Beauty Drinks Market Size

The Global Beauty Drinks Market size was valued at USD 1,929.29 million in 2024 and is projected to witness lucrative growth by reaching up to USD 3,098.72 million by 2028. The market is growing at a CAGR of 11.4% during the forecast period (2024-2031).

The beauty drinks market has kick-started recently where the products and competitors are small in number.

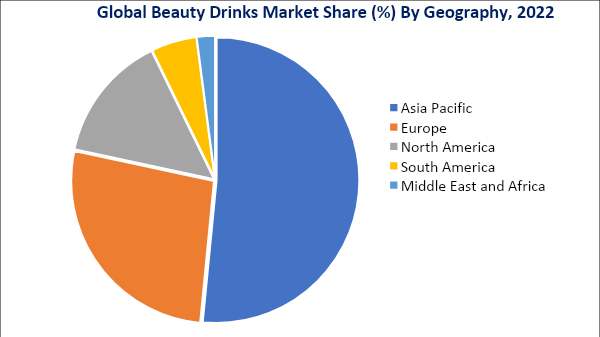

Beverages companies are picking up both developed and developing countries to launch their products. The growing consumer awareness about the benefits of the consumption of health drinks andanti-aging products is expected to boost the demand for the beauty drink market. As per a regional research study, Europe regions had the highest market share in 2018 and remain to be a dominant global market for beauty drinks throughout the forecast period.

Market Scope

| Metrics | Details |

| CAGR | 11.4% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Ingredient Type, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | Europe |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know more Insights - Download Sample

Market Dynamics

Changing Lifestyles of the Consumers is Driving the Market Growth

Environmental pollution and lifestyle choices can cause the skin to age prematurely. According to WHO, the pace of population aging is much faster than in the past. Hence creating a huge demand for beauty drinks over the forecast period. The report by WHO also found that between 2015 and 2022, the world's population that is aged above 60 years will double from 12% to 22%. In 2050, 80% of older people will belong to low and middle-income countries.

The busy lifestyle and lack of time to follow a healthy skincare routine are anticipated to increase the sale of beauty drinks. Beauty drinks containing vitamins and minerals are gaining popularity owing to their great benefits. For instance, a beauty drink containing vitamin A will help in the new skin cell formation and maintain the skin’s firmness and help to control skin damage such as acne and dark spots.

High Prices Associated with Beauty Drinks

The high cost of beauty drinks is one of the main factors that can restrain the growth and adoption of this market. The high cost of nutricosmetics is a significant factor that can hinder their widespread adoption. The premium price of nutricosmetics is due to the inclusion of high-quality ingredients and the extensive research and development that goes into creating these products. Furthermore, a survey conducted by Mintel found that 38% of US consumers who do not purchase beauty supplements stated that they are too expensive.

Beauty Drinks Market Segmentation Analysis

The global beauty drink market is segmented based on ingredient type, distribution channel and region.

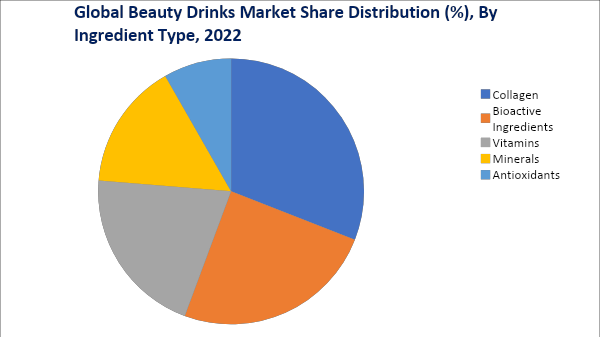

Based on Ingredient, Collagen-based Beauty Drink Holds the Largest Market Share

Collagen-made beauty drinks accounted for the highest market share in 2022 and are expected to remain the same over the forecast period as they provide structural protein to the skin which makes skin look young, and plump and protects skin from sun exposure and environmental pollution. According to NewYork-based Zeichner Dermatology, 75 to 80 percent of skin is made up of collagen and begins to decline around the age of 30. Supplement of collagen protects skin from early aging, hence creating a demand for collagen-made beauty drinks.

Beauty Drinks Market Regional Share

Europe Holds the Largest Market Share of Beauty Drinks

Europe had the highest market share in 2022 and remains to be dominant over the forecast period. According to NHS, Europe has the highest percentage of the elder population and the secretion of collagen stops after the age of 25 years creating demand for anti-aging products. According to Cosmetics Europe, in 2021, the EU spent €328 billion on research & development (R&D), up 6% compared with the previous year (€310 billion) and estimated to increase further over the forecast period.

Beauty Drinks Key Companies

The major global players include My Beauty & GO, Bella Berry, Sappe Public Company Limited, Skinade, Big Quark LLC, THE COCA-COLA COMPANY, Nestle S.A., DyDo DRIN CO, Vital Protiens LLC and Shiseido Co Ltd.

Key Developments

- Beauty drinks provide supplements that provide beauty benefits from within when compared to the benefits obtained by eating normal foods.

Beauty drinks consist of various blends of powerful and concentrated extracts taken from plants, nutrients that enhance the appearance and

condition of human skin. - The beauty drinks market has kick-started recently where the products and competitors are small in number. Beverages companies are picking up

both developed and developing countries to launch their products. - Changing lifestyles, increasing expenditure levels on beauty products, early aging due to pollution and inappropriate eating habits are driving the

global beauty drinks market over the forecast period. - Environmental pollution and lifestyle choices can cause the skin to age prematurely. According to WHO in 2018, the pace of population aging is much

faster than in the past. Hence creating a huge demand for beauty drinks over the forecast period. - The global beauty drinks market is segmented on the basis of ingredient and region. Collagen-made beauty drinks provide structural protein to the

skin which makes skin look young, plump and protects skin from sun exposure and environmental pollution.

Why Purchase the Report?

- To visualize the global beauty drinks market segmentation based on ingredient type and distribution channel to understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous beauty drinks market-level data points all for segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Global Beauty Drinks Market Report Would Provide Approximately 53 Tables, 50 Figures and 102 Pages.