Biomarker Discovery Market Size & Industry Outlook

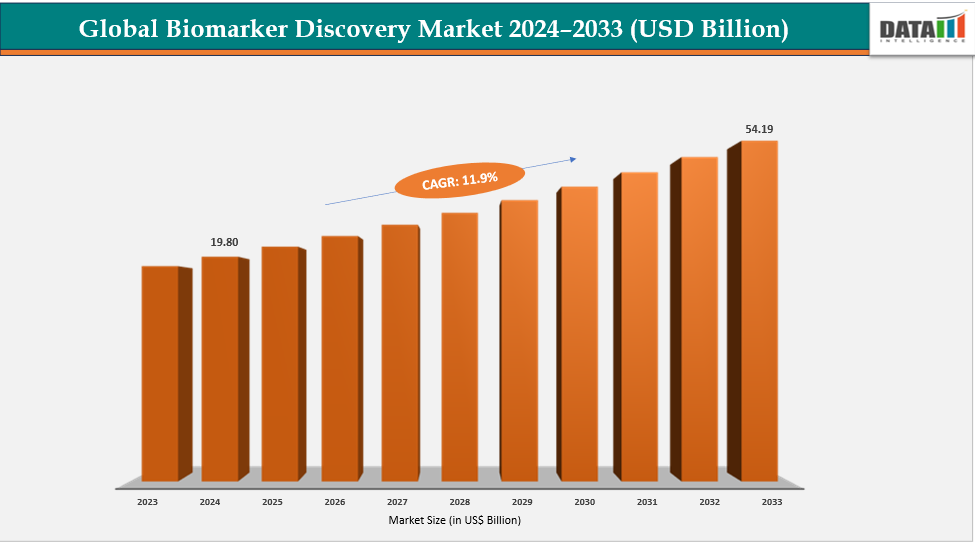

The global biomarker discovery market size reached US$ 17.84 Billion in 2023 with a rise of US$ 19.80 Billion in 2024 and is expected to reach US$ 54.19 Billion by 2033, growing at a CAGR of 11.9% during the forecast period 2025-2033.

Biomarker discovery is being revolutionized by rapid advancements in measurement technologies, including mass spectrometry, next-generation sequencing, and high-throughput screening. These technologies allow for the accurate identification, quantification, and validation of molecular signatures across proteomics, metabolomics, and genomics. These technologies speed up the creation and analysis of data by offering increased sensitivity, precision, and reproducibility. Reliable biomarkers are needed to customize treatments based on patient profiles, and the need for precision medicine and companion diagnostics is increasing at the same time. Biomarkers are essential to individualized healthcare because they can be used to predict drug response, track the course of a disease, and improve therapy results.

Key Highlights

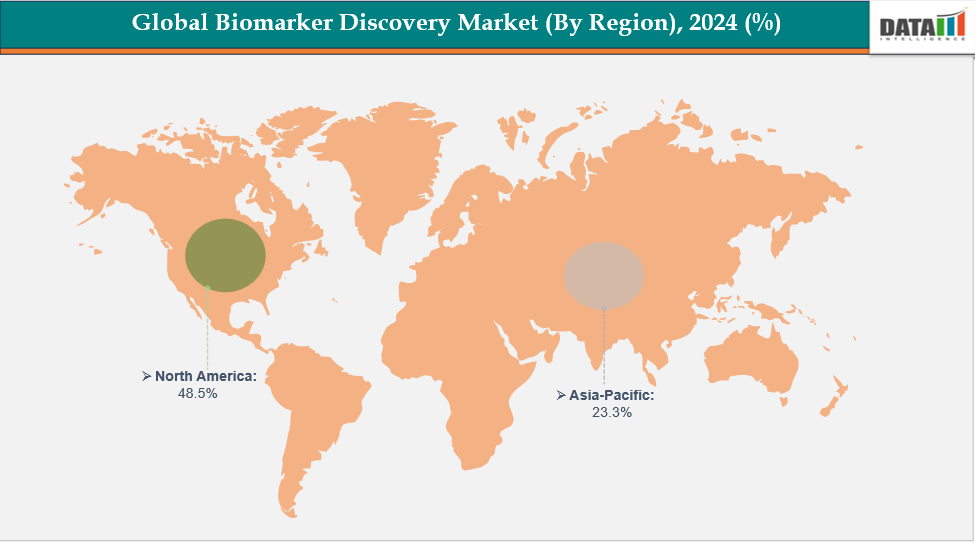

- North America is dominating the global biomarker discovery market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global with a CAGR of 7.7% in 2024

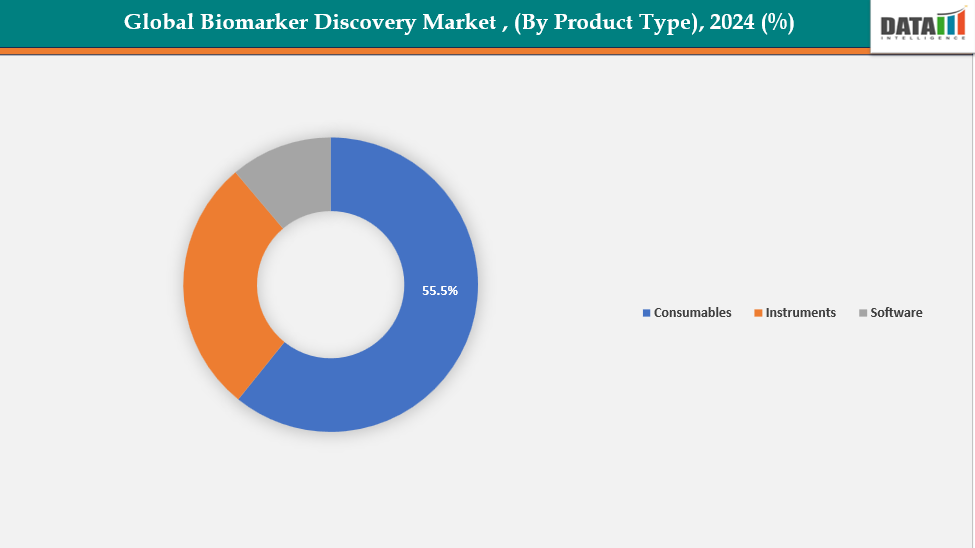

- The consumables segment from product type is dominating the biomarker discovery market with a 55.5% share in 2024

- The genomics segment from technology is dominating the biomarker discovery market with a 35.3% share in 2024

- Top companies in the biomarker discovery market include Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Merck KGaA, Hoffmann-La Roche Ltd, Abcam Limited, Olink, SomaLogic, and BD, among others.

For More Details, Request for Sample

Market Dynamics

Drivers: Wider adoption of multi-omics and integrative approaches are accelerating the growth of the biomarker discovery market

The broader use of integrative and multi-omics methods is facilitating a more comprehensive understanding of disease biology, which is speeding up the search for biomarkers. By merging data from transcriptomics, metabolomics, proteomics, and genomes, scientists can find biomarkers spanning several molecular layers with greater precision and clinical significance. Single-omics investigations frequently fail to reveal intricate biological relationships, but the integration of these datasets, aided by sophisticated bioinformatics and artificial intelligence techniques, does.

Additionally, continuous multi-omics research and development is propelling technical innovation, increasing analytical precision, and broadening the spectrum of observable biomolecular fingerprints, all of which are contributing to the adoption of biomarker discoveries. For instance, in February 2025, Metabolon introduced advanced multi-omics biomarker discovery capabilities within its Integrated Bioinformatics Platform, featuring predictive modeling, latent factor analysis, and pathway enrichment tools, enhancing data integration and accelerating breakthroughs in precision medicine and therapeutic development. analysis using public tools like Reactome and sophisticated multi-omics data visualization resources.

Restraints: High cost of advanced platforms, consumables, and tests are hampering the growth of the biomarker discovery market

The high cost of advanced platforms, consumables, and tests is hampering the growth of the biomarker discovery market by limiting accessibility and scalability. Mass spectrometry, single-cell analysis, and next-generation sequencing are examples of technologies that demand a large initial investment, specialized infrastructure, and knowledgeable staff.

Additionally, operational costs are greatly increased by ongoing expenditures for reagents, assay kits, and data analysis software. Adopting state-of-the-art biomarker discovery technologies is challenging for new biotech companies and smaller research institutes due to these budgetary constraints.

For more details on this report, see Request for Sample

Biomarker Discovery Market, Segmentation Analysis

The global biomarker discovery market is segmented based on product type, technology, application, end user and region

By Product Type: The consumables segment from product type is dominating the biomarker discovery market with a 55.5% share in 2024

The consumables segment dominates the biomarker discovery market due to its essential and recurring role in research and diagnostic workflows. Every stage of the experiment, from sample preparation to validation, depends on consumables like reagents, assay kits, antibodies, and microplates, which fuel ongoing demand. Consumable use is becoming much more common as biomarker research in genomes, proteomics, and metabolomics grows. Consumables produce consistent, recurring revenue streams as opposed to instruments, which are one-time investments.

Additionally, ongoing product innovations by key players like Thermo Fisher Scientific, Merck KGaA, QIAGEN, and Bio-Rad Laboratories enhance assay precision and sensitivity, further boosting adoption.

By Technology: The genomics segment form technology is dominating the biomarker discovery market with a 35.3% share in 2024

The genomics segment leads the biomarker discovery market because of its crucial function in comprehending molecular illness mechanisms. Genetic variants, mutations, and single nucleotide polymorphisms (SNPs) linked to diseases can be quickly and accurately identified thanks to genomic technology, especially whole-genome analysis and next-generation sequencing (NGS). Finding predictive, diagnostic, and prognostic biomarkers requires this knowledge.

Additionally, genomic applications in oncology, neurology, and infectious illnesses have increased due to ongoing advancements, falling sequencing costs, and the emergence of precision medicine. For instance, in August 2024, Illumina achieved FDA approval for its TruSight Oncology Comprehensive test, a groundbreaking genomic-based IVD for precision oncology. This 500+ gene assay, featuring two companion diagnostics, enables comprehensive genomic profiling across cancers, enhancing biomarker discovery and accelerating targeted therapy matching for personalized cancer treatment

Biomarker Discovery Market, Geographical Analysis

North America is dominating the global biomarker discovery market with a 48.5% in 2024

North America is projected to lead the global biomarker discovery market due to its advanced healthcare infrastructure, strong biotechnology presence, and high adoption of omics-based and molecular diagnostic technologies. Regional market domination and innovation are further fueled by growing investments in precision medicine and an increase in the need for quick, multiplex testing options.

In the USA, the biomarker discovery market is driven by rising research and development investments, advancements in multi-omics technologies, growing adoption of precision medicine for targeted diagnostics and therapeutics, and regulatory support and approvals.

For instance, in May 2025, Fujirebio received FDA 510(k) clearance for its Lumipulse G pTau 217/β-Amyloid 1-42 Plasma Ratio test, the first FDA-approved blood-based IVD for Alzheimer’s disease. This breakthrough enabled accurate, noninvasive assessment of amyloid pathology, advancing early diagnosis and biomarker-based detection of cognitive decline.

Europe is the second region after North America which is expected to dominate the global biomarker discovery market with a 34.5% in 2024

Europe’s biomarker discovery market is expanding due to strong healthcare infrastructure, high disease awareness, and broad access to diagnostic facilities. Biomarker validation, translational research, and precision medicine improvements throughout the region are accelerated by strategic partnerships among biotechnology businesses, research institutes, and healthcare organizations.

Germany’s biomarker discovery market is growing rapidly, driven by advanced healthcare infrastructure, strong regulatory frameworks, and active research collaborations. Precision medicine is being advanced and market growth is being reinforced nationwide through strategic acquisitions, partnerships, and industry-academic alliances that are stimulating innovation, increasing biomarker capacities, and speeding up translational research.

For instance, in July 2025, Alden Scientific acquired Oncimmune Germany GmbH, strengthening its global position in multi-omic research and precision medicine. The acquisition integrated Oncimmune’s ImmunoINSIGHTS biomarker discovery platform, enhancing Alden’s capabilities in immunodiagnostics, autoantibody profiling, and AI-driven precision health innovation.

The Asia Pacific region is the fastest-growing region in the global with a CAGR of 7.7% in 2024

The Asia-Pacific including Japan, China, India, and South Korea, is expanding rapidly due to rising disease burden, strong government support, and growing R&D investments. Early detection, precision medicine, and biomarker-based innovation are being propelled throughout the area by developments in omics technology, scholarly partnerships, and enhanced diagnostic infrastructure.

China’s biomarker discovery market is expanding rapidly, driven by strong government support, rising disease burden, and advanced R&D capabilities. Biomarker validation, clinical acceptance, and overall market growth are being accelerated nationwide by frequent NMPA approvals, expanding biopharma partnerships, and higher investment in precision medicine and omics research. For instance, in September 2024, Amoy Diagnostics received NMPA approval for its AmoyDx Pan Lung Cancer PCR Panel, enabling precise detection of EGFR, ALK, ROS1, and METex14 mutations in non-small cell lung cancer patients, strengthening China’s precision oncology and biomarker-based diagnostic capabilities.

Competitive Landscape

Top companies in the biomarker discovery market include Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Merck KGaA, Hoffmann-La Roche Ltd, Abcam Limited, Olink, SomaLogic, and BD, among others.

Thermo Fisher Scientific Inc.: Thermo Fisher Scientific is a global leader in biomarker discovery, supplying instruments (e.g., orbitrap high-resolution mass spectrometers), reagents, sample preparation kits, and bioinformatics/LIMS solutions for multi-omic workflows. It offers end-to-end discovery & validation services in genomics, proteomics, transcriptomics, and protein biomarker analysis, enabling high sensitivity and throughput. Acquisitions like Intrinsic Bioprobes have expanded its quantitative proteomics and immuno-enrichment capabilities.

Key Developments:

- In August 2024, Hitachi High-Tech and Gencurix formed a strategic partnership in cancer molecular diagnostics, combining Hitachi’s expertise in in vitro diagnostic development and digital technology with Gencurix’s biomarker discovery capabilities. The collaboration aimed to advance innovative testing services, enhancing precision and efficiency in cancer diagnosis and personalized treatment solutions.

- In January 2024, Genialis and Debiopharm established a biomarker discovery collaboration to identify predictive biomarkers in the DNA Damage Repair (DDR) biology space. Using Genialis’ machine learning–enabled ResponderID platform, the partnership aimed to enhance patient stratification and optimize DDR-targeted therapies within Debiopharm’s oncology drug development pipeline.

Market Scope

| Metrics | Details | |

| CAGR | 11.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Product Type | Consumables, Instruments, Software |

| By Technology | Genomics, Proteomics, Metabolomics, Transcriptomics, Epigenomics, Lipidomics and Others | |

| By Application | Drug Discovery, Diagnostics, Personalized Medicine and Others | |

| By End User | Pharmaceutical & Biotechnology Companies, Contract Research Organizations, Academic & Research Institutes, Diagnostic Labs, Hospitals and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global biomarker discovery market report delivers a detailed analysis with 70 key tables, more than 69 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.