappropriate activation of the short-circuit protection feature, which can prevent the device from delivering necessary shocks to correct life-threatening arrhythmias. These recalls can lead to serious health risks for patients who depend on these devices for life-saving therapies. Thus, the above factors could be limiting the global cardiac rhythm management devices market's potential growth.

Cardiac Rhythm Management Devices Market Segment Analysis

The global cardiac rhythm management devices market is segmented based on product type, application, end-user, and region.

Product Type:

The cardiac resynchronization therapy (CRT) devices from the product type segment are expected to hold 54.4% of the global cardiac rhythm management devices market in 2024

A CRT device is designed to deliver the image by sending small electrical impulses to both ventricles. These impulses help the ventricles beat together in a more synchronized pattern, coordinated movement of the fingers and thumb as they flex and curl inward together to form a fist. This synchronization enhances the heart's ability to pump blood more effectively, improving overall cardiac output and ensuring that oxygen and nutrients are delivered efficiently throughout the body.

Cardiac resynchronization therapy (CRT) devices are essential components of the global cardiac rhythm management devices market, particularly in managing heart failure and certain arrhythmias. These devices improve heart contractions, which is crucial for effective cardiac function. The CRT segment is experiencing significant growth owing to multiple factors, including the increasing prevalence of cardiovascular diseases, advancements in technology, and a growing geriatric population.

Furthermore, key players in the industry and their product launches will propel this segment's growth in the cardiac rhythm management devices market. For instance, in April 2024, MicroPort CRM launched two new ranges of devices in Europe, TALENTIA and ENERGYA. These products include Implantable Cardiac Defibrillators (ICDs) and Cardiac Resynchronization Therapy and Defibrillation devices (CRT-Ds), both featuring advanced Bluetooth connectivity. The integration of Bluetooth technology allows for wireless communication between the devices and healthcare providers.

Also, in February 2024, MicroPort CRM announced the launch of two significant products in Japan: the GALI SonR Cardiac Resynchronization Therapy and Defibrillation device (CRT-D) and the NAVIGO 4LV left ventricular pacing leads. This launch marks an important advancement in cardiac care technology aimed at improving patient outcomes for individuals with heart rhythm disorders. These factors have solidified the segment's position in the global cardiac rhythm management devices market.

Cardiac Rhythm Management Devices Market Geographical Analysis

North America is expected to hold 43.5% of the global cardiac rhythm management devices market in 2024

The rising incidence of cardiovascular diseases (CVDs), including heart failure, arrhythmias, and coronary artery disease, is a significant driver for the cardiac rhythm management devices market. According to CDC data in October 2024, heart disease is indeed the leading cause of death for men, women, and people of most racial and ethnic groups in the United States. One person dies every 33 seconds from cardiovascular disease. In 2022, 702,880 people died from heart disease.

The increasing burden of cardiovascular diseases (CVDs) is significantly influenced by lifestyle factors such as sedentary behavior, unhealthy dietary habits, and an aging population. As healthcare providers seek advanced technologies to manage these conditions effectively, the cardiac rhythm management (CRM) devices market is poised for substantial growth.

Moreover, in this region, a major number of key players’ presence, well-advanced healthcare infrastructure, government initiatives & regulatory support, technological advancements, & investments, and product launches & approvals would propel the cardiac rhythm management devices market growth.

For instance, in September 2024, Boston Scientific Corporation received U.S. Food and Drug Administration (FDA) approval to broaden the use of its current-generation INGEVITY+ Pacing Leads. These leads, thin wires implanted in the heart and connected to a pacemaker, are now approved for conduction system pacing (CSP) and sensing in the left bundle branch area (LBBA) when used with single- or dual-chamber pacemakers.

Cardiac Rhythm Management Devices Market Major Players

The major global players in the cardiac rhythm management devices market include Medtronic, Abbott, Boston Scientific Corporation, Biotronik, Koninklijke Philips N.V., Schiller AG, ZOLL Medical Corporation, Physio-Control, Inc. (Stryker), Shenzhen Mindray Bio-Medical Electronics Co., Ltd., and GE HealthCare, among others.

Key Developments

In April 2025, Boston Scientific Corporation reported positive 12-month primary endpoint results from the second phase of the ADVANTAGE AF clinical trial, which assessed the FARAPULSE Pulsed Field Ablation (PFA) System and the adjunctive use of the FARAPOINT PFA Catheter in patients with persistent atrial fibrillation (AF).

In November 2024, Abbott launched the AVEIR VR leadless pacemaker in India, specifically designed for patients experiencing slow heart rhythms. This innovative device has received approval from both the Central Drugs Standard Control Organization (CDSCO) in India and the U.S. Food and Drug Administration (FDA), marking a significant advancement in cardiac care.

In March 2024, Abbott received CE mark approval in Europe for its Assert-IQ insertable cardiac monitor (ICM), which is designed for long-term remote monitoring of patients' heart rhythms for up to six years. This device represents a significant advancement in cardiac care technology, enabling healthcare providers to effectively manage patients experiencing irregular heartbeats, including challenging cases such as atrial fibrillation (AF).

In January 2024, Medtronic announced a strategic partnership with Cardiac Design Labs (CDL) to launch and expand access to a novel heart rhythm monitoring technology called Padma Rhythms in India. This collaboration aims to enhance cardiac care by providing comprehensive, long-term heart monitoring through an External Loop Recorder (ELR) patch.

Market Scope

Metrics | Details | |

CAGR | 6.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Pacemakers, Defibrillators, Cardiac Resynchronization Therapy (CRT) Devices, Others |

Application | Heart Failure, Atrial Fibrillation, Myocardial Infarction, Arrhythmias, Others | |

End-User | Hospitals & Specialty Clinics, Ambulatory Care Settings, Home Care Settings, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |