Overview

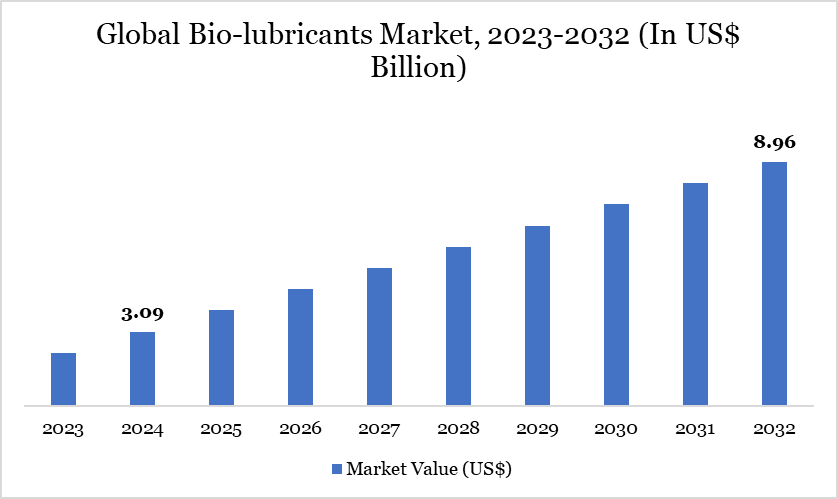

Global bio-lubricants market reached US$3.09 billion in 2024 and is expected to reach US$8.96 billion by 2032, growing with a CAGR of 14.23% during the forecast period 2025-2032, according to DataM intelligence report.

The global bio-lubricants market is set for substantial growth due to heightened awareness of environmental sustainability and escalating regulatory demands in various industrial sectors. Bio-lubricants, formulated from sustainable and biodegradable base stocks, are increasingly being adopted in the transportation and manufacturing sectors. These sectors are progressively embracing bio-based alternatives to traditional petroleum-based lubricants due to their reduced toxicity, enhanced lubricity, and superior biodegradability.

In recent years, China manufactured 26,082,220 automobiles, as reported by the International Organization of Motor Vehicle Manufacturers (OICA), highlighting the significant potential for automotive bio-lubricants. India's domestic passenger vehicle sales for 2021–2022 totaled 3,069,499, reflecting a 13 percent increase over the prior year.

These numbers illustrate the increasing demand for bio-based lubricants in the automotive sectors. The existing global regulatory framework, along with advancements in innovation and research and development funding, is anticipated to expedite market expansion and establish bio-lubricants as a feasible and progressively favored option in sustainability-oriented sectors.

Market Trends

Current trends in the bio-lubricants market indicate a significant transition towards holistic sustainability, lifetime assessment, and adherence to regulations. Regulators are increasingly promoting an increase in renewable content levels in bio-lubricants from 25–50 percent to as high as 60–80 percent. This trend promotes bio-synthetic base stocks and oleochemical synthetic esters while eliminating petrochemical synthetic base stocks.

The market is experiencing an increase in demand for high-performance bio-lubricants in automotive and industrial applications that necessitate enhanced viscosity, combustion temperature, and lubricity. Both governments and corporate sectors are allocating money to research, resulting in the creation of bio-lubricants that match or surpass the performance standards of conventional alternatives.

Initiatives like the EU Eco-label and the Vessel General Permit in North America highlight the focus on lifecycle effect evaluations and environmental certifications. With the increasing strategic significance of sustainability, particularly in the marine, automotive, and manufacturing industries, bio-lubricants are anticipated to become essential.

Market Scope

Metrics | Details |

By Product | Engine Oil, Transmission and Hydraulic Fluid, Metalworking Fluid, General Industrial Oil, Gear Oil, Grease, Process Oil, Other |

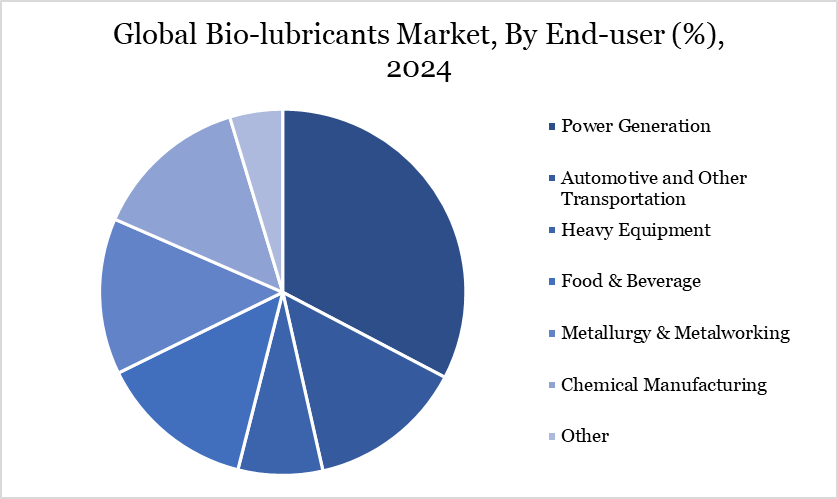

By End-user | Power Generation, Automotive and Other Transportation, Heavy Equipment, Food & Beverage, Metallurgy & Metalworking, Chemical Manufacturing, Other |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dynamics

Industrial Shift to Sustainable Performance Solutions

A primary driver in the bio-lubricants industry is the industrial shift towards sustainable and high-efficiency performance solutions. Various industries, including automotive and manufacturing, are progressively choosing bio-lubricants because of their reduced toxicity, enhanced viscosity index, and ability to extend machine longevity. In the US and Canada, the automotive sector is both growing and conforming to more stringent environmental regulations.

The US Air Force illustrates this tendency by advocating for plant-based biodegradable goods within its national defense strategy. The transportation sector particularly demands lubricants that provide superior durability, energy efficiency, and environmentally beneficial characteristics. Furthermore, bio-greases are extensively utilized in forestry machinery, construction vehicles, rail systems, and maritime applications, demonstrating the diverse applicability of bio-lubricants. The amalgamation of these variables with governmental incentives for research and development, as well as innovation, is advancing the market, establishing sustainable performance as a fundamental aspect of industrial lubricant plans.

Cost Barriers and Material Availability

The bio-lubricants market encounters numerous constraints, chiefly arising from regulatory intricacies and performance compatibility. Regulations such as the EU Eco-label and the US Vessel General Permit foster sustainability yet impose limitations on the chemical composition of lubricants. Authorities are intensifying their examination of specific performance-enhancing additives, including corrosion inhibitors, biocides, and heat-resistant chemicals, owing to their possible environmental repercussions.

The challenge is to create bio-lubricants that satisfy stringent environmental standards while also achieving competitive performance levels without incurring high costs. Furthermore, attaining equilibrium among cost, sustainability, and technological effectiveness presents a significant challenge, particularly in emerging markets characterized by heightened price sensitivity. These regulatory dynamics may hinder adoption if not mitigated via coordinated innovation, industry collaboration, and cost-effective production strategies that meet both environmental and performance standards.

Segment Analysis

The global bio-lubricants market is segmented based on product, end-user and region.

Driving Sustainability Through Bio-Lubricants in Automotive and Transportation

The automotive and transportation sector constitutes a substantial share of global bio-lubricant demand, mostly owing to the industry's emphasis on enhancing performance, durability, and environmental sustainability. Bio-based lubricants have been extensively utilized in applications including engine oils, greases for rail flanges and curves, and specialized lubricants for maritime and construction equipment.

Bio-greases are widely utilized in high-load applications, providing advantages such as elevated temperature resistance, minimal toxicity, and prolonged machinery lifespan. Metal cutting fluids and coolants utilized in gear cutting, grinding, and general machining in automotive production lines are being substituted with bio-based alternatives.

These fluids offer enhanced lubricity, diminish machinery wear, and are more environmentally and occupationally safe. The swift growth of the automotive sector in nations such as China and India, along with regulatory focus on environmentally friendly practices in North America and Europe, positions transportation as a leading application category in the bio-lubricants market.

