Bioprocessing Equipment Market Size& Industry Outlook

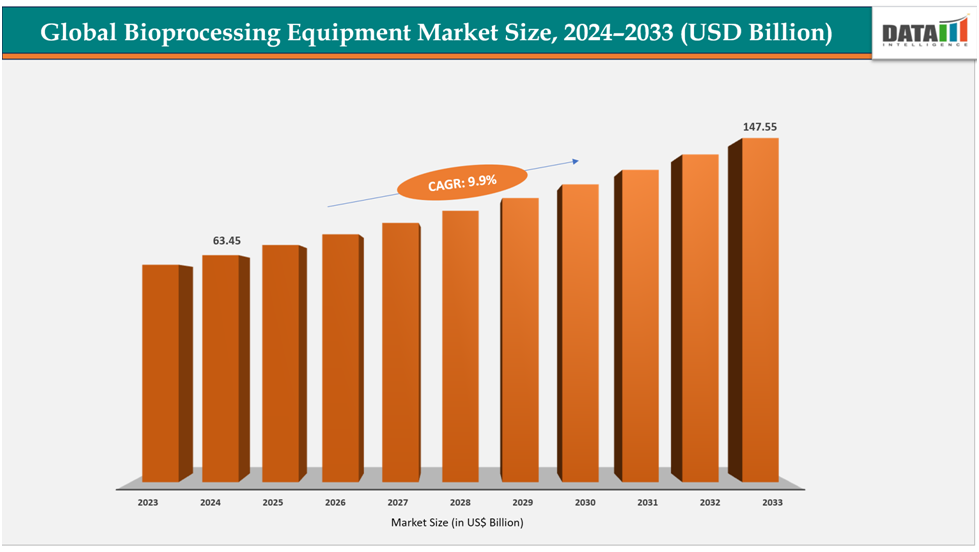

The global bioprocessing equipment market size reached US$ 58.14billion with rise of US$63.45billion in 2024 is expected to reach US$ 147.55billion by 2033, growing at a CAGR of 9.9%during the forecast period 2025-2033.

One major driver of the global bioprocessing equipment market, is the shift toward continuous bioprocessing. Unlike traditional batch methods, continuous processing improves efficiency, reduces production costs, and enhances product consistency. For instance, in monoclonal antibody (mAb) manufacturing, companies adopting continuous chromatography systems can achieve higher yields with smaller equipment footprints, allowing faster scale-up and better flexibility. This shift is encouraging both established biopharma companies and contract manufacturing organizations (CMOs) to invest heavily in advanced equipment designed to support continuous operations.

Key Highlights

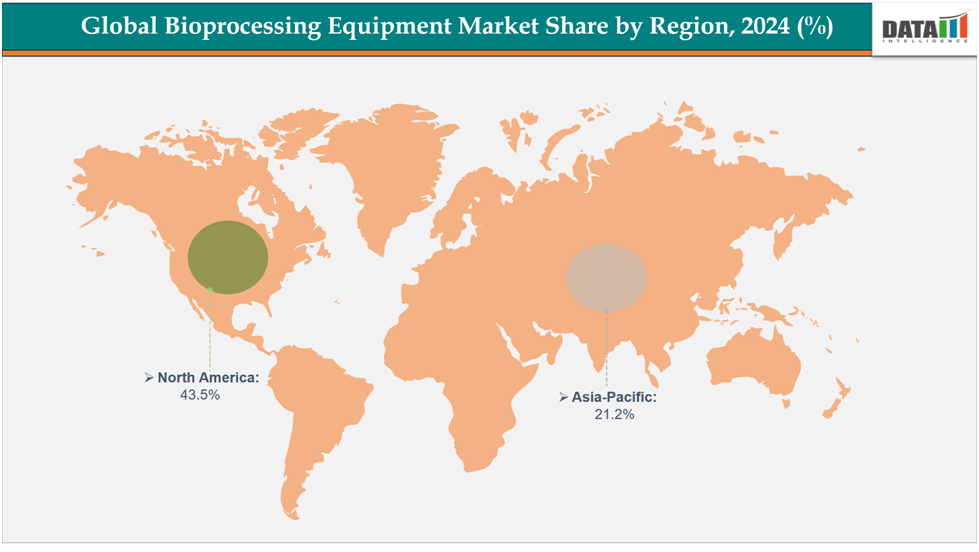

- North America dominates the bioprocessing equipment market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of8.1% over the forecast period.

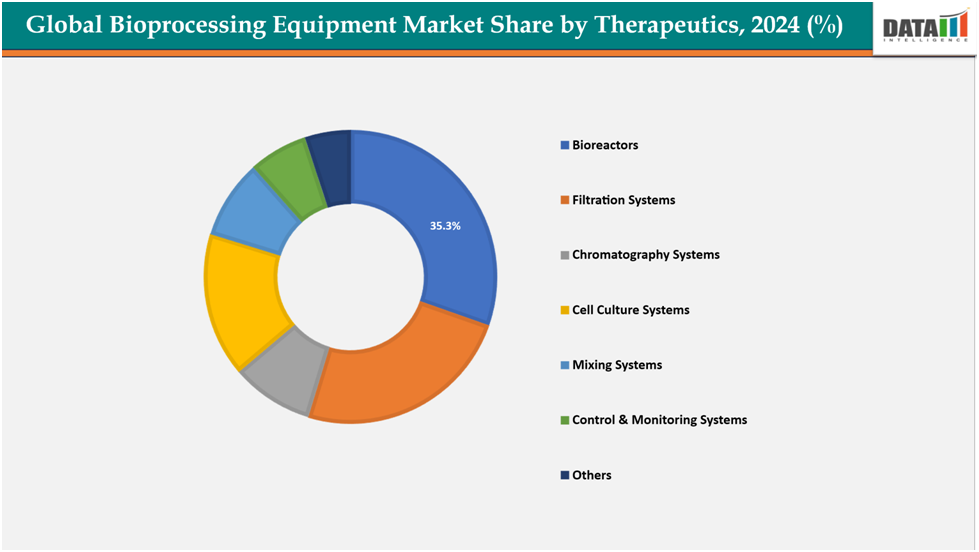

- Based on product type, bioreactors segmented the market with the largest revenue share of 35.3% in 2024.

- The major market players in the Thermo Fisher Scientific, Inc, Sartorius AG, Danaher Corporation (Cytiva), Merck KGaA, Eppendorf, Bionet, Solaris Biotech, PBS Biotech, Inc., Applikon Biotechnology(Getinge / Applikon), Celartia and among others.

Market Dynamics

Drivers: Growing demand for biopharmaceutical production is significantly driving the bioprocessing equipment market growth

The global bioprocessing equipment market is driven by the increasing demand for biopharmaceutical production, driven by the expansion of biologics pipelines in therapeutic areas like oncology, autoimmune diseases, and rare genetic disorders. Biologics, such as monoclonal antibodies, recombinant proteins, vaccines, and advanced cell and gene therapies, are preferred due to their precision and higher efficacy. This shift in manufacturing capabilities is fueling demand for advanced bioreactors, filtration systems, chromatography units, and single-use technologies.

For instance, in April 2025, Wuxi Biologics completed its first commercial Process Performance Qualification (PPQ) campaign for its three 5,000 L single-use bioreactors at its MFG20 facility in Hangzhou. These are Asia’s first reactors in a 15,000-L configuration using single-use technology. The upgrade increased capacity at MFG20 from 8,000 L to 23,000 L by combining the new 5,000 L units with existing 2,000 L reactor.

Restraints: Stringent regulatory compliance requirements are hampering the growth of the bioprocessing equipment market

The global bioprocessing equipment market faces significant challenges due to stringent regulatory compliance requirements from agencies like the FDA and EMA. These standards ensure product safety, consistency, and quality in bioprocessing equipment used in biologics, vaccines, and cell and gene therapies. Meeting these standards requires extensive validation, documentation, and inspections, increasing time-to-market and cost for manufacturers. Smaller biotech firms and new entrants face even greater difficulties, as regulatory hurdles can limit their ability to adopt innovative equipment quickly. This complex regulatory environment, essential for patient safety, acts as a bottleneck for innovation and scaling in the bioprocessing equipment market.

For more details on this report – Request for Sample

Segmentation Analysis

The global bioprocessing equipment market is segmented based onproduct type, process, application, end user, and region.

Product Type:

The bioreactors from Product Type segment to dominate the Bioprocessing Equipment market with a 35.3% share in 2024

The bioreactors segment is being driven by the rising need for scalable, flexible, and efficient production systems to support the growing pipeline of biologics, including monoclonal antibodies, recombinant proteins, and cell and gene therapies. The shift toward single-use bioreactors has further accelerated growth, as they offer reduced risk of contamination, lower cleaning costs, and faster turnaround between production runs. Additionally, continuous innovations such as automated control systems, perfusion-enabled bioreactors, and hybrid stainless steel–disposable modular allowing manufacturers to enhance yield and maintain product consistency, making bioreactors a cornerstone of modern bioprocessing.

For instance, in April 2025, Thermo Fisher Scientific has introduced the 5L DynaDrive Single-Use Bioreactor, a new addition to its bioreactor portfolio. This innovative device offers scalability from 1 to 5,000 liters, accelerates bench-scale process development, and facilitates a cost-effective transition from bench to commercialization, ensuring consistent reactor design and film across all scales.

Application: The vaccines segment is estimated to have a 41.2% of the bioprocessing equipment market share in 2024

The vaccines segment is being fueled by the global focus on preventive healthcare and preparedness for infectious disease outbreaks, as seen during the COVID-19 pandemic. Rising demand for mRNA vaccines, viral vector-based vaccines, and recombinant protein vaccines is creating significant pressure on manufacturers to expand capacity, which in turn drives investment in advanced bioprocessing equipment. Governments and international health organizations are also increasing funding to boost vaccine R&D and production infrastructure, particularly in emerging markets. This trend is further supported by the move toward personalized and therapeutic vaccines, requiring flexible equipment that can handle diverse vaccine platforms efficiently.

Geographical Analysis

North America dominates the global bioprocessing equipment market with a 43.5% in 2024

North America dominates the global bioprocessing equipment market due to its biopharmaceutical manufacturers, advanced research infrastructure, and early adoption of innovative technologies. The region benefits from rising biologic demand and continuous investments by leading players like Thermo Fisher Scientific and Danaher. CDMOs support outsourcing trends, boosting equipment sales.

The U.S. is the core growth driver in North America, supported by the highest number of FDA-approved biologics and cell and gene therapies globally. Growing investments by companies such as Sartorius, Moderna, and WuXi Biologics USA in expanding biomanufacturing facilities fuel the need for scalable and flexible equipment. Government programs focused on pandemic preparedness and vaccine capacity also continue to drive the market forward.

For instance, in November 2024, Sartorius Stedim Biotech has opened its new Center for Bioprocess Innovation in Marlborough, Massachusetts, aiming to promote collaboration, co-development, and learning among customers and external innovation partners, utilizing Sartorius' latest technologies in real-life bioprocess workflows.

Europe is the second region after North America which is expected to dominate the global bioprocessing equipment market with a 34.5% in 2024

Europe is driven by its well-regulated biopharma landscape, high standards for quality manufacturing, and focus on biosimilars and vaccines. Countries like Switzerland, France, and the U.K. host major biotech clusters, making the region an important hub for innovation. The adoption of single-use systems, automation, and continuous bioprocessing is rising steadily as companies look to optimize production efficiency and reduce costs.

Germany stands out in Europe due to its strong manufacturing base and world-leading biotech companies like Sartorius and Merck KGaA, which are continuously innovating in bioprocessing solutions. The government’s support for biotech R&D and initiatives in vaccine development and regenerative medicine enhance equipment demand. Germany’s focus on expanding capacity for monoclonal antibodies and cell therapy production makes it a key growth engine in the region.

For instance, in March 2025, Sartorius, a German pharmaceutical and laboratory equipment supplier, plans to invest in a new production line for pallet tanks used in single-use bioreactors at its Bengaluru R&D facility until 2027 to meet local and global demands.

The Asia Pacific region is the fastest-growing region in the global bioprocessing equipment market, with a CAGR of 8.1% in 2024

Asia Pacific is experiencing rapid growth as countries like China, South Korea, and India emerge as leading hubs for biologics and biosimilar manufacturing. The region benefits from lower production costs, government support for domestic biopharma, and increasing foreign investments by CDMOs. Rising healthcare needs and a growing patient population are also encouraging adoption of advanced bioprocessing equipment for large-scale vaccine and biologics production.

Japan’s market is primarily driven by its focus on regenerative medicine, stem cell research, and gene therapies, supported by favorable policies such as fast-track approval pathways. Local companies are adopting closed, automated bioprocessing systems to ensure efficiency and compliance for advanced therapies. The government’s consistent funding and collaborations with global biopharma players are accelerating demand for next-generation equipment.

For instance, in April 2025, Asahi Kasei, a Japan-based pharmaceutical company, has restructured its bioprocess businesses to provide more agile services, deep innovation in bioprocess solutions, and stronger support in emerging modalities, in response to growing pharmaceutical industry demand.

Competitive Landscape

Top companies in the bioprocessing equipment market include Thermo Fisher Scientific, Inc., Sartorius AG, Danaher Corporation (Cytiva), Merck KGaA, Eppendorf, Bionet, Solaris Biotech, PBS Biotech, Inc., Applikon Biotechnology (Getinge / Applikon), Celartia and among others.

Thermo Fisher Scientific, Inc :Allergan Plc is a leading global brand in the Bioprocessing Equipment market, known for its innovative treatments that address both medical and cosmetic aspects of acne management. With a strong global distribution network and strategic marketing initiatives, Allergan expands access to acne solutions across multiple regions. The company's expertise in developing advanced formulations and combination therapies has enhanced treatment effectiveness and improved patient adherence.

Market Scope

| Metrics | Details | |

| CAGR | 9.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Bioreactors, Filtration Systems, Chromatography Systems Cell Culture Systems, Mixing Systems, Control & Monitoring Systems, Others |

| Process | Upstream Processing, Downstream Processing | |

| Application | Vaccines, Gene & Cell Therapy, Monoclonal Antibodies (mAbs), Recombinant Proteins, Others | |

| End User | Biopharmaceutical Companies, Contract Manufacturing Organizations (CMOs), Academic & Research Institutes | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global bioprocessing equipment market report delivers a detailed analysis with 62 key tables, more than 57visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more laboratory equipment-related reports, please click here