Geographical Penetration

North America’s Strategic Innovation and Feedstock Advantage

North America is a pivotal location in the bio-lubricants market, bolstered by a strong regulatory framework, abundant feedstock availability, and effective defense measures. The US leads with regulations like the Vessel General Permit, which promotes the use of environmentally appropriate lubricants.

A significant strategic project involves the US Air Force's advocacy for plant-based biodegradable products to bolster national security. The region benefits from ample soybean and rapeseed feedstock, supported by its existing biodiesel sector. Government funding persists in bolstering research and development in the maritime and automotive sectors, thereby augmenting the region's competitive advantage in bio-lubricant innovation.

The expanding automobile sector in the US and Canada acts as a significant catalyst, as the transportation industry increasingly emphasizes sustainable and high-performance lubricants. These variables collectively establish North America as a crucial influencer in determining market trends and innovation standards for bio-lubricants worldwide.

Sustainability Analysis

Sustainability is fundamental to the bio-lubricants sector, serving not merely as a statutory obligation but as a strategic necessity. The market has transitioned from a fundamental emphasis on biodegradability to a comprehensive consideration of the whole lifetime of bio-lubricants, encompassing raw material procurement, manufacturing, application, and disposal.

Prominent regions, including the US and Europe, have established systems such as the Vessel General Permit and the EU Eco-label to facilitate sustainable product creation. These restrictions compel producers to evaluate environmental implications at each stage, promoting the utilization of renewable inputs and restricting dangerous additions.

The transition to base stocks sourced from plant oils and oleochemical esters, as opposed to petrochemical alternatives, is being bolstered by increasing renewable content requirements, escalating from 25–50% to 60–80%. This alteration not only advantages the environment but also fortifies market resilience by synchronizing industry practices with enduring climate objectives. In this changing ecology, sustainability is emerging as both a distinguishing factor and a fundamental commercial necessity.

Competitive Landscape

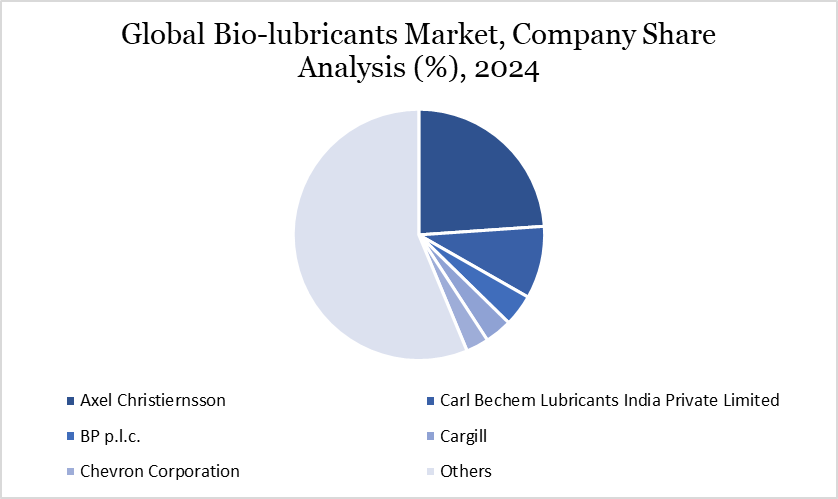

The major global players in the market include Axel Christiernsson, Carl Bechem Lubricants India Private Limited, BP p.l.c., Cargill, Chevron Corporation, Cortec Corporation, Environmental Lubricants Manufacturing, Inc., Exxon Mobil Corporation, FUCHS, KCM Petro Chemicals. and among others.

Key Developments

In April 2023, Exxon Mobil announced its intention to invest up to US$ 110 million in the development of a lubricants manufacturing plant in India. The planned facility is expected to begin full operations by the end of 2025. The facility's objective is to achieve a manufacturing capacity of 159 million liters of finished lubricants annually.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